Investments

320Portfolio Exits

37Funds

11Partners & Customers

1Service Providers

1About MONASHEES

MONASHEES is a venture capital firm that focuses on innovation within the technology sector. It provides funding and support to founders who are addressing significant market needs through technology. It serves the technology startup ecosystem and partners with entrepreneurs from their initial stages. It was founded in 2005 and is based in Sao Paulo, Brazil.

Research containing MONASHEES

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MONASHEES in 1 CB Insights research brief, most recently on Oct 5, 2023.

Oct 5, 2023 report

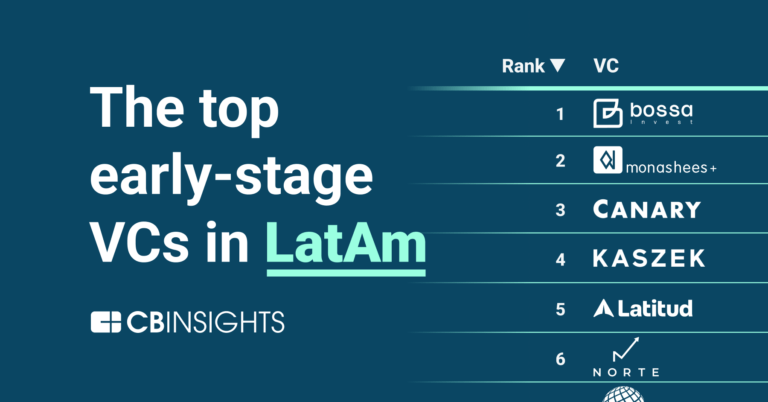

The top 25 early-stage LatAm VCsLatest MONASHEES News

Oct 12, 2025

Griffero no pensaba asistir. Todo cambió el 12 de agosto, cuando Julia Duarte, de Monashees -el fondo brasileño que invirtió en Fintoc- le escribió para comentarle sobre el evento. Postuló ese mismo día y fue aceptado, pero sólo para la transmisión online. No le bastó. Por: Equipo DF MAS Noticias destacadas OpenAI volvió a mover la frontera tecnológica. ChatGPT ya tiene 800 millones de usuarios activos al mes y es la empresa privada más valiosa del planeta, con una valoración de US$ 500 mil millones. El lunes, frente a 1.500 personas en el histórico Fort Mason de San Francisco, Sam Altman presentó las novedades del producto. Entre los asistentes estaba Cristóbal Griffero, CEO de Fintoc, uno de los pocos chilenos que presenció el DevDay 2025. Griffero no pensaba asistir. Todo cambió el 12 de agosto, cuando Julia Duarte, de Monashees -el fondo brasileño que invirtió en Fintoc- le escribió para comentarle sobre el evento. Postuló ese mismo día y fue aceptado, pero sólo para la transmisión online. No le bastó. “Le escribí un mail a una cuenta genérica @openai con un poco de contexto: ‘Hola, soy Cristóbal, hice Fintoc, un producto que usa el 40 % de la población chilena, también fundé una empresa de criptomonedas que transó US$ 300 millones y he hecho aportes al código fuente de Bitcoin’”, cuenta. Funcionó. OpenAI le regaló una entrada presencial. El evento comenzó a las 8 am, con dos horas de networking y desayuno antes de que Altman subiera al escenario. “Fue poco bullshit o teorías de adónde va el mundo -recuerda Griffero-, básicamente fueron los anuncios y los números de ChatGPT”. El primero fue SDK: “que son básicamente sistemas que permiten que uno pueda tener aplicaciones nativas dentro de ChatGPT”, explica. Esto -dice- le cambió su visión de lo que viene en inteligencia artificial, porque “básicamente están trayendo las aplicaciones hacia adentro de ChatGPT, no ChatGPT que salga hacia afuera”. El segundo anuncio fue el Agent Kit, “el primer paso para que cada persona pueda construir su propio asistente personal”. Esta es la herramienta más comentada del evento, ya que puede impactar el día a día de cualquier persona y no es un anuncio técnico. El cierre trajo mejoras en Codex -la herramienta de OpenAI para programadores- y el lanzamiento de la API de Sora 2, su sistema de videos generados por IA. Altman mostró ejemplos como Mattel, que entrega un boceto a Sora y obtiene un video listo para publicidad. Han sido semanas intensas para la firma: firmaron una alianza con AMD y ya circulan rumores sobre el dispositivo que diseña Jony Ive, el histórico creador del iPhone, junto a Altman. Comparte

MONASHEES Investments

320 Investments

MONASHEES has made 320 investments. Their latest investment was in Motorista PX as part of their Series B on November 10, 2025.

MONASHEES Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/10/2025 | Series B | Motorista PX | $47.1M | No | 1 | |

10/29/2025 | Series B | Vammo | $45M | No | 2150, Construct Capital, Ecosystem Integrity Fund, Endeavor Catalyst, Maniv Mobility, Qualcomm Ventures, and Undisclosed Angel Investors | 3 |

9/23/2025 | Seed VC - II | Gigi | $3M | No | Khosla Ventures, OpenAI, and Sequoia Capital | 2 |

8/15/2025 | Series A - II | |||||

8/5/2025 | Series A |

Date | 11/10/2025 | 10/29/2025 | 9/23/2025 | 8/15/2025 | 8/5/2025 |

|---|---|---|---|---|---|

Round | Series B | Series B | Seed VC - II | Series A - II | Series A |

Company | Motorista PX | Vammo | Gigi | ||

Amount | $47.1M | $45M | $3M | ||

New? | No | No | No | ||

Co-Investors | 2150, Construct Capital, Ecosystem Integrity Fund, Endeavor Catalyst, Maniv Mobility, Qualcomm Ventures, and Undisclosed Angel Investors | Khosla Ventures, OpenAI, and Sequoia Capital | |||

Sources | 1 | 3 | 2 |

MONASHEES Portfolio Exits

37 Portfolio Exits

MONASHEES has 37 portfolio exits. Their latest portfolio exit was ContaAzul on August 01, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/1/2025 | Acquired | 1 | |||

1/29/2025 | Acquired | 3 | |||

12/4/2024 | Acquired | Softplan | 2 | ||

MONASHEES Fund History

11 Fund Histories

MONASHEES has 11 funds, including Monashees Expansion II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/21/2021 | Monashees Expansion II | 1 | |||

12/21/2021 | Monashees X | 1 | |||

6/19/2020 | Monashees Expansion | 1 | |||

11/7/2018 | Monashees VIII | ||||

12/31/2012 | Monashees Capital VI LP |

Closing Date | 12/21/2021 | 12/21/2021 | 6/19/2020 | 11/7/2018 | 12/31/2012 |

|---|---|---|---|---|---|

Fund | Monashees Expansion II | Monashees X | Monashees Expansion | Monashees VIII | Monashees Capital VI LP |

Fund Type | |||||

Status | |||||

Amount | |||||

Sources | 1 | 1 | 1 |

MONASHEES Partners & Customers

1 Partners and customers

MONASHEES has 1 strategic partners and customers. MONASHEES recently partnered with Foresight AI on .

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

Vendor | United States | 1 |

Date | |

|---|---|

Type | Vendor |

Business Partner | |

Country | United States |

News Snippet | |

Sources | 1 |

MONASHEES Service Providers

1 Service Provider

MONASHEES has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Gunderson Dettmer | Counsel | General Counsel |

Service Provider | Gunderson Dettmer |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

MONASHEES Team

6 Team Members

MONASHEES has 6 team members, including current Founder, Managing Partner, Eric Acher.

Name | Work History | Title | Status |

|---|---|---|---|

Eric Acher | Founder, Managing Partner | Current | |

Name | Eric Acher | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Partner | ||||

Status | Current |

Compare MONASHEES to Competitors

Redpoint eventures operates as a venture capital firm The firm focuses on early-stage consumer Internet. It is a joint venture between Redpoint and eventures and brings funding, Silicon Valley access, and global best practices to promising local entrepreneurs. it was founded in 2012 and is based in Sao Paolo, Brazil.

Bossa Inves focuses on the startup ecosystem, offering investment and support to emerging companies. The firm provides venture capital investments, connections, and access to the startup market, along with insights on investment strategies such as crowdfunding, direct investment, co-investment, and funds. Bossa Invest has a focus on the technology sector, particularly in B2B companies with a SaaS or mobile approach. It was founded in 2011 and is based in Sao Paulo, Brazil.

ACE Ventures is an early stage venture capital firm that invests in entrepreneurs within the startup ecosystem. The company provides venture capital investments and mentorship to assist startups in their development. ACE Ventures primarily focuses on the Brazilian startup community, offering guidance throughout the entrepreneurial process. It was founded in 2012 and is based in Sao Paulo, Brazil.

Valor Capital Group is an investment firm focused on Brazil and US-Brazil cross-border opportunities with a presence in New York, Silicon Valley, and Rio de Janeiro / Sao Paulo. The firm operates across two investment strategies: Growth Equity and Venture Capital.

Kaszek Ventures is a venture capital firm that focuses on technology-based companies in Latin America. The firm provides capital and strategic guidance, operational support, and access to networks to entrepreneurs at various stages, primarily seed, series A, and series B rounds. Kaszek Ventures invests in industries where technology and innovation can create disruption and value. It was founded in 2011 and is based in Sao Paulo, Brazil.

Bzplan operates as a venture capital firm. The company supports entrepreneurs and invests in startups. It also facilitates the sale of companies and fundraising. It serves the financial industries. The company was founded in 2002 and is based in Florianopolis, Brazil.

Loading...