MoneyView

Founded Year

2014Stage

Series E - II | AliveTotal Raised

$185.45MValuation

$0000Last Raised

$4.65M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-59 points in the past 30 days

About MoneyView

MoneyView is a digital platform focused on personal finance and lending services. The company offers various financial products including personal loans, business loans, home loans, credit cards, and insurance, along with investment options like fixed deposits and digital gold. MoneyView serves individuals and businesses. It was founded in 2014 and is based in Bengaluru, India.

Loading...

MoneyView's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

MoneyView's Products & Differentiators

Money View Loans

An instant personal loan app that helps provide customised personal loans in just a few minutes. The App uses data & external factors like bureau/liabilities to provide the max loan amount, tenure & ROI- All this with a 100% online, easy application process. The customers can find their eligibility in less than 2 minutes & proceed with the application.

Loading...

Research containing MoneyView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MoneyView in 1 CB Insights research brief, most recently on Oct 3, 2024.

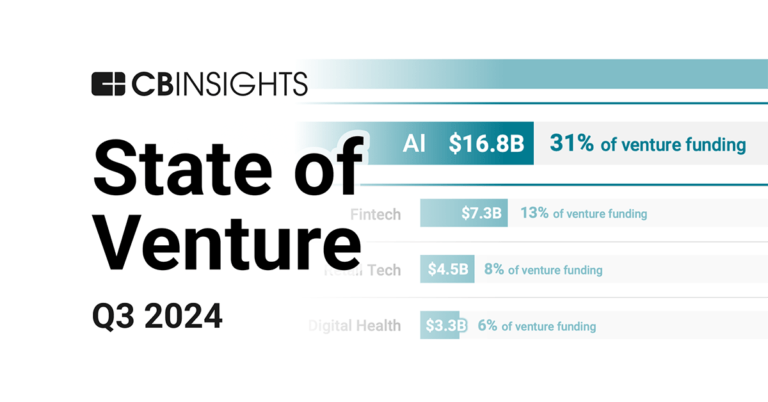

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing MoneyView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MoneyView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Digital Lending

2,538 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest MoneyView News

Nov 6, 2025

Moneyview's revenue from operations grew to Rs 2,339 crore in FY25 from Rs 1,342.37 crore in FY25, according to its consolidated financial statements filed with the Registrar of Companies (RoC) Founded in 2014 by Puneet Agarwal and Sanjay Aggarwal, Moneyview provides personalized… More like this

MoneyView Frequently Asked Questions (FAQ)

When was MoneyView founded?

MoneyView was founded in 2014.

Where is MoneyView's headquarters?

MoneyView's headquarters is located at 3rd Floor, Survey No. 17, 1A, Outer Ring Road, Bengaluru.

What is MoneyView's latest funding round?

MoneyView's latest funding round is Series E - II.

How much did MoneyView raise?

MoneyView raised a total of $185.45M.

Who are the investors of MoneyView?

Investors of MoneyView include Accel, Nexus Ventures, Tiger Global Management, Evolvence India, Rockstone Ventures and 12 more.

Who are MoneyView's competitors?

Competitors of MoneyView include Tala and 6 more.

What products does MoneyView offer?

MoneyView's products include Money View Loans and 2 more.

Loading...

Compare MoneyView to Competitors

Simpl is a company focused on digital payment solutions within the e-commerce sector. Its main offerings include a one-tap checkout network, buyer protection, and a pay-later facility. The company primarily serves the consumer experience platform and e-commerce sectors. Simpl was formerly known as Get Simpl. It was founded in 2015 and is based in Bengaluru, India.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

BharatPe provides financial services. It offers merchant discount rate (MDR) services and allows merchants to sign up and start receiving the funds in their respective bank accounts. It serves offline retailers and businesses. The company was founded in 2018 and is based in Gurgaon, India.

Colendi is a financial technology company that specializes in alternative credit scoring and microcredit solutions. The company offers a platform that provides instant micro-credit options, buy now, pay later services, and investment opportunities without traditional banking barriers. Its products cater to both individual consumers seeking personal finance options. The company was founded in 2018 and is based in London, United Kingdom.

Fundfina is a fintech company that operates within the financial services sector. The company provides lending programs and cash flow-based credit scoring for micro, small, and medium enterprises (MSMEs), as well as software development and management services for lenders. Fundfina serves the financial services industry, aiming to improve access to credit for MSMEs. It was founded in 2017 and is based in Maharashtra, India.

Kueski operates as a financial technology company focused on online consumer lending within the financial services industry. The company offers personal loans and a digital payment method that allows users to make purchases in installments without a credit card. Kueski primarily serves individuals who may not qualify for traditional bank loans. It was founded in 2012 and is based in Jalisco, Mexico.

Loading...