Next Insurance

Founded Year

2016Stage

Acquired | AcquiredTotal Raised

$1.148BValuation

$0000Revenue

$0000About Next Insurance

Next Insurance provides insurance solutions for small businesses across various sectors. The company offers a range of insurance products, including general liability, workers' compensation, professional liability, and commercial property insurance. It serves the self-employed and small business owners, offering coverage that meets various business needs. It was founded in 2016 and is based in Palo Alto, California. In March 2025, Next Insurance was acquired by ERGO Group.6B.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

NEXT’s Comprehensive Insurance Platform

Powered by automation, AI and industry-leading expertise, NEXT removes traditional coverage complexity and empowers entrepreneurs to protect their businesses in minutes. It delivers a seamless digital insurance experience for small and growing businesses through a customizable, all-in-one coverage platform. Customers can quickly secure essential protection, including general liability, BOP, professional liability, and workers’ compensation in one streamlined package using our online tools. The platform adapts alongside businesses as they expand, including multi-location capabilities and policy bundling, all accessible via a self-service portal and smartphone app.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 8 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

May 8, 2025 report

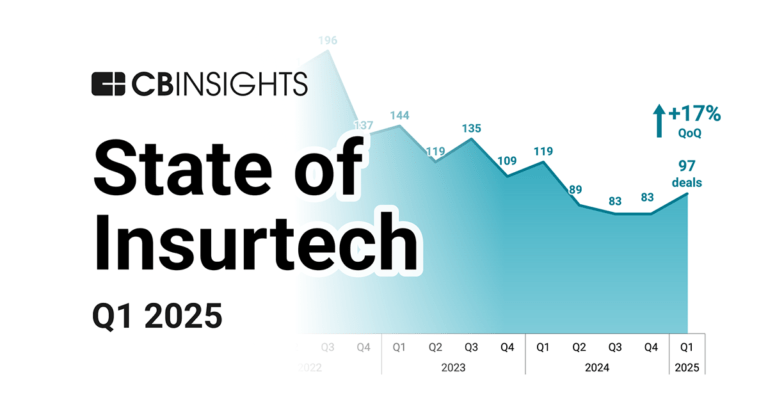

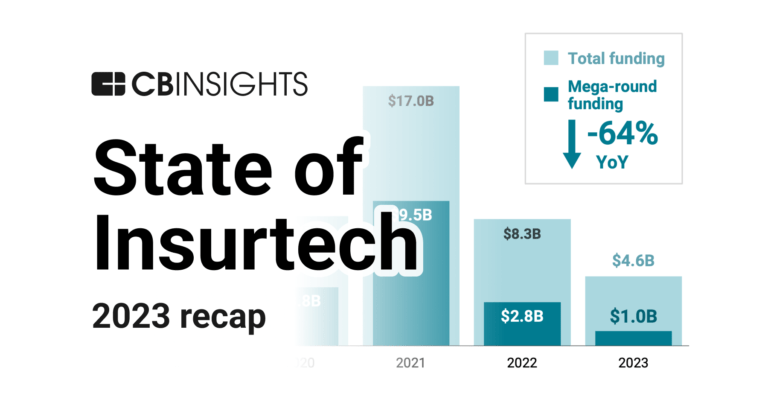

State of Insurtech Q1’25 Report

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

State of Insurtech 2023 Report

Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 8 Expert Collections, including Fintech 100.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Next Insurance News

Nov 1, 2025

According to the study, nearly 10% of all new startups globally founded by serial entrepreneurs are based in Israel, second only to the United States. Despite their far larger populations, countries such as the UK, France, and Germany trail well behind. 1 View gallery Wiz founders. (Photo: Avishag Shaar-Yashuv) Israel also ranks first in the world in the ratio of startups founded by experienced versus first-time entrepreneurs: one in every 22 new companies is led by at least one seasoned founder. In comparison, the ratio in the U.S. is one in 38; in France, one in 62; and even lower in Germany and the UK. Over the past five years, Israeli companies founded by experienced entrepreneurs have recorded exits totaling $75 billion, counting only sales above $1 billion. Many of Israel's largest recent exits involved repeat founders, including the teams behind Wiz, Next Insurance, CyberArk, and Melio. Why does this concentration of serial entrepreneurs matter? Data from PitchBook suggests that venture capital funds consistently prefer startups led by proven founders. The gap is stark: on average, early-stage startups founded by serial entrepreneurs raise four to five times more capital than those led by first-time founders. For example, an experienced entrepreneur typically raised $12 million in early funding, compared to just $3 million for a new founder. Valuations at the time of fundraising were also two to three times higher for startups with experienced leadership. Barak Schoster, the initiator of the study and a partner at Battery Ventures who has already achieved a successful exit, explains that fundraising speed and volume remain remarkably stable for serial entrepreneurs, regardless of the investment climate, while new founders experience far greater volatility. This, he argues, helps explain the relative resilience of Israel's high-tech sector during the past two years of war and instability. Why do funds prefer experienced entrepreneurs, who might be more opinionated and, at times, less easy to work with? The reasons range from the ability to better articulate a company's story to the advantage of quickly recruiting an initial core team through existing networks. A high-quality first team is critical for building a startup and rapidly achieving product-market fit. However, one of the main advantages of experienced founders lies elsewhere: in their ability to resist the temptation of an early sale, ultimately generating higher returns for investors. “Entrepreneurs often receive offers that are hard to refuse early on and sell too soon. We see this very clearly in the Israeli cyber industry,” says Schoster. “A company like Dome9, for example, which was founded around the same time as Wiz and developed a similar product, was sold to Check Point in 2018 for $175 million, and that was too early. Today, the biggest exits are happening in companies run by serial entrepreneurs because they turned down multiple offers over the years.” Who qualifies as a serial entrepreneur for the purposes of the study? Those who have founded at least two companies that were either sold or raised over $8 million. Although the importance of prior experience tends to decline as a startup matures, Israel still maintains its lead over European countries and ranks second only to the U.S. even in later-stage startups led by experienced founders. “Great Openness to Failure” The study also explores why Israel has such a high concentration of serial entrepreneurs, and what drives them to start new ventures after already achieving financial success. “In other countries too, there are plenty of talented and highly motivated people,” says Schoster. “But in Israel there's greater cultural openness, both toward making mistakes and failing, and toward sharing information, knowledge, employee referrals, and even gossip.” The report also notes that Israel's high number of exits constantly fuels movement among employees and founders. Recently, however, another force has been pushing entrepreneurs to start again: artificial intelligence. According to data cited in the report from Anthropic, the company behind the Claude AI engine, Israel ranks first in the world in cloud usage on a per capita basis. Israelis use Claude seven times more than would be expected based on population size. This widespread use of AI tools allows startups to test product alternatives more easily, recruit fewer employees at the early stage, and shorten development timelines, all factors that may help explain why so many Israeli founders, even after major exits, are eager to begin again.

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Acquired.

How much did Next Insurance raise?

Next Insurance raised a total of $1.148B.

Who are the investors of Next Insurance?

Investors of Next Insurance include ERGO Group, Allianz X, Allstate Strategic Ventures, 1435 Capital, Mitsui Sumitomo Insurance and 24 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Amwins, AmTrust Financial Services, Vouch, Thimble, Superscript and 7 more.

What products does Next Insurance offer?

Next Insurance's products include NEXT’s Comprehensive Insurance Platform.

Loading...

Compare Next Insurance to Competitors

Pie Insurance operates a platform for workers' compensation insurance. It matches price with risk across a broad spectrum of small business types that offer sustainable insurance to small business owners. The company was founded in 2017 and is based in Washington, District of Columbia.

Coterie Insurance provides small business insurance within the commercial insurance sector. The company offers products including business owners policies, general liability, professional liability, and cyber insurance, facilitated through a digital platform that enables quotes. Coterie Insurance serves independent agents and brokers, providing them with resources for the insurance process. It was founded in 2018 and is based in Appleton, Wisconsin.

Coverdash is a digital business insurance agency that specializes in providing tailored insurance solutions for various business sectors. The company offers a range of products, including general liability, business owner's policies, workers' compensation, cyber, professional, and management liability insurance. Coverdash primarily serves small businesses, startups, e-commerce merchants, and freelancers. It was founded in 2022 and is based in New York, New York.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Alliant Insurance Services provides insurance brokerage and consulting services within the financial services sector. The company offers services including risk management, employee benefits consulting, and various insurance solutions such as property and casualty insurance, captive insurance, and surety bonds. Alliant serves a range of industries, including agribusiness, aviation, construction, healthcare, and public entities. It was founded in 1925 and is based in Irvine, California.

Loading...