Nirvana

Founded Year

2020Stage

Series C | AliveTotal Raised

$159MValuation

$0000Last Raised

$80M | 8 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Nirvana

Nirvana provides commercial insurance focused on the trucking industry. The company offers various insurance products including fleet and non-fleet insurance, as well as safety solutions and a safety intelligence platform for fleet safety and efficiency. Nirvana's services address the needs of the trucking sector, using technology and data to create safety models, provide quotes, and manage risks. It was founded in 2020 and is based in San Francisco, California.

Loading...

Loading...

Research containing Nirvana

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Nirvana in 3 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

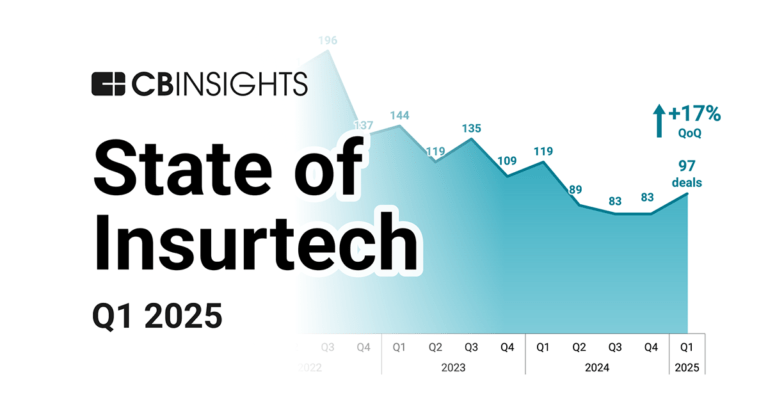

May 8, 2025 report

State of Insurtech Q1’25 Report

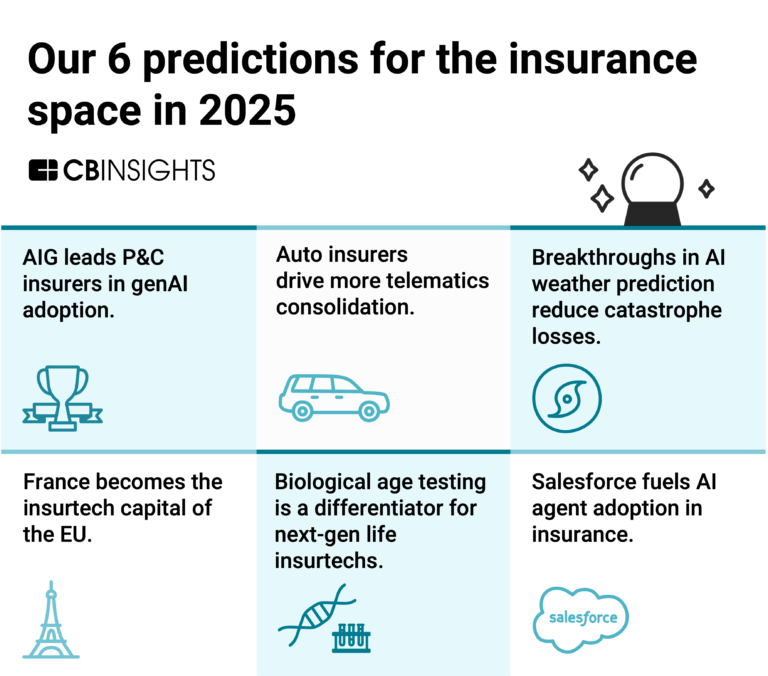

Mar 12, 2025

Our 6 predictions for the insurance space in 2025Expert Collections containing Nirvana

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Nirvana is included in 9 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

100 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Auto Tech

2,715 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Nirvana Patents

Nirvana has filed 1 patent.

The 3 most popular patent topics include:

- candles

- electrical generators

- electromagnetic components

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/16/2022 | Electromagnetism, Electromagnetic components, Candles, Electrical generators, Fire | Application |

Application Date | 8/16/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Electromagnetism, Electromagnetic components, Candles, Electrical generators, Fire |

Status | Application |

Latest Nirvana News

Sep 29, 2025

Insurance Underwriting Gets an Upgrade Providers Are Moving Beyond Manual Practices Key Takeaways: All-at-once or gradual? Companies' approach to AI adoption and integration depends on their needs. Some businesses use AI to augment their current practices. Artificial intelligence is becoming increasingly commonplace in modern life and in business, from aggregating search results and summarizing complex documents to acting as a personal assistant through smartphones. In the trucking industry, insurance policies represent one of the new fields where AI is beginning to have an impact. Some insurance firms, such as trucking insurance provider Nirvana, are taking an AI-first approach to risk assessment and underwriting. “There’s something about insurance that is deeply flawed,” said Bandar El-Eita, Nirvana’s head of marketing. “In any cohort, you are going to blend the risk.” When pursuing an insurance policy from a traditional firm, companies are evaluated based on their industry profiles and placed into a cohort, he noted. The cohort then pools the risk and the insurance provider sets the rates accordingly. Image El-Eita In trucking, that approach means that the safest, best-run motor carriers in a cohort effectively subsidize the group’s higher risk carriers, which have little incentive to improve, El-Eita said. That’s where Nirvana’s technology comes in. Before setting a rate for a potential trucking client, the insurance company hooks into the fleet’s telematics, electronic logging devices, dashcams and advanced driver assistance systems. With the implementation of the ELD mandate starting in 2017, onboard technology on trucks has been quietly collecting all sorts of usable data on a fleet’s performance in real time, El-Eita said. “The obvious question became [if] I’m making these improvements with ELDs and dashcams, how can I leverage this data to save myself some money on insurance?” El-Eita said. “The way we look at it is, while you can save up to 20%, it’s really about finding the right price for your actual risk.” Steve Miller, vice president of innovation and mobility for insurance brokerage Hub International, has worked with innovative insurance products since 2015, when he first insured a company working on an autonomous vehicle. Since then, he has watched as the conservative, highly regulated industry that he’s in has struggled to adapt to new technology. Image Miller He said he sees two tiers of AI implementation and integration in the industry: First, the companies that are all-in on the tech and look to use it wherever possible; and second, companies that are more reserved in their adoption and are poking at the technology to figure out how it best fits their business model. “The industry is struggling right now to absorb the technology,” and make it do more than just answer simple queries or generate clever slide decks, Miller said. The common thread of both AI integration approaches, he said, is the fact that both factions realize the treasure trove of data to be gained from a trucking company’s telematics. “AI is enabling that dataset to be more readily and robustly digested, analyzed and then used from an actuarial perspective. Actuaries take historical information to price future risk. And what we need to do is disrupt that process and accelerate adoption of real-time data,” Miller said. The difficulty, he said, is when insurance companies want to take that new way of pricing and adapt it to the patchwork of rate requirements and regulatory frameworks across each of the 50 states. “That’s a big part of what’s slowing things down,” he said. AI-Driven Efficiency Other insurance companies are finding ways to use AI to augment and speed up existing business processes. Sentry Insurance has been using AI for applications such as claims fraud models and sales opportunities models, said Denise Christophel, director of advanced analytics at the firm. “We use machine learning for things that are not decisioning models,” she said. “We are not using AI to make decisions. We’re using AI to help inform our associates as they are making the decisions.” Image Christophel The company is using AI to help generate claim summaries and support customer service representatives with real-time recommendations during customer interactions, but none of the interactions customers havee with the company pass through an AI filter. Future projects are aimed at helping underwriting work more efficiently. Some of the manuals connected with the firm’s process encompass hundreds of pages, and finding a precise answer to a specific question can be time intensive, Christophel said. Nick Saeger, assistant vice president of products and pricing for transportation and specialty at Sentry, said the company has put its focus on AI applications that allow people to focus on higher-level interactions and projects while computers handle the mundane. Image Saeger “These are things that allow them to take more time to think through. On the claims side, it’s [allowing them] to communicate with claimants, with attorneys, with our customers, and do the things that need to be done to progress the claim and get it to its resolution,” Saegar said. “On the underwriting side, it allows them to not be leafing through or digitally leafing through an underwriting manual to find a particular thing. We can find it more quickly and now we can get at underwriting the actual account itself and it’s spending more time getting to the right price. That’s why I love it from a business perspective.” Peter Berg, principal and practice leader at TrueNorth, oversees the company’s final-mile transportation products. Image Berg “That sector is ripe for opportunity because that final-mile component makes up [about] 40% of the cost of the supply chain,” Berg said. “There’s a ton of technology in terms of how you automate, how do you scale and how do you take out some of the overhead that is associated with that model, which is very much human labor driven.” Berg said he’s increasingly seeing the insurance companies his firm brokers use AI to drill down into data to offer more accurate pricing and create better risk assessments. Reducing Risk AI may also come into play when managing risk and limiting liability. “Fleets are subject to nuclear verdicts. That’s just a reality. So are insurance carriers because they’re the ones that are on the hooks paying for it,” Hub International’s Miller said. Increasingly, fleets have been deploying telematics systems, advanced driver assistance systems, and inward- and outward-facing cameras. All of those systems generate data. Mark Hill and Danielle Villegas of PCS Software discuss their AI engine, Cortex, designed specifically to level the playing field for midsized carriers. Tune in above or by going to RoadSigns.ttnews.com . “Insurance companies are starting to get better at integrating and taking that data and using it to price to the degree that they can,” Miller said. The real-time data collection and interpretation also can allow for real-time driver coaching and faster identification of driver safety risks, he said. Nirvana’s El-Eita said using AI to speed along the process after a claim is filed can help mitigate claims expenses as well. “If you can resolve a claim faster, you can get everyone back on the road faster,” he said. Plus, being able to provide hard data from the driver’s trip experience leading up to the claim event has proved valuable in helping ward off some lawsuits that might have tied up the company in legal proceedings. “How did they drive? Were they crazy people behind the wheel or were they driving with all diligence and care? And that can really protect the fleets from more fraudulent factors,” El-Eita said.

Nirvana Frequently Asked Questions (FAQ)

When was Nirvana founded?

Nirvana was founded in 2020.

Where is Nirvana's headquarters?

Nirvana's headquarters is located at 595 Market Street, San Francisco.

What is Nirvana's latest funding round?

Nirvana's latest funding round is Series C.

How much did Nirvana raise?

Nirvana raised a total of $159M.

Who are the investors of Nirvana?

Investors of Nirvana include Lightspeed Venture Partners, General Catalyst, Valor Equity Partners, SiriusPoint, Elad Gil and 7 more.

Who are Nirvana's competitors?

Competitors of Nirvana include Cover Whale and 4 more.

Loading...

Compare Nirvana to Competitors

Progressive Commercial provides commercial insurance products for business sectors. The company offers insurance services including commercial auto insurance and business liability coverage. Progressive Commercial serves small businesses with insurance solutions. It is based in Mayfield Village, Ohio.

HDVI specializes in modern insurance solutions for the commercial trucking industry. The company offers dynamically-priced insurance policies, integrated telematics, and fleet safety tools designed to help trucking fleets manage risk and potentially earn discounts on monthly premiums. HDVI primarily serves commercial truck fleets and insurance agents. It was founded in 2018 and is based in Chicago, Illinois.

Koffie Financial provides trucking and transportation insurance services. The company offers insurance coverage and uses technology to save money and time in underwriting, loss control, claims handling, and fleet operations. Koffie Financial was formerly known as Omnirisk. The company was founded in 2019 and is based in Wilmington, Delaware.

Matrix iQ provides telematics and IoT solutions for the fleet management and insurance sectors. The company offers services including vehicle tracking, driver risk management, fleet efficiency optimization, advanced video monitoring, and asset recovery devices. Matrix iQ serves businesses aiming to improve the safety of their fleet and protect their assets. The company was formerly known as Matrix Telematics. It was founded in 2001 and is based in Altrincham, England.

Great West Casualty Company provides commercial trucking insurance, including auto liability, cargo coverage, physical damage coverage, workers compensation, and various specialty coverages for the trucking industry. The company serves the commercial transportation sector, including small businesses, large fleets, and owner-operators. It was founded in 1956 and is based in South Sioux City, Nebraska.

Loading...