OpenSea

Founded Year

2017Stage

Series C | AliveTotal Raised

$425.12MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+2 points in the past 30 days

About OpenSea

OpenSea is a company involved in digital asset trading within the blockchain and cryptocurrency industry. It operates an NFT marketplace that enables the trading and creation of non-fungible tokens (NFTs) and other digital assets. The platform serves various sectors of the economy, including art, music, gaming, and virtual goods. It was founded in 2017 and is based in New York, New York.

Loading...

ESPs containing OpenSea

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The non-fungible token (NFT) platforms market provides solutions for creating, selling, and managing unique digital assets on the blockchain. These platforms offer proof of ownership verification, marketplace functionality, wallet integration, and tools for minting NFTs of digital art, music, collectibles, and virtual experiences. Companies in this market serve creators, brands, and developers wit…

OpenSea named as Leader among 10 other companies, including Magic Eden, Phantom, and Venly.

Loading...

Research containing OpenSea

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned OpenSea in 2 CB Insights research briefs, most recently on May 24, 2023.

Dec 14, 2022

What L’Oréal, Nike, and LVMH are doing in Web3Expert Collections containing OpenSea

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

OpenSea is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Blockchain

13,456 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Influencer & Content Creator Tech

340 items

Companies that serve independent creators who want to monetize their own work, from content creation tools to administrative back-end platforms to financing solutions.

Blockchain 50

50 items

Latest OpenSea News

Nov 7, 2025

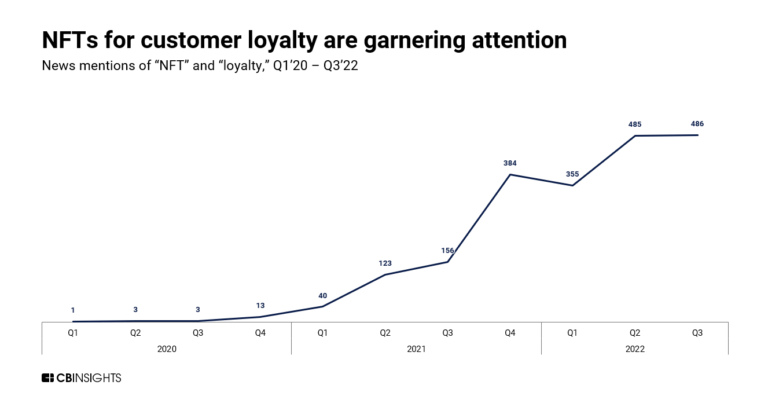

当然,并非所有人都认可这个观点的。 不久前,Contrary 风险投资公司合伙人Kyle Harrison就撰文提到,Bryan的想法其实和埃隆·马斯克有点像。马斯克曾说:“护城河没什么用,那是老派做法。如果你抵御竞争的唯一方式是护城河,那你迟早会被超越。真正重要的是创新的速度。” 但两者的关键区别也在这里,前者强调的“势头”,更多是指收入增长,尤其是年度经常性收入(ARR)的增长速度。他把快速增长视为公司早期最重要的信号。 问题是,当人们过于关注“涨得快不快”时,风险投资体系里原本存在的一些问题就会被放大:企业会被逼着走捷径、忽视长期建设,只追求短期的数字好看。 以下是Kyle Harrison撰写的原文: 01当资本只追逐“顶尖5%”,被神话绑架的创业生态 这就是经典的“在拿着锤子的人眼里,所有问题都像钉子”。无论是布莱恩的“除非你能在10天内把年经常性收入从0涨到200万美元,否则我没兴趣”,还是赫曼特的“三倍增长已经过时了。你需要从100万美元涨到2000万美元再到1亿美元才算有趣”,都体现了这种思维模式。 这就是管理数十亿美元基金的人的心态。他们需要尽可能大的回报,所以每家公司都应该以尽可能大的回报为目标,才能显得有趣。 我一直觉得,创业并没有绝对正确的方式。每个创始人都有自己的路径,只要合法合规,就没有问题。 但让我担心的是,很多人用错了方法——拿着锤子,看什么都像钉子。这样的方式,可能会限制下一代公司的成长,让它们很难突破规模瓶颈,只能停留在“中等体量”,而不是成长为真正有影响力的百亿美元公司。 你可以说“瞄准月亮,也许能击中星星”,但事实是,你用什么方式去造一家公司,基本就决定了它能走多远。 要把一家公司从100万美元做到2000万美元,再到1亿美元,几乎不可能靠“稳扎稳打”完成。你得在定价、营销、招聘、研发等各个环节都更激进、更高效。除了极少数能靠极少人做到巨大规模的例外,大多数公司要想快速成长,往往得采用一种并不长久的高压式增长方式。 举个例子,Wealthfront已经成立17年,如今营收3.08亿美元,净利润1.23亿美元。能做到这一步,已经是非常出色的公司了。可在一些大型风投眼里,这样的成绩反而“不够格”——他们追求的是能冲到100亿美元、1000亿美元市值的“超级独角兽”。 问题就在这里。现实中,所有上市公司里,市值超过100亿美元的不到5%,超过1000亿美元的更是凤毛麟角。也就是说,风投们只在追逐那前5%的极端成功,却忽视了那95%稳健、盈利、能长期创造价值的好公司。 当这种思维主导市场时,创业者开始模仿,投资人也跟风,生态系统最终就被“顶尖公司神话”绑架了。 而那些原本能做出好产品、养活团队、让员工受益、让客户满意的公司,也就是真正能支撑经济“中产阶层”的企业,反而被挤出了舞台。 02竞争是傻瓜才玩的 “势头是唯一的护城河”这句话的讽刺在于,所谓的“势头”,其实往往是一种反护城河。 彼得·蒂尔在《从零到一》里说过一句名言:“竞争是傻瓜才会做的事。” 托尔斯泰写道:“幸福的家庭都是相似的,不幸的家庭各有各的不幸。”放到商业世界里,恰好相反——每家成功的公司都有自己独特的成功方式,都是靠解决一个别人没解决的问题获得垄断地位;而失败的公司却惊人地相似:它们都被困在竞争里。 如今,很多人追逐“势头”,就是在做这种无谓的竞争。几乎每周都能听到某家公司“几个月就做到几百万美元ARR(年度经常性收入)”,听起来令人兴奋,也会立刻引来一大批模仿者。 于是大家开始一窝蜂地进入同一个赛道:法律AI、AI代码生成、AI写作、AI集成、AI编排……每个方向都出现了“最快做到1亿美元ARR”的公司。后来,又有人开始追求“最快做到10亿美元ARR”。 问题是,这种“势头”吸引来的往往是更多的竞争者和资本,而不是更稳固的护城河。竞争会让原本就难维持的商业模式变得更难成立。 比如,在代码生成领域,Cursor 的ARR已经达到10亿美元,Lovable、Windsurf、Devin等公司的收入也超过1亿美元。但这些公司大多在计算资源上严重依赖Anthropic,还要在销售和市场推广上投入巨额成本去抢客户。结果就是,原本就脆弱的利润空间,被“竞争的势头”彻底挤压。 所谓“势头”,看似让公司跑得更快,实际上可能是通往悬崖的加速器。 03AI的增长“幻觉” 正如有人在布莱恩那篇“势头是唯一的护城河”的帖子下评论的: “能在10天内从0涨到200万美元的,也能在10天内跌回零。” 这句话点出了动量型公司的最大风险——涨得快,也可能掉得更快。很多被过度炒作的行业都是这样。 比如 OpenSea。2021 年加密市场最火的时候,它的月营收高达 1.22 亿美元,公司估值飙到 133 亿美元。但风口一过,市场暴跌,OpenSea 至今都没能回到那个巅峰。 这并不意味着 OpenSea 是家坏公司。实际上,它现在的年化收入仍有 3.65 亿美元,只是和当初的估值相比,显然不匹配。而那些在高点投资的机构,早已经历了惨痛的减值。 更糟的是,这种情况在今天的AI行业中也屡见不鲜。很多公司为了看起来增长迅猛,会“虚胖式”地计算收入: 他们把免费试用期的收入也算进年度收入; 他们把一次性的项目收入按年化计算; 他们甚至以1美元的价格卖2美元的服务,只为让增长曲线更漂亮。 这种“势头”制造的增长其实不可持续。投资者买的不是企业的真实价值,而是一个短期的幻觉。 Slow Ventures 的 Yoni Rechtman 说过一句很有意思的话:“这既是一场马拉松,也是一场短跑。” 问题在于,动量型投资者往往只看到了短跑这段。等到终点线出现时,他们早已跑不动了。 04势头 ≠ 创新速度 马斯克说,护城河其实没那么重要,真正重要的是创新的速度。但很多人把“创新速度”误解成了“市场热度”或“增长动能”。 a16z 的合伙人亚历克斯·伊默曼对此补充得很形象:“动量不是护城河,而是船。”意思是,势头可以带你抵达能建护城河的岛屿,但本身并不是护城河。 在早期阶段,公司靠的是势头;当你发展到一定规模后,才能真正建立护城河。即使在 ChatGPT 时代,这些护城河的本质仍没变——依然来自转换成本、网络效应、规模经济、品牌和专有数据。只是现在模型更容易获取、产品组件更便宜、发展速度更快,但防御逻辑仍旧如此。 马斯克提到的“创新速度”,并不是指你做出了多少东西,而是你推动创新循环的能力。很多公司看似增长很快,收入数据亮眼,但那往往是靠烧钱或低效模式堆出来的,并不代表它们真的拥有能持续产生高质量创新的引擎。 真正的高速创新,来自更好的产品、更强的技术突破,以及能快速消除低效的团队。 更糟糕的是,如今大量追逐“势头”的投资者反而在放大问题——他们推高了短期动量,却掩盖了缺乏真正创新能力的风险。 05总结 当资本充裕到一定程度,它其实会掩盖很多问题。每家大公司都在抢投那些“可能成为下一个顶尖1%赢家”的公司,生怕错过机会。于是他们越来越早下注——只要看到一点点成功迹象,就会立刻砸钱。 结果是,很多商业模式还没被验证、经济逻辑不稳、团队执行力一般的公司,也能拿到巨额融资。钱和关注一多,它们就能吸引更多人才、更多资本、更多媒体曝光,让原本并不健康的模式看起来更像是“成功范式”。 更糟的是,这会影响下一代创业者。大家都开始照搬这些套路:快速融资、烧钱扩张、靠短期增长数据讲故事,而不是打磨真正可持续的产品和商业引擎。 势头确实重要,但它不是护城河。 真正决定企业命运的,是能不能打造出高质量、长期可持续的创新引擎。如果把“追热点”当成成长的核心,只会让整个生态变得越来越浮躁。 最终能留下来的,还是那最顶尖的1%创始人——他们无论有没有资本的推波助澜,都会创造伟大的公司。而被时代遗忘的,将是那中间50%的企业:不是最差的,也不是最好的,只是那些被浪潮裹挟、昙花一现的公司。

OpenSea Frequently Asked Questions (FAQ)

When was OpenSea founded?

OpenSea was founded in 2017.

Where is OpenSea's headquarters?

OpenSea's headquarters is located at 228 Park Avenue South, New York.

What is OpenSea's latest funding round?

OpenSea's latest funding round is Series C.

How much did OpenSea raise?

OpenSea raised a total of $425.12M.

Who are the investors of OpenSea?

Investors of OpenSea include Coatue, KRH, Paradigm, FinTech Collective, Bossa Invest and 49 more.

Who are OpenSea's competitors?

Competitors of OpenSea include Loyi, Zora, FirstMate, Fractal, UPYO and 7 more.

Loading...

Compare OpenSea to Competitors

Dixel Club is a company focused on providing a platform for launching non-fungible token (NFT) collections in the digital asset industry. Their main service allows users to quickly create and mint their own NFT collections, with a feature for minting various color editions following an original genesis edition. The platform caters to individuals and creators interested in the NFT marketplace. It is based in Singapore, Singapore.

Starly is a company that provides a platform for launching non-fungible tokens (NFT) collections and a marketplace for buying and selling these digital assets within the digital asset industry. Its services support creators and collectors in the NFT space. It was founded in 2021 and is based in Central Singapore, Singapore.

Exclusible operates as a gaming and immersive technology studio focusing on revolutionizing brand engagement. The company offers strategic solutions to integrate global brands into gaming communities, leveraging platforms like Roblox, Fortnite, and Minecraft to craft immersive experiences to resonate with younger audiences. It was founded in 2021 and is based in Cascais, Portugal.

Larva Labs is a technology company that works in the blockchain and mobile app development sectors. The company creates crypto art projects, including collectible NFTs like CryptoPunks and Meebits, and on-chain generative art such as Autoglyphs, all secured by the Ethereum blockchain. Larva Labs has also developed data visualizations and mobile applications. It was founded in 2005 and is based in New York, New York.

Magic Eden is an NFT marketplace operating across various blockchain networks. The company facilitates the buying and selling of NFTs, offering services such as NFT minting, analytics, and marketplace aggregation. Magic Eden serves the cryptocurrency and digital collectible sectors. It was founded in 2021 and is based in San Francisco, California.

Loyi specializes in creating gamified loyalty programs for the lifestyle sector, focusing on Gen Z customers. The company offers a platform that allows brands to build quests, award collectibles, and deliver rewards to enhance customer loyalty. Loyi's services cater to brands looking to improve customer engagement and retention through loyalty solutions. Loyi was formerly known as Enefty. It was founded in 2021 and is based in Berlin, Germany.

Loading...