Orus

Founded Year

2021Stage

Series B | AliveTotal Raised

$45.73MLast Raised

$29.04M | 5 mos agoAbout Orus

Orus focuses on providing insurance services, operating within the insurance industry. The company offers a range of insurance products, including professional liability insurance, multi-risk restaurant insurance, ten-year insurance, and health insurance for independent workers. Its services are designed to provide coverage for various professional activities, with a particular emphasis on independent workers, startups, and small to medium-sized enterprises. The company was founded in 2021 and is based in Paris, France.

Loading...

Orus's Products & Differentiators

Professional Multirisk

Covers premises against fire, theft, property damage and other risks associated with commercial activity.

Loading...

Research containing Orus

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Orus in 2 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Aug 7, 2025 report

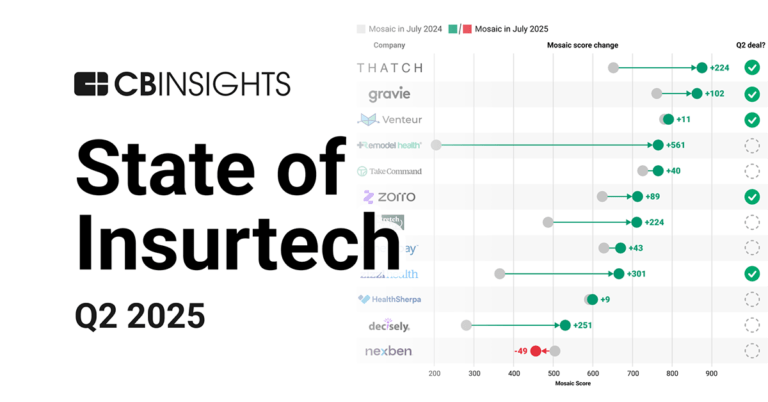

State of Insurtech Q2’25 ReportExpert Collections containing Orus

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Orus is included in 4 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Insurtech 50 2025

50 items

Do not share

Insurtech 50

50 items

Latest Orus News

Sep 27, 2025

| PYMNTS.com By PYMNTS | September 26, 2025 | Get the Full Story Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins required. yesSubscribe to our daily newsletter, PYMNTS Today. By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions . Δ The company filed its registration statement on Form S-1 with the Securities and Exchange Commission for a proposed IPO and intends to list its Class A common stock on the Nasdaq Global Select Market under the ticker symbol “LIFE,” it said in a Friday press release . “The number of shares to be offered and the price range for the proposed offering have not yet been determined,” Ethos said in the release. The company’s technology platform serves consumers, agents and carriers, and it offers access to life insurance products with just a few health questions and no medical exam required, according to the release. Ethos said in its Form S-1 that it began operations in 2018 and that it has expanded from one to ten products since then. They also surpassed 450,000 cumulative policies activated in 2025. During the 12 months ended June 30, the company earned revenue of $320 million, year-over-year revenue growth of 57% and a gross margin of 98%, according to the form. Advertisement: Scroll to Continue Its platform provides consumers with affordable coverage in minutes, offers agents an instant selling process and next-day commissions and delivers strong risk management capabilities to carriers, the company said in the form. “Ethos is a low, single-digit percentage of the life insurance industry today,” the company said in the form. “By building a high-NPS, vertically-integrated technology platform that transforms the life insurance experience for consumers, agents and carriers — we are well-positioned to seize the opportunity before us and transform the industry.” The company was valued at $2.7 billion in July 2021 when it raised an additional $100 million on the heels of a $200 million Series D round two months earlier. In another recent development in the InsurTech sector, DynaRisk said in July that it raised $4.7 million in a funding round to accelerate product innovation and fuel the international expansion of its cyber risk management solutions for the insurance sector. In June, Orus raised 25 million euros in a Series B funding round to fuel the planned pan-European expansion of its digital platform offering tailored insurance for small and medium-sized businesses. Recommended

Orus Frequently Asked Questions (FAQ)

When was Orus founded?

Orus was founded in 2021.

Where is Orus's headquarters?

Orus's headquarters is located at 8, rue Sainte-Cecile, Paris.

What is Orus's latest funding round?

Orus's latest funding round is Series B.

How much did Orus raise?

Orus raised a total of $45.73M.

Who are the investors of Orus?

Investors of Orus include Redstone, Notion Capital, Singular, Partech, Frst Capital and 12 more.

Who are Orus's competitors?

Competitors of Orus include Insify, Stello, Olino, Welfaire, Globality Health and 7 more.

What products does Orus offer?

Orus's products include Professional Multirisk and 3 more.

Loading...

Compare Orus to Competitors

Onsi is a company that specializes in providing flexible worker benefits and insurance solutions operating within the human resources and insurance sectors. The company offers a platform that enables businesses to manage on-demand pay, rewards, and insurance for their workers based on shift data, with minimal manual work required. Onsi primarily serves businesses that employ shift workers and require scalable benefits programs. It was formerly known as Collective Society and changed its name to Onsi in September 2024. The company was founded in 2019 and is based in London, United Kingdom.

+Simple is a digital insurance broker that provides insurance solutions for independent professionals and small businesses. The company offers professional liability insurance and other insurance products for various trades, including those in the wellness and beauty sectors. +Simple serves independent professionals and small and medium-sized enterprises (SMEs) across different industries. +Simple was formerly known as Hobast. It was founded in 2015 and is based in Marseille, France.

Indeez is an InsurTech company that focuses on providing sustainable and inclusive insurance benefits within the financial services and green mobility sectors. The company offers a range of insurance products, including accident and sickness coverage, professional indemnity, and public liability, designed to protect independent workers and support business growth. Indeez primarily serves sectors such as mobility, freelancing, staffing, delivery, and banking. It was founded in 2020 and is based in Paris, France.

Portabl is a company that provides a support platform for freelancers, operating within the freelance services industry. The company offers tools for project and task management, dashboards, and billable hours tracking, which aim to assist independent workers. Additionally, Portabl provides access to a community for networking and resources related to insurance, financial, and wellbeing benefits for freelancers. It was founded in 2018 and is based in London, England.

Trupo is a company that produces vegan milk chocolate and treats within the confectionery industry. Their products are vegan, gluten-free, soy-free, and nut-free. Trupo products include versions of popular childhood snacks, using fairly traded cocoa. It is based in Brooklyn, New York.

Optisure provides insurance for freelancers and entrepreneurs. Optisure's digital platform enables users to complete the paperwork for and adjust their insurance coverage online. It is based in Karlsruhe, Germany.

Loading...