Overjet

Founded Year

2018Stage

Series C | AliveTotal Raised

$130.55MValuation

$0000Last Raised

$53.2M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+31 points in the past 30 days

About Overjet

Overjet focuses on dental artificial intelligence (AI) and operates within the healthcare technology sector. It offers a platform that supports dental providers and payers by enhancing clinical care and administrative efficiency through AI-driven radiographic analysis and claims processing optimization. The company primarily sells to the dental industry, including dental service organizations (DSOs), dental groups, and insurance companies. It was founded in 2018 and is based in Boston, Massachusetts.

Loading...

Overjet's Product Videos

_OnePager_v2_thumbnail.png?w=3840)

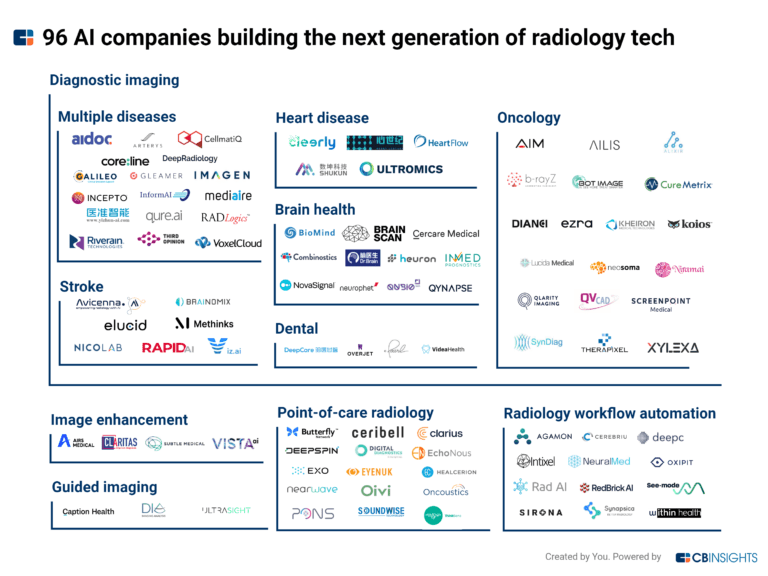

ESPs containing Overjet

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The dental imaging analytics platforms market aims to improve the accuracy and efficiency of dental disease detection and treatment. Vendors here are using tech to detect and diagnose dental conditions such as cavities, gum disease, and oral cancer by analyzing X-ray and 3D imaging data. Tech is also used to detect early signs of periodontal disease and identify the presence of impacted teeth. The…

Overjet named as Leader among 9 other companies, including Philips, Pearl, and VideaHealth.

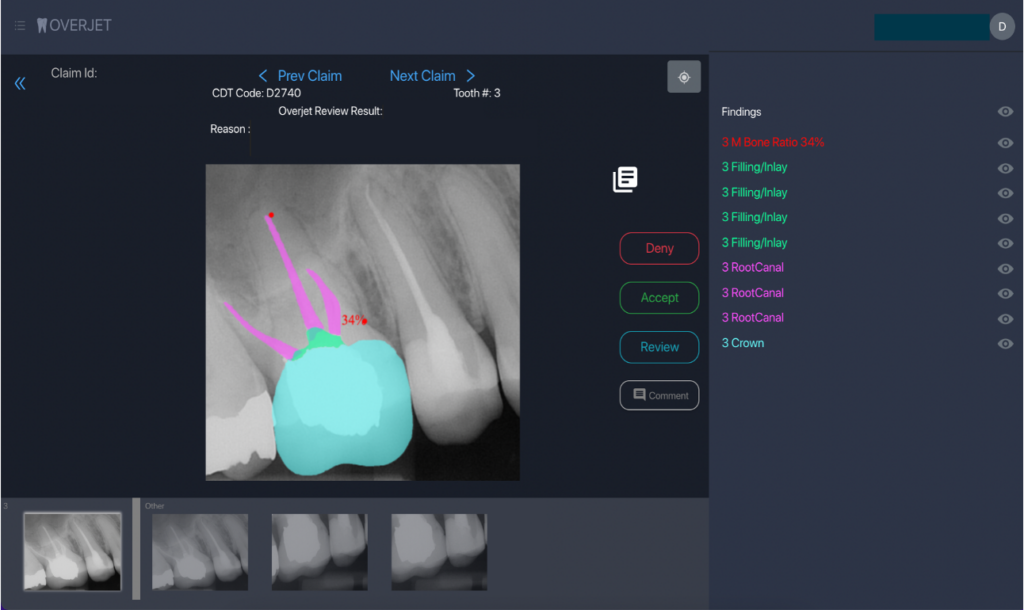

Overjet's Products & Differentiators

Insurance Intelligence Platform

The Insurance Intelligence Platform is the only end-to-end utilization review solution that can make expert, compliant decisions on dental insurance claims — using a powerful combination of AI and independent, licensed reviewers.

Loading...

Research containing Overjet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Overjet in 5 CB Insights research briefs, most recently on Oct 20, 2025.

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

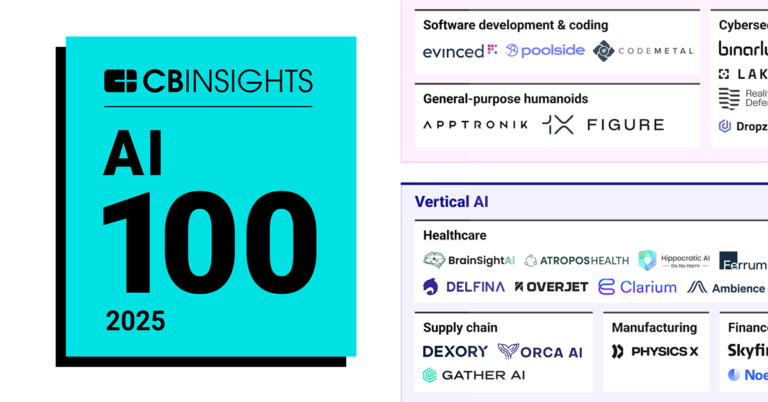

AI 100: The most promising artificial intelligence startups of 2025Expert Collections containing Overjet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Overjet is included in 9 Expert Collections, including Insurtech.

Insurtech

3,403 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

AI 100 (All Winners 2018-2025)

200 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Digital Health 50

300 items

The winners of the third annual CB Insights Digital Health 150.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Overjet Patents

Overjet has filed 6 patents.

The 3 most popular patent topics include:

- image processing

- medical imaging

- dentistry

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/22/2021 | 12/3/2024 | Dentistry, Artificial neural networks, Optical illusions, Acquired tooth disorders, Dental materials | Grant |

Application Date | 12/22/2021 |

|---|---|

Grant Date | 12/3/2024 |

Title | |

Related Topics | Dentistry, Artificial neural networks, Optical illusions, Acquired tooth disorders, Dental materials |

Status | Grant |

Latest Overjet News

Oct 7, 2025

The Dental Insurance Market size was at US$ 200 billion in 2024 and is expected to grow to US$ 428.32 billion by 2033 at a CAGR of 8.83% from 2025 to 2033. Increased awareness of oral health, mounting dental care expenses, and wider employer-sponsored protection are prime drivers of market growth in both developed and developing economies. Popularity of dental insurance is increasing in the world with greater awareness towards oral health and its relationship to overall health. Increased costs associated with dental care make insurance increasingly popular among people and families to ensure financial cover. Many companies across the world, particularly in the U.S., provide dental coverage as one of the benefits for employees, which further propels adoption. Increased levels of income and health literacy in emerging economies are widening the scope of the insured population. The ease of combining health and dental coverages is also helping to push demand for dental insurance protection higher. Growth Drivers in the Dental Insurance Market Increasing Oral Health Awareness Public awareness of the need for dental care and its association with general health has considerably fueled dental insurance demand. Oral problems are now widely seen as potential causes or signs of other conditions including heart disease and diabetes. More people are therefore looking for preventive dental treatment and routine check-ups, making insurance a viable and essential option. Awareness campaigns by governments and healthcare providers are also fueling market growth. Approximately 3.5 billion individuals worldwide live with oral diseases, with the most prevalent one being untreated tooth decay. World Oral Health Day on 20 March every year is a reminder of healthy gums and teeth. The 2025 campaign promotes higher awareness and action and prioritizes making small daily habits a necessity for good oral health. Growing Cost of Dental Treatment Dental procedures, particularly larger services such as implants, orthodontics, and surgeries, are expensive without insurance. As dental care costs keep increasing all over the world, insurance is now a desirable option for those who want financial security. Even simple procedures like cleanings and fillings add to high out-of-pocket expenses in the long run. Insurance policies spread these expenses through reasonable premiums, making dental services affordable and promoting regular visits. March 2025, Overjet, the global leader in dental AI, announces today the launch of the Dental Clarity Network (DCN). The DCN is an alliance of leading companies within the dental care system that are leveraging advanced technology to enhance the patient experience, while eliminating friction between payers and providers. Employer-Sponsored Insurance Plans One of the major drivers in the dental insurance sector is the growth in employer-sponsored dental insurance, particularly in industrialized nations such as the United States, Canada, and regions in Europe. Dental benefits are considered an important part of desirable compensation packages by employers. Such group cover generally includes lower premiums and extensive coverage, which promotes higher participation among employees. Growing corporate priorities about the health and retention of employees will likely increase the population covered. Challenges Facing the Dental Insurance Market Limited Benefits and High Out-of-Pocket Expenses Most dental insurance policies have restrictions in the form of yearly coverage limits, waiting times, and partial payments, particularly for cosmetic or complicated procedures. Policyholders are thus left with considerable out-of-pocket costs even after having an insurance policy. Such restrictions might discourage some consumers from buying or renewing policies. Another factor that contributes to customer confusion and dissatisfaction is the absence of uniformity in plan benefits among providers. Lack of Penetration in Developing Regions In most developing nations, the dental insurance sector remains underdeveloped. Low levels of awareness, mistrust of insurance companies, and unaffordability limit market penetration. In areas where public health systems exclude dental care, individuals either do not seek treatment or pay in full out-of-pocket. This is a significant growth barrier. Increasing insurance literacy and affordability will be critical to accessing these large, underpenetrated markets. Dental Insurance Preferred Provider Organizations (PPO) Market Preferred Provider Organization (PPO) dental plans are the most sought-after types because they're flexible and have a vast network of providers. PPO plans provide partial benefits for out-of-network care but encourage using in-network providers by having reduced out-of-pocket expenses. PPO plans are appealing to individuals as well as employers because they're balanced in terms of cost and freedom of choice. The increasing popularity is because of self-referral possibilities and the option to select specialists without having to visit the primary care dentist. Dental Insurance Indemnity Plans Market Indemnity policies, or conventional dental insurance, enable policyholders to see any network-eligible dentist. Indemnity policies pay a proportion of the cost of care, usually after a deductible is reached. Indemnity policies are more costly than other varieties but provide maximum flexibility and are best for consumers who value flexibility over cost management. Although less prevalent in contemporary times, they continue to be popular with a niche market, especially among older generations or high-income individuals. Key Attributes: Report Attribute Details No. of Pages Forecast Period Estimated Market Value (USD) in 2024 $200 Billion Forecasted Market Value (USD) by 2033 $428.32 Billion Compound Annual Growth Rate Regions Covered Global Key Players Analysis: Overview, Key Persons, Recent Development & Strategies, Revenue Analysis Cigna AXA AFLAC Inc Allianz SE Aetna Ameritas Life Insurance Corp United HealthCare Services Inc. Metlife Services & Solutions Dental Insurance Market Segmentation Coverage Dental Preferred Provider Organizations Dental Health Maintenance Organizations Dental Indemnity Plans Others Type Preventive Basic Major Demographics Senior Citizens Adults Minors Countries North America United States Canada Europe France Germany Italy Spain United Kingdom Belgium Netherlands Turkey Asia Pacific China Japan India South Korea Thailand Malaysia Indonesia Australia New Zealand Latin America Brazil Mexico Argentina Middle East & Africa Saudi Arabia UAE South Africa For more information about this report visit https://www.researchandmarkets.com/r/hv16az About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. View source version on businesswire.com: https://www.businesswire.com/news/home/20251007024765/en/ Contacts ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Overjet Frequently Asked Questions (FAQ)

When was Overjet founded?

Overjet was founded in 2018.

Where is Overjet's headquarters?

Overjet's headquarters is located at 200 State Street, Boston.

What is Overjet's latest funding round?

Overjet's latest funding round is Series C.

How much did Overjet raise?

Overjet raised a total of $130.55M.

Who are the investors of Overjet?

Investors of Overjet include Crosslink Capital, E14 Fund, Liquid 2 Ventures, Insight Partners, General Catalyst and 10 more.

Who are Overjet's competitors?

Competitors of Overjet include VideaHealth, Pearl, Adravision, KELLS, Pearlii and 7 more.

What products does Overjet offer?

Overjet's products include Insurance Intelligence Platform.

Who are Overjet's customers?

Customers of Overjet include Guardian.

Loading...

Compare Overjet to Competitors

VideaHealth develops artificial intelligence solutions for the dental industry. The company provides a dental artificial intelligence (AI) platform that aims to improve diagnostic accuracy and optimize practice workflows by combining clinical and workflow AI. VideaHealth targets dental service organizations (DSOs) and individual dental clinicians. VideaHealth was formerly known as DentistAI. It was founded in 2018 and is based in Boston, Massachusetts.

Pearl specializes in dental artificial intelligence (AI) solutions within the healthcare technology sector. Its main offerings include an AI-enabled radiologic platform for dental diagnostics and artificial intelligence services for dental practices. Its technology is utilized by the dental industry to improve the efficiency, accuracy, and consistency of dental care. It was founded in 2019 and is based in West Hollywood, California.

Denti.AI develops dental technology in the healthcare sector. The company offers products such as a dental scribe for recording clinician-patient conversations, voice-enabled perio charting for periodontal assessments, and automated X-ray diagnostics. Denti.AI primarily serves the dental healthcare industry, integrating its solutions with existing practice management systems to improve clinical workflows. It was founded in 2017 and is based in Toronto, Ontario.

Retrace is a company that provides payment solutions for the oral health care sector. It offers automation tools that assist with billing and office processes for dental practices. Retrace serves oral health care providers, payers, and patients by addressing claims processing. It was founded in 2016 and is based in San Francisco, California.

KELLS operates as an artificial intelligence-powered personal dental companion that operates in the healthcare technology sector. The company offers virtual and onsite dental evaluations, real-time advice, and treatment verification services to improve oral health care. KELLS primarily serves the healthcare industry by partnering with payors and providers to manage oral health risks and reduce costs. It was founded in 2018 and is based in Long Island City, New York.

Boneprox provides digital dental care and healthcare solutions, focusing on imaging and diagnostics. The company offers services including communication platforms for telediagnostics, AI for dental imaging analysis, and education programs for dental professionals. Boneprox serves the dental and healthcare sectors with its solutions. It was founded in 2013 and is based in Gothenburg, Sweden.

Loading...