OwlTing

Founded Year

2010Stage

IPO | IPOTotal Raised

$10MDate of IPO

10/17/2025About OwlTing

OwlTing provides stablecoin infrastructure within the fintech sector, focusing on payment solutions. The company offers services for the conversion between stablecoins and fiat currencies, stablecoin payments, and compliance solutions for digital asset transactions. OwlTing serves enterprises and individuals looking to integrate stablecoin solutions into their operations. It was founded in 2010 and is based in Taipei City, Taiwan.

Loading...

OwlTing's Product Videos

OwlTing's Products & Differentiators

Stablecoin payment infrastructure

Loading...

Research containing OwlTing

Get data-driven expert analysis from the CB Insights Intelligence Unit.

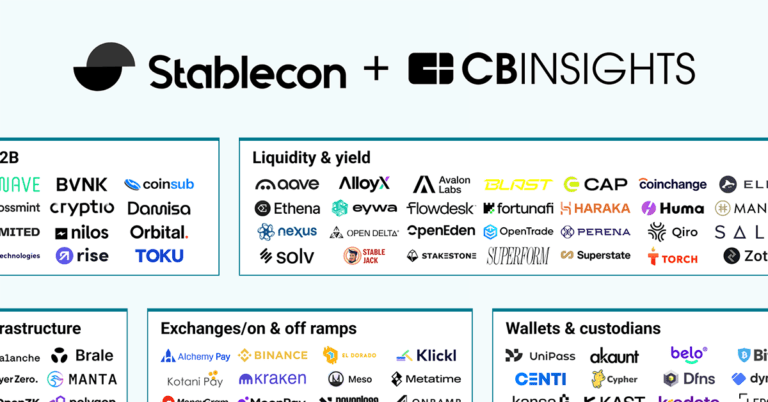

CB Insights Intelligence Analysts have mentioned OwlTing in 1 CB Insights research brief, most recently on May 29, 2025.

May 29, 2025

The stablecoin market mapExpert Collections containing OwlTing

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

OwlTing is included in 2 Expert Collections, including Blockchain.

Blockchain

9,320 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Stablecoin

471 items

Latest OwlTing News

Nov 17, 2025

Taipei, Taiwan ARLINGTON, Va., Nov. 17, 2025 (GLOBE NEWSWIRE) -- OBOOK Holdings Inc. (NASDAQ: OWLS) (the "Company" or "OwlTing"), a blockchain technology company operating as the OwlTing Group, today shared updated indicators of accelerating enterprise adoption across stablecoin-based settlement and tokenized financial infrastructure, as global companies shift from pilot exploration to real production integration. Since its Nasdaq direct listing on October 16, OwlTing has seen a significant rise in inbound interest from payment companies, remittance providers, and financial institutions preparing for a future in which stablecoins and tokenized cash operate as standard rails for global commerce. Multiple clients across Canada, Europe, Africa, and Asia have already advanced into API integration and live transaction testing with OwlPay Harbor1, the Company’s enterprise-grade on/off-ramp and settlement layer for compliant USD–USDC2 flows. These onboarding clients collectively manage up to US$100 million in monthly cross-border fiat volume, representing meaningful potential for phased migration onto stablecoin rails. “The discussions we are having post-listing are markedly different from six months ago,” said Darren Wang, Founder and CEO at OwlTing Group. “Enterprises are no longer just studying stablecoins and tokenization, they are moving to the integration phase and preparing to shift real volume. It is particularly encouraging to see established payment companies in Asia and Europe view our platform as a compliant bridge to the U.S. market.” Industry Momentum: Tokenized Money and Instant Settlement Are Converging This shift reflects two accelerating global forces. The increasing adoption of tokenized assets, including cash deposits, treasuries, and stocks, by major global banks, trading platforms, and capital markets providers. Analysts estimate the tokenized-equity segment alone could exceed US$1 trillion if only 1% of global equities migrate on-chain3. The rising demand for a compliant, real-time settlement layer capable of handling instant, programmable cross-border flows. OwlPay Harbor addresses these needs with regulatory coverage across 40 U.S. states4, enterprise-grade AML/KYC infrastructure, continuous transaction monitoring, multi-chain settlement capabilities, and optimized corridors spanning North America, Europe, and high-growth emerging markets. Early Client Profiles Current participants integrating or testing OwlPay Harbor include remittance fintechs seeking faster U.S.–Africa and U.S.–Asia transfers, Canadian payment firms managing frequent USD flows, European SMEs exploring stablecoin-based supplier payments, and traditional financial institutions assessing tokenized cash and deposit strategies. Introducing Stablecoin Checkout: A Replacement for Traditional Payment Gateways OwlTing has also expanded into merchant payments with OwlPay Stablecoin Checkout, an embedded acquiring solution that allows global merchants to accept stablecoins from customers worldwide, settle instantly in fiat or stablecoins, reduce card fees, eliminate chargebacks, and bypass traditional card networks and payment gateways. Stablecoin Checkout positions OwlTing as a next-generation alternative to legacy payment gateways, offering programmable settlement and global reach without the delays and fees of traditional card infrastructures. x402: An AI “Autopilot” for Global Settlement OwlTing is also preparing to launch x402, an AI-driven settlement engine that automates routing optimization, compliance screening including AML, sanctions, and KYC, liquidity and FX management, multi-currency, multi-chain settlement, reconciliation and clearing. In plain terms, x402 functions as a self-driving autopilot for cross-border stablecoin settlement, reducing dozens of manual steps into a single automated workflow. 2025 Product Suite Positioned for Multi-Trillion-Dollar Growth With Citi projecting the stablecoin and tokenized-cash market could reach up to US$4 trillion by 2030 in a bullish scenario5, OwlTing has rolled out a comprehensive 2025 product suite designed to capture this growth: OwlPay Harbor: API-enabled payment rail for enterprise-grade USD–USDC on/off-ramping across major blockchains; OwlPay Stablecoin Checkout: an embedded acquiring solution that lets merchants accept stablecoin payments and settle instantly in fiat; OwlPay Wallet Pro: a self-custodial digital wallet for individual users with real-world spending via integrated gift cards at over 100 major U.S. retailers, and another custodial version for business users for tiered fund management; Comprehensive AML/KYC/KYT Services: Integrated across all OwlPay solutions, providing end-to-end compliance with automated identity verification, transaction screening, and continuous monitoring to ensure seamless, risk-managed stablecoin operations in cross-border payments. Together, these solutions are supported by extensive licensing coverage and a compliance-first framework that positions OwlTing to serve as a critical infrastructure provider for enterprises and individuals, navigating the ongoing shift toward faster, programmable, and borderless financial flows. About OBOOK Holdings Inc. (OwlTing Group) OBOOK Holdings Inc. (NASDAQ: OWLS) is a blockchain technology company operating as the OwlTing Group. The Company was founded and is headquartered in Taiwan, with subsidiaries in the United States, Japan, Poland, Singapore, Hong Kong, Thailand, and Malaysia. The Company operates a diversified ecosystem across payments, hospitality, and e-commerce. In 2025, according to CB Insights’ Stablecoin Market Map, OwlTing was ranked among the top 2 global players in the “Enterprise & B2B” category. The Company’s mission is to use blockchain technology to provide businesses with more reliable and transparent data management, to reinvent global flow of funds for businesses and consumers and to lead the digital transformation of business operations. To this end, the Company introduced OwlPay, a Web2 and Web3 hybrid payment solution, to empower global businesses to operate confidently in the expanding stablecoin economy. For more information, visit https://www.owlting.com/portal/?lang=en . Safe Harbor Statement Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “aim,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “likely,” “potential,” “project,” or “continue,” or the negative of these terms or other comparable terminology. The Company undertakes no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot guarantee that such expectations will prove correct. The Company cautions investors that actual results may differ materially from those anticipated and encourages investors to review other factors that may affect its future results in the Company’s registration statement filed with and declared effective by the SEC and other filings with the SEC, available at www.sec.gov . OBOOK Holdings Inc. Media Relations Michael Hsu, Public Relations Director

OwlTing Frequently Asked Questions (FAQ)

When was OwlTing founded?

OwlTing was founded in 2010.

Where is OwlTing's headquarters?

OwlTing's headquarters is located at No. 26, Wencheng Rd., Beitou Dist., Taipei City.

What is OwlTing's latest funding round?

OwlTing's latest funding round is IPO.

How much did OwlTing raise?

OwlTing raised a total of $10M.

Who are the investors of OwlTing?

Investors of OwlTing include UNIVA Oak Holding, Stellar, SBI Holdings and Kyber Capital.

Who are OwlTing's competitors?

Competitors of OwlTing include BVNK and 7 more.

What products does OwlTing offer?

OwlTing's products include Stablecoin payment infrastructure .

Loading...

Compare OwlTing to Competitors

TransFi develops a payment platform for the purchase of digital assets and nonfungible tokens (NFTs). The company's main service involves providing fiat-to-crypto ramps, allowing users to easily buy and sell cryptocurrency using their local currency and banking or e-wallet services. It was founded in 2022 and is based in Tampa, Florida.

Interac operates as a financial technology company offering digital payment solutions and identity verification services. The company provides services such as Interac Debit for in-store payments, Interac e-Transfer for sending and receiving money online, and Interac Direct for online shopping payments. Interac also offers solutions for individuals and businesses to authenticate identities and transactions. Interac was formerly known as Acxsys. It was founded in 1984 and is based in Toronto, Canada.

HotelRunner is a SaaS-enabled platform that provides solutions for sales, operations, and distribution management within the travel and hospitality industry. The company offers products such as a booking engine, channel manager, property management system, guest relationship management tools, revenue management tools, and payment processing. HotelRunner serves various types of accommodations including hotels, vacation rentals, and bed & breakfasts, as well as travel agencies. It was founded in 2011 and is based in Wilmington, Delaware.

CurrencE provides global payout solutions within the financial technology sector. The company offers services including real-time and beneficiary-directed payments, payout routing, and a platform for businesses to manage their payouts. CurrencE serves sectors such as corporate finance, affiliate marketing, clinical trials, and the gig economy. It is based in Webster, New York.

Zero Hash is providing financial infrastructure for the crypto and stablecoin sectors. The company's offerings include API technology and regulatory infrastructure that allow businesses to launch crypto products while ensuring compliance, covering the functions for fiat and crypto. Zero Hash serves sectors including fintechs, trading platforms, payment issuers, brands, and developers. It was founded in 2017 and is based in Chicago, Illinois.

CFX Labs provides digital dollar infrastructure and global payment solutions. The company offers services that connect digital assets with local currency through a regulated payment network, allowing transactions for businesses and individuals. It serves sectors that require digital remittance, cross-border payments, and the integration of digital currencies with traditional financial systems. It was founded in 2021 and is based in Chicago, Illinois.

Loading...