Pathos

Founded Year

2022Stage

Series D | AliveTotal Raised

$457MValuation

$0000Last Raised

$365M | 7 mos agoAbout Pathos

Pathos is a clinical-stage biotechnology focuses on the re-engineering of drug development using AI technologies. It provides services such as optimizing patient selection strategies and developing precision medicines. Pathos serves the biopharmaceutical industry by partnering to advance clinical-stage therapeutics. It was founded in 2022 and is based in Chicago, Illinois.

Loading...

Loading...

Research containing Pathos

Get data-driven expert analysis from the CB Insights Intelligence Unit.

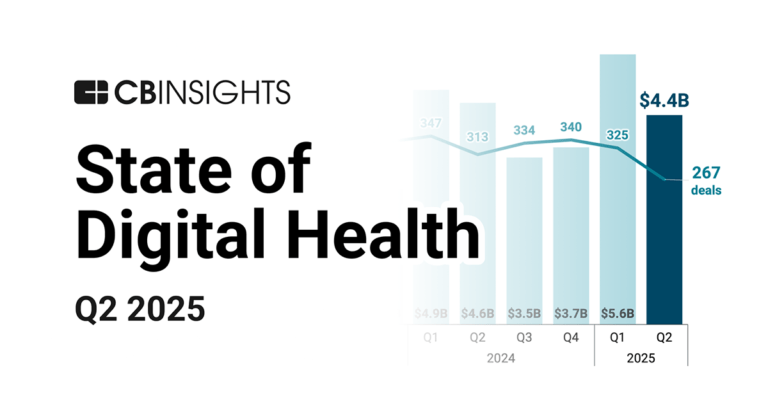

CB Insights Intelligence Analysts have mentioned Pathos in 1 CB Insights research brief, most recently on Jul 24, 2025.

Jul 24, 2025 report

State of Digital Health Q2’25 ReportExpert Collections containing Pathos

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pathos is included in 3 Expert Collections, including Digital Health.

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Artificial Intelligence (AI)

20,894 items

Unicorns- Billion Dollar Startups

1,309 items

Latest Pathos News

Oct 16, 2025

Dylan Doran Kennett, Tom Watkins, and Lerryn Martin Article Insights Dylan Doran Kennett's articles from Herbert Smith Freehills Kramer LLP are most popular: in United Kingdom Herbert Smith Freehills Kramer LLP are most popular: within Food, Drugs, Healthcare, Life Sciences, Environment and Coronavirus (COVID-19) topic(s) Activity overview Life sciences venture activity levels remained stable in 2024 and total investment value in the sector was up after a two-year period of decline. So far, 2025 paints a varied picture with a strong first quarter performance in terms of both value and volume. However, this pace did not continue into Q2 with a slow-down in activity levels which continued into the summer. This is perhaps reflective of the increasing uncertainty for the sector (particularly in the US) which is adding further pressure in what was already a challenging investment environment. It is a similar tale for IPOs in the US. There was early promise with a flurry of biotech IPOs in the first two months of the year. However, this momentum was not sustained with only 4 between March and mid-September. Meanwhile, Europe's IPO scene remains practically non-existent with only 1 in the first half of the year. In this article, we look at some of the key life sciences investment themes in 2025 so far and provide our outlook on the final months of the year and beyond. For our recent article on trends and themes in biopharma M&A, please see here Key investment themes 2025 has seen continued investor interest in companies utilising AI technology across the life sciences spectrum, with examples including: AI driven drug discovery companies, Isomorphic Labs (which raised $600m in its first external financing round) and oncology-focused Pathos AI (which raised $365m its Series D financing in May). Cera Care, an AI-led home healthcare company which secured $150m in debt and equity funding. Abridge, which is utilising AI for clinical conversations and raised $300m in its Series E financing in June. Neuralink which raised a $650m Series E financing to continue the development of its brain computer interface. Healthcare AI / data solutions company Innovaceer, which raised $275m in its Series F funding round. In terms of therapeutic areas , popular biopharma investment targets include: Neurology – with companies completing successful rounds including Neurona Therapeutics which raised $102m in an oversubscribed private funding round to advance its pipeline, including to take its lead candidate for epilepsy into Phase 3, and CNS-disorder focused Maplight's (also over-subscribed) $372.5m Series D in July. Mirroring M&A trends, oncology continues to gather interest with some of the larger investment rounds including Pathos (as mentioned above) and Eikon which raised $351m in its Series D financing. Similarly, interest in immunology remains steady as seen in the $200m Series C round raised by Abcuro (which is developing immunotherapies for autoimmune diseases and cancer) and Timberlyne Therapeutics, which raised a $180m Series A to advance what it sees as a potential best-in-class monoclonal antibody. Despite doubts as to whether the trend would last, obesity / cardiometabolic has still been able to pull investors as seen in the over-subscribed $411 million Series A funding round by Verdiva Bio with its advanced next gen oral and injectables. Another theme which aligns with a broader trend shaking up the industry is the rise in investment in companies with underlying Chinese-developed technologies . The sector has recently seen a significant increase of licensing deals out of China (and, in contrast to the US and Europe, there has been a flurry of life sciences IPOs on the Hong Kong Exchange reflecting the interest and confidence in the region). We are now also seeing investment flowing into US and European biotechs that are developing technologies licensed from Chinese biotechs . Examples include the aforementioned Verdiva Bio (with candidates licensed from China's SciWind Biosciences) and Timberlyne Therapeutics (formed in partnership between Mountainfield Venture Partners and Chinese biotech, Keymed Biosciences, which is developing assets licensed from the latter). Outlook for the rest of 2025 and beyond In terms of the outlook for venture investment in life sciences in the US and Europe, we expect activity levels to remain relatively consistent whilst volatility and uncertainty for the sector remains. It is possible that the latter months of 2025 could see a slight post-summer uptick in investment and IPO activity but this cannot be called with any certainty. In terms of investor focus, we expect companies utilising AI and other emerging technologies will remain a real focus for investors in the months (and years) ahead. Similarly, we expect more US and European biotechs will look to China-based assets and that these companies will continue to draw investment interest The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Pathos Frequently Asked Questions (FAQ)

When was Pathos founded?

Pathos was founded in 2022.

Where is Pathos's headquarters?

Pathos's headquarters is located at 600 West Chicago Avenue, Chicago.

What is Pathos's latest funding round?

Pathos's latest funding round is Series D.

How much did Pathos raise?

Pathos raised a total of $457M.

Who are the investors of Pathos?

Investors of Pathos include Lightbank, NEA, Revolution, Builders VC, Tempus and 5 more.

Who are Pathos's competitors?

Competitors of Pathos include Kekulai.

Loading...

Compare Pathos to Competitors

Pangea Botanica is a biotechnology company involved in drug discovery and development within the healthcare sector, particularly targeting neurological and neuropsychiatric disorders. The company employs artificial intelligence to analyze natural compounds that have a history of traditional use. It was founded in 2021 and is based in Kent, England.

Gandeeva Therapeutics is a medicine company that engages in drug discovery within the biotechnology sector. The company utilizes artificial intelligence and cryogenic electron microscopy to develop therapies that target protein interactions, particularly in oncology. Gandeeva Therapeutics collaborates and licenses technologies and has a team in structural biology, computer science, and medicinal chemistry. It was founded in 2021 and is based in Burnaby, Canada.

Enveda operates as a biotechnology company using artificial intelligence (AI) to assist in the development of medicines. The company identifies and characterizes a variety of molecules produced by living organisms, some of which have not been scientifically explored, creating a database of chemical biodiversity. The database is used by Enveda to address medical challenges. Enveda was formerly known as Enveda Therapeutics. It was founded in 2019 and is based in Boulder, Colorado.

Kekulai focuses on small-molecule drug discovery using artificial intelligence in the pharmaceutical industry. It provides solutions that combine artificial intelligence (AI) with combinatorial chemical libraries to aid the drug discovery process. It was founded in 2024 and is based in Seattle, Washington.

Molab.ai is an AI company focused on drug discovery within the pharmaceutical industry. It provides a discovery platform that combines in-silico design and evaluation with wet lab validation, including virtual library screening and ADMET prediction. Its services aim to enhance small molecule drugs using AI/ML and cheminformatics techniques. It was founded in 2022 and is based in München, Germany. In July 2025, Molab.ai was acquired by Cresset Group.

Loading...