Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.84MValuation

$0000Last Raised

$100M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-2 points in the past 30 days

About Payhawk

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

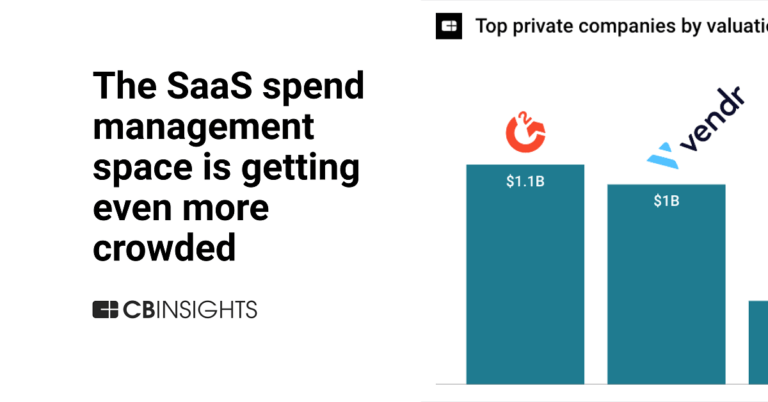

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Payhawk named as Outperformer among 15 other companies, including Coupa, Ramp, and Pleo.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Expert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Payhawk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

SMB Fintech

1,648 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

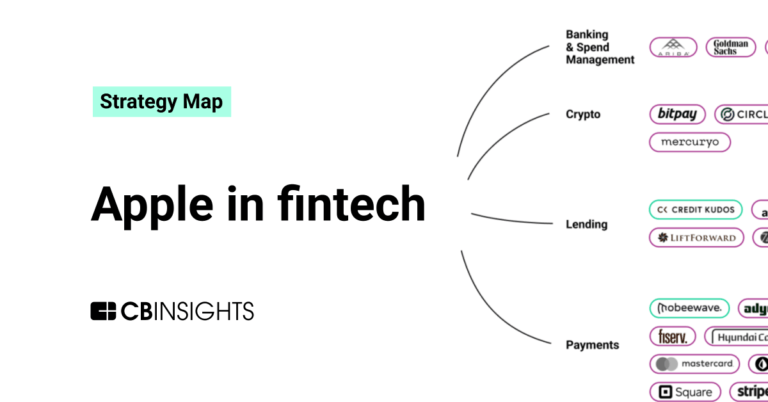

Fintech

14,203 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Payhawk News

Nov 4, 2025

Tech.eu Tech.eu Insights creates insight and guides strategies with its comprehensive content and reports. Browse popular Insights content. Bulgarian unicorn Payhawk plays down Brex's European challenge Payhawk is hoping to grow its US revenues to up to 30 per cent of overall revenues in the next five years. The CEO of Bulgarian spend management unicorn Payhawk has played down the threat of US rival Brex, which recently announced it was launching across the EU, saying they were targeting different customer bases and that the EU was a fragmented market. Payhawk CEO and co-founder Hristo Borisov also said that Payhawk was not pursuing an IPO in the near term, but was keeping its options open regarding a potential listing venue if and when it decided to go public. Borisov said: “We’re keeping optionality. The US offers deep capital markets for large SaaS/fintech issuers; Europe is core to our business and talent footprint. We’ll choose the market that best matches our scale and investor base when the time is right.” Payhawk, which became Bulgaria's first-ever unicorn in 2022, now employs around 480 people with offices in Sofia, London, Berlin, Barcelona, Amsterdam, Vilnius, Munich, Paris, New York and a soon-to-open new office in another European city. Payhawk offers customers spend management services, so employees can manage their spending lifecycle, from company card to bills and invoices in one place. Payhawk, founded in 2018, reported revenues of €23.4m in the year ending December 2024, up 85 per cent on the year, but it is not yet full-year profitable. The boost in revenues was attributed to the startup offering a broader suite of services, on top of its corporate cards, including travel, accounts payable and procurement services. Currently, around 95 per cent of Payhawk's revenues come from Europe. Earlier this year, San Francisco-based spend management rival Brex said it was launching in the EU , having bagged an EU Payment Institution licence. But Borisov played down the threat from Brex, saying the US firm had a different target market to Payhawk, targeting startups and small businesses with up to 40 people. Borisov: ‘We are usually owning the mid-market space, the more mature companies, so that is a key differentiator. Furthermore, he also pointed out that the EU was a fragmented market, with different rules across areas like payments and currencies. He added: ‘You don’t have to win in one market, you need to win in 29.” Big incumbents like American Express also have a major presence in the corporate card market. In the US, Borisov said he expected Payhawk’s US revenues to grow as much as 30 per cent of its overall revenues in five years. He said US businesses were more amenable than European businesses to working with startups like Payhawk. He said the two firms had gained traction by giving out free corporate cards to startups and small businesses. He said: “The problem we have seen in the US is that the spend management market has been a market which has been heavily subsidised from a go-to-market perspective. "From a price perspective, there are several companies that have already raised more than $3 billion. The way they compete is really heavily subsidising the product. "What we have been trying to do in the US is if they are playing that game, to try and change the game, so instead of us offering a free product and trying to monetise the customer later on, we have tried to build something sustainable that customers are willing to pay with right now.” Instead of offering its own corporate cards, Payhawk offers services on top of existing card giants like Visa and MasterCard. Borisov also said that Payhawk, which has yet to make any acquisitions, was currently being turned off from making acquisitions by, generally speaking, prices being too high for potential targets, saying startups were clinging to their high valuations of 2021.

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at 53-64 Chancery Lane, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.84M.

Who are the investors of Payhawk?

Investors of Payhawk include Earlybird Venture, Bek Ventures, QED Investors, Greenoaks, Sprints Capital and 14 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Husk, Yokoy, Brex, Spendesk, Pleo and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Spendesk provides financial management tools for businesses. It offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. It was founded in 2016 and is based in Paris, France.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Moss provides spend management solutions within the financial technology sector. The company has a platform that allows businesses to manage expenses, handle month-end financial closing, and connect with existing human resources and accounting systems. Moss serves finance teams that require expense management tools. It was founded in 2019 and is based in Berlin, Germany.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mooncard operates as a software-as-a-service (SaaS) company that focuses on business expenses and corporate spend management. The company offers smart payment cards linked to accounting and management software, which automate expense reports and simplify the daily lives of employees. It primarily serves companies of all sizes across various sectors. The company was founded in 2016 and is based in Paris, France.

Loading...