PayPal

Founded Year

1998Stage

PIPE - III | IPOTotal Raised

$203MMarket Cap

62.00BStock Price

66.22Revenue

$0000About PayPal

PayPal is a financial technology company involved in digital payment processing and online money transfers. The company provides a platform for individuals and businesses to send, receive, and manage money, along with a range of financial services such as savings accounts, credit products, and cryptocurrency transactions. PayPal was formerly known as X.Com. It was founded in 1998 and is based in San Jose, California.

Loading...

ESPs containing PayPal

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The quick response (QR) code payments market enables businesses to accept payments by having customers scan QR codes with their mobile devices, or by scanning customer-generated QR codes. Solutions include QR code payment gateways, merchant QR code systems, table-side payment platforms for restaurants, in-store checkout via QR scanning, and payment links with embedded QR codes. Key features includ…

PayPal named as Leader among 8 other companies, including Block, Qlub, and Sunday.

PayPal's Products & Differentiators

PayPal

Millions of people trust PayPal to buy, sell, and send money—without sharing their financial information.

Loading...

Research containing PayPal

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PayPal in 23 CB Insights research briefs, most recently on Oct 7, 2025.

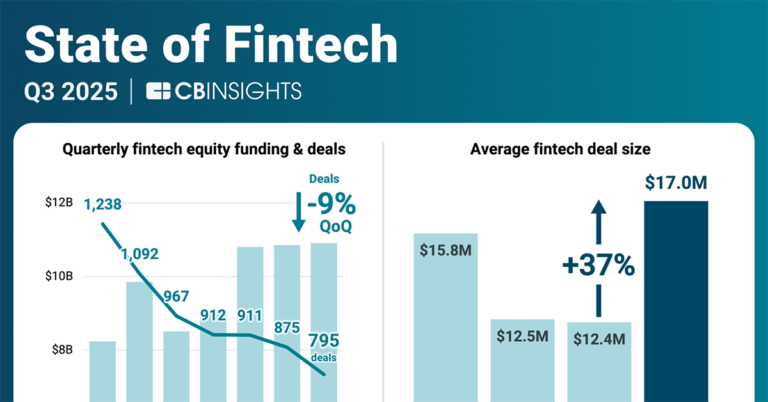

Oct 7, 2025 report

State of Fintech Q3’25 Report

Oct 3, 2025 report

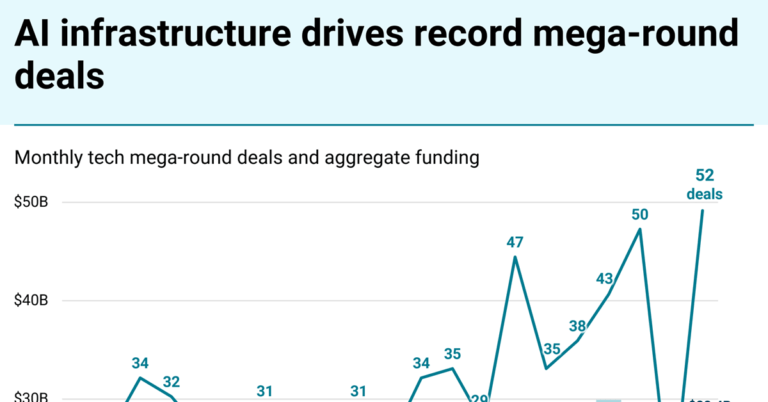

Dual AI engines: LLMs and optimizers sweep September mega-round funding

Sep 12, 2025

How payments leaders are seizing the SMB opportunity

Aug 4, 2025

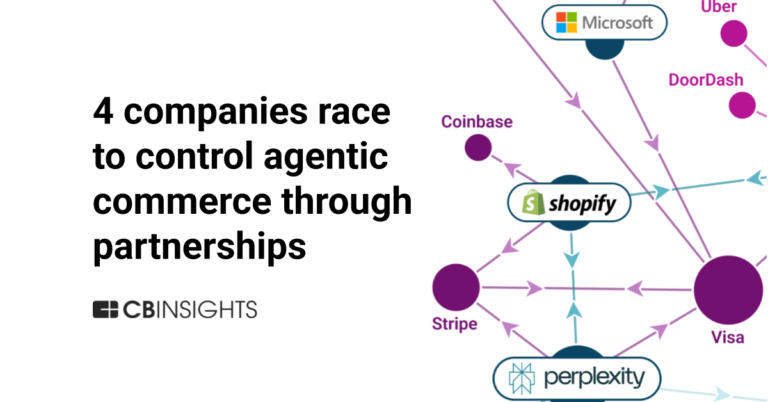

3 markets fueling the shift to agentic commerce

Jul 31, 2025 report

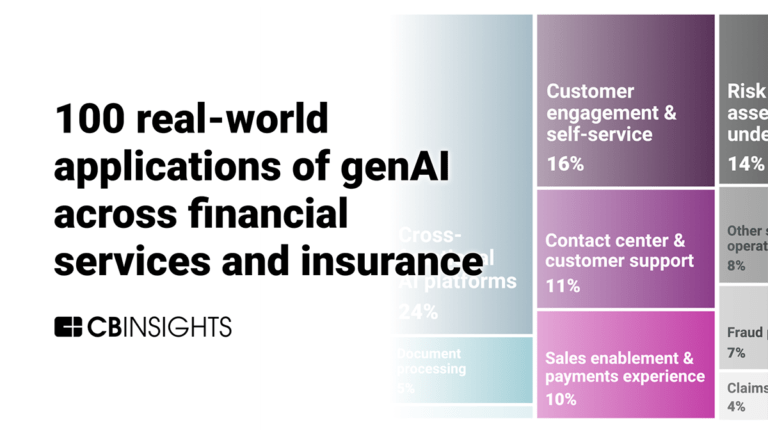

100 real-world applications of genAI across financial services and insurance

Jun 6, 2025

The SMB fintech market mapExpert Collections containing PayPal

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PayPal is included in 10 Expert Collections, including Blockchain.

Blockchain

9,829 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

SMB Fintech

1,586 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

PayPal Patents

PayPal has filed 3286 patents.

The 3 most popular patent topics include:

- payment systems

- data management

- payment service providers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/11/2020 | 4/8/2025 | Payment systems, Payment service providers, Barcodes, Mobile payments, Online payments | Grant |

Application Date | 11/11/2020 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Payment systems, Payment service providers, Barcodes, Mobile payments, Online payments |

Status | Grant |

Latest PayPal News

Nov 10, 2025

UPI Gets Integrated Into Paypal For Cross-Border Payments UPI Gets Integrated Into Paypal For Cross-Border Payments Nov 10, 2025 In a major boost to digital payments, PayPal has announced plans to integrate Unified Payments Interface (UPI) into its PayPal World platform, enabling seamless cross-border transactions between Indian UPI users and global merchants. This integration will allow Indian users to make international purchases directly using UPI, strengthening India’s role in the global digital payments landscape. Expanding UPI’s Global Reach This development follows PayPal’s collaboration with NPCI International Payments Limited (NIPL), the organization responsible for internationalising India’s UPI and RuPay networks. The partnership marks a critical step in expanding UPI’s global footprint by connecting it with PayPal’s vast international merchant base. Ritesh Shukla, CEO of NIPL, stated that the initiative would “enhance convenience for Indian users making payments abroad while enabling global merchants to access India’s growing UPI user base.” Soon, Indian consumers shopping on global platforms will see UPI as a payment option when clicking the PayPal checkout button, simplifying overseas purchases without relying on credit or debit cards. PayPal World: Building a Unified Global Payments Network The PayPal World initiative is a comprehensive effort to connect multiple digital payment systems and wallets across the globe. PayPal has partnered with platforms such as Latin America’s Mercado Pago, China’s TenPay Global, US-based Venmo, and India’s NIPL. These integrations will enable interoperability between different payment systems, allowing users of connected wallets to execute cross-border transactions seamlessly. The system leverages open commerce APIs and a cloud native, multi-region architecture designed to ensure low latency and high availability worldwide. Global Reach and Next-Gen Capabilities According to PayPal, the PayPal World platform could potentially connect nearly two billion users across global markets. It supports dynamic payment buttons and even stablecoin payments, offering merchants flexibility and customers modern, secure options for digital commerce. By linking India’s robust UPI ecosystem with its international network, PayPal is addressing one of the biggest challenges in digital finance—making cross-border payments as easy as local ones.

PayPal Frequently Asked Questions (FAQ)

When was PayPal founded?

PayPal was founded in 1998.

Where is PayPal's headquarters?

PayPal's headquarters is located at 2211 North First Street, San Jose.

What is PayPal's latest funding round?

PayPal's latest funding round is PIPE - III.

How much did PayPal raise?

PayPal raised a total of $203M.

Who are the investors of PayPal?

Investors of PayPal include Tudor Investment Corporation, Elliott Management, Third Point, eBay, Bankinter and 44 more.

Who are PayPal's competitors?

Competitors of PayPal include Worldpay, Revolut, PayPay, Bolt, M-Pesa and 7 more.

What products does PayPal offer?

PayPal's products include PayPal and 4 more.

Who are PayPal's customers?

Customers of PayPal include United Airlines.

Loading...

Compare PayPal to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Amazon Pay is a digital payment platform that offers financial services such as mobile recharges, bill payments, and purchases of digital gift cards and vouchers. It also facilitates payments for travel tickets and insurance premiums. It is based in India.

Interac operates as a financial technology company offering digital payment solutions and identity verification services. The company provides services such as Interac Debit for in-store payments, Interac e-Transfer for sending and receiving money online, and Interac Direct for online shopping payments. Interac also offers solutions for individuals and businesses to authenticate identities and transactions. Interac was formerly known as Acxsys. It was founded in 1984 and is based in Toronto, Canada.

Revolut operates as a financial technology company that provides a digital banking platform. It offers financial services including money management tools, foreign exchange trading, cryptocurrency transactions, and investment services. The company serves individual consumers who want to manage finances. It was founded in 2015 and is based in London, United Kingdom.

Moneris Solutions provides commerce solutions within the financial technology sector. The company offers services including payment processing, point-of-sale systems, and online payment gateways for businesses. Moneris Solutions serves the retail, restaurant, professional services, and public sector industries with commerce solutions. It was founded in 2000 and is based in Toronto, Canada.

PagoNxt is a payment solution provider in the financial services industry, backed by Santander. The company offers services including merchant, international trade, and consumer payment solutions to help clients manage, receive, and transfer money. PagoNxt serves merchants, international corporates, and SMEs. It was founded in 2020 and is based in Madrid, Spain.

Loading...