Perfios

Founded Year

2008Stage

Series D - II | AliveTotal Raised

$443.18MValuation

$0000Last Raised

$80M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-22 points in the past 30 days

About Perfios

Perfios provides credit decisioning and analytics solutions for the banking, financial services, and insurance (BFSI) sectors. The company offers products that automate onboarding, due diligence, and financial data analysis for financial institutions. It was founded in 2008 and is based in Bangalore, India.

Loading...

Perfios's Product Videos

ESPs containing Perfios

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

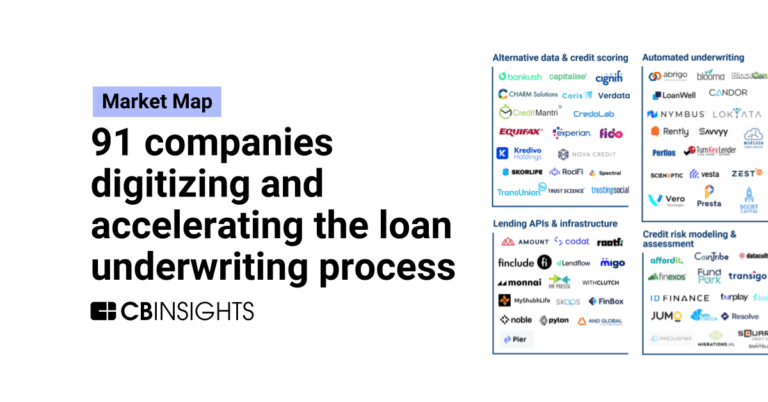

The loan underwriting market provides AI-powered software platforms that automate the evaluation of borrower creditworthiness and loan eligibility decisions. These solutions analyze financial documents, bank statements, credit reports, and alternative data sources to assess risk and streamline underwriting workflows for lenders. Key capabilities include automated document processing, fraud detecti…

Perfios named as Highflier among 15 other companies, including Scienaptic, Zest AI, and Tavant.

Loading...

Research containing Perfios

Get data-driven expert analysis from the CB Insights Intelligence Unit.

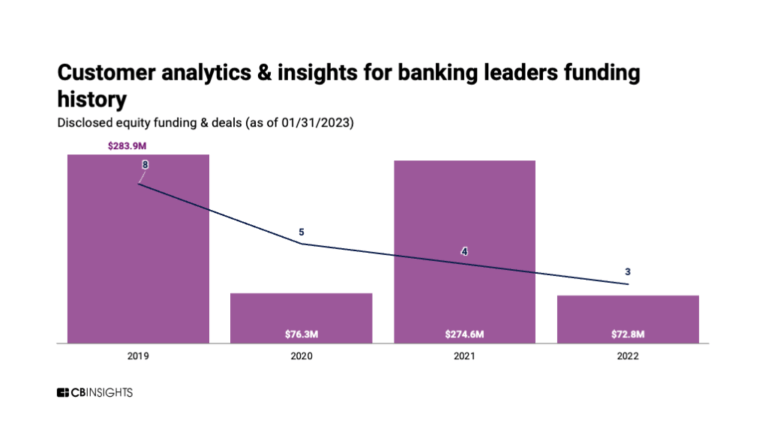

CB Insights Intelligence Analysts have mentioned Perfios in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Oct 18, 2023 report

State of Fintech Q3’23 ReportExpert Collections containing Perfios

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Perfios is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,735 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

14,203 items

Excludes US-based companies

Latest Perfios News

Nov 17, 2025

Beehive Fintech , a leading digital SME lending platform, has transformed its underwriting process with Perfios's AI-powered automation solutions. By deploying Perfios Nexus, Beehive Fintech has accelerated loan underwriting by 48%, improving risk accuracy and decision speed. The collaboration was announced today at the Singapore Fintech Festival , marking a significant milestone in Beehive Fintech's mission to deliver faster, data-driven lending to SMEs. Perfios Nexus 360 , an advanced, end-to-end platform for document ingestion, classification, intelligence and processing, built to power real-time credit decisioning, has enabled faster due diligence and fully automated workflows, helping lenders achieve unprecedented turnaround efficiency. Following the success of this deployment, the company plans to expand Perfios' solutions across the GCC region, strengthening its digital lending infrastructure and enabling a broader reach to underserved businesses. “At Beehive Fintech, our goal has always been to make business financing faster, simpler, and more accessible for SMEs,” said Abiha Ahmed, Director – Operations & Risk, Beehive Fintech . “The Perfios Nexus solution has been a game-changer for our underwriting process, enabling us to evaluate applications with greater speed and precision while maintaining strong risk governance. This partnership has strengthened our ability to deliver seamless, data-driven credit access to SMEs and will continue to play a key role as we expand our presence across the GCC region.” “We are thrilled to partner with Beehive Fintech in their transformative journey,” said Pramod Veturi, CEO – International Business, Perfios . “Perfios Nexus brings intelligence, precision, and scalability to every stage of credit evaluation. Beehive Fintech's rapid success demonstrates how technology can redefine decision-making speed and quality in lending. We're proud to be part of their journey toward building a more agile and data-intelligent financial ecosystem.”

Perfios Frequently Asked Questions (FAQ)

When was Perfios founded?

Perfios was founded in 2008.

Where is Perfios's headquarters?

Perfios's headquarters is located at 66/525, Hosur Road, above Star Hyper, Chikku Lakshmaiah Layout, Adugodi, Bangalore.

What is Perfios's latest funding round?

Perfios's latest funding round is Series D - II.

How much did Perfios raise?

Perfios raised a total of $443.18M.

Who are the investors of Perfios?

Investors of Perfios include Teachers' Venture Growth, Kedaara Capital, Stride Ventures, Visa Accelerator Program, Bessemer Venture Partners and 7 more.

Who are Perfios's competitors?

Competitors of Perfios include FinBox, Scienaptic, LENDOX, Yodlee, Plaid and 7 more.

Loading...

Compare Perfios to Competitors

MoneyThumb provides financial document conversion services and software solutions for the finance and accounting industries. The company offers tools to convert portable document format (PDF) bank statements into various formats for use in loan underwriting, fraud detection, and accounting data migration. Its products serve lenders, accountants, bookkeepers, and small businesses, focusing on financial data management. It was founded in 2012 and is based in Encinitas, California.

MX provides financial data intelligence solutions within the financial services sector. The company offers products that allow financial institutions and fintechs to connect accounts, verify financial data, and analyze financial information. MX serves the financial services industry, including banks, credit unions, and fintech companies. MX was formerly known as MoneyDesktop. It was founded in 2010 and is based in Lehi, Utah.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Salt Edge operates as a company specializing in open banking solutions within the fintech sector. The company provides access to real-time bank data and payment initiation capabilities, supporting financial services for various businesses. Salt Edge's products serve sectors such as lending, banking, e-commerce, treasury management, automotive, and iGaming. It was founded in 2013 and is based in Toronto, Canada

Pinwheel provides financial technology solutions, including direct deposit switching, digital payroll data connectivity, and tools for managing subscriptions and financial insights. The company serves the banking, lending, and credit union sectors. It was founded in 2018 and is based in New York, New York.

Underwrite.ai focuses on AI-driven credit risk modeling in the financial services industry. The company provides credit risk modeling that aims to improve the precision of lending decisions by using machine learning techniques. Underwrite.ai's services serve community banks, credit unions, and peer-to-peer lending platforms by offering AI models that assess the probability of default with a limited amount of borrower information. It was founded in 2015 and is based in Boston, Massachusetts.

Loading...