Placer.ai

Founded Year

2016Stage

Series D | AliveTotal Raised

$277.9MValuation

$0000Last Raised

$75M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-78 points in the past 30 days

About Placer.ai

Placer.ai is a company specializing in location intelligence and foot traffic data within the analytics and data science industry. The company provides an analytics platform for sectors like retail, commercial real estate, and economic development. Placer.ai's services are utilized by professionals in retail, real estate, hospitality, and economic development to make decisions based on consumer behavior and foot traffic patterns. It was founded in 2016 and is based in Covina, California.

Loading...

Placer.ai's Product Videos

ESPs containing Placer.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The retail spatial intelligence & traffic analytics market provides solutions for retailers to gather and analyze customer movement data in physical spaces. These solutions leverage various technologies such as indoor positioning, people counting sensors, and AI-powered computer vision that integrate with existing camera infrastructure to track customer and staff movement patterns. Key features in…

Placer.ai named as Leader among 15 other companies, including CARTO, Gorilla Technology, and RetailNext.

Placer.ai's Products & Differentiators

Platform

The Placer platform is the company's core product offering bringing the proprietary data to customers within easy-to-consume dashboards that enable enhanced accessibility. The core product is being constantly upgraded with new features and product updates hitting on a monthly basis. The ability to bring industry leading accuracy and accessibility together is a core strength for the product and company.

Loading...

Research containing Placer.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Placer.ai in 2 CB Insights research briefs, most recently on Aug 14, 2023.

Aug 14, 2023

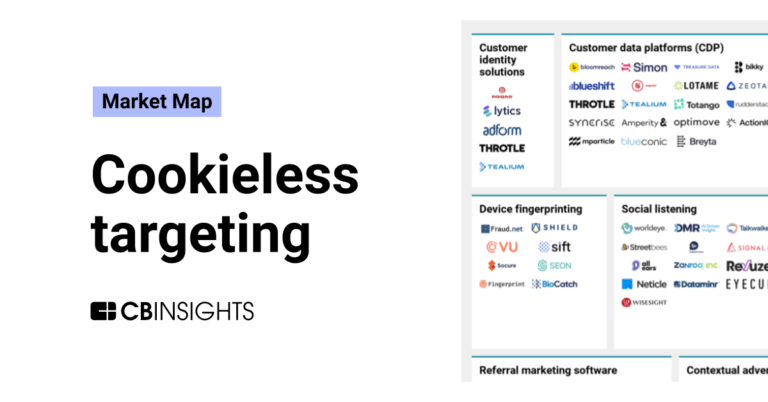

The cookieless targeting market mapExpert Collections containing Placer.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Placer.ai is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,896 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,309 items

Conference Exhibitors

5,302 items

Targeted Marketing Tech

659 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Retail Media Networks

324 items

Tech companies helping retailers build and operate retail media networks. Includes solutions like demand-side platforms, AI-generated content, digital shelf displays, and more.

Latest Placer.ai News

Nov 6, 2025

While teleworking has been around nearly since the dawn of the internet, remote work saw a boom at the start of the COVID-19 pandemic. According to a 2022 U.S. Census Bureau report , the number of Americans working from home tripled between 2019 and 2021, going from 9 million people to 27.6 million. That figure dropped to 22.5 million people in 2023 , and now many workplaces are beginning to question the viability of remote work and are requiring their employees to return to in-person roles. Is this what employees really want, and is it good for them? Using data collected from sources like Pew Research Center and the Cleveland Clinic, WorkTango has outlined the pros and cons of returning to the office, the preferences of current job holders, and how the transition can be made more seamless for everyone involved. Pros and cons of returning to the office The average American will spend a third of their working years at their job. For some, remote work has provided flexibility and new opportunities. For others, it has brought loneliness and poor productivity . There are various benefits and drawbacks associated with returning to in-person work, and not everyone will agree across workforces and businesses. However, there are a few general points: Benefits Workplaces can enjoy improved productivity and collaboration. Studies have found that sitting near a high performer can improve someone’s performance . Employees get more socialization through casual conversation that would normally not occur on a Zoom call. A better work-life balance is possible, as people do not bring their work home with them. Drawbacks Based on the average commute time of 27.6 minutes before the COVID-19 pandemic, some workers will have less free time as they travel to and from work. Employers can lose money from having to maintain office space. Business perspectives on returning to work Many businesses believe that returning to in-person work is positive. Last year, Amazon CEO Andy Jassy said returning allows the company to be “…better set up to invent, collaborate, and be connected enough to each other and our culture to deliver the absolute best for customers and the business…” At the same time, having employees return to work can also be more costly for a company. They need to provide office spaces, technology, utilities, and benefits like coffee, snacks, and more. Employee perspectives and the effects of return to work The effects of return-to-work policies are strongly felt by the employee. Working remotely is popular, with 36% of workers in a 2023 YouGov survey saying they would prefer to work from home every day. Another 28% said they would prefer a hybrid work environment. Still, many employees also enjoy the benefits of working in person, particularly those who are extroverted and require more socialization. The Myers-Briggs Company’s 2022 research report found that statistically, extroverts prefer remote work less than introverts and are more likely to agree to the statement, “I miss having people around me.” Mental health and the return-to-office transition In a study done by McKinsey & Co. in 2021 , a third of respondents who had already returned to in-person work reported negative impacts on their mental health. The mental health effects were most strongly felt by individuals who benefited from the more flexible work environments, especially parents with children. Overall, workplaces can contribute to mental health issues. The Cleveland Clinic reported in 2021 that 84% of respondents claimed their workplace was negatively impacting their mental health in at least one way. Some of the key stressors that were cited by the Cleveland Clinic include no paid sick leave, night shifts and rotating shifts, unpredictable pay, and inconsistent scheduling. Preventive measures that employers can take Easing the burden of returning to work is a responsibility of the employer. The U.S. Surgeon General’s office has a framework that workplaces can follow to promote better mental health amongst their employees. Following these recommendations is key for businesses looking to implement return-to-office policies. Current return-to-office trends Five years after the onset of COVID-19, many companies are exploring return-to-office policies for their employees. Some of the most notable corporations in the U.S., including Amazon, JPMorgan Chase, and Nike, have implemented policies that require employees to be in the office at least four days a week. Others are opting for hybrid work schedules that can accommodate employee preferences. McKinsey & Co. has found that the proportion of mostly in-person workers (working in person at least four days a week) doubled between 2023 and 2024. The number of workers in a hybrid format (working in person two to three days a week) declined to 14% from 22%. By the end of 2025, Resume Templates expects that 27% of companies will be fully in-person again , and 67% will have some level of flexible, hybrid work. Geographic trends Some cities are returning to in-person work quicker than others. According to Placer.ai , New York is leading the way and saw positive (1.3%) year-over-year office foot traffic growth in July 2025. San Francisco topped the year-over-year office recovery charts, seeing a 21.6% increase from 2024 to 2025. Preferences vs. reality: What do workers really want? A 2023 YouGov survey also found that return-to-work policies generally go against the wishes of the employee. Up to 64% of employees in the United States would prefer not to have to work in the office every day. Data (as seen in the graphic below) suggests that the extent to which employees want to be remote can vary, with most opting for a hybrid scenario. WorkTango Effective return-to-office strategies for employers to consider The Stanford Institute for Economic Policy Research explains that there is a “Great Resistance” among the workforce about going back to the office. For employers that do require presence in the office, about 20% of workers were not showing up as much as requested in 2022. For employers who are attempting to bring workers back to the office, there are a few approaches that can be taken. Support programs Programs that support employee mental health and well-being can make the transition back to in-office work easier. The Center for Workplace Mental Health suggests creating employee resources, supporting people-oriented staff, promoting company culture, and prioritizing communication. Hybrid work arrangements Hybrid work is a middle ground for employees who want the flexibility of working from home and for employers who want in-office collaboration. Company-specific policies can be developed to accommodate the needs of everyone. In-person work requirements can be as few as one day a week, or as many as four. Navigating returning to the office with confidence For some businesses, getting employees to return to the office is easy. For others, it’s a significant challenge. Pros and cons exist for both remote and in-person work environments, and there is no clear-cut answer for which is better for the employee or employer. Understanding the reasons why workers want to return or stay at home is an important step that businesses can take to develop a comprehensive return-to-office plan. Additionally, employees can be receptive to the requests of their employers in regards to performance and culture. If both parties remain open, the flexibility of remote work and the sense of collaboration of an in-person setting can be maintained.

Placer.ai Frequently Asked Questions (FAQ)

When was Placer.ai founded?

Placer.ai was founded in 2016.

Where is Placer.ai's headquarters?

Placer.ai's headquarters is located at 440 North Barranca Avenue, Covina.

What is Placer.ai's latest funding round?

Placer.ai's latest funding round is Series D.

How much did Placer.ai raise?

Placer.ai raised a total of $277.9M.

Who are the investors of Placer.ai?

Investors of Placer.ai include Fifth Wall, Josh Buckley, Array Ventures, Lachy Groom, WndrCo and 32 more.

Who are Placer.ai's competitors?

Competitors of Placer.ai include Foursquare, xMap, Plaace, Geoblink, Gravy Analytics and 7 more.

What products does Placer.ai offer?

Placer.ai's products include Platform and 2 more.

Who are Placer.ai's customers?

Customers of Placer.ai include Newmark Merrill.

Loading...

Compare Placer.ai to Competitors

Foursquare provides a geospatial technology platform that focuses on location intelligence and analytics. The company provides various solutions to assist businesses in understanding locations and human mobility, which may influence revenue, marketing, and product strategies. Its tools are used by enterprises to gain insights into consumer behavior. It was founded in 2009 and is based in New York, New York.

SafeGraph specializes in curating geospatial data for analytics and is a key player in the data services industry. The company offers a comprehensive suite of products, including detailed point of interest (POI) data, building footprint information, and attributes that provide context and precision to geospatial analyses. SafeGraph's data solutions cater to a variety of sectors, such as retail site selection, competitive intelligence, risk assessment, and consumer behavior analysis. It was founded in 2016 and is based in Denver, Colorado.

Cuebiq focuses on offline behavior measurement and analytics within the marketing and advertising technology sectors. The company provides tools for measuring advertising efforts and targeting audiences based on offline behaviors. Cuebiq serves marketers, agencies, data analysts, and technology providers who use location data for decision-making. It is based in New York, New York.

GroundTruth is a media platform that operates within the advertising technology sector. The company provides advertising campaigns that utilize consumer behavior data, including location and purchase data, to assess the effectiveness of ads across different screens. GroundTruth primarily serves advertisers aiming to understand customer engagement and enhance store visits and sales through advertising. GroundTruth was formerly known as xAd. It was founded in 2009 and is based in New York, New York.

Cosmose helps to understand, predict, and influence people to shop offline. It offers an offline behavioral data technology that helps brands and marketers influence and predict consumers' choices, targets them with online ads, and measures online campaigns' impact on offline visits and sales. It uses AI analytics to track in-store foot traffic and engage with shoppers online. The company was founded in 2014 and is based in Singapore.

Adsquare is a location intelligence platform that provides tools for campaign planning, activation, measurement, and attribution, using geospatial data science to support marketing activities. Adsquare serves advertisers, media agencies, and out-of-home advertising operators within the advertising ecosystem. It was founded in 2012 and is based in Hennigsdorf, Germany.

Loading...