Plaid

Founded Year

2013Stage

Unattributed VC - II | AliveTotal Raised

$1.316BValuation

$0000Last Raised

$575M | 8 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+52 points in the past 30 days

About Plaid

Plaid provides fintech solutions across various sectors. It offers products that connect financial data to applications and services, including bank account verification, balance checks, payment processing, identity verification, and transaction monitoring. Plaid serves the fintech industry and provides infrastructure for transactions, fraud prevention, and finance insights. It was founded in 2013 and is based in San Francisco, California.

Loading...

ESPs containing Plaid

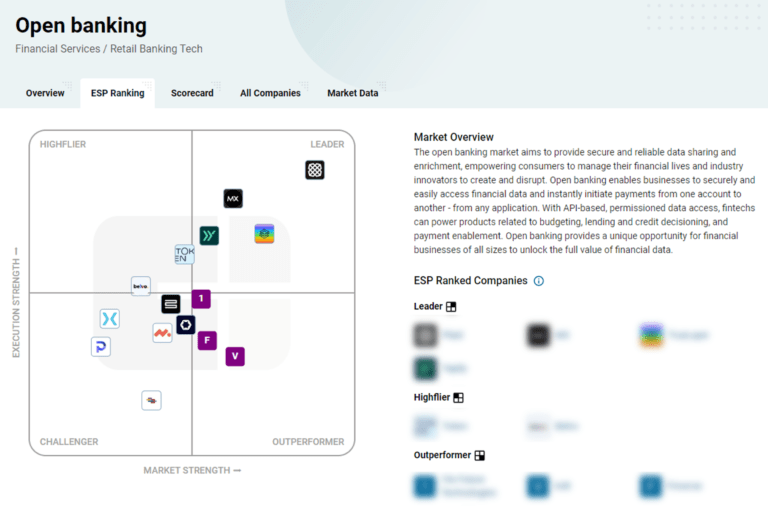

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The income & employment verification platforms market enables lenders, property managers, and financial institutions to verify and validate applicant income and employment information. These platforms utilize APIs, machine learning, and document processing to automate verification processes, replacing manual paperwork and phone calls. Companies in this market connect to payroll providers, analyze …

Plaid named as Leader among 11 other companies, including Equifax, Argyle, and Atomic.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plaid in 11 CB Insights research briefs, most recently on Jul 17, 2025.

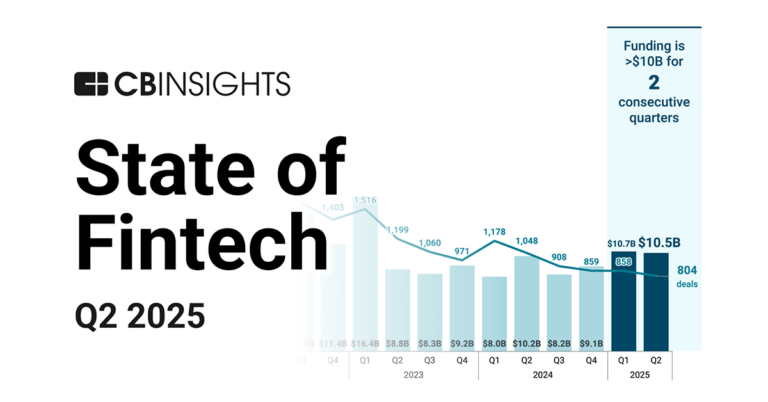

Jul 17, 2025 report

State of Fintech Q2’25 Report

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,641 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 70 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2022 | 3/25/2025 | Data management, Computer security, Payment systems, Computer network security, Internet privacy | Grant |

Application Date | 6/16/2022 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Data management, Computer security, Payment systems, Computer network security, Internet privacy |

Status | Grant |

Latest Plaid News

Nov 11, 2025

As a result of the stock split, the number of issued and outstanding common shares will increase from ~17.39M to 69.56M. The shares are expected to begin trading on a post-stock split basis on or about November 14, 2025. More on Plaid Technologies Seeking Alpha's Quant Rating on Plaid Technologies Inc. Financial information for Plaid Technologies Inc. Recommended For You More Trending News

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Unattributed VC - II.

How much did Plaid raise?

Plaid raised a total of $1.316B.

Who are the investors of Plaid?

Investors of Plaid include NEA, Ribbit Capital, CE Ventures, BlackRock, Fidelity and 53 more.

Who are Plaid's competitors?

Competitors of Plaid include DRUO, Yodlee, Passiv, Solaris, Finix and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking API infrastructure platform operating within the financial services sector. The company provides products that allow businesses to access financial data and initiate payments, enabling financial experiences. Yapily serves sectors such as payment services, digital banking, lending, investing, and accounting, providing resources to improve customer offerings. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, England.

Yodlee provides data aggregation and analytics for the financial services industry. The company offers services such as financial data aggregation, account verification, transaction data enrichment, and financial wellness solutions, powered by APIs and analytics. Yodlee's products assist financial institutions and FinTech companies in developing financial applications and services. It was founded in 1999 and is based in Raleigh, North Carolina.

Railsr is a global embedded finance platform that provides Banking as a Service (BaaS) and Cards as a Service (CaaS) in the financial technology sector. The company offers services including digital wallets, banking, and card solutions, which are integrated into customer experiences for financial transactions. It serves fintech startups, scale-ups, sports clubs, and brands that implement embedded finance experiences. Railsr was formerly known as Embedded Finance Limited. It was founded in 2016 and is based in London, United Kingdom. In April 2025, Railsr merged with Equals Money.

TrueLayer operates as an open banking platform in the financial technology sector. The company offers a network that enables bank payments, integrating financial and identity data for online transactions. TrueLayer's services cater to businesses of all sizes, providing solutions for user onboarding and payment processing. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Powens is an open finance platform that provides embedded finance and payment experiences within the financial services industry. The company offers solutions including data and document aggregation, identity verification, and various accounts and payment services aimed at supporting financial operations. Powens serves banking groups, insurance firms, software vendors, tech companies, and telecommunications and utilities companies. Powens was formerly known as Budget Insight. It was founded in 2012 and is based in Paris, France. Powens operates as a subsidiary of Arkea.

MX provides financial data intelligence solutions within the financial services sector. The company offers products that allow financial institutions and fintechs to connect accounts, verify financial data, and analyze financial information. MX serves the financial services industry, including banks, credit unions, and fintech companies. MX was formerly known as MoneyDesktop. It was founded in 2010 and is based in Lehi, Utah.

Loading...