Plata

Founded Year

2022Stage

Series B | AliveTotal Raised

$510MValuation

$0000Last Raised

$250M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+262 points in the past 30 days

About Plata

Plata specializes in consumer credit and financial management services. The company offers an online platform for credit card applications, featuring a card with cashback rewards, buy now pay later options, and a user-friendly mobile app for managing finances. Plata's credit card also provides security features, interest-free installment plans, and is backed by Mastercard certification. It was founded in 2022 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Plata

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plata in 1 CB Insights research brief, most recently on Apr 10, 2025.

Apr 10, 2025 report

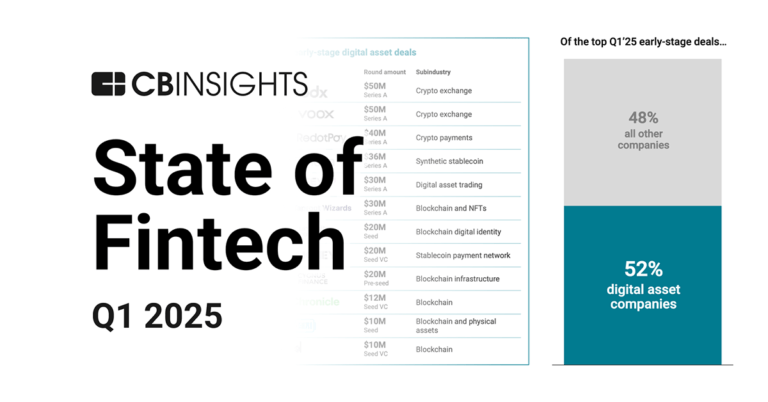

State of Fintech Q1’25 ReportExpert Collections containing Plata

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plata is included in 4 Expert Collections, including Payments.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Digital Lending

2,538 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Unicorns- Billion Dollar Startups

1,309 items

Latest Plata News

Nov 2, 2025

Fintech News Funding Alert By StartupStory | November 2, 2025 Mexican fintech firm Plata raises $250 million in new funding, achieves $3.1 billion valuation Plata, the Mexico-based digital financial platform, has announced the completion of a $250 million funding round, doubling… More like this

Plata Frequently Asked Questions (FAQ)

When was Plata founded?

Plata was founded in 2022.

Where is Plata's headquarters?

Plata's headquarters is located at Mariano Escobedo 476, Anzures, Miguel Hidalgo, Mexico City.

What is Plata's latest funding round?

Plata's latest funding round is Series B.

How much did Plata raise?

Plata raised a total of $510M.

Who are the investors of Plata?

Investors of Plata include Kora Investment, Audeo Ventures, TelevisaUnivision, Spice Expeditions, Moore Ventures and 9 more.

Who are Plata's competitors?

Competitors of Plata include Vexi and 6 more.

Loading...

Compare Plata to Competitors

Stori is a financial technology company that focuses on providing credit access and financial services. The company offers credit cards with high approval rates and cashback rewards, as well as deposit accounts with competitive returns. Stori primarily serves the underbanked population in Latin America, offering financial products that aim to democratize credit access and enhance financial inclusion. It was founded in 2019 and is based in Mexico City, Mexico.

Addi provides consumer financing options in the financial technology sector. The company offers installment payment plans for customers to purchase products and pay over time, without requiring credit cards or extensive paperwork. Addi serves the e-commerce industry and retail sectors by providing point-of-sale financing and integrating with various online and physical merchants. It was founded in 2018 and is based in Bogota, Colombia.

Aplazo provides buy now pay later solutions within the payment services industry. The company offers a platform that enables physical and digital retailers to allow their customers to pay for products in installments. Aplazo serves the retail sector and provides payment options. It was founded in 2020 and is based in Mexico City, Mexico.

Luegopago.com is a company focused on providing a buy now, pay later service within the online retail sector. The company offers customers the ability to make purchases and pay for them over time in interest-free installments, enhancing the shopping experience with payment flexibility. Luegopago.com caters to a wide range of product categories including electronics, home appliances, beauty products, and more. It was founded in 2020 and is based in Antioquia, Colombia.

Nelo is a financial technology company that provides credit solutions in the fintech industry. The company offers credit approval, repayment plans, and services for users to manage payments and purchases. Nelo primarily serves consumers seeking credit options. It was founded in 2019 and is based in Mexico City, Mexico.

Fondeadora provides digital banking services. The company offers personal and business debit accounts with features such as no minimum balances and no opening costs. It serves individuals and businesses. It was founded in 2011 and is based in Mexico City, Mexico.

Loading...