Plug and Play Ventures

Investments

2189Portfolio Exits

268Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 5 CB Insights research briefs, most recently on Oct 24, 2024.

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

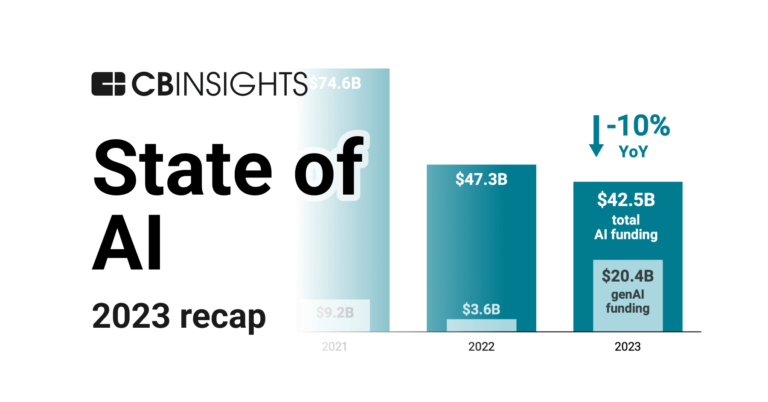

Feb 1, 2024 report

State of AI 2023 Report

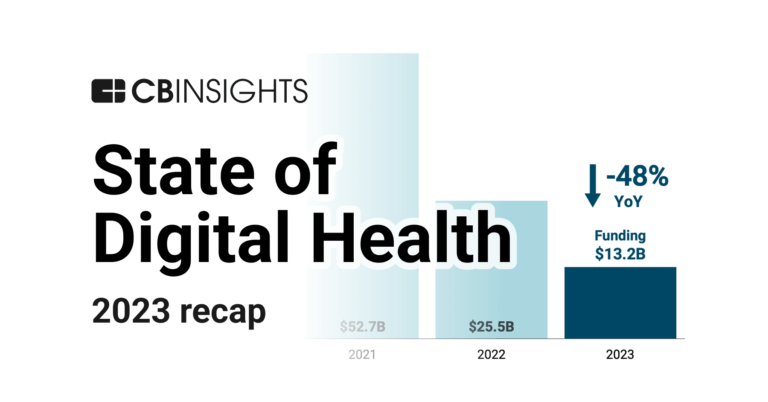

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportLatest Plug and Play Ventures News

Oct 29, 2025

2025 Saudi Global Health Saudi Exhibition , a leading event for healthcare leaders, investors, and innovators. Here, Ayah is sharing insights across two sessions: “Mapping the Future of Healthcare Investment Globally” and “Catalyzing Health Tech Innovation: Venture Builders, CVC and Accelerators.” Her presentations, held on October 28 and 29 in Riyadh, were part of a conference that brings together global leaders to explore the future of healthcare and emerging investment opportunities. The 2025 Saudi Global Health Exhibition features an exceptional lineup of global health leaders — including executives from Philips, Sanofi, BD, GSK, Microsoft, Google, Meta, and Johns Hopkins Aramco Healthcare — alongside visionary innovators and policymakers such as Roy Jakobs, Frédéric Oudéa, Dr. David Rhew, Dr. Abnousi, Aashima Gupta, Dr. Howard Podolsky, and Sir Jonathan Symonds, showcasing groundbreaking perspectives on the future of healthcare, technology, and public health transformation. At Plug and Play Ventures, Ayah leads early-stage digital health investments and builds partnerships with global pharmaceutical companies, including Lilly, Pfizer, and AstraZeneca, as well as healthcare systems such as Orlando Health and Wellstar, and medtech innovators like Zimmer Biomet. The Plug and Play Health portfolio includes investments such as Guardant Health and Owkin, both recognized as unicorns. Previously, Ayah helped scale Carbon Health during its Series B and C growth, scaling technology for the nation's largest COVID-19 testing and vaccination sites through public and private partnerships. She also founded a digital health startup, Fatima Connect, through the Harvard Innovation Lab, which leveraged digital health technologies to advance access to care for refugee mothers. Ayah holds a Master's in Epidemiology from Harvard, a Bachelor's in Public Health from UC Berkeley, and a Certificate in Health Innovation from MIT Sloan. Her experience in clinical epidemiology, digital health, and venture investment positions her to offer valuable insights on global healthcare investment trends and challenges. "The future of healthcare investment is at the intersection of innovation, technology, and global collaboration. I'm excited to share insights on how early-stage digital health solutions can transform care delivery and make a meaningful impact worldwide," said Ayah Hamdan. About Ayah: Ayah Hamdan is a Harvard graduate and recognized leader in healthcare innovation and venture capital, with a record of advancing solutions that connect medicine, technology, and investment. Marisa Spano Elkordy Global Strategies marisa@elkordyglobal.com Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Plug and Play Ventures Investments

2,189 Investments

Plug and Play Ventures has made 2,189 investments. Their latest investment was in Mobius Industries as part of their Pre-Seed on October 09, 2025.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/9/2025 | Pre-Seed | Mobius Industries | $3.8M | Yes | E14 Fund, Entropy Industrial, EWOR, GoAhead Ventures, Mana Ventures, Outlander VC, Thursday Ventures, and Undisclosed Angel Investors | 3 |

10/7/2025 | Seed VC | Luna Robotics | $1.25M | Yes | Coinvest Capital, and Undisclosed Angel Investors | 3 |

9/9/2025 | Seed VC | Gobano Robotics | $3.51M | Yes | Axeleo Capital, Bpifrance, Kima Ventures, Motier Ventures, Polytechnique Ventures, Undisclosed Angel Investors, and Undisclosed Venture Investors | 2 |

9/3/2025 | Series A | |||||

7/30/2025 | Pre-Seed |

Date | 10/9/2025 | 10/7/2025 | 9/9/2025 | 9/3/2025 | 7/30/2025 |

|---|---|---|---|---|---|

Round | Pre-Seed | Seed VC | Seed VC | Series A | Pre-Seed |

Company | Mobius Industries | Luna Robotics | Gobano Robotics | ||

Amount | $3.8M | $1.25M | $3.51M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | E14 Fund, Entropy Industrial, EWOR, GoAhead Ventures, Mana Ventures, Outlander VC, Thursday Ventures, and Undisclosed Angel Investors | Coinvest Capital, and Undisclosed Angel Investors | Axeleo Capital, Bpifrance, Kima Ventures, Motier Ventures, Polytechnique Ventures, Undisclosed Angel Investors, and Undisclosed Venture Investors | ||

Sources | 3 | 3 | 2 |

Plug and Play Ventures Portfolio Exits

268 Portfolio Exits

Plug and Play Ventures has 268 portfolio exits. Their latest portfolio exit was Einride on November 12, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/12/2025 | Acq - Pending | 4 | |||

11/7/2025 | Acquired | 5 | |||

11/4/2025 | Acquired | 4 | |||

Plug and Play Ventures Fund History

4 Fund Histories

Plug and Play Ventures has 4 funds, including Plug and Play Supply Chain Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/19/2022 | Plug and Play Supply Chain Fund I | $25.5M | 1 | ||

Plug & Play Umbrella Fund | |||||

Plug & Play Future Commerce Fund I | |||||

Plug & Play Growth Fund |

Closing Date | 4/19/2022 | |||

|---|---|---|---|---|

Fund | Plug and Play Supply Chain Fund I | Plug & Play Umbrella Fund | Plug & Play Future Commerce Fund I | Plug & Play Growth Fund |

Fund Type | ||||

Status | ||||

Amount | $25.5M | |||

Sources | 1 |

Plug and Play Ventures Partners & Customers

10 Partners and customers

Plug and Play Ventures has 10 strategic partners and customers. Plug and Play Ventures recently partnered with The Rawlings Group on June 6, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/17/2024 | Partner | United States | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | 1 | |

6/1/2023 | Partner | Netherlands | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | 1 | |

11/15/2022 | Partner | Netherlands | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | 1 | |

11/15/2022 | Partner | ||||

11/15/2022 | Partner |

Date | 6/17/2024 | 6/1/2023 | 11/15/2022 | 11/15/2022 | 11/15/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | Netherlands | Netherlands | ||

News Snippet | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | ||

Sources | 1 | 1 | 1 |

Compare Plug and Play Ventures to Competitors

500 Global operates as a venture capital firm focused on investing in technology companies with a global outlook. The company provides venture capital investment and mentorship to entrepreneurs and investors, with the goal of supporting startups and fostering innovation across various markets. It was founded in 2010 and is based in Palo Alto, California.

SOSV operates as a venture capital firm with a focus on deep technology aimed at improving human and planetary health. The company provides multi-stage investments and operates startup development programs, such as HAX and IndieBio, to accelerate product development and scale innovative technologies. SOSV's programs support startups in sectors like hard tech and life sciences, offering expertise, lab facilities, and supply chain access. It was founded in 1995 and is based in Princeton, New Jersey.

Bessemer Venture Partners operates in the technology sectors and supports entrepreneurs in building companies. The company provides funding and guidance to startups at various growth stages, particularly in the enterprise, consumer, and healthcare areas. Its investment portfolio includes sectors such as artificial intelligence (AI) and machine learning (ML), biotechnology, cloud computing, consumer products, cybersecurity, fintech, and vertical software. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners invests in the enterprise, consumer, health, and financial technology sectors. The firm provides funding and support to entrepreneurs at various stages of their development. Lightspeed Venture Partners serves the startup ecosystem by offering financial resources and industry knowledge to companies within its targeted sectors. It was founded in 2000 and is based in Menlo Park, California.

Founders Fund operates as a venture capital firm investing in technologies across various sectors. The firm provides capital to companies at different stages of development, focusing on those that address complex problems. Founders Fund's portfolio includes a range of companies, reflecting its investment strategy. It was founded in 2005 and is based in San Francisco, California.

Entrepreneur First operates as a startup incubator in the business services sector. The company primarily focuses on bringing together and funding exceptional individuals to help them meet co-founders, develop ideas, and raise money from leading investors. Its services are mainly utilized by the startup industry. Entrepreneur First was formerly known as EF Investment. It was founded in 2011 and is based in London, United Kingdom.

Loading...