Investments

305Portfolio Exits

40Funds

7Partners & Customers

1About Point Nine Capital

Point Nine Capital is an early-stage venture capital firm that focuses on investments in Internet companies, particularly SaaS (Software as a Service), e-commerce, marketplaces, and lead generation. The firm was founded in 2008 and is based in Berlin, Germany.

Expert Collections containing Point Nine Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Point Nine Capital in 1 Expert Collection, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Research containing Point Nine Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Point Nine Capital in 1 CB Insights research brief, most recently on Aug 7, 2025.

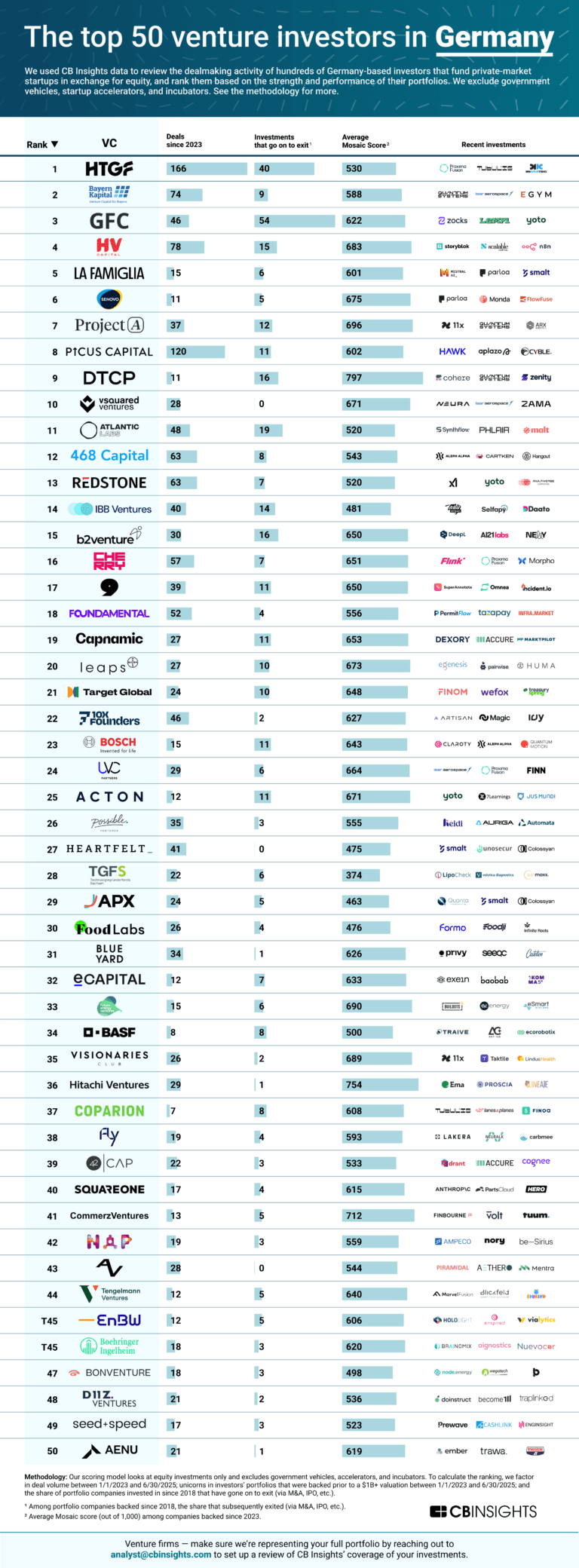

Aug 7, 2025

The top 50 venture investors in GermanyLatest Point Nine Capital News

Oct 13, 2025

Europe's top startups investors are riding the wave of a new influx of AI talent forming startups on the continent, with companies like Elevenlabs, Mistral and Black Forest Labs competing with the world's best and commanding billion-dollar plus valuations. This year's rankings also face a shakeup thanks to Klarna's $20 billion IPO, one of largest exits for local investors, and a flurry of three comma deals that promise to shake up this year's rankings. Submissions for the Midas List Europe 2025, the definitive ranking of the continent's best venture capitalists, are now open through October 23. Produced in partnership with TrueBridge Capital Partners, the Midas List Europe is a data-driven list that evaluates hundreds of investors from across Europe and the Middle East's top venture firms. MIDAS LIST NOMINATION FORM The Midas List Europe features the continent's top 25 VCs ranked based on their portfolio results by Forbes , our partner TrueBridge and an independent judging panel of industry experts. Eligible portfolio companies must have gone public or been acquired for at least $100 million over the past five years, or have at least doubled their private valuation since initial investment to $200 million or more over the same period. Liquid exits count for more than unrealized returns, and the Midas model rewards investors who have made high conviction bets. With decades of experience and industry data, Midas and TrueBridge can ensure that data is input correctly and confidentially; portfolio performance shared in the Midas process is not published or shared. The list and process is reviewed by a judging panel featuring three senior investment professionals who collectively manage over $120 billion of assets and allocate capital to venture funds and startups but are not themselves eligible for the list. The judging panel is anonymous to protect the list's integrity. Last year's Midas List Europe saw Berlin-based Pawel Chudzinski of Point Nine Capital surge to the top of the rankings thanks to early bets on fintech Revolut, which is now reportedly raising at a $65 billion valuation. A new wave of European AI startups and a flurry of exits in the Nordics could bring an even bigger shakeup to this year's list. Note: Investors that submitted for the global Midas List, published each May, are encouraged to re-submit for Midas List Europe unless their portfolio activity remains unchanged. MORE FROM FORBES

Point Nine Capital Investments

305 Investments

Point Nine Capital has made 305 investments. Their latest investment was in Amenitiz as part of their Series B on November 11, 2025.

Point Nine Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/11/2025 | Series B | Amenitiz | No | 4 | ||

10/16/2025 | Series A - III | Upciti | $20M | No | 3 | |

9/22/2025 | Pre-Seed | Rekord | $2.1M | Yes | Baseline Ventures, Eugene Danilkis, Hello World, Octopus Ventures, and Undisclosed Angel Investors | 2 |

9/18/2025 | Seed VC | |||||

9/17/2025 | Series B |

Date | 11/11/2025 | 10/16/2025 | 9/22/2025 | 9/18/2025 | 9/17/2025 |

|---|---|---|---|---|---|

Round | Series B | Series A - III | Pre-Seed | Seed VC | Series B |

Company | Amenitiz | Upciti | Rekord | ||

Amount | $20M | $2.1M | |||

New? | No | No | Yes | ||

Co-Investors | Baseline Ventures, Eugene Danilkis, Hello World, Octopus Ventures, and Undisclosed Angel Investors | ||||

Sources | 4 | 3 | 2 |

Point Nine Capital Portfolio Exits

40 Portfolio Exits

Point Nine Capital has 40 portfolio exits. Their latest portfolio exit was Gourmey on October 15, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/15/2025 | Merger | PARIMA | 7 | ||

10/1/2024 | Acq - Fin | 3 | |||

3/19/2024 | Acquired | 2 | |||

Date | 10/15/2025 | 10/1/2024 | 3/19/2024 | ||

|---|---|---|---|---|---|

Exit | Merger | Acq - Fin | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | PARIMA | ||||

Sources | 7 | 3 | 2 |

Point Nine Capital Fund History

7 Fund Histories

Point Nine Capital has 7 funds, including Point Nine Capital Fund VI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

9/26/2022 | Point Nine Capital Fund VI | $172.91M | 1 | ||

9/22/2020 | P9 V | ||||

12/3/2019 | Point Nine Capital Fund IV | ||||

12/3/2019 | Point Nine Capital Fund II | ||||

7/6/2016 | Point Nine Annex |

Closing Date | 9/26/2022 | 9/22/2020 | 12/3/2019 | 12/3/2019 | 7/6/2016 |

|---|---|---|---|---|---|

Fund | Point Nine Capital Fund VI | P9 V | Point Nine Capital Fund IV | Point Nine Capital Fund II | Point Nine Annex |

Fund Type | |||||

Status | |||||

Amount | $172.91M | ||||

Sources | 1 |

Point Nine Capital Partners & Customers

1 Partners and customers

Point Nine Capital has 1 strategic partners and customers. Point Nine Capital recently partnered with b.fine on May 5, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/25/2022 | Client | Belgium | 2 |

Date | 5/25/2022 |

|---|---|

Type | Client |

Business Partner | |

Country | Belgium |

News Snippet | |

Sources | 2 |

Point Nine Capital Team

3 Team Members

Point Nine Capital has 3 team members, including current Founder, Managing Partner, Christoph Janz.

Name | Work History | Title | Status |

|---|---|---|---|

Christoph Janz | Founder, Managing Partner | Current | |

Name | Christoph Janz | ||

|---|---|---|---|

Work History | |||

Title | Founder, Managing Partner | ||

Status | Current |

Compare Point Nine Capital to Competitors

Balderton Capital operates as a venture firm focused on supporting European-founded tech companies across various stages of growth. The company provides venture capital funding from seed stage to initial public offering (IPO), primarily within the technology sector, and offers support through programs aimed at the well-being and performance of founders. Balderton Capital invests in technology-focused startups, contributing to their growth and development. Balderton Capital was formerly known as Benchmark Capital Europe. It was founded in 2000 and is based in London, United Kingdom.

Speedinvest operates as a venture capital firm funding early-stage technology startups across various sectors. The company provides capital and support to scale startups from seed to Series A and beyond, focusing on sectors such as Deep Tech, Fintech, Health, Bio, Climate Tech, Industrial Tech, Marketplaces, Consumer, and SaaS & Infra. Speedinvest serves the technology startup ecosystem by providing financial backing and strategic guidance. It was founded in 2011 and is based in Vienna, Austria.

Partech operates as a global tech investment firm providing capital and support to founders in the technology sector. The company offers financial backing and guidance to startups and growth-stage companies, utilizing its team to assist entrepreneurs. Partech serves the technology and digital sectors, with a portfolio spanning multiple continents. It was founded in 1982 and is based in Paris, France.

b2venture is a venture capital firm It manages its own funds, and partner funds and offers direct investment opportunities to private investors. b2venture was formerly known as btov Partners. The company was founded in 2000 and is based in Berlin, Germany.

Lead Ventures is a venture capital and private equity firm specializing in financing scale-ups in Central Europe. The company provides capital, experience, and a wide-ranging professional network to support promising ventures in transforming their industry with innovation. Lead Ventures targets capital-intensive scale-ups post-seed funding, focusing on dynamic teams with market-acknowledged solutions. It was founded in 2018 and is based in Budapest, Hungary.

Accel operates as a global venture capital firm, partners with teams across various stages of private company growth. The firm provides funding and support to early-stage and growth-stage companies, helping them to develop into businesses. Accel primarily serves the technology sector, focusing on helping entrepreneurs to build and scale their companies. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Loading...