Powder

Founded Year

2023Stage

Seed VC - II | AliveTotal Raised

$5.5MLast Raised

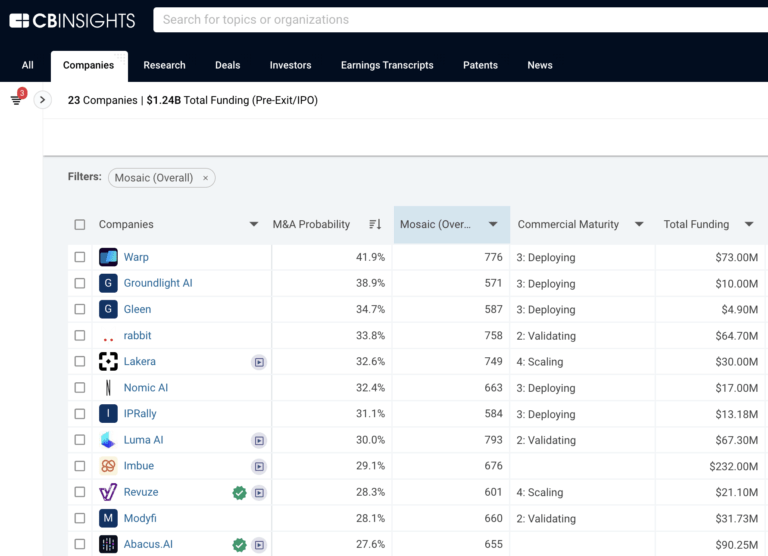

$5M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-54 points in the past 30 days

About Powder

Powder provides artificial intelligence (AI) solutions for the wealth management sector, focusing on document analysis. The company offers AI agents that automate the parsing and analysis of financial documents, which reduces the time required for these tasks and allows wealth management professionals to engage with clients and perform other activities. Powder's AI technology aims to improve client service by increasing productivity, ensuring compliance, and providing data security. It was founded in 2023 and is based in Los Altos, California.

Loading...

ESPs containing Powder

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The document automation software market offers software solutions for automating the creation, management, and processing of documents. This market provides tools and platforms that streamline the document workflow, enabling organizations to generate accurate and consistent documents efficiently. Document automation software encompasses features such as templates, data integration, workflow automa…

Powder named as Challenger among 15 other companies, including Adobe, Esker, and Hyperscience.

Loading...

Research containing Powder

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Powder in 5 CB Insights research briefs, most recently on Mar 6, 2025.

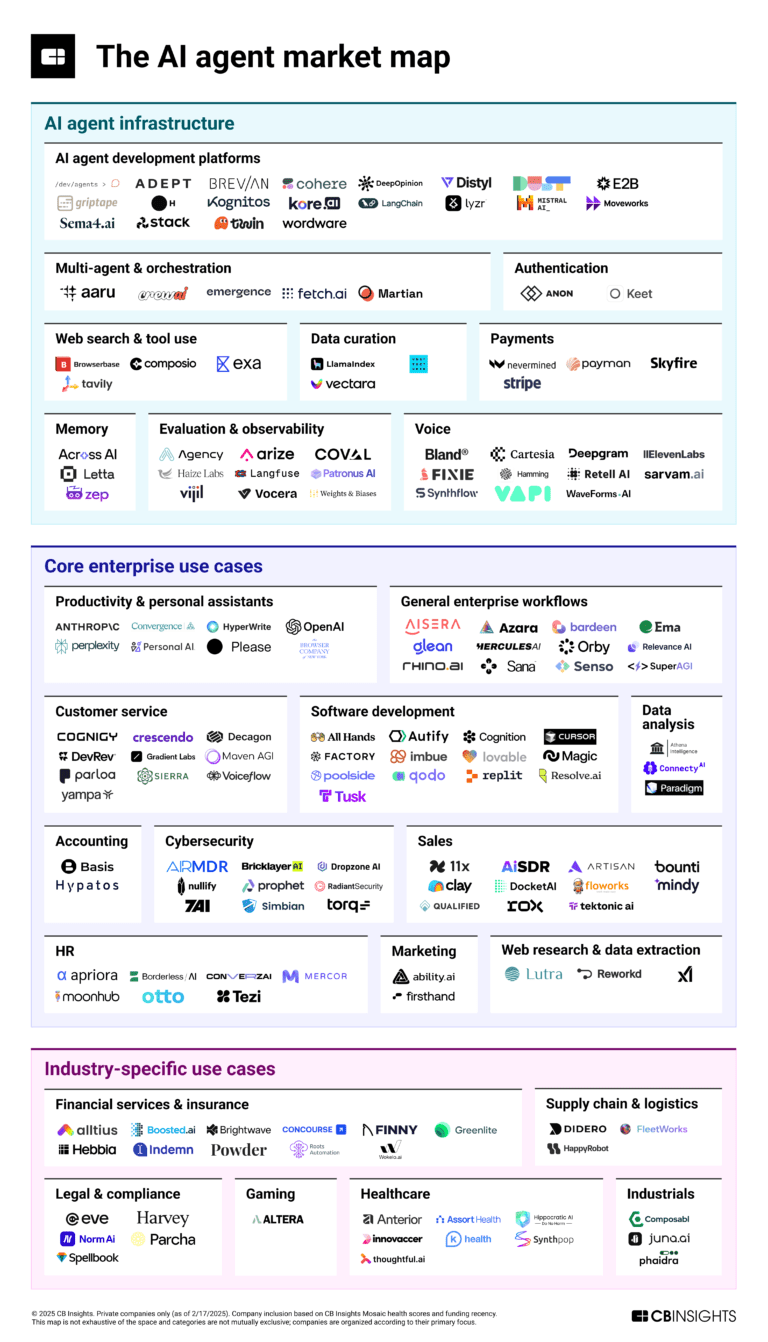

Mar 6, 2025

The AI agent market map: March 2025 edition

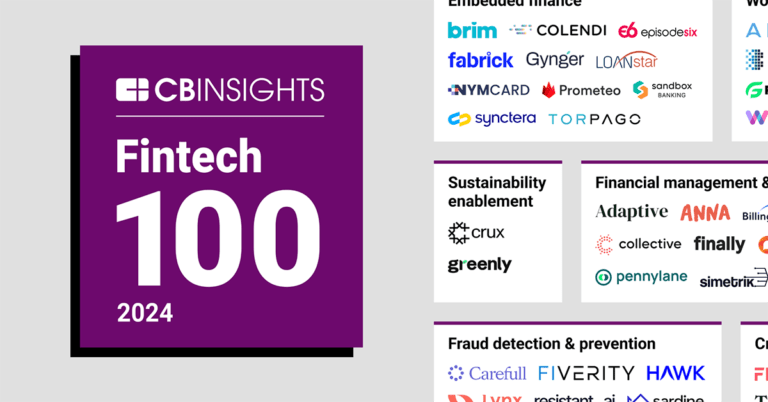

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

May 24, 2024

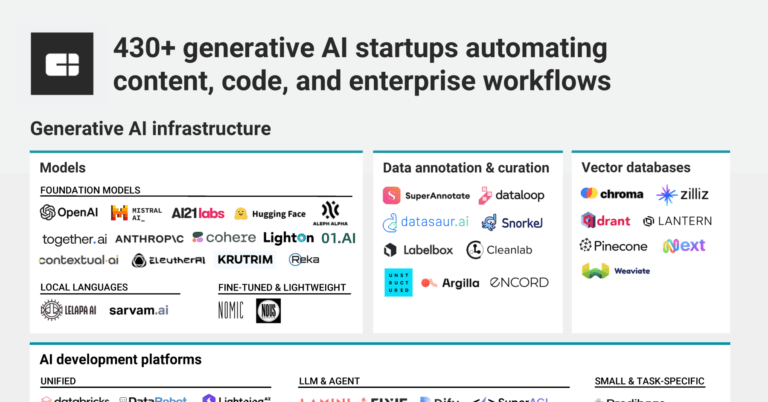

The generative AI market mapExpert Collections containing Powder

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Powder is included in 9 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

37,333 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100 (2024)

100 items

Fintech 100

100 items

Latest Powder News

Oct 29, 2025

Dave Breslin, EVP Wealth Management, GC Wealth Christine Leong Connors, Co-Founder & CEO, Verita Strategic Wealth Partners Ryan Fedricks, Partner, Plante Moran Zane Keller, Chief Executive Officer, Ducere Wealth Management Hannah Kim, Senior Wealth Associate, BakerAvenue Steve Kuhn, Executive Director, OnePoint BFG Rick Nott, Managing Director, Angeles Wealth Management Kevin Thornton, Head of Sales, AE Wealth Management Marcelo Vedovatto, Chief Operating Officer, SCS Financial “Our CAB partners are the pivotal ingredient we’ll mix with our world-class technology team,” said Powder CEO Kanishk Parashar. “By combining their deep industry expertise with our engineering talent, we can create AI that doesn’t just automate tasks, but works alongside wealth managers like a true team member. Together, we’ll focus on building agentic workflows that solve real-world problems and redefine how firms operate at scale.” Members of Powder’s client advisory board already attest to meaningful improvements in efficiency and client service. "Our business model at SCS is predicated on providing white-glove service to the ultra-high-net-worth and family office community. Powder has been instrumental in helping us deliver on this commitment by enabling our people to work more efficiently and focus on delivering comprehensive and insightful investment analysis to enhance our client experience,” said Marcelo Vedovatto, Chief Operating Officer, SCS Financial. "Powder is building the tools to make the future real, and I’m thrilled to help shape what’s next. Wealth management is at a pivotal moment. AI won’t replace advisors, but it will redefine how we advise — shifting our time from repetitive tasks to deeper conversations, sharper insights, and more scalable excellence,” said Dave Breslin, Executive Vice President, GC Wealth. “I am excited to join the client advisory board at Powder! This technology has already provided so much efficiency/scalability to my team here at AE Wealth Management. I can’t wait to watch what continues to evolve,” said Kevin Thornton, Head of Sales, AE Wealth Management. “Powder enables us to shift from data entry to dialogue—freeing time to engage prospects thoughtfully and deliver the personalized experience they expect,” said Ryan Fedricks, Partner, Plante Moran. “Powder streamlines our highly customized investment proposal process—enabling us to craft polished, client-specific deliverables tailored to each individual’s needs in hours instead of days,” said Steve Kuhn, Executive Director of Investment Policy, OnePointBFG. OnePoint BFG offers investment advisory and financial planning services offered through Bleakley Financial Group, LLC, an SEC registered investment adviser. The Bleakley Financial Group is now doing business as OnePoint BFG Wealth Partners. “Powder has significantly optimized our proposal workflow, by enabling a faster turnaround and transforming what previously took days into a streamlined, more efficient process,” said Hannah Kim, Senior Wealth Associate, BakerAvenue Wealth Management. The advisory board will meet quarterly and collaborate on projects year round, working closely with Powder’s product and engineering teams. Together, they will uncover high-value workflows where AI automation can be securely adopted to reduce costs, eliminate manual burdens and deliver better service across portfolio analysis, estate planning, compliance and beyond. "Bringing industry leaders together ensures that our AI systems are built with compliance and security in mind and that they provide a measurable impact on day-to-day operations and productivity," said Dominic Tully, CRO of Powder. “Powder has already proven its ability to relieve the pain points wealth managers face daily. Withour advisory board in place, we’re doubling down on our mission to future-proof firms by embedding AI into the workflows that matter most.” Powder’s AI agents tackle the work no one wants to do but that every wealth manager must do—from parsing prospective client statements to synthesizing estate documents and gathering held-away assets. By automating these processes, Powder saves firms up to 80% of the cost while allowing advisors to focus on client service and growth. Unlike generic AI platforms, Powder is the only company working across multiple workflows in wealth management, including proposal generation, compliance, portfolio integration and onboarding documentation. About Powder Powder is the AI-powered co-pilot that helps wealth advisors automate time-consuming tasks, aggregate financial data, and build portfolio and tax models to eliminate manual processes. By embedding AI into the workflows that matter most—proposals, compliance, onboarding, portfolio analysis—Powder allows firms to focus on serving clients and scaling their businesses, while reducing costs by up to 80%. For more information, visit www.powderfi.com . The views shared by Powder's Client Advisory Board members are their own, and participation is voluntary and uncompensated. Powder is not a registered investment adviser and does not offer investment advice.

Powder Frequently Asked Questions (FAQ)

When was Powder founded?

Powder was founded in 2023.

Where is Powder's headquarters?

Powder's headquarters is located at 110 Pasa Robles Avenue, Los Altos.

What is Powder's latest funding round?

Powder's latest funding round is Seed VC - II.

How much did Powder raise?

Powder raised a total of $5.5M.

Who are the investors of Powder?

Investors of Powder include Elefund, Y Combinator, Jon Xu, Bryant Chou, Litquidity and 12 more.

Who are Powder's competitors?

Competitors of Powder include Addepar, Facet Wealth, BridgeFT, AFS Financial Group, BehaviorQuant and 7 more.

Loading...

Compare Powder to Competitors

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to the market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in New York, New York.

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

FINNY AI provides tools for financial advisors to assist in their prospecting efforts within the financial services industry. The company offers services that include identifying potential prospects, prioritizing them based on a compatibility score, and automating outreach processes to support advisor-client connections. Its platform aims to improve the prospecting process, allowing financial advisors to focus on building relationships and developing their businesses. The company was founded in 2023 and is based in New York, New York.

Metaframe Technology Solutions provides financial technology solutions that focus on asset management and investment firms. The company offers services that include intelligent agents through its DashHub AI platform, which automates financial operations and reporting. Metaframe also provides ITSM solutions, technology leadership, and compliance automation to support IT infrastructure and regulatory adherence for financial services. It was founded in 2010 and is based in New York, New York.

Facet Wealth provides financial planning services across various life stages and financial goals. The company offers financial roadmaps, advice, and a membership model, focusing on investment strategy, retirement planning, tax optimization, estate planning, and related areas. Facet Wealth serves individuals seeking assistance to navigate their financial wellness journey. Facet Wealth was formerly known as OneK Financial. It was founded in 2016 and is based in Baltimore, Maryland.

Loading...