Prima Assicurazioni

Founded Year

2014Stage

Corporate Majority | AcquiredTotal Raised

$115.84MValuation

$0000About Prima Assicurazioni

Prima Assicurazioni offers online motor insurance, and home and family insurance products. The company utilizes technology and data to provide services. It was founded in 2014 and is based in Milan, Italy. In August 2025, AXA acquired a majority stake in Prima Assicurazioni for $571.6M.

Loading...

Prima Assicurazioni's Product Videos

ESPs containing Prima Assicurazioni

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — auto market comprises insurtech agents, brokers, distributors, and other intermediaries that provide automotive insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

Prima Assicurazioni named as Leader among 15 other companies, including Qover, Insurify, and PolicyStreet.

Prima Assicurazioni's Products & Differentiators

Vehicles insurance

Prima’s first product: vehicles insurance – protecting customers from third-party liability and vehicle damages such as theft, fire and atmospheric events – covering cars, motorcycles and vans

Loading...

Research containing Prima Assicurazioni

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Prima Assicurazioni in 1 CB Insights research brief, most recently on Nov 6, 2025.

Nov 6, 2025 report

State of Insurtech Q3’25 ReportExpert Collections containing Prima Assicurazioni

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Prima Assicurazioni is included in 2 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Latest Prima Assicurazioni News

Nov 11, 2025

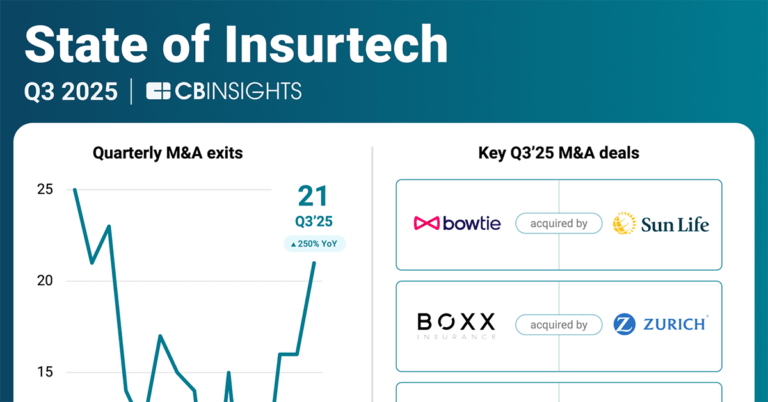

Insurtech dealmaking is now said to be consolidating, reportedly marked by relatively fewer investors and startups in recent quarters. This, according to an update from CB Insights which noted that overall insurtech funding has plateaued or flattened over the past 12 quarters, including $1.0B in funding that had been secured by insurtechs in Q3’25. Despite this, CB Insights said that the industry’s strongest startups face quite favorable business conditions, as insurtech M&A exits reached “a recent high in Q3’25.” The report also mentioned that median early-stage insurtech deal size has been shrinking, thus “thinning innovation pipeline.” As noted in the research report , Insurtechs are now focused on scaling with less capital “as median early-stage insurtech deal size “fell 24% YoY, from $3.8M in 2024 to $2.9M YTD in 2025.” According to the latest CB Insights update, the sizeable drop reverses “much of the early-stage growth seen between 2023 and 2024, signaling a tougher environment for seed-stage insurtechs looking to raise Series A and B funding.” Meanwhile, the wider venture environment has seen median early-stage deal size increase “39% YoY as investors redirect capital to more AI-driven sectors, including capital-intensive markets like humanoid robots.” Notably, Insurtech ’s early-stage pipeline continues to narrow. In 2025 YTD, merely 60% of all deals have “gone to early-stage startups — the lowest share since 2011 and down from 72% in 2022, 66% in 2023, and 64% in 2024.” Future implication: Reduced early-stage insurtech dealmaking weakens the pipeline for potential acquirers, who will “increasingly need to identify and assess promising acquisition targets earlier than the competition.” Insurtech deal count fell to just 76 in Q3’25 — the “lowest level since 2016 and 65% below the Q1’21 peak of 219 deals.” Both property and casualty (down from 65 to 56 deals) and life and health (34 to 18) saw “quarter-over-quarter declines, reflecting a broader slowdown in the venture environment.” Despite the relatively fewer deals, insurtech funding is generally stable, averaging “$1.2B per quarter since Q4’22, suggesting a more selective environment.” Unless there is a significant surge in deal activity or “a resurgence of $100M+ mega-rounds, funding levels are likely to remain close to $1B per quarter.” Future implication: Incumbents should closely “monitor recently-funded insurtechs, as many exhibit operational strength.” Insurtechs with 10+ employees that “raised in Q3’25 grew headcount 15.8% over 12 months, signaling capital flows to companies with measurable traction.” Investor count peaked in Q2’21 at 655 and has since fallen by “72% to hit 186 in Q3’25, mirroring the broader venture pullback that leaves insurtechs competing in a smaller funding pool.” Commitment to the sector is said to now be waning. In Q3’25, only 4 investors made “2 or more insurtech investments: American Family Ventures, ManchesterStory Group, Munich Re Ventures, and OperaTech Ventures — the fewest in over 10 years, and down sharply from the 13 last quarter.” As stated in the report, established insurance companies (and tech vendors) have a rare opportunity to engage “more closely with emerging insurtechs given reduced competition for attention from investors.” Insurtech M&A increased from 16 in Q2’25 to 21 in Q3’25, the most since Q3’22 (23). The increase reverses the trend of “decreasing M&A activity within insurtech between 2022 and 2024, signaling increased confidence in the industry’s startups.” 5 key acquisitions occurred in Q3’25: Hong Kong-based health insurer and 2024 Insurtech 50 winner Bowtie was acquired in a corporate majority deal by Sun Life. Canada-based cyber MGA BOXX Insurance was acquired by Zurich Insurance Group. Cytora, an AI claims and underwriting processing platform, was acquired by Applied Systems. DigitalOwl, an AI medical review platform and 2024 Insurtech 50 winner, was acquired by Datavant. Italy-based Prima Assicurazioni, a personal lines MGA, was acquired in a corporate majority deal by AXA at a $1.1B valuation. Additionally, risk transfer exchange Accelerant secured $0.7B in its initial public offering. The firm was a 2023 and 2024 Insurtech 50 winner, placing it among the world’s high-potential insurtech startups globally. 2025 is the first time since 2021 that insurtech has seen two straight quarters of IPO activity. Potential future implication: None of the listed acquisitions nor Accelerant finalized a Series C+ prior to exit, indicating that insurtechs “are favoring M&A or IPOs over late-stage fundraising.” Sponsored Links by DQ Promote

Prima Assicurazioni Frequently Asked Questions (FAQ)

When was Prima Assicurazioni founded?

Prima Assicurazioni was founded in 2014.

Where is Prima Assicurazioni's headquarters?

Prima Assicurazioni's headquarters is located at Piazzale Loreto 17, Milan.

What is Prima Assicurazioni's latest funding round?

Prima Assicurazioni's latest funding round is Corporate Majority.

How much did Prima Assicurazioni raise?

Prima Assicurazioni raised a total of $115.84M.

Who are the investors of Prima Assicurazioni?

Investors of Prima Assicurazioni include AXA, Goldman Sachs and Blackstone.

Who are Prima Assicurazioni's competitors?

Competitors of Prima Assicurazioni include AutoConnexa and 5 more.

What products does Prima Assicurazioni offer?

Prima Assicurazioni's products include Vehicles insurance and 1 more.

Loading...

Compare Prima Assicurazioni to Competitors

ConTe.it is a direct insurance company that provides various insurance products including auto, motorcycle, and pet insurance. The company offers services like roadside assistance, legal protection, and coverage for theft and fire. It was founded in 2007 and is based in Rome, Italy.

Socialbroker is a key player among insurance intermediary aggregators. The company provides a platform for insurance intermediaries to access commercial resources, competitive pricing, and sales leads to enhance their market presence. Socialbroker aims to empower small-scale intermediaries with opportunities typically reserved for larger organizations, enabling them to tackle current market challenges effectively. It was founded in 2018 and is based in Milano, Italy.

AutoConnexa specializes in smart insurance solutions within the automotive insurance sector. The company offers usage-based car insurance policies that adapt to individual driving styles, providing cost savings for safe and infrequent drivers, and includes a mobile app designed to evaluate and potentially improve driving habits while simplifying insurance procedures. AutoConnexa primarily serves customers looking for personalized and technology-driven insurance services in the automotive industry. It was founded in 2019 and is based in Bari, Italy.

Facile.it operates as a digital company in the comparison website sector. The company's main service is to simplify and expedite the process of choosing insurance, financial products, and household expenses, thereby saving time and money for its users. It was founded in 2008 and is based in Milan, Italy.

Wide Group is an insurance brokerage firm that provides insurance products across various sectors. The company offers a range of insurance products to cover different risks associated with corporate, professional, personal, luxury, health, travel, special risks, and non-profit activities. Wide Group was formerly known as Wide Group S.P.A. It was founded in 2016 and is based in Bolzano, Italy.

Stubben Edge is a financial services group that utilizes technology to distribute financial services. The company provides a marketplace for financial services, including broking, capital, and compliance consulting, supported by its technology platform, Flightdeck, which offers tools for service delivery. Stubben Edge serves the financial services industry, providing solutions that assist brokers, independent financial advisors, and business owners with their insurance businesses. It was founded in 2010 and is based in London, England.

Loading...