Prove Identity

Founded Year

2008Stage

Series I | AliveTotal Raised

$261.3MValuation

$0000Last Raised

$40M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+55 points in the past 30 days

About Prove Identity

Prove Identity focuses on digital identity verification and authentication across different sectors. The company provides a platform for verifying consumer identities and streamlining onboarding processes. Prove Identity serves industries including banking, fintech, healthcare, and online gaming. Prove Identity was formerly known as Payfone. It was founded in 2008 and is based in New York, New York.

Loading...

Prove Identity's Product Videos

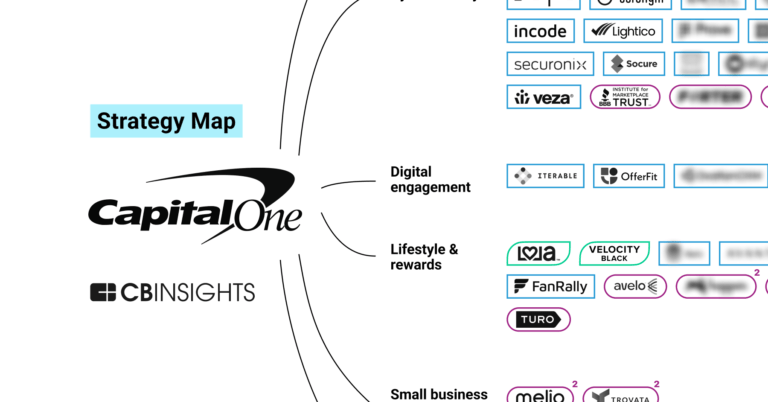

ESPs containing Prove Identity

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent authentication platforms market provides solutions for authenticating, securing, and managing identities for AI systems and agents. These platforms enable organizations to verify the identities of AI agents, prevent impersonation attacks, control access to sensitive resources, and monitor the activity of AI agents. Important features include authentication protocols, access control po…

Prove Identity named as Highflier among 13 other companies, including 1Password, Riskified, and Trulioo.

Prove Identity's Products & Differentiators

Prove Pre-Fill

Prove Pre-Fill is a phone-centric identity verification and authentication solution designed to streamline digital onboarding and mitigate fraud. Leveraging a vast network of mobile network operator (MNO) and authoritative data, it passively verifies a user's identity and their real-time possession of a mobile device. This enables the secure pre-population of online forms with verified customer data (e.g., name, address, phone number, DOB, SSN last 4), significantly reducing manual entry friction for legitimate users. Simultaneously, Prove Pre-Fill employs advanced risk signals, including phone reputation and behavioral analytics, to detect and block sophisticated fraud vectors such as synthetic identities, identity theft, and SIM swap attacks, often before an application is even submitted.

Loading...

Research containing Prove Identity

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Prove Identity in 6 CB Insights research briefs, most recently on Mar 18, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Prove Identity

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Prove Identity is included in 11 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

SMB Fintech

2,003 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Cybersecurity

11,028 items

These companies protect organizations from digital threats.

Prove Identity Patents

Prove Identity has filed 35 patents.

The 3 most popular patent topics include:

- wireless networking

- payment systems

- computer network security

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2022 | 2/25/2025 | Wireless networking, Computer network security, Network protocols, Payment systems, Health informatics | Grant |

Application Date | 5/18/2022 |

|---|---|

Grant Date | 2/25/2025 |

Title | |

Related Topics | Wireless networking, Computer network security, Network protocols, Payment systems, Health informatics |

Status | Grant |

Latest Prove Identity News

Nov 10, 2025

Temenos taps Prove to revolutionise digital identity and onboarding By Vriti Gothi Share Temenos has integrated Prove Pre-Fill®, a cutting-edge digital identity solution from Prove, into the Temenos Journey Manager. Now available on the Temenos Exchange, this collaboration empowers financial institutions worldwide to accelerate customer onboarding, strengthen fraud prevention, and deliver seamless, secure digital experiences. Through this strategic partnership, Temenos clients can now access Prove Pre-Fill® directly from the Temenos Exchange ecosystem, enabling instant pre-population of application forms with verified identity data. The solution eliminates the need for manual data entry, such as date of birth or national ID, and verifies identity in real time using device and phone intelligence. Banks using Prove Pre-Fill® have reported onboarding speed improvements of up to 79%, a 35% reduction in application abandonment, and fraud losses reduced by as much as 75%. “Temenos is dedicated to empowering financial institutions to accelerate innovation and deliver outstanding customer experiences,” said Rodrigo Silva, President – Americas, Temenos. “We are proud to welcome Prove to Temenos Exchange. Our platform and ecosystem approach ensures that complementary solutions like Prove Pre-Fill can be rapidly deployed, enabling institutions in the U.S. and globally to drive digital transformation and deliver greater value to their customers.” Temenos Exchange serves as a dynamic hub for innovation, offering financial institutions a curated marketplace of FinTech solutions ready for seamless deployment within the Temenos Banking Platform. The addition of Prove Pre-Fill® strengthens the Exchange’s mission to enable banks to adopt advanced digital identity verification capabilities quickly and securely. “Digital onboarding shouldn’t be the reason a good customer walks away,” said Scott Bonnell, Chief Revenue Officer at Prove. “Our collaboration with Temenos brings together two leaders in digital banking to eliminate unnecessary friction and deliver the gold standard in secure, seamless account opening. With Prove Pre-Fill, banks can dramatically improve conversion rates while meeting the highest standards of security and compliance.” Powered by Prove’s patented digital identity technology, the solution verifies and authenticates users through private, passive, and persistent signals, minimising friction while maximising trust. Already relied upon by 19 of the top 20 U.S. banks, this integration brings enterprise-grade identity verification within reach of Temenos customers worldwide. Previous Article Digital monthly issue Global coverage

Prove Identity Frequently Asked Questions (FAQ)

When was Prove Identity founded?

Prove Identity was founded in 2008.

Where is Prove Identity's headquarters?

Prove Identity's headquarters is located at 245 Fifth Avenue, New York.

What is Prove Identity's latest funding round?

Prove Identity's latest funding round is Series I.

How much did Prove Identity raise?

Prove Identity raised a total of $261.3M.

Who are the investors of Prove Identity?

Investors of Prove Identity include MassMutual Ventures, Wellington Management, Apax Digital, Capital One Ventures, Stack Capital and 27 more.

Who are Prove Identity's competitors?

Competitors of Prove Identity include AuthenticID, Persona, Fourthline, Worth, ZignSec and 7 more.

What products does Prove Identity offer?

Prove Identity's products include Prove Pre-Fill and 4 more.

Loading...

Compare Prove Identity to Competitors

Sumsub operates as an identity verification platform serving the fintech, crypto, transportation, trading, e-commerce, and gaming industries. The company offers services such as user verification, business verification, transaction monitoring, and fraud prevention, powered by artificial intelligence (AI) to support compliance and security. Sumsub provides tools, including document and biometric verification, as well as anti-money laundering (AML) transaction monitoring, and analytics for risk scoring and case management. It was founded in 2015 and is based in London, United Kingdom.

Veriff provides identity verification services within the cybersecurity sector. The company offers services such as identity and document verification, proof of address, database verification, age validation, Anti-Money Laundering (AML) screening, biometric authentication, and fraud prevention. Veriff serves sectors that require identity verification processes, including financial services, e-commerce, iGaming, video gaming, mobility, transportation, and human resources. It was founded in 2015 and is based in Tallinn, Estonia.

Shufti is a digital identity verification solutions provider specializing in KYC, KYB, and AML services across various industries. The company offers services, including facial biometrics, video KYC verification, multi-factor authentication, and transaction trust screening. Shufti serves sectors such as gaming, fintech, e-commerce, social networks, crypto, and foreign exchange. It was founded in 2016 and is based in London, United Kingdom.

Au10tix provides identity verification and fraud prevention services across various sectors including payments, crypto, gaming, and others. The company offers solutions for document, address, age, and biometric verification, along with Anti-Money Laundering (AML) screening and KYC compliance. The technology aims to support customer onboarding and improve security for businesses by identifying and preventing fraud. It was founded in 2002 and is based in New York, New York.

Mitek Systems provides mobile capture and digital identity verification solutions in the technology sector. The company offers products like an identity verification platform, biometric authentication, and mobile deposit services for businesses to verify user identities during digital transactions. Mitek's solutions serve financial institutions, fintech companies, and other businesses in regulated markets, focusing on financial risk and compliance requirements. Mitek Systems was formerly known as Mitek Systems of Delaware, Inc.. It was founded in 1986 and is based in San Diego, California.

Trulioo provides identity verification and fraud prevention within the digital economy. Its services involve verifying identity documents and business entities, as well as checking against global watchlists. Trulioo serves sectors that require identity verification solutions, such as financial institutions and e-commerce platforms. It was founded in 2011 and is based in Vancouver, Canada.

Loading...