Quandri

Founded Year

2020Stage

Series A - II | AliveTotal Raised

$22MValuation

$0000Last Raised

$12M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+127 points in the past 30 days

About Quandri

Quandri automates the end-to-end renewal process for personal lines brokerages and agencies across North America. Its AI-powered Renewal Intelligence Platform analyzes policy data, automatically requotes at-risk policies, and generates personalized, ready-to-send client communications. By eliminating the manual work tied to renewals, Quandri frees brokers and agents to focus on retention and growth. The company was founded in 2020 and is based in Vancouver, Canada.

Loading...

Quandri's Products & Differentiators

Policy Analysis

Quandri’s Policy Analysis capability goes beyond basic renewal comparisons to deliver deep, intelligent insights that drive retention and efficiency. It automatically analyzes renewing personal lines policies to detect coverage gaps, apply embedded carrier logic, enforce agency standards, and trigger follow-up activities within the agency's AMS. Quandri equips agencies to act proactively, tailoring recommendations to evolving client needs and ensuring every renewal meets or exceeds your agency’s service standards. With seamless Applied Epic integration and smart automation, agents can focus on strategic client engagement—not manual checks. The result: a scalable, proactive renewal experience that elevates your agency’s value and performance.

Loading...

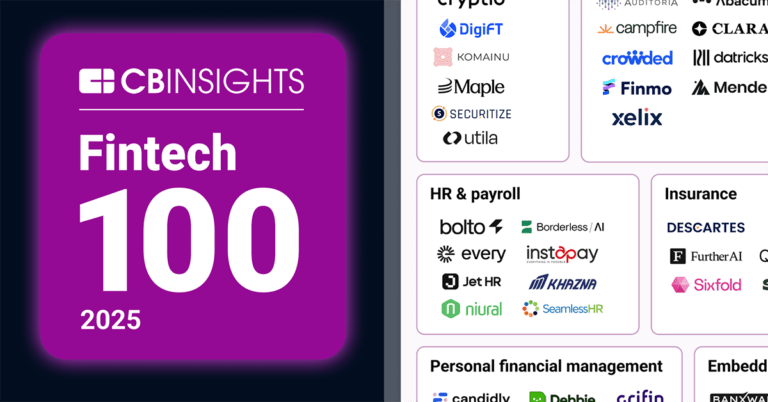

Research containing Quandri

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Quandri in 3 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025Expert Collections containing Quandri

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Quandri is included in 6 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Insurtech 50 2025

50 items

Do not share

Artificial Intelligence (AI)

20,629 items

Insurtech 50

50 items

Fintech 100

100 items

Latest Quandri News

Oct 6, 2025

Quandri , the AI platform modernizing servicing work for insurance agencies, has announced the U.S. launch of its new Requoting capability. Integrated into Quandri's Renewal Intelligence Platform, the new feature automates one of the most complex and time-consuming steps in personal lines insurance. With this addition, the platform now automates the entire renewal process end to end, transforming agency operations and reshaping the client experience by delivering proactive and competitive service at every renewal. Requoting has traditionally been one of the most resource-intensive and costly steps in the renewal workflow. Agencies often dedicate staff to re-enter policy data across multiple carrier portals or outsource remarketing work, resulting in delayed service and higher operational expenses. Quandri's Requoting capability eliminates these inefficiencies by generating real-time, competitive quotes. A process that previously consumed hours can now be completed in minutes, enabling agencies to present clients with the most advantageous options effortlessly. Andrew Thompson , CEO of The Gibson Agency, highlighted the efficiency gains for his team. “Our agents sometimes spend up to an hour manually requoting each renewal, clicking through more than 15 screens just to get started. With Quandri, they instantly receive competitive quotes upon renewal. This has saved our team significant time and freed them to focus on building stronger client relationships that drive loyalty and retention.” The benefits extend beyond time savings. Agencies are now able to adopt a more proactive role, showcasing market expertise by delivering timely, data-driven recommendations rather than reacting to clients who may already be exploring other options. The AI-powered process also creates opportunities for upselling and cross-selling as agents compare coverages across carriers and identify ways to offer more comprehensive protection. This shift not only modernizes the renewal experience but also sets a new standard for client retention, growth, and loyalty in personal lines insurance. Jamieson Fregeau , President and Co-Founder of Quandri, emphasized the broader implications. “Requoting is one of the most frustrating and time-consuming parts of insurance, and AI is the only way to solve it at scale. For clients, it means seeing clear, competitive options at renewal, which builds confidence in their coverage and trust that their agent is acting in their best interest. This is not simply about reducing administrative burden. It is about redefining how agencies compete, how they engage with clients at renewal, and how they adapt to the increasing demands of a modern insurance marketplace.” With the addition of Requoting, Quandri's Renewal Intelligence Platform now delivers a fully automated renewal journey in personal lines, from policy checking through to requoting and final client communications. Embedded directly into the Agency Management System, the platform eliminates the need for entire teams to handle renewals, while clients benefit from proactive, personalized service and competitive options. This evolution turns a historically time-consuming process into a significant competitive advantage for agencies.

Quandri Frequently Asked Questions (FAQ)

When was Quandri founded?

Quandri was founded in 2020.

Where is Quandri's headquarters?

Quandri's headquarters is located at 384 East 1st Avenue, Vancouver.

What is Quandri's latest funding round?

Quandri's latest funding round is Series A - II.

How much did Quandri raise?

Quandri raised a total of $22M.

Who are the investors of Quandri?

Investors of Quandri include FUSE, Defined Capital, Intact Ventures, Framework Venture Partners, Aviso Ventures and 7 more.

Who are Quandri's competitors?

Competitors of Quandri include Roots, Ocrolus, Luminai, Eleviant, ReSource Pro and 7 more.

What products does Quandri offer?

Quandri's products include Policy Analysis and 2 more.

Loading...

Compare Quandri to Competitors

Hyperscience provides enterprise artificial intelligence (AI) infrastructure software focused on hyperautomation. The company automates and orchestrates end-to-end processes to utilize back-office data and documents. Its solutions aim to improve decision-making and customer experiences. It was founded in 2014 and is based in New York, New York.

Hypatos develops artificial intelligence systems to automate document data capture and processing. Its technology captures data points from documents, performs validations, and automates processes like accounting, travel and expenses, loan underwriting, and claims processing. The company was founded in 2018 and is based in Potsdam, Germany.

PaperBox provides document processing and workflow automation for the insurance industry. The company's offerings include automating email triage and task assignment to improve operational processes. PaperBox serves the insurance sector with solutions that assist in claims and policy administration. It was founded in 2021 and is based in Gent, Belgium.

Inscribe operates as a risk intelligence solution. It provides fintechs to reduce fraud losses and automate manual reviews. It offers fraud detection, automation, document collection, and more. It was founded in 2017 and is based in San Francisco, California.

Noum provides technological solutions aimed at improving operational efficiency for organizations through digital systems. It offers tools that utilize artificial intelligence (AI), robotic process automation (RPA), and machine learning (ML) to optimize processes and assist in decision-making. Its solutions target municipalities and businesses, with an emphasis on enhancing operational performance. It is based in Santiago, Chile.

Fisent Technologies provides AI-enabled automation solutions for enterprise business processes. The company offers products for end-to-end automation of repetitive tasks and Fisent Risk for customer risk assessment and management. It was founded in 2021 and is based in Toronto, Canada.

Loading...