Quantexa

Founded Year

2016Stage

Series F | AliveTotal Raised

$547.7MValuation

$0000Last Raised

$175M | 9 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+10 points in the past 30 days

About Quantexa

Quantexa specializes in decision intelligence within the technology sector, providing solutions for data-driven decision-making across various industries. The company offers a platform that integrates artificial intelligence to unify data and resolve entities, performing graph analytics for risk management, customer intelligence, and financial crime prevention. Quantexa serves sectors including banking, insurance, government, telecommunication, health and social care, and the public sector. It was founded in 2016 and is based in London, United Kingdom.

Loading...

ESPs containing Quantexa

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

Quantexa named as Challenger among 15 other companies, including Microsoft, Oracle, and BAE Systems.

Quantexa's Products & Differentiators

Contextual Decision Intelligence

Quantexa’s strategic Contextual Decision Intelligence platform uncovers hidden risk and reveals new, unexpected opportunities across the customer lifecycle. CDI is a new approach to data that gives organizations the ability to connect internal and external data sets at scale to provide a single view, enriched with intelligence about the relationships between people, places and organizations. Powered by market-leading Entity Resolution and Network generation capabilities, our platform dynamically generates the context needed to automate millions of operational decisions, at scale, across multiple business units, including Anti-Money Laundering, Fraud, Credit Risk and Customer Intelligence.

Loading...

Research containing Quantexa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Quantexa in 5 CB Insights research briefs, most recently on May 16, 2025.

May 16, 2025 report

Book of Scouting Reports: ITC Europe 2025

May 8, 2025 report

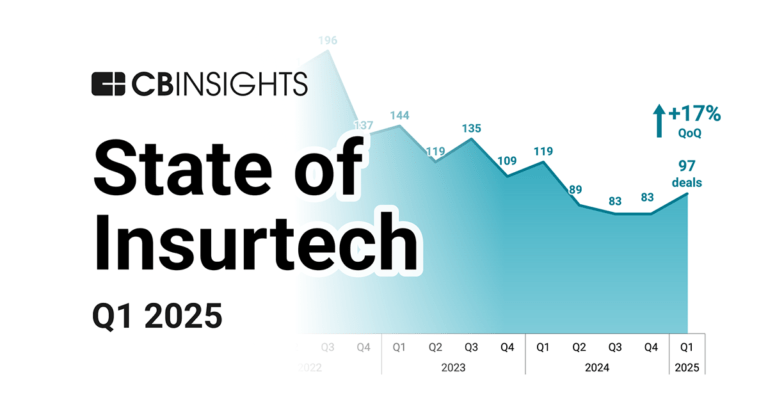

State of Insurtech Q1’25 Report

Mar 14, 2024

The retail banking fraud & compliance market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Quantexa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Quantexa is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Regtech

1,811 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence (AI)

14,208 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Quantexa News

Nov 14, 2025

Quantexa, a global enabler of Decision Intelligence, unveiled Quantexa AI, the so-called next evolution of its Decision Intelligence Platform, now agentic ready. As organizations increase their use of large language models and smaller, purpose-built and domain-trained models, many are discovering a common limitation: when AI interacts “with fragmented or untrusted data, it can amplify inaccuracies, make flawed decisions, and create costly feedback loops.” Whether using general models or specialized ones, enterprises can only achieve accurate, explainable, and auditable outcomes when AI is “grounded in trusted, contextualized data that reflects the complete view of the business.” Securely accessing and contextualizing enterprise data for AI has prompted many organizations to “rethink their AI deployments and their broader data and operating models.” The breakthrough with Quantexa AI lies in its ability to democratize and operationalize contextualized enterprise data that can “interact bidirectionally with both LLMs and task-specific models using open industry standards.” This enables humans and AI agents to converse with data in context, combining the “reasoning power of LLMs with the precision of specialized models, so they can act and decide confidently and responsibly in real time.” It represents the next evolution in helping organizations leverage AI safely and effectively to serve customers better, “mitigate risk, and drive operational efficiency.” Unlike typical analytics tools or model platforms that can operate in isolation, Quantexa AI connects every layer of intelligence, from foundational data unification to “reasoning and action, in one governed environment. Quantexa AI leverages NLP pipelines, predictive analytics, graph machine learning, and agentic AI to deliver explainable insights and fully auditable decision-making.” Building and managing agentic systems can be complex and risky when data lacks trust. Quantexa’s new Agent Gateway addresses this “challenge with a secure orchestration and integration layer that enables agent-to-agent collaboration, enforces governance, and ensures explainability across distributed systems.” Enterprises can use LLMs from providers such as OpenAI , Claude, Mistral, and Gemini, or bring their own, “integrating seamlessly with existing enterprise stacks.” The Agent Gateway, powered by Quantexa’s MCP Server, standardizes how agents interact with “enterprise systems and data securely and at scale.” Agent Gateway Key Features Include: An agnostic approach connecting data, context, and leading LLMs through one trusted platform Governance, lineage, and compliance enforced at every step Secure multi-agent coordination at scale Support for open standards such as MCP and A2A for interoperable, decision-ready ecosystems With Agent Gateway, Quantexa is building on open standard-based frameworks with partners such “as Microsoft, Google, Accenture , and KPMG to ensure enterprises can operate AI safely, moving beyond insight delivery to decision execution.” Q Assist Workspace builds on Quantexa ’s agentic copilot capabilities, expanding the data and context currently available to users and “enabling them to converse with and be guided by their data.” Key Capabilities Include:

Quantexa Frequently Asked Questions (FAQ)

When was Quantexa founded?

Quantexa was founded in 2016.

Where is Quantexa's headquarters?

Quantexa's headquarters is located at 10 York Road, London.

What is Quantexa's latest funding round?

Quantexa's latest funding round is Series F.

How much did Quantexa raise?

Quantexa raised a total of $547.7M.

Who are the investors of Quantexa?

Investors of Quantexa include British Patient Capital, Teachers' Venture Growth, World Economic Forum Global Innovator Community, AlbionVC, Dawn Capital and 14 more.

Who are Quantexa's competitors?

Competitors of Quantexa include Resistant AI, Napier, Quantifind, Ripjar, Tookitaki and 7 more.

What products does Quantexa offer?

Quantexa's products include Contextual Decision Intelligence and 1 more.

Who are Quantexa's customers?

Customers of Quantexa include HSBC, Danske Bank, OFX and Govia Thameslink Railway.

Loading...

Compare Quantexa to Competitors

ComplyAdvantage provides solutions for financial crime and compliance management, focusing on the security of the financial system. The company offers a platform that supplies insights for managing risks and meeting compliance obligations. ComplyAdvantage serves sectors that require compliance and risk management, such as financial institutions and businesses dealing with sensitive financial data. ComplyAdvantage was formerly known as Mimiro. It was founded in 2014 and is based in London, United Kingdom.

ThetaRay focuses on financial crime detection for financial institutions using machine learning and artificial intelligence (AI) technology. The company's solutions aim to identify criminals while recognizing legitimate customers, which can lead to reduced operational costs and improved customer experiences. ThetaRay serves the financial services sector, providing tools that assist institutions in onboarding customers and addressing the risk of financial crime. It was founded in 2013 and is based in Hod Hasharon, Israel.

Unit21 offers a no-code platform for risk and compliance operations within the financial services sector. The main offerings include tools for preventing and detecting payment fraud, monitoring anti-money laundering (AML) transactions, and providing device intelligence and customer risk ratings. The platform includes features such as artificial intelligence (AI) driven alerts, case management, regulatory filing automation, and risk data enrichment. It was founded in 2018 and is based in San Francisco, California.

Locstat provides graph intelligence platforms, focusing on AI analytics and event processing across various industries. Their offerings include transaction monitoring, fraud detection, anti-money laundering, customer retention management, and supply chain intelligence. Locstat serves sectors such as financial services, retail, supply chain, law enforcement, and intelligence. It was founded in 2016 and is based in Cape Town, South Africa.

Hawk specializes in anti-money laundering (AML) and counter-financial terrorism (CFT) technology, operating within the financial services sector. The company offers solutions for anti-money laundering (AML) transaction monitoring, payment screening, customer due diligence, and fraud prevention, focusing on risk coverage and operational efficiency for financial institutions. Hawk's products serve banks, payment companies, neobanks, fintechs, and the cryptocurrency industry. It was founded in 2018 and is based in Munich, Germany.

Schwarzthal Tech is building solutions to tackle financial crime using AI and algorithms. The platform provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning.

Loading...