Reka AI

Founded Year

2022Stage

Incubator/Accelerator | AliveTotal Raised

$167.5MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+127 points in the past 30 days

About Reka AI

Reka AI focuses on the development of multimodal artificial intelligence (AI) models within the AI sector. Its offerings include AI models that can process text, code, images, video, and audio and can be deployed on devices, on premises, or in the cloud. Its products serve various sectors that require AI reasoning and understanding. It was founded in 2022 and is based in Sunnyvale, California.

Loading...

ESPs containing Reka AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The multimodal AI developers market provides foundation models and APIs that process and generate content across multiple modalities including text, images, audio, and video. These companies develop transformer-based architectures and vision-language models that enable simultaneous understanding and generation across different data types. Solutions include text-to-image generation, image-to-video …

Reka AI named as Challenger among 15 other companies, including OpenAI, Microsoft, and Amazon.

Loading...

Research containing Reka AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Reka AI in 3 CB Insights research briefs, most recently on Aug 11, 2025.

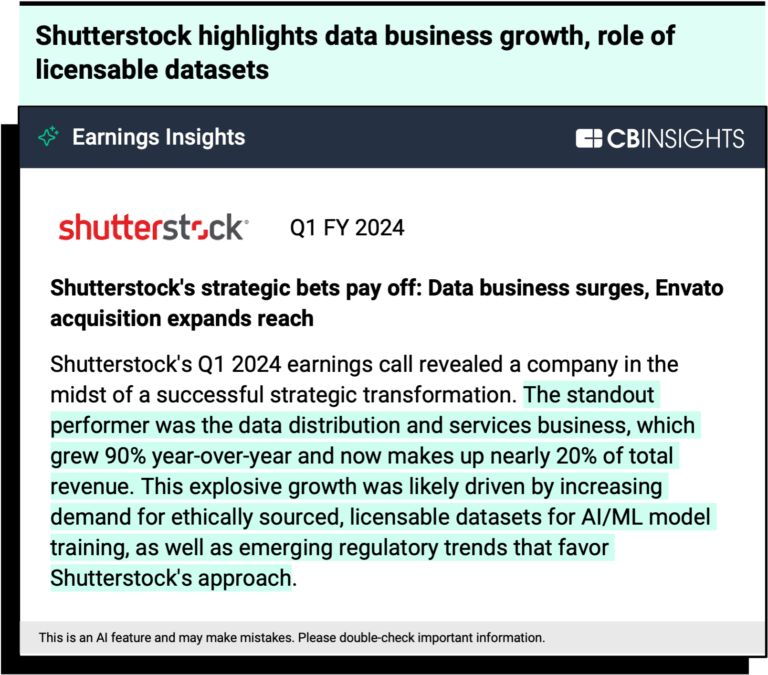

Aug 11, 2025 report

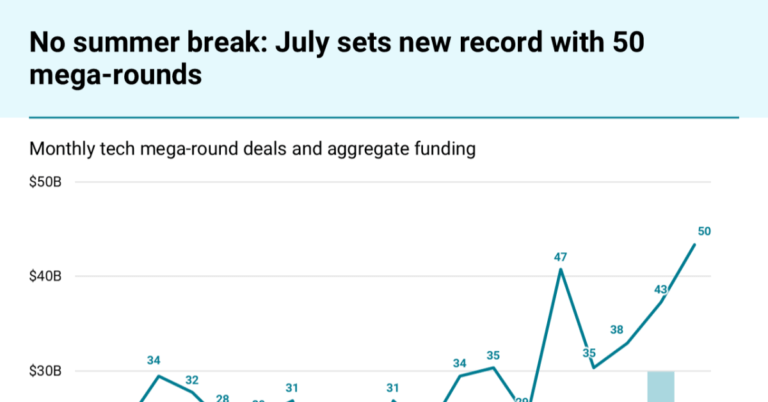

No summer break for AI: July 2025 hits 50 mega-rounds and 7 new unicorns

Oct 11, 2024

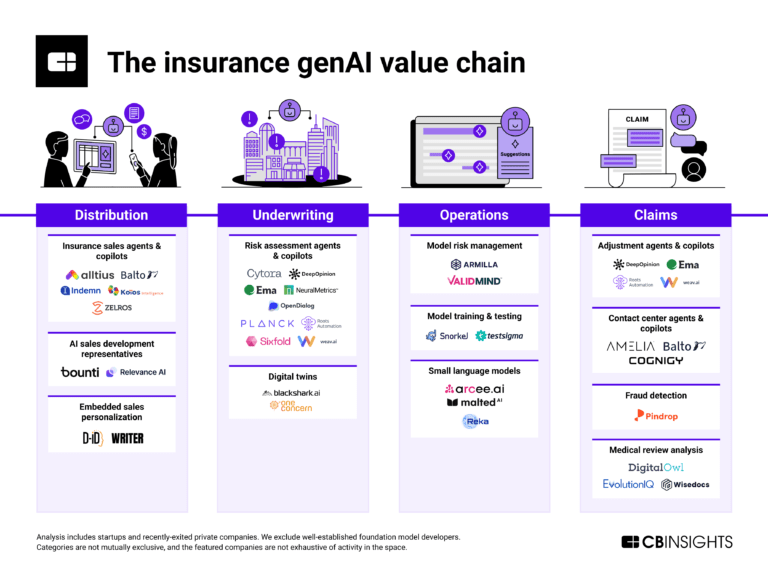

How genAI is reshaping the insurance value chainExpert Collections containing Reka AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Reka AI is included in 5 Expert Collections, including Artificial Intelligence (AI).

Artificial Intelligence (AI)

37,256 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI 100 (2024)

100 items

AI 100 (All Winners 2018-2025)

100 items

Unicorns- Billion Dollar Startups

1,297 items

Latest Reka AI News

Nov 3, 2025

Market Signals: Unicorn Growth Outpaces Public Market While public markets showed moderate strength in Q3—with the Nasdaq gaining , the S&P 500 up and the Dow Jones rising —the Silicon Valley Unicorn Index climbed 14.66%, outperforming all three major benchmarks. This widening gap reflects more than market sentiment. It underscores a structural revaluation of how growth and long-term potential are assessed in private markets. Pre-IPO companies building category-defining infrastructure—particularly in AI, logistics and industrial systems—are increasingly viewed as critical to the next wave of digital transformation. For operators and finance professionals, this trend highlights the value of watching private market momentum as a leading signal. Many of the technologies reshaping entire industries are being built in stealth—long before they register on public earnings calls or institutional radars. Capital Allocation: Infrastructure At The Core Of the $30.68 billion in venture funding in Q3 2025, over 90% of capital flowed into just three sectors: artificial intelligence ($24.08 billion), enterprise software ($2.57 billion), and fintech ($1.65 billion). This narrowing focus underscores a broader market thesis—long-term value is coming not from thematic novelty, but from scalable systems that can anchor entire industries. Artificial intelligence alone accounted for nearly 80% of all funding, continuing a multi-quarter trend in which foundational models, infrastructure layers and agentic systems attracted the majority of capital. One of the most notable examples was xAI, which secured over $10 billion in new financing—split evenly between equity and debt—to advance its platform for building general-purpose AI systems. The size and structure of the deal reflect the market's confidence in AI as a strategic layer of infrastructure, not just a category of tools. Enterprise software and fintech, while smaller in comparison, also reflect infrastructure-first investment logic. These segments attracted capital for tools that support compliance, automation and operational resilience—essentials in a market that prizes defensibility and embedded utility. For finance leaders and ecosystem builders, this allocation pattern signals a continued emphasis on systems that serve as critical infrastructure. The trend isn't toward more apps—it's toward more architecture. New Entrants To The Unicorn Club Among the companies that entered unicorn territory in Q3 were several that exemplify the infrastructure-first thesis shaping today's innovation economy. One such example is a team advancing multimodal foundational models—Reka AI—whose recent valuation milestone reflects growing interest in general-purpose systems with cross-sector applicability. Another entrant, Decart, is tackling one of the critically important layers of AI deployment: data infrastructure . By enabling enterprises to unify and operationalize fragmented datasets, the company is building the connective tissue that supports scalable machine learning. In a similar vein, Distyl AI reached unicorn status through its work on agentic frameworks designed to automate complex workflows. Rather than targeting niche tasks, its platform is built to adapt and compose across enterprise environments. Together, these new unicorns reinforce a broader capital allocation pattern: Investors are placing a premium on companies that serve as foundational layers, not stand-alone solutions. The momentum continues to favor platforms that can embed deeply, scale flexibly and unlock second-order innovation across entire industries. Practical Implications For those navigating the evolving innovation economy, Q3 offers more than a snapshot—it reveals a structural signal. The ventures receiving the most capital are not optimizing for speed to market or hype cycles; they are solving for scalability, interoperability and resilience at the systems level. This sustained capital alignment around infrastructure suggests that the ability to build deeply integrated, long-range capabilities is becoming a key benchmark of venture-worthiness. For ecosystem participants—whether operators, analysts or strategic partners—recognizing where foundational value is being constructed may provide a more reliable map of emerging priorities than surface-level trends. Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

Reka AI Frequently Asked Questions (FAQ)

When was Reka AI founded?

Reka AI was founded in 2022.

Where is Reka AI's headquarters?

Reka AI's headquarters is located at 530 Lawrence Expressway, Sunnyvale.

What is Reka AI's latest funding round?

Reka AI's latest funding round is Incubator/Accelerator.

How much did Reka AI raise?

Reka AI raised a total of $167.5M.

Who are the investors of Reka AI?

Investors of Reka AI include Oracle Defense Ecosystem, NVIDIA, Snowflake, Radical Ventures, Nat Friedman and 5 more.

Who are Reka AI's competitors?

Competitors of Reka AI include Proceder.ai and 1 more.

Loading...

Compare Reka AI to Competitors

BerriAI is a technology company focused on LLM (Large Language Model) access management and analytics within the software development domain. The company provides tools for platform teams to manage LLM access for developers, including spend tracking, model access, and observability features, which can work with existing systems. BerriAI serves sectors that need AI model integration, such as tech companies and enterprises using language models for various applications. It was founded in 2023 and is based in San Francisco, California.

GoCharlie is a generative artificial intelligence (AI) company that operates in the technology sector. The company's main service involves the use of an AI engine, Charlie, which generates various types of content, such as social posts and blog posts, based on user needs. The company primarily serves the marketing industry. It was founded in 2021 and is based in Allentown, Pennsylvania.

Uniphore focuses on AI transformation in various industries. The company provides a multimodal AI and data platform that allows businesses to deploy AI agents and create domain-specific AI models. Uniphore's technology includes features related to data security and sovereignty. Uniphore was formerly known as Uniphore Software Systems. It was founded in 2008 and is based in Palo Alto, California.

Aimesoft is a company that develops multimodal AI solutions within the artificial intelligence sector. Their offerings include technologies such as image processing, computer vision, speech processing, natural language processing, and data mining, and they serve industries such as healthcare, hospitality, and transportation. It was founded in 2018 and is based in San Jose, California.

Twelve Labs is a company that focuses on video intelligence within the tech industry. The company's offerings include a platform that analyzes, searches, generates, and embeds video content, and provides workflow automation for various applications. The company serves sectors that require video understanding, such as media and entertainment, security, and automotive industries. It was founded in 2021 and is based in San Francisco, California.

Akira AI specializes in the development and deployment of generative AI applications for enterprise data management across various industries. The company offers a suite of services including training and fine-tuning large language models (LLMs), securing AI applications against vulnerabilities, and facilitating deployment on hybrid cloud environments. Akira AI's platform also provides tools for integrating AI functionalities into existing workflows, generating synthetic data, and managing the entire AI model lifecycle. It was founded in 2023 and is based in Sahibzada Ajit Singh Nagar, India.

Loading...