Revolut

Founded Year

2015Stage

Secondary Market - II | AliveTotal Raised

$1.721BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+75 points in the past 30 days

About Revolut

Revolut operates as a financial technology company that provides a digital banking platform. It offers financial services including money management tools, foreign exchange trading, cryptocurrency transactions, and investment services. The company serves individual consumers who want to manage finances. It was founded in 2015 and is based in London, United Kingdom.

Loading...

ESPs containing Revolut

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

Revolut named as Leader among 15 other companies, including SoFi, MoneyLion, and Monzo.

Loading...

Research containing Revolut

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Revolut in 9 CB Insights research briefs, most recently on Sep 23, 2025.

Sep 23, 2025 report

The Money Awards Finalist Spotlight

Sep 11, 2025

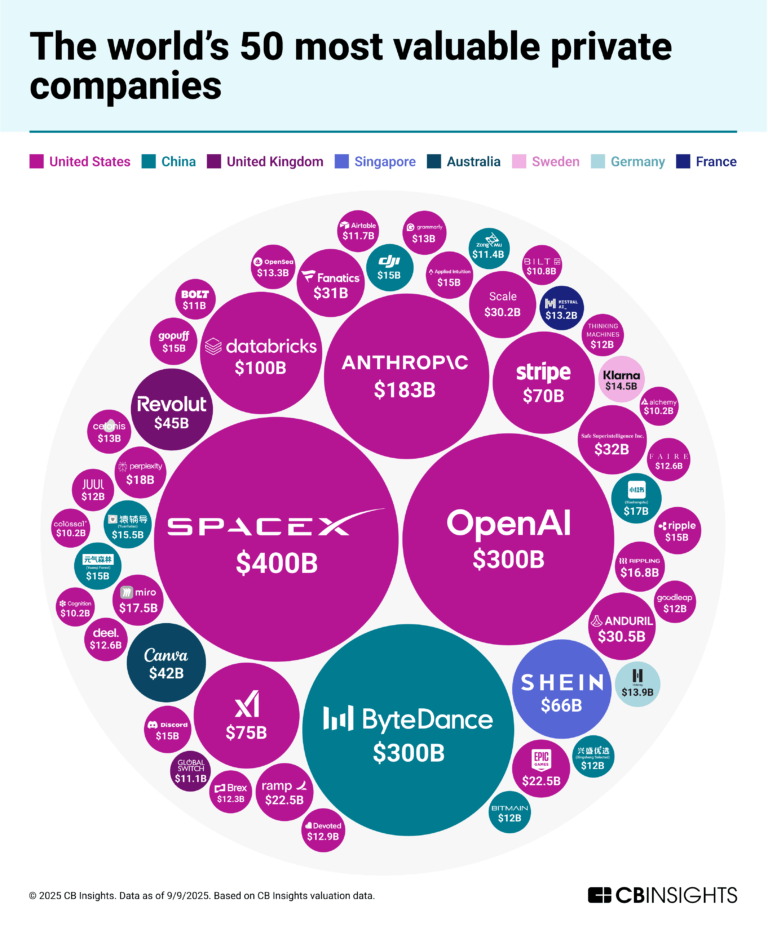

The world’s 50 most valuable private companies

Jun 6, 2025

The SMB fintech market map

Aug 30, 2024

The financial planning market map

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Revolut

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Revolut is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Revolut Patents

Revolut has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/21/2014 | Payment systems, Payment service providers, Credit cards, Online payments, Debit cards | Application |

Application Date | 11/21/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Payment service providers, Credit cards, Online payments, Debit cards |

Status | Application |

Latest Revolut News

Nov 15, 2025

Revolut is now expected to hold off its eagerly anticipated Irish mortgages launch until 2026, even though it has been quietly testing its planned offering with staff in the Republic in recent months. Executives from the neobank told The Irish Times in April that they were planning for an Irish launch in the fourth quarter of this year. However, sources say that the group is continuing to focus, for now, on the Lithuanian market, home of its existing euro-zone banking licence, where it unveiled its first mortgage product in May. Revolut is doubling down on further improving its mortgage product in that market before rolling it out elsewhere, the sources added, declining to comment on timing of an official Irish start. A spokesman for Revolut declined to comment when asked about the timing of the mortgages launch in the Republic. The company has focused on the switcher market in Lithuania to date, taking advantage of regulatory changes in that market in February that have made it easier for borrowers to refinance mortgages with other lenders. Revolut is currently making mortgages available directly through its app in Lithuania, with its loan rate linked to a key European benchmark – the so-called Euribor rate at which banks are willing to lend to each other in the euro zone. Revolut's more than three million customers in Ireland will present a big opportunity to market its mortgage offering. Photographer: Betty Laura Zapata/Bloomberg via Getty Images Avant Money launched a similar product in the Irish market earlier this year. It has echoes of the European Central Bank (ECB) tracker mortgages that were prevalent in the Republic before the financial crisis. Lenders stopped offering these in 2008, when their own borrowing costs spiralled and lost any correlation with ECB rates. The rate on the Avant product is set on the day of drawdown and adjusted annually based on the 12-month Euribor market rates. Sources cautioned that Revolut's mortgage distribution and product in Lithuania should not be seen as a precedent for its Irish offering. While about 45 per cent of Irish home loans are written through brokers, they are much less of a feature in the Baltic state. Meanwhile, loans linked to Euribor are standard in Lithuania. Revolut's more than three million customers in Ireland will present a big opportunity to market its mortgage offering and take on the three Irish banks that accounted for 92 per cent of €12.6 billion of mortgages issued last year. Still, Béatrice Cossa-Dumurgier, chief executive of Revolut's new western Europe hub in Paris, told the Business Post in September that mortgages are “not a product that we're going to push very aggressively” when they are launched in Ireland. She declined at that stage to be drawn on timelines, saying that “there is no hurry”. The Irish operation will ultimately fall under the western European unit, subject to the latter securing a French banking licence. Others also trying to loosen the banks' stranglehold on mortgages include Avant Money ICS Mortgages , which has become more active in the last year, and new entrants Nuá Money and MoCo . MoCo, which is owned by Austrian banking group Bawag, recently expanded into savings products, while Avant Money, a unit of Spain's Bankinter, is eyeing an imminent launch of deposit accounts. Meanwhile, the future ownership of PTSB, the State's third-largest mortgage lender, is uncertain, after the bank announced it was putting itself up for sale earlier this month. PTSB is currently trying to convince the Central Bank to allow it to lower the amount of expensive capital it needs to hold in reserve against its home loans – to put it on a more competitive footing with its larger rivals, AIB and Bank of Ireland. A new owner will benefit from an expected capital alleviation.

Revolut Frequently Asked Questions (FAQ)

When was Revolut founded?

Revolut was founded in 2015.

Where is Revolut's headquarters?

Revolut's headquarters is located at 7 Westferry Circus, Canary Wharf, London.

What is Revolut's latest funding round?

Revolut's latest funding round is Secondary Market - II.

How much did Revolut raise?

Revolut raised a total of $1.721B.

Who are the investors of Revolut?

Investors of Revolut include Financecommunity Fintech Awards, Garage Syndicate, Tiger Global Management, D1 Capital Partners, Coatue and 53 more.

Who are Revolut's competitors?

Competitors of Revolut include CloudWalk, Airwallex, Finom, Chime, Circle and 7 more.

Loading...

Compare Revolut to Competitors

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

N26 is a mobile bank that provides digital banking services and operates in the financial services industry. The company enables users to manage their finances, conduct transactions, and access financial services through their smartphones. N26 primarily serves individual customers. It was founded in 2013 and is based in Berlin, Germany.

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

Alipay operates as a mobile and online payments platform, operated by Ant Financial, that provides digital payment services. The company offers services including mobile payments, online payments, and various lifestyle service applications such as utility bill payments, credit card bill payments, and group red envelope collection. Alipay primarily serves individual users and small to micro-sized businesses, facilitating both online and offline transactions. It was founded in 2004 and is based in Hangzhou, China.

Cash App develops a financial services platform. The company offers a range of services, including instant payments, everyday spending savings, simplified banking, stock and bitcoin trading, and tax filing. Its primary customers are individuals seeking a comprehensive solution for their financial needs. It was founded in 2013 and is based in New York, New York.

Loading...