Ro

Founded Year

2017Stage

Series D - II | AliveTotal Raised

$1.027BValuation

$0000Last Raised

$150M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+10 points in the past 30 days

About Ro

Ro provides telehealth services and healthcare products across various sectors. The company offers online consultations and treatments for weight loss, sexual health, hair loss, fertility, and skin care, using Food and Drug Administration (FDA) approved medications. Ro serves individuals seeking healthcare solutions without the need for insurance. Ro was formerly known as Roman. It was founded in 2017 and is based in New York, New York.

Loading...

Ro's Products & Differentiators

Roman / Rory / Plenity / Zero

Ro first started with three digital health clinics to offer patients end-to-end telehealth treatment for over 20 conditions. Roman which offers treatments for men’s health conditions from sexual health, to hair loss to daily vitamin supplements. Rory, a clinic for women offering treatments for conditions from skincare to menopause to sexual wellness. And Zero, a clinic to help patients quit smoking. Ro also offers Plenity, an offering that provides patients with safe and effective options to manage their weight and tackle obesity.

Loading...

Research containing Ro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ro in 2 CB Insights research briefs, most recently on Mar 28, 2024.

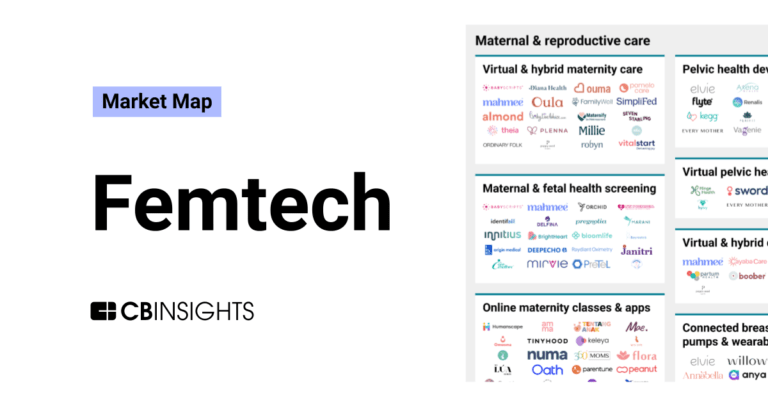

Mar 28, 2024

The femtech market map

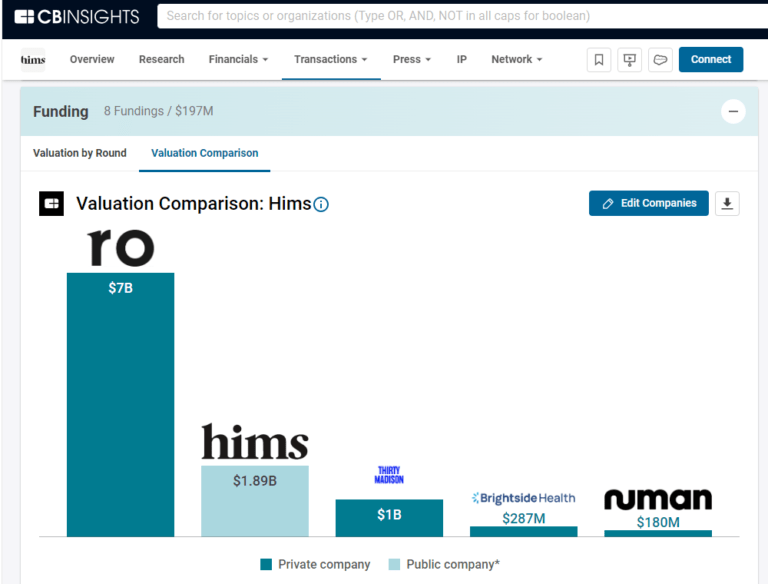

Jan 3, 2024

2024 prediction: Hims merges with RoExpert Collections containing Ro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ro is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,424 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,309 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Ro Patents

Ro has filed 14 patents.

The 3 most popular patent topics include:

- eyewear

- eyewear brands

- geometrical optics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/30/2022 | 12/10/2024 | Off-road racing video games, Off-road racing drivers, Electronics manufacturing, Stock car racing, Fluid dynamics | Grant |

Application Date | 9/30/2022 |

|---|---|

Grant Date | 12/10/2024 |

Title | |

Related Topics | Off-road racing video games, Off-road racing drivers, Electronics manufacturing, Stock car racing, Fluid dynamics |

Status | Grant |

Latest Ro News

Nov 14, 2025

Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, UNITED KINGDOM, November 14, 2025 / EINPresswire.com / -- Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors Hair Loss Telehealth Market Growth Forecast: What To Expect By 2025? In recent times, there has been a substantial expansion in the market size of hair loss telehealth . The growth forecast shows that it will rise from $2.25 billion in 2024 to $2.76 billion in 2025, with a compound annual growth rate (CAGR) of 22.4%. Factors contributing to this growth during the historic period include soaring digital health acceptance, a spike in telehealth due to the pandemic, a greater consumer demand for ease, broadening of direct-to-consumer platforms, and the emergence of consumer segments focused on wellness. In the coming years, the market size of telehealth for hair loss is expected to surge significantly. By 2029, it is projected to expand to $6.11 billion with a compound annual growth rate (CAGR) of 22.0%. The predicted expansion during the forecast period is due to factors such as the rise in the occurrence of androgenetic alopecia, the development of individualized treatment methods, increased insurance provision for telehealth services, the surge in app-based consultation platforms, and the focus on non-invasive treatments. Key trends for this forecast period include progress in teledermatology, the incorporation of artificial intelligence (AI) into diagnostics, introduction of peptide-based therapies, merging of telehealth with wearable health monitoring gadgets, bespoke hair loss treatment strategies, and forward strides in digital health technologies. Download a free sample of the hair loss telehealth market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=29073&type=smp What Are Key Factors Driving The Demand In The Global Hair Loss Telehealth Market? The surge in smartphone usage and mobile internet is anticipated to boost the hair loss telehealth market's advancement . This refers to the more frequent possession and utilization of mobile devices with internet capabilities, allowing for easy access to online services, applications, and digital healthcare solutions anytime, anywhere. The increased prevalence of smartphones and mobile internet is attributable to the expanded 5G network infrastructure and improved mobile broadband access. Telecommunications providers have substantially augmented coverage and connection speed in both urban and rural areas, making the internet more dependable and accessible for various populations. These advancements have also enabled those suffering from hair loss to easily consult with specialists through virtual appointments, receive personalized treatment plans from uploaded mobile images of their scalp and obtain prescribed pharmaceuticals through digital platforms, eliminating the need for in-person clinic visits. As per the Federal Communications Commission, a US government agency, total connections grew by roughly 2.5% from June 2023 to June 2024, eventually hitting 549 million in May 2025. In June 2024, mobile connections accounted for 416 million of these, a 2.5% increase from the previous year, while fixed connections rose by about 2.3% to 133 million during the same timeframe. Therefore, the surge in smartphone and mobile internet usage is propelling the growth of the hair loss telehealth market. Who Are The Leading Players In The Hair Loss Telehealth Market? Major players in the Hair Loss Telehealth Global Market Report 2025 include: • Hims & Hers Health Inc. • Ro Inc. • LifeMD Inc. • Zocdoc Inc. • Shapiro MD Inc. • Sesame Care Inc. • Happy Head Inc. • Numan Ltd. • BosleyMD Inc. • XYON Health Inc. What Are The Major Trends That Will Shape The Hair Loss Telehealth Market In The Future? In an attempt to increase convenience and patient compliance, leading businesses in the hair loss telehealth sector are transitioning to inventive approaches such as delivery of prescriptions directly to consumers. This service delivers drugs from the mart to the patient's residence, enhancing convenience, saving time, eliminating the requirement for physical pharmacy visits, enriching medication adherence, and ensuring speedier access to vital prescriptions. In November 2024, Amazon, an American tech firm, introduced an affordable telehealth service for its Prime members including treatment plans and rapid, no-cost men's hair loss medicine, anti-aging, erectile dysfunction, eyelash growth, and motion sickness medication delivery. Patients are able to schedule remote consultations with authorized medical professionals via chat or video call, acquire personalized treatments, and get their prescriptions from Amazon Pharmacy. The medications, enclosed in discreet packaging, typically arrive within a few hours, offering a streamlined and convenient experience. This service eliminates the need for in-person visits to the pharmacy and improves patient adherence by ensuring swift access to the prescribed treatments. With transparent pricing, patients can view the full cost of consults and prescriptions in advance, enabling more informed decisions and lowering financial constraints to healthcare access. By integrating telehealth with direct-to-consumer prescription delivery, Amazon positions itself as a significant player in the hair loss and wider lifestyle telehealth industry, addressing the increasing consumer desire for convenience, speed, and easy access to healthcare services. Analysis Of Major Segments Driving The Hair Loss Telehealth Market Growth The hair loss telehealthmarket covered in this report is segmented – 1) By Service Type: Consultation, Diagnosis, Prescription, Follow-Up Care, Other Service Types 2) By Platform: Web-Based, App-Based 3) By Age Group: 18-34, 35-54, 55+ 4) By Provider: Direct-To-Consumer, Hospitals And Clinics, Other Providers 5) By End User: Men, Women, Other End Users Subsegments: 1) By Consultation: Initial Consultation, Specialist Consultation, Virtual Consultation, Follow-Up Consultation 2) By Diagnosis: Scalp Examination, Blood Test Analysis, Genetic Testing, Dermatological Assessment 3) By Prescription: Topical Medication Prescription, Oral Medication Prescription, Hair Growth Supplement Prescription, Customized Treatment Plan 4) By Follow-Up Care: Routine Progress Monitoring, Treatment Adjustment Sessions, Teleconsultation Follow-Ups, Patient Support Programs 5) By Other Service Types: Hair Transplant Guidance, Lifestyle And Nutritional Counseling, Psychological Support Services, Educational Resources And Workshops View the full hair loss telehealth market report: https://www.thebusinessresearchcompany.com/report/hair-loss-telehealth-global-market-report Which Region Is Expected To Lead The Hair Loss Telehealth Market By 2025? In 2024, North America had the most significant share in the Hair Loss Telehealth Global Market Report and is expected to maintain noteworthy growth. The report covers various regions including Asia-Pacific, which is predicted to be the fastest-growing region. Other regions detailed in the report include Western Europe, Eastern Europe, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Hair Loss Telehealth Market 2025, By The Business Research Company Telehealth Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/telehealth-global-market-report Telehealth Software Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/telehealth-software-global-market-report Hair Transplant Global Market Report Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/hair-transplant-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Ro Frequently Asked Questions (FAQ)

When was Ro founded?

Ro was founded in 2017.

Where is Ro's headquarters?

Ro's headquarters is located at 625 6th Avenue, New York.

What is Ro's latest funding round?

Ro's latest funding round is Series D - II.

How much did Ro raise?

Ro raised a total of $1.027B.

Who are the investors of Ro?

Investors of Ro include General Catalyst, Initialized Capital, FirstMark Capital, TQ Ventures, BoxGroup and 40 more.

Who are Ro's competitors?

Competitors of Ro include Lemonaid Health, Thirty Madison, Blink Health, Hone Health, Piction Health and 7 more.

What products does Ro offer?

Ro's products include Roman / Rory / Plenity / Zero and 4 more.

Loading...

Compare Ro to Competitors

Maven is a virtual clinic specializing in women's and family health across various life stages. The company offers digital programs that provide clinical, emotional, and financial support for fertility and family building, maternity and newborn care, parenting and pediatrics, as well as menopause and midlife health. Maven serves employers, health plans, and consultants. It was founded in 2014 and is based in New York, New York.

DoctorBox is a digital health platform focused on preventive healthcare and health data management. The company offers a mobile application that provides assistance for health recommendations, medication reminders, prescription renewals, secure document storage, and emergency medical ID management. DoctorBox serves individuals seeking to manage their health through digital means. It was founded in 2016 and is based in Berlin, Germany.

HealthTap is a tech-enabled virtual physician practice operating in the healthcare sector. The company provides primary care through a direct-to-consumer model and partnerships with various healthcare entities, offering services like urgent care access. HealthTap's platform is designed to integrate into existing patient workflows and electronic medical records (EMRs), facilitating ongoing relationships between patients and doctors. It was founded in 2010 and is based in Sunnyvale, California.

Rezilient provides healthcare services. It combines telehealth services with in-person care capabilities. The company offers primary and urgent care services, accessible through both virtual and physical examinations, including labs and imaging. It provides individuals and families with convenient healthcare solutions. Rezilient was formerly known as DynamicSurgical. It was founded in 2016 and is based in Saint Louis, Missouri.

Medcase operates within the telehealth and medical data sectors. It connects organizations with healthcare professionals for virtual care services and offers data solutions, including medical data annotation and labeling. Medcase serves the pharmaceutical, biotechnology, telehealth infrastructure, clinical staffing, and medical device industries. Medcase was formerly known as Edgecase AI. It was founded in 2021 and is based in Hingham, Massachusetts.

98point6 Technologies specializes in digital health solutions and focuses on telehealth and healthcare technology. The company offers a virtual care platform that provides asynchronous and real-time telehealth services, designed to streamline administrative tasks for clinicians and enhance patient-provider interactions. Their platform serves the healthcare industry by increasing provider efficiency and patient satisfaction through technology that supports various care modalities. 98point6 Technologies was formerly known as 98point6. It was founded in 2017 and is based in Seattle, Washington. 98point6 Technologies operates as a subsidiary of Transcarent.

Loading...