Zipline

Founded Year

2014Stage

Series F | AliveTotal Raised

$817.26MValuation

$0000Last Raised

$330M | 3 yrs agoRevenue

$0000About Zipline

Zipline provides drone delivery and logistics services across various sectors. The company operates an automated delivery system, offering delivery services to consumers and businesses. Zipline serves sectors such as healthcare, ecommerce, and public health. Zipline was formerly known as Romotive. It was founded in 2014 and is based in South San Francisco, California.

Loading...

ESPs containing Zipline

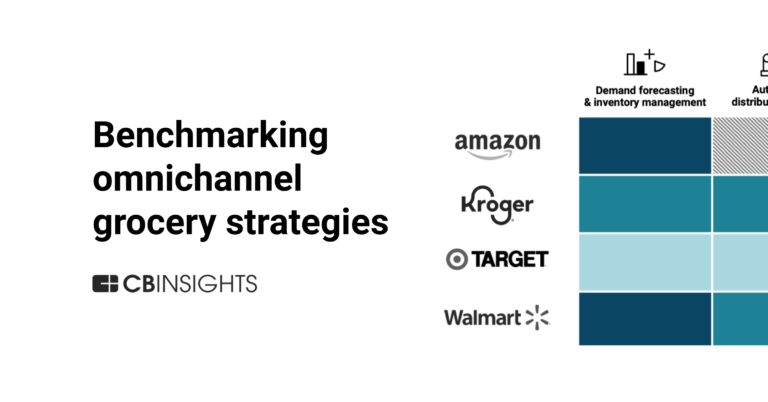

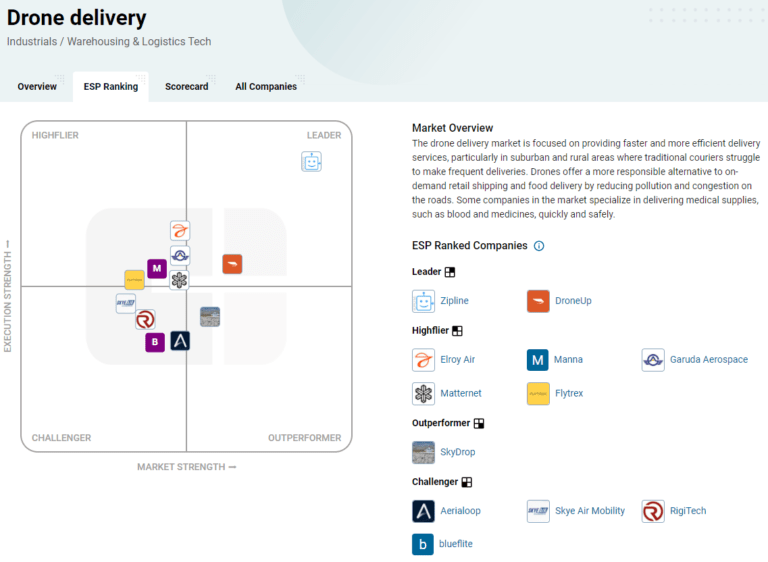

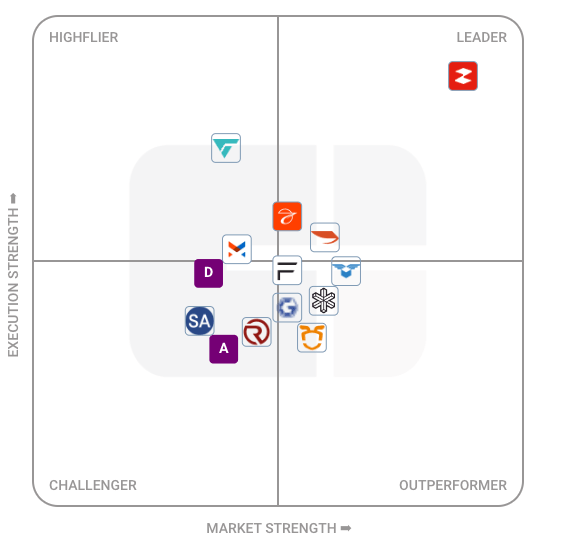

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The delivery drone developers market develops unmanned aerial vehicles (UAVs) designed to transport packages, medical supplies, and other goods across various sectors. These solutions typically feature vertical takeoff & landing capabilities, autonomous navigation systems, and specialized cargo compartments to enable efficient aerial logistics. The market includes both hardware manufacturers creat…

Zipline named as Leader among 15 other companies, including Amazon, Wingcopter, and Manna.

Loading...

Research containing Zipline

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zipline in 8 CB Insights research briefs, most recently on Aug 27, 2025.

Aug 27, 2025

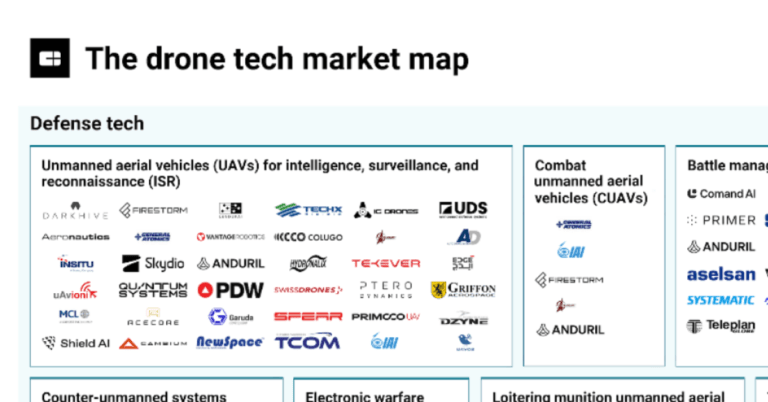

The drone tech market map

Feb 23, 2024

The pharma supply chain tech market map

Dec 22, 2023

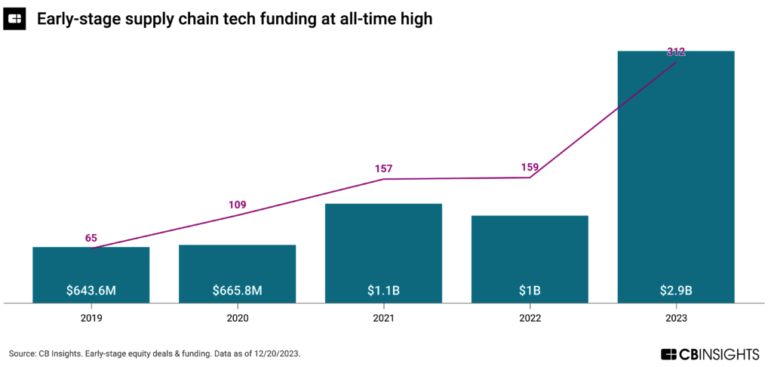

5 supply chain markets gaining momentum in 2024

Oct 12, 2023

What is helping drone delivery leaders take flight?Expert Collections containing Zipline

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zipline is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

6,805 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,297 items

Robotics

2,753 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Game Changers 2018

70 items

Aerospace & Space Tech

5,039 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Defense Tech

1,292 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Zipline Patents

Zipline has filed 44 patents.

The 3 most popular patent topics include:

- avionics

- aircraft controls

- unmanned aerial vehicle manufacturers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/15/2023 | 11/26/2024 | Audio engineering, Aerodynamics, Fluid dynamics, Loudspeakers, Aerospace engineering | Grant |

Application Date | 8/15/2023 |

|---|---|

Grant Date | 11/26/2024 |

Title | |

Related Topics | Audio engineering, Aerodynamics, Fluid dynamics, Loudspeakers, Aerospace engineering |

Status | Grant |

Latest Zipline News

Nov 11, 2025

Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, November 11, 2025 / EINPresswire.com / -- "Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors What Is The Expected Cagr For The Medical Drones Market Through 2025? In recent years, the market size for medical drones has seen a swift expansion. The market, standing at $1.55 billion in 2024, is projected to escalate to $1.81 billion in 2025, indicating a Compound Annual Growth Rate (CAGR) of 16.9%. Factors contributing to this progressive trend during the historic period include emergency medical services, the challenge of reaching isolated locations, diminished transport durations, worldwide health calamities, and regulatory endorsement for drone maneuvers. In the coming years, the market size of medical drones is predicted to expand significantly, reaching $3.48 billion by 2029, with a compound annual growth rate (CAGR) of 17.8%. This expected growth in the forecasted timeframe can be credited to aspects such as artificial intelligence integration, growing telemedicine services, increased payload capacities, emphasis on last-mile delivery, and shifting regulatory frameworks. Several potential trends that may rise during the forecasted period include collaboration and partnerships, refinement of drone technologies, the establishment of automated drone stations, the usage of temperature-regulated transport for pharmaceuticals, and responses to humanitarian and disaster scenarios. Download a free sample of the medical drones market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=13482&type=smp What Are The Driving Factors Impacting The Medical Drones Market? The pumping of funds into medical drones by the government is anticipated to boost the expansion of the medical drone market. Medical drones, also referred to as medical transport drones, are unmanned aerial vehicles (UAVs) specially crafted for medical usage within the health sector. In other words, government financing for medical drones entails the monetary aid offered by government bodies to foster the growth, implementation, or broadening of drone usage for medical and healthcare needs. As an example, the UK government in November 2022, as per the Department for Business, Energy, and Industrial Strategy, embarked on about $14.38 million (12 million pound sterlings) in 24 novel projects to vanquish regulatory obstacles and support enterprises in launching products and services encompassing medical drones. Moreover, in July 2022, the UK government, as per the Department for Business, Energy, and Industrial Strategy, disclosed a $324 million (273 million pound sterlings) funding for aircraft innovation, inclusive of the fabrication of drones that can ferry medical materials. Consequently, the growth of the medical drone market is being fuelled by government financing for medical drones. Which Players Dominate The Medical Drones Industry Landscape? Major players in the Medical Drones Global Market Report 2025 include: • DHL International GmbH • United Parcel Service Inc. • Toyota Tsusho Corporation • Airbus SE • Bell Textron Inc. • AeroVironment Inc. • Zipline International Inc. • Parrot SA • Tata Advanced Systems Limited • Wing Aviation LLC What Are Some Emerging Trends In The Medical Drones Market? Leading businesses in the medical drone sector are devising cutting-edge networks embedded with progressive technologies like medical drone delivery networks, aiming to transform healthcare and enhance the distribution of medical necessities. These networks are systems engineered to carry medical equipment, provisions, and even organs through unmanned aerial vehicles (UAVs), widely referred to as drones. To cite an example, in September 2022, AGS Airport spearheaded the CAELUS consortium, a UK-based airport firm, partnered with NHS Scotland, a government agency in Scotland, to roll out the second phase of the UK's pioneering medical drone delivery network. This landmark national drone network is capable of transporting crucial medicines, blood, and other medical supplies all over Scotland, extending even to secluded communities. This drone system guarantees efficient delivery of critical medical supplies, thereby significantly reducing waiting periods for test outcomes and more. Global Medical Drones Market Segmentation By Type, Application, And Region The medical drones market covered in this report is segmented – 1) By Type: Fixed Wing, Rotor Drones, Hybrid Drones 2) By Payload Capacity: Below 2 Kg, 2-4 kg, Above 4 Kg 3) By Application: Emergency Blood Logistics, Medical Drug And Vaccine, Emergency Organ Logistics, Other Applications 4) By End-User: Hospitals, Blood Banks, Government Institutions, Other End-Users Subsegments: 1) By Fixed Wing Drones: Long-Range Fixed Wing Drones, Short-Range Fixed Wing Drones 2) By Rotor Drones: Single-Rotor Drones, Multi-Rotor Drones 3) By Hybrid Drones: Vertical Takeoff and Landing (VTOL) Hybrid Drones, Fixed Wing-Rotor Hybrid Drones View the full medical drones market report: https://www.thebusinessresearchcompany.com/report/medical-drones-global-market-report Which Region Holds The Largest Market Share In The Medical Drones Market? For the year 2025, the Medical Drones Global Market Report identifies North America as the leading region, having been the largest market in 2024. The report includes regions such as Asia-Pacific, Western Europe, Eastern Europe, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Medical Drones Market 2025, By The Business Research Company Medical Adhesive Tapes Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/medical-adhesive-tapes-global-market-report Medical Aesthetics Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/medical-aesthetics-global-market-report Medical Alert Systems Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/medical-alert-systems-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Zipline Frequently Asked Questions (FAQ)

When was Zipline founded?

Zipline was founded in 2014.

Where is Zipline's headquarters?

Zipline's headquarters is located at 333 Corey Way, South San Francisco.

What is Zipline's latest funding round?

Zipline's latest funding round is Series F.

How much did Zipline raise?

Zipline raised a total of $817.26M.

Who are the investors of Zipline?

Investors of Zipline include NVIDIA Inception Program, Scottish Mortgage Investment Trust, Katalyst Ventures, Temasek, Emerging Capital Partners and 40 more.

Who are Zipline's competitors?

Competitors of Zipline include Neolix, Starship Technologies, Flytrex, Nuro, Drone Express and 7 more.

Loading...

Compare Zipline to Competitors

Flytrex provides drone delivery services within the suburban U.S. market. Its main offering includes delivering a variety of products, such as food and essentials, directly to customers' backyards using drones. Flytrex primarily serves the quick-service restaurants, retailers, and events sectors. It was founded in 2012 and is based in Tel Aviv, Israel.

Matternet develops autonomous drone networks for package delivery in sectors. It provides a system for delivery services targeting healthcare, commerce, and new economies. Matternet's technology has achieved FAA Type Certification and is used in urban and suburban environments for commercial drone delivery. It was founded in 2011 and is based in Mountain View, California.

Manna serves as a drone delivery service that operates a fleet of aviation-grade drones capable of delivering a variety of goods, including food and essential items, to local neighborhoods. Its service is designed to bypass traditional road traffic. It was founded in 2019 and is based in Dublin, Ireland.

Udelv develops autonomous delivery vehicles for the transportation and logistics industry. The Transporter is an autonomous electric vehicle designed for multi-stop, last-mile, and middle-mile deliveries. Udelv's vehicles have level 4 autonomy and include a cargo container known as the uPod, along with fleet management and tele-operation tools for delivery operations. It was founded in 2016 and is based in Burlingame, California.

Starship Technologies specializes in autonomous delivery robots within the technology and logistics sectors. The company offers a fleet of level 4 autonomous robots designed to deliver hot food, groceries, and industrial supplies, utilizing radars, cameras, sensors, and machine learning for navigation and object identification. Starship Technologies primarily serves university campuses, grocery retailers, delivery apps, and industrial sites. It was founded in 2014 and is based in San Francisco, California.

Airpost is a drone-related delivery system for distances of over 300 km with a capacity of up to 5 kg. It also uses a clean fuel-hydrogen. It is based in Istanbul, Turkey.

Loading...