Safe Superintelligence

Founded Year

2024Stage

Series B | AliveTotal Raised

$3BValuation

$0000Last Raised

$2B | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Safe Superintelligence

Safe Superintelligence is a company focused on the development of superintelligence within the artificial intelligence sector. Its main objective is to create a superintelligence through engineering and scientific advancements, ensuring safety. The company primarily targets sectors that require advanced AI safety and security solutions. It was founded in 2024 and is based in Palo Alto, California.

Loading...

Loading...

Research containing Safe Superintelligence

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Safe Superintelligence in 5 CB Insights research briefs, most recently on May 1, 2025.

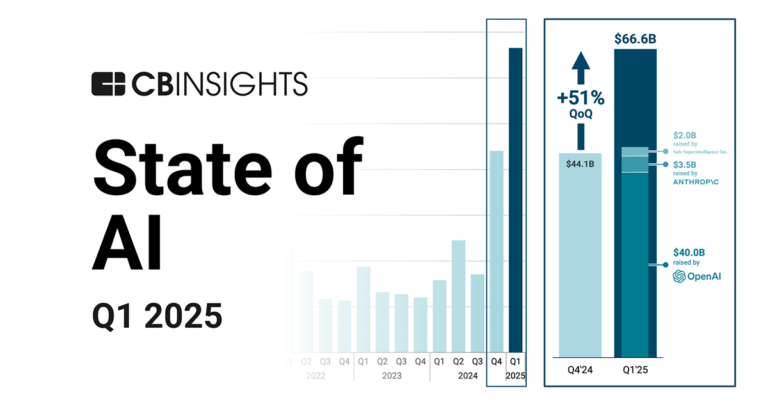

May 1, 2025 report

State of AI Q1’25 Report

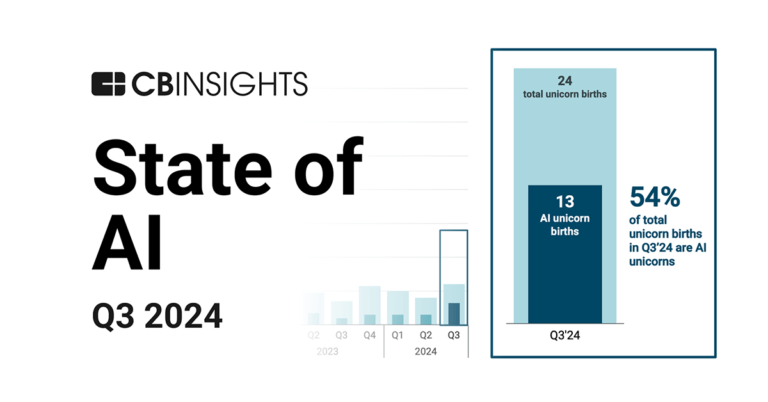

Oct 29, 2024 report

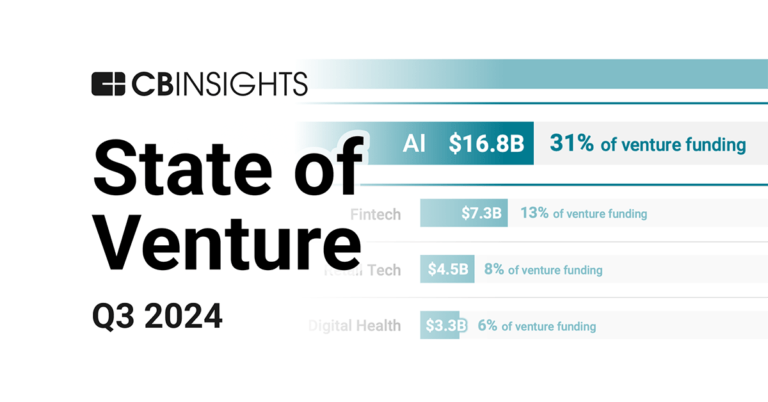

State of AI Q3’24 Report

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing Safe Superintelligence

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Safe Superintelligence is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Artificial Intelligence (AI)

20,894 items

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Latest Safe Superintelligence News

Nov 16, 2025

Sutskever’s Genomic Gamble: AI Luminary Bets on Baby Gene Editing Ilya Sutskever, OpenAI co-founder, invests in a gene-editing startup, merging AI for genomic analysis to prevent diseases in embryos. This move forecasts $125B in AI-biotech revenue by 2025, emphasizing safe innovation amid ethical concerns. Industry insiders see it as a pivotal fusion of technologies. Sutskever’s Genomic Gamble: AI Luminary Bets on Baby Gene Editing Written by Maya Perez Sunday, November 16, 2025 In a bold intersection of artificial intelligence and biotechnology, Ilya Sutskever, the co-founder and former chief scientist of OpenAI, has made a significant investment in a gene-editing startup focused on embryonic modifications. This move signals a growing convergence between AI-driven analytics and genomic engineering, potentially revolutionizing preventive medicine and personalized healthcare. According to reports, Sutskever’s backing is aimed at leveraging advanced AI models, similar to Google’s Gemini, for precise genomic analysis, forecasting a boom in AI-biotech synergies projected to generate $125 billion in revenue by 2025. The startup, which remains unnamed in initial disclosures but is described as specializing in ‘baby gene-editing,’ aims to edit embryos to prevent hereditary diseases. This investment aligns with Sutskever’s post-OpenAI ventures, where he has emphasized safe and transformative technologies. Drawing from his expertise in developing foundational AI systems, Sutskever sees AI as a tool to accelerate biotech innovations, compressing years of research into months. The AI-Biotech Fusion Takes Shape Sutskever’s involvement comes at a time when AI is increasingly integrated into biotech. For instance, AI models are being used for protein folding predictions and drug discovery, as highlighted in various industry analyses. The Telegraph reported on November 14, 2025, that this investment blends AI for genomic analysis, paving the way for substantial market growth ( The Telegraph ). This echoes broader trends where AI pioneers like Sutskever are diversifying into life sciences. From his Wikipedia entry, updated as of November 4, 2025, Sutskever founded Safe Superintelligence Inc. (SSI) in 2024, raising billions to pursue safe AI development. Now, extending his vision, this gene-editing bet could apply SSI’s safety-focused AI to biotech, ensuring ethical genomic edits. Geoffrey Hinton, in an October 2024 interview, praised Sutskever’s safety concerns, noting his role in AI governance ( Wikipedia ). Valuation Surge and Investor Confidence SSI itself has seen meteoric valuations, reaching $32 billion by March 2025, as per Observer reports from March 6, 2025 ( Observer ). This financial clout enables investments like the gene-editing venture. Fortune detailed in February 2025 that SSI’s valuation positions it among top AI firms, fueled by Sutskever’s reputation ( Fortune ). The gene-editing startup’s focus on embryos draws parallels to companies like Preventive, backed by Sam Altman and Brian Armstrong, which raised $30 million for disease-preventing edits, as noted in posts on X from November 2025. While not directly linked, such initiatives highlight the sector’s momentum, with AI enabling programmable evolution. Safety in Superintelligence and Genomics Sutskever’s philosophy, as expressed in a June 2025 interview, underscores AI’s potential to ‘do everything humans can do,’ including biomedical advancements ( posts on X ). He warns of an ‘intelligence explosion’ where AI builds better AI, potentially eradicating diseases but risking uncontrolled outcomes. This mirrors concerns in gene editing, where AI could optimize edits but demands rigorous safety protocols. TechCrunch reported in April 2025 that Sutskever tapped Google Cloud for SSI’s research, focusing on safe superintelligent AI ( TechCrunch ). Applying this to biotech, AI could simulate genomic scenarios, reducing errors in CRISPR-like technologies. Recent X posts discuss prime editing’s efficiency jumps, from sub-10% to 20-50%, underscoring AI’s role in refining these tools. Market Projections and Ethical Hurdles The projected $125 billion AI-biotech revenue for 2025 stems from accelerating innovations, as per industry forecasts. Sutskever’s investment could catalyze this, blending his Q* research insights—hinted at in March 2025 X posts—with genomic data analysis. CIO noted in June 2024 that SSI aims for a ‘straight-shot’ to superintelligence, now possibly extending to biotech ( CIO ). Ethical considerations loom large. Sutskever, honored with a University of Toronto degree in June 2025 for responsible AI development ( University of Toronto Faculty of Arts & Science ), emphasizes safety. In gene editing, this means preventing unintended mutations, especially in embryonic applications. Competitive Landscape and Future Trajectories Competitors like Meta have eyed SSI, attempting acquisitions and hiring key personnel, as CNBC reported in June 2025 ( CNBC ). This underscores Sutskever’s influence. In biotech, startups like Preventive illustrate the trend, with AI enabling designed embryos to eradicate diseases. Sutskever’s vision, shared in September 2025 Medium articles, warns of AI’s unpredictable power while highlighting its potential to extend life ( Medium ). Integrating this with gene editing could lead to breakthroughs, but requires balancing innovation with safeguards. Investor Backing and Strategic Alliances SSI raised $1 billion in September 2024 from firms like Andreessen Horowitz and Sequoia, as per CNBC ( CNBC ). This capital supports diversification into biotech. X posts from June 2025 discuss AI’s role in compressing biomedical research, aligning with Sutskever’s recursive AI ideas. Partnerships, like with Google Cloud, provide computational power for genomic modeling. As genome sequencing costs plummet to $200 by 2025, per X discussions, AI-driven analysis becomes feasible, amplifying the impact of Sutskever’s investment. Broader Implications for Industry Insiders For biotech executives, this signals a shift toward AI-integrated R&D. Sutskever’s move, detailed in Bioengineer.org from February 2025, positions SSI for $20B+ valuations through innovative paths ( Bioengineer.org ). Ultimately, this investment could redefine human health, with AI ensuring safe, efficient gene edits. As Sutskever noted, ‘AI will be able to do everything,’ including transforming biotech landscapes. Subscribe for Updates

Safe Superintelligence Frequently Asked Questions (FAQ)

When was Safe Superintelligence founded?

Safe Superintelligence was founded in 2024.

Where is Safe Superintelligence's headquarters?

Safe Superintelligence's headquarters is located at Palo Alto.

What is Safe Superintelligence's latest funding round?

Safe Superintelligence's latest funding round is Series B.

How much did Safe Superintelligence raise?

Safe Superintelligence raised a total of $3B.

Who are the investors of Safe Superintelligence?

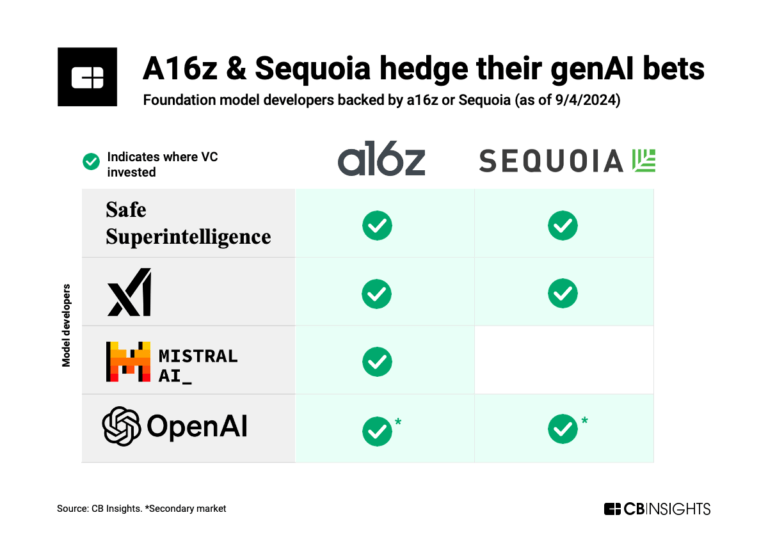

Investors of Safe Superintelligence include Andreessen Horowitz, Sequoia Capital, Alphabet, Lightspeed Venture Partners, NVentures and 10 more.

Who are Safe Superintelligence's competitors?

Competitors of Safe Superintelligence include Klover.

Loading...

Compare Safe Superintelligence to Competitors

xAI focuses on artificial intelligence, specifically in the domain of language learning models. The company's main product, Grok, is designed to answer questions and suggest potential inquiries, functioning as a research assistant that helps users find information online. xAI primarily caters to the artificial intelligence (AI) research community and the general public seeking AI tools for information retrieval and understanding. It was founded in 2023 and is based in Palo Alto, California.

Zhongxingxin Telecom provides telecommunications services including mobile communication, legal services, and business information. It was founded in 1985 and is based in Shenzhen, Guangdong.

Klover offers Artificial General Decision Making™ (AGD™), and is revolutionizing decision-making by humanizing AI. Their proprietary modular library of AI systems slashes development time, enabling rapid prototyping and testing of tailored Ensembles of AI Systems with Multi-Agent Systems Core in Decision Making (EAIS-MASC'd). Klover's holistic approach to AGD™ spans quantum computing, data center and data architecture, software development, and AGD™ research. The company serves individuals and organizations. It was founded in 2023 and is based in San Francisco, California.

Pezzo is an AI platform that provides tools for managing prompts, monitoring performance, troubleshooting issues, and supporting collaboration among teams. The platform assists in the processes of building, testing, and deploying applications that incorporate AI features. It was founded in 2023 and is based in San Francisco, California.

RapidCanvas is a technology company that provides artificial intelligence solutions across various sectors. The company has an AI platform that allows business users to create AI agents and applications without requiring technical expertise. RapidCanvas serves industries such as insurance, retail, manufacturing, real estate, energy and utilities, and financial services. It was founded in 2021 and is based in Austin, Texas.

Google operates as a technology company with a focus on internet services and products. The company offers a search engine, online advertising services, cloud computing solutions, software development tools, and hardware products primarily in the internet services, advertising, cloud computing, and consumer electronics sectors. It was founded in 1998 and is based in Mountain View, California.

Loading...