Investments

522Portfolio Exits

112Funds

5Partners & Customers

10About Samsung Ventures

Samsung Ventures operates as the venture investment arm of Samsung Group, focusing on technologies and industries through venture capital. The company invests in anticipatory technologies and industries to support the growth of a venture ecosystem. Samsung Ventures aims to contribute to society and the group. It was founded in 1999 and is based in Seoul, South Korea.

Expert Collections containing Samsung Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Samsung Ventures in 2 Expert Collections, including AR/VR.

AR/VR

33 items

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Samsung Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Samsung Ventures in 4 CB Insights research briefs, most recently on Oct 9, 2024.

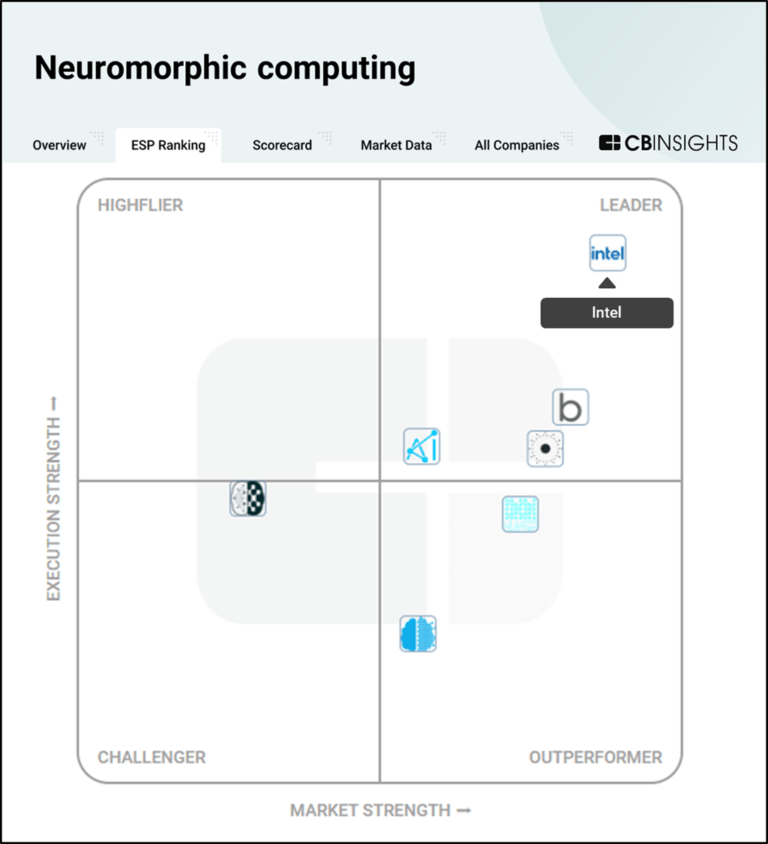

May 16, 2024 report

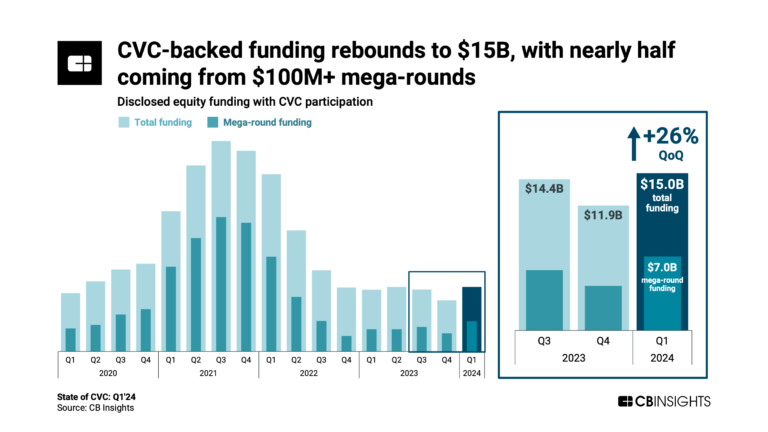

State of CVC Q1’24 Report

Mar 26, 2024

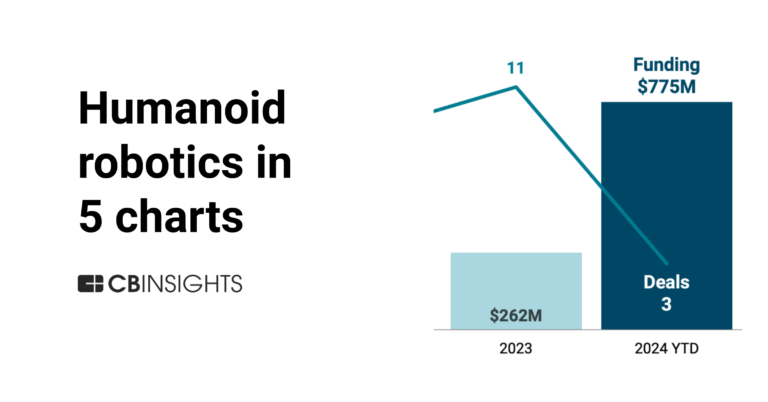

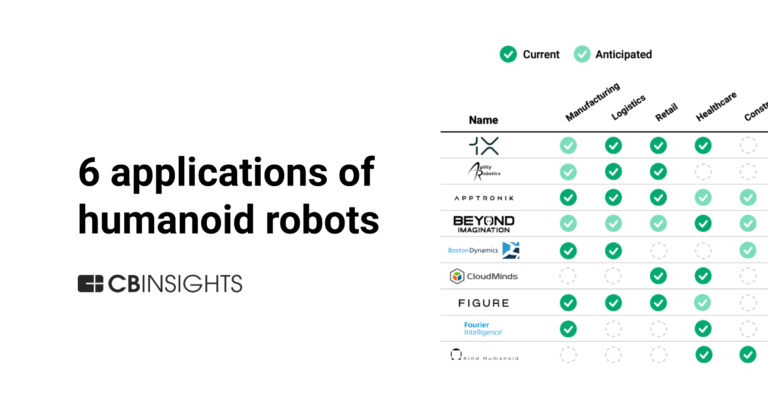

6 applications of humanoid robots across industriesLatest Samsung Ventures News

Oct 28, 2025

지분율(17%)은 거래소 기준치를 밑돌고 있는 상황에서 특수관계가 없는 재무적투자자(FI)들과도 공동목적 보유확약을 체결해 단기간에 경영권이 급격하게 변동될 가능성을 최소화 시켰다. 특히 삼성벤처투자와 삼성증권이 전면에 나선 것으로 파악된다. 의결권 공동 행사에 동의하면서도 보유 지분을 최대 1년 간 매각하지 않겠다는 확약을 걸었다. 막강한 브랜드 파워를 가진 삼성의 장기 투자 의지에 투자자들의 기대감도 커지는 분위기다. ◇최대주주 낮은 지분율 '보완'…공동목적보유확약 체결 지원 27일 투자은행(IB) 업계에 따르면 테라뷰와 상장 주관사 삼성증권은 내달 13일부터 19일까지 기관 투자자들로부터 희망 공모주 물량과 공모 가격을 접수 받을 계획이다. 희망 공모가 밴드는 7000~8000원으로 거래소 상장 예정인 예탁증서(DR) 수가 3551만7731주임을 감안하면 2486억~2841억원 사이에서 시가총액이 형성될 전망이다. 영국 기업 가운데 국내에 상장하는 사례는 처음이기 때문에 투자자들이 호응할 공모 구조 설계에 역점이 가해진 모습이다. 테라뷰에 따르면 상장 당일 시장에 쏟아질 것으로 예상되는 유통물량은 발행주식총수의 34.10%다. 지난 1년 동안 상장한 기업들의 평균치(32%) 수준으로 거래소가 적정한 유통비율이라고 밝힌 30~40% 범위에 안착했다. 시장 평균에 부합하는 유통 물량은 대주주와 주요주주로 등재된 투자자들의 합의가 없었다면 불가능했을 결과로 관측된다. 지난 14일 기준 데이지정밀산업과 특수관계인들의 공모 후 지분율(17.34%)은 거래소가 적정하다고 여기는 최소 지배력(20%)을 밑돌고 있다. 대주주가 시장 친화적인 공모 구조를 설계하겠다는 의지를 고양해도 투자자들이 내키는 대로 의사결정이 이뤄질 공산이 큰 구조인 셈이다. 이에 테라뷰는 핵심 투자자들과 공동으로 의결권을 행사할 수 있는 장치를 도입했다. 회사 측에 따르면 도널드 아논 대표이사가 유수의 FI들과 공동목적보유확약을 맺은 결과 공모 후 지분율은 48.16%로 상승하게 된다. FI마다 1개월~1년 동안 공동목적보유확약을 맺은 만큼 해당 기간 동안 대주주가 급격하게 바뀔 가능성은 한층 낮아졌다는 평이다. 출처: 테라뷰 ◇삼성 금융계열 역할 주목…벤처투자· 증권, 장기 투자 이어간다 이 과정에서 삼성그룹의 역할이 작지 않은 것으로 파악된다. 테라뷰가 국내에서 자금을 조달하던 초창기 때부터 회사의 성장 잠재력을 눈여겨본 삼성벤처투자는 2017년부터 실탄을 공급하며 현재 기준 4.70%의 지배력을 보유하고 있다. 상장 주관사로 발탁된 삼성증권도 지난해 프리 IPO 라운드에서 3.24%의 주식을 취득해 주요 주주로 올랐다. 양사는 투자자들 중에서도 회사의 경영권 보장에 유독 신경을 기울인 것으로 전해졌다. 보유 지분의 절반씩 쪼개 6개월, 1년 동안 의결권을 공동으로 행사하겠다고 밝혔다. 발행주식총수의 8%가 상장 후 6개월 동안 대주주 지분율에 더해지는 셈으로, 6개월 이상 공동목적보유를 확약한 투자자들 가운데 단연 돋보이는 비중이다. 공동목적보유확약한 기간대로 자발적 락업에 나선 것도 주목할 만한 대목이다. 삼성벤처투자는 테라뷰의 주식을 장기간 들고 있었던 터라 당국이 확약을 강제할 순 없다. 다만 회사는 보유 지분의 절반씩 쪼개 각각 6개월, 1년 동안 팔지 않겠다고 약속했다. 삼성증권의 경우 보유 기간이 2년 미만이라 1개월 간 의무적으로 보유해야 하지만 자발적 락업을 거쳐 최대 1년으로 대폭 늘렸다. 물론 삼성벤처투자는 전략적투자자(SI)라 장기 보유 의지가 부각된다. 그러나 삼성증권까지 동조하는 그림은 중장기 투자가 새 패러다임으로 자리 잡은 공모주 시장에서 중요한 벤치마크가 될 전망이다. 증권업계 관계자는 "삼성이 눈여겨보고 있다는 것 하나로 매력적인 세일즈 포인트"라며 "강화된 기관 의무보유확약 규제에 대응하는 차원에서도 삼성의 움직임은 의미가 있다고 본다"고 밝혔다. 출처: 테라뷰 < 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

Samsung Ventures Investments

522 Investments

Samsung Ventures has made 522 investments. Their latest investment was in Nanoramic as part of their Series F - II on November 17, 2025.

Samsung Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series F - II | Nanoramic | $10M | No | Catalus Capital, Fortistar, GM Ventures, ITOCHU, PEP Capital, Top Material, and WindSail Capital Group | 7 |

10/9/2025 | Seed VC | Bondu | $5.3M | Yes | Boost VC, Founders, and Makers Fund | 2 |

9/30/2025 | Series C - II | Rebellions | $250M | No | Arm, BonAngels Venture Partners, HL D&I Halla, InterVest, JUSUNG ENGINEERING, KDB Capital, Kindred Ventures, Korea Development Bank, Korelya Capital, Lion X Ventures, Medici Investment, Pegatron Venture Capital, POSCO Capital, Samsung Securities, Top Tier Capital Partners, Undisclosed Investors, and Vision Equity Partners | 9 |

9/24/2025 | Series A | |||||

9/10/2025 | Series A |

Date | 11/17/2025 | 10/9/2025 | 9/30/2025 | 9/24/2025 | 9/10/2025 |

|---|---|---|---|---|---|

Round | Series F - II | Seed VC | Series C - II | Series A | Series A |

Company | Nanoramic | Bondu | Rebellions | ||

Amount | $10M | $5.3M | $250M | ||

New? | No | Yes | No | ||

Co-Investors | Catalus Capital, Fortistar, GM Ventures, ITOCHU, PEP Capital, Top Material, and WindSail Capital Group | Boost VC, Founders, and Makers Fund | Arm, BonAngels Venture Partners, HL D&I Halla, InterVest, JUSUNG ENGINEERING, KDB Capital, Kindred Ventures, Korea Development Bank, Korelya Capital, Lion X Ventures, Medici Investment, Pegatron Venture Capital, POSCO Capital, Samsung Securities, Top Tier Capital Partners, Undisclosed Investors, and Vision Equity Partners | ||

Sources | 7 | 2 | 9 |

Samsung Ventures Portfolio Exits

112 Portfolio Exits

Samsung Ventures has 112 portfolio exits. Their latest portfolio exit was Nota AI on November 03, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/3/2025 | IPO | Public | 7 | ||

10/2/2025 | Acq - Fin | 4 | |||

8/6/2025 | Asset Sale | 4 | |||

Samsung Ventures Fund History

5 Fund Histories

Samsung Ventures has 5 funds, including Automotive Innovation Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

9/14/2017 | Automotive Innovation Fund | $300M | 1 | ||

5/29/2014 | Samsung Wearable Health Fund | ||||

2/4/2013 | Samsung Catalyst Fund | ||||

Samsung Life Science Fund | |||||

Samsung Life Science Fund II |

Closing Date | 9/14/2017 | 5/29/2014 | 2/4/2013 | ||

|---|---|---|---|---|---|

Fund | Automotive Innovation Fund | Samsung Wearable Health Fund | Samsung Catalyst Fund | Samsung Life Science Fund | Samsung Life Science Fund II |

Fund Type | |||||

Status | |||||

Amount | $300M | ||||

Sources | 1 |

Samsung Ventures Partners & Customers

10 Partners and customers

Samsung Ventures has 10 strategic partners and customers. Samsung Ventures recently partnered with Aramco on December 12, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/5/2024 | Partner | Saudi Arabia | Aramco, Carbon Clean, Samsung partner on carbon capture tech Aramco has signed a collaboration agreement with Carbon Clean and Samsung E&A to demonstrate a new carbon capture technology . | 2 | |

3/6/2019 | Partner | China | DeepMotion launches digital avatars for Samsung’s Galaxy S10 smartphones `` Body language is a key part of human social interaction , and our partnership with Samsung Ventures empowers Galaxy S10 owners to use their natural body movements to express themselves through emojis , '' said Kevin He , CEO of DeepMotion , in a statement . | 1 | |

1/6/2014 | Partner | United States | Bitcasa and Samsung Partner to Bring More Storage and Usability to Tablet Devices `` Our partnership gives Samsung and TabPRO users frustration-free storage and makes their digital belongings infinitely useful . | 2 | |

Partner | |||||

Partner |

Date | 12/5/2024 | 3/6/2019 | 1/6/2014 | ||

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Saudi Arabia | China | United States | ||

News Snippet | Aramco, Carbon Clean, Samsung partner on carbon capture tech Aramco has signed a collaboration agreement with Carbon Clean and Samsung E&A to demonstrate a new carbon capture technology . | DeepMotion launches digital avatars for Samsung’s Galaxy S10 smartphones `` Body language is a key part of human social interaction , and our partnership with Samsung Ventures empowers Galaxy S10 owners to use their natural body movements to express themselves through emojis , '' said Kevin He , CEO of DeepMotion , in a statement . | Bitcasa and Samsung Partner to Bring More Storage and Usability to Tablet Devices `` Our partnership gives Samsung and TabPRO users frustration-free storage and makes their digital belongings infinitely useful . | ||

Sources | 2 | 1 | 2 |

Samsung Ventures Team

14 Team Members

Samsung Ventures has 14 team members, including current Chief Executive Officer, President, Youngjoon Choi.

Name | Work History | Title | Status |

|---|---|---|---|

Youngjoon Choi | Chief Executive Officer, President | Current | |

Name | Youngjoon Choi | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer, President | ||||

Status | Current |

Compare Samsung Ventures to Competitors

Samsung NEXT operates as a venture capital firm investing in technology sectors, including artificial intelligence, healthtech, consumer services, and frontier technology. The company focuses on funding founders who are developing innovations and applying technologies to various use cases, improving health management and consumer experiences. It primarily invests in startups that are active in the technology landscape. Samsung NEXT was formerly known as Samsung Global Innovation Center. It was founded in 2012 and is based in Mountain View, California.

Deloitte Ventures operates as the corporate venture arm for Deloitte. Deloitte Ventures is focused on investing in and collaborating with early-stage companies. Deloitte Ventures works with startups in sectors including financial services, consumer, data, artificial intelligence (AI), cybersecurity, healthcare, and more. It is based in London, United Kingdom.

Qualcomm Ventures operates as the venture capital arm of Qualcomm, focusing on investments in the technology sector. The company provides funding and support to mobile technology companies, focusing on internet of things (IoT), connected automotive, artificial intelligence (AI), consumer, enterprise, and cloud. Qualcomm Ventures connects entrepreneurs with resources and relationships. It was founded in 2000 and is based in San Diego, California.

Sony Innovation Fund operates as a venture capital initiative focused on investing in early-stage companies within the technology, content, and services sectors. The fund provides investment and access to Sony's global network, fostering business creation and innovation in various areas of interest to Sony, including entertainment, health, and emerging technologies. It primarily targets seed to Series B funding stages for consumer and enterprise-facing businesses. It was founded in 2016 and is based in Tokyo, Japan.

Allumia Ventures operates as a healthcare venture capital firm investing in digital health and technology-enabled healthcare services. The company seeks to align with its limited partners and serves sectors requiring healthcare ecosystem solutions. Allumia Ventures was formerly known as Providence Ventures. It was founded in 2015 and is based in Seattle, Washington.

Toyota Ventures operates as an early-stage venture capital arm of Toyota, focusing on frontier and climate technologies. The company invests in artificial intelligence, autonomy, mobility, robotics, cloud technology, smart cities, digital health, fintech, materials, and climate technologies aimed at carbon neutrality. Toyota Ventures provides support to its portfolio companies, utilizing Toyota's expertise and resources. Toyota Ventures was formerly known as Toyota AI Ventures. It was founded in 2017 and is based in Los Altos, California.

Loading...