Investments

91Portfolio Exits

13Funds

1Partners & Customers

1Service Providers

2About Mouro Capital

Mouro Capital operates as a venture capital firm that focuses on the financial services sector. The company offers early to growth stage investment opportunities, utilizing its knowledge of fintech and global connections to assist start-ups. Mouro Capital invests in the financial technology industry across Europe, North America, and Latin America. Mouro Capital was formerly known as Santander InnoVentures. It was founded in 2014 and is based in London, United Kingdom.

Research containing Mouro Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

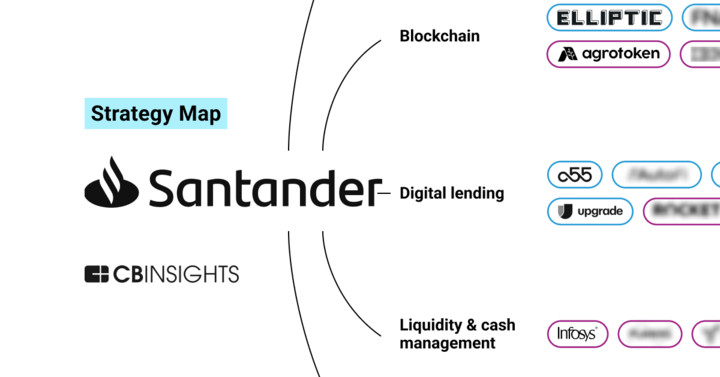

CB Insights Intelligence Analysts have mentioned Mouro Capital in 1 CB Insights research brief, most recently on Mar 28, 2023.

Latest Mouro Capital News

Nov 4, 2025

Santander USA cierra cuentas de clientes vinculados a Irán para cumplir con la legislación de EEUU. Santander ha puesto fin a la alianza en el negocio de crédito para coches que mantenía con Stellantis en EEUU desde hace más de una década. El banco y el grupo automovilístico han acordado concluir ya, tres meses antes de lo previsto, el pacto que su scribieron hace doce años y que estaba previsto finalizar en diciembre. Santander y Stellantis siguen siendo socios en Europa. "El 28 de julio de 2025, Santander Consumer y Stellantis suscribieron un acuerdo para acelerar la rescisión de la alianza (...) Se rescindió con efecto a partir del 15 de septiembre de 2025, salvo determinadas obligaciones residuales de reparto de ingresos y riesgos sobre las originaciones hasta la fecha efectiva de la rescisión", señalan las cuentas del tercer trimestre de Santander USA. El banco y Chrysler, integrada ahora en el gigante automovilístico surgido de la fusión entre Fiat Chrysler (FCA) y PSA, se asociaron en 2013 en EEUU. Entonces suscribieron un pacto por un periodo inicial de 10 años, que en 2022 decidieron extender hasta diciembre de 2025, coincidiendo con el lanzamiento por parte de Stellantis de su propio proyecto de financiación de coches. Santander suscribió el pacto con Chrysler durante la etapa en la presidencia de Emilio Botín. El banco pasó a ocupar la condición de socio preferente que entonces tenía Ally Financial, después de un año de negociaciones en el que Chrysler mantuvo contactos con una decena de entidades. Santander le abonó una comisión no reembolsable de 150 millones de dólares (130 millones de euros). En 2018, Fiat Chrysler ya valoró el lanzamiento de su propio negocio de financiación de coches. Tras un año de conversaciones, los dos socios acordaron finalmente actualizar el acuerdo y éste siguió vigente tras otro pago por parte de Santander de 60 millones de dólares (51 millones de euros. La asociación Stellantis ha sido generado clave de ingresos para Consumer USA, el negocio de Santander en EEUU que está más consolidado y tiene mayor escala. Desde hace tiempo, el grupo ha venido desarrollando distintas iniciativas, entre ellas, la firma de alianza con otros fabricantes de coches, para intentar suplir la actividad generada por Stellantis. Mouro Capital Por otra parte, Santander ha traspasado Mouro Capital, el fondo especializado en inversiones tecnológicas radicado en Reino Unido, a su filial de EEUU. El activo se ha integrado en su negocio de gestión de patrimonios. Para formalizar la operación, concretada en septiembre, Santander USA ha adquirido Mouro Capital o otra filial controlada por Santander a un precio de 801,9 millones de dólares (700 millones de euros). La filial estadounidense ha financiado la compra con un préstamo concedido por la matriz. No se ha generado fondo de comercio ni plusvalías. Cuentas ligadas a Irán Santander, a su vez, ha procedido al cierre del cuentas de clientes vinculados a Irán para cumplir con la legislación de EEUU sobre la aplicación del régimen internacional de sanciones. El banco, sin embargo, ya no detalla sus últimas cuentas el número de operaciones que se mantienen vivas. A cierre de junio, Santander mantenía congeladas nueve cuentas corrientes en Reino Unido, otra siete en su filial Cosumer y tres más en Santander Brasil. "Un número limitado de cuentas de clientes designados posteriormente por EEUU en el marco del programa de sanciones se mantuvieron o se mantienen en determinadas filiales no estadounidenses de Santander. Todas las cuentas han sido congeladas o canceladas para cumplir con los requisitos legales aplicables", señala el grupo. En febrero de 2024, Financial Times publicó que Irán se sirvió de Santander UK para esquivar las sanciones internacionales. Hasta el momento no ha trascendido que el banco haya sido objeto de multas u otras actuaciones por parte de los supervisores. © 2025 Unidad Editorial Información Económica S.L. De conformidad con lo previsto en el artículo 67.3 del Real Decreto - ley 24/2021, de 2 de noviembre, la reproducción y utilización de las obras y otras prestaciones disponibles en este portal web mediante técnicas de minería de textos y datos, u otros procedimientos automatizados de extracción de información, está expresamente reservada en favor de Unidad Editorial Información Económica, S.L.U. Apúntate a nuestras newsletters Síguenos en

Mouro Capital Investments

91 Investments

Mouro Capital has made 91 investments. Their latest investment was in Sakana AI as part of their Series B on November 17, 2025.

Mouro Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series B | Sakana AI | $135M | Yes | Factorial Funds, Fundomo, Geodesic Capital, IQT, Khosla Ventures, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | 6 |

10/30/2025 | Series A | Alinia AI | $8.85M | Yes | 1 | |

10/15/2025 | Series A | HyperLayer | $39.97M | Yes | CDAM, Flintlock Capital, Iona Star, Susquehanna International Group, and Undisclosed Investors | 4 |

7/1/2025 | Series C | |||||

3/19/2025 | Seed VC |

Date | 11/17/2025 | 10/30/2025 | 10/15/2025 | 7/1/2025 | 3/19/2025 |

|---|---|---|---|---|---|

Round | Series B | Series A | Series A | Series C | Seed VC |

Company | Sakana AI | Alinia AI | HyperLayer | ||

Amount | $135M | $8.85M | $39.97M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Factorial Funds, Fundomo, Geodesic Capital, IQT, Khosla Ventures, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | CDAM, Flintlock Capital, Iona Star, Susquehanna International Group, and Undisclosed Investors | |||

Sources | 6 | 1 | 4 |

Mouro Capital Portfolio Exits

13 Portfolio Exits

Mouro Capital has 13 portfolio exits. Their latest portfolio exit was Curve on November 14, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/14/2025 | Acquired | Lloyds Banking Group | 4 | ||

10/28/2025 | Acq - Pending | Cantor Equity Partners II | 3 | ||

10/21/2025 | Acquired | 4 | |||

Date | 11/14/2025 | 10/28/2025 | 10/21/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acq - Pending | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Lloyds Banking Group | Cantor Equity Partners II | |||

Sources | 4 | 3 | 4 |

Mouro Capital Fund History

1 Fund History

Mouro Capital has 1 fund, including Santander Innoventures Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/18/2016 | Santander Innoventures Fund | Early-Stage Venture Capital | Closed | $200M | 9 |

Closing Date | 7/18/2016 |

|---|---|

Fund | Santander Innoventures Fund |

Fund Type | Early-Stage Venture Capital |

Status | Closed |

Amount | $200M |

Sources | 9 |

Mouro Capital Partners & Customers

1 Partners and customers

Mouro Capital has 1 strategic partners and customers. Mouro Capital recently partnered with Gridspace on July 7, 2017.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

7/14/2017 | Licensor | United States | Santander InnoVentures Adds Pixoneye, Curve & Gridspace to Fintech Portfolio `` At Gridspace , we 're thrilled to broaden our relationship with the Santander InnoVentures team and bring next generation speech analysis capabilities to their organization . '' | 1 |

Date | 7/14/2017 |

|---|---|

Type | Licensor |

Business Partner | |

Country | United States |

News Snippet | Santander InnoVentures Adds Pixoneye, Curve & Gridspace to Fintech Portfolio `` At Gridspace , we 're thrilled to broaden our relationship with the Santander InnoVentures team and bring next generation speech analysis capabilities to their organization . '' |

Sources | 1 |

Mouro Capital Service Providers

2 Service Providers

Mouro Capital has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | ||

|---|---|---|

Associated Rounds | ||

Provider Type | Counsel | |

Service Type | General Counsel |

Partnership data by VentureSource

Mouro Capital Team

5 Team Members

Mouro Capital has 5 team members, including current Chief Financial Officer, Álvaro Meliá Navarro.

Name | Work History | Title | Status |

|---|---|---|---|

Álvaro Meliá Navarro | Santander, and Universidad Politecnica de Madrid | Chief Financial Officer | Current |

Name | Álvaro Meliá Navarro | ||||

|---|---|---|---|---|---|

Work History | Santander, and Universidad Politecnica de Madrid | ||||

Title | Chief Financial Officer | ||||

Status | Current |

Compare Mouro Capital to Competitors

Bossa Inves focuses on the startup ecosystem, offering investment and support to emerging companies. The firm provides venture capital investments, connections, and access to the startup market, along with insights on investment strategies such as crowdfunding, direct investment, co-investment, and funds. Bossa Invest has a focus on the technology sector, particularly in B2B companies with a SaaS or mobile approach. It was founded in 2011 and is based in Sao Paulo, Brazil.

G2D Investments operates as a venture capital firm focused on investing in startups and businesses across various industries. The company provides funding and support to entrepreneurs within sectors. G2D Investments serves the startup ecosystem, fostering the growth of companies with potential. It was founded in 2020 and is based in Hamilton, Bermuda.

Redpoint eventures operates as a venture capital firm The firm focuses on early-stage consumer Internet. It is a joint venture between Redpoint and eventures and brings funding, Silicon Valley access, and global best practices to promising local entrepreneurs. it was founded in 2012 and is based in Sao Paolo, Brazil.

MONASHEES is a venture capital firm that focuses on innovation within the technology sector. It provides funding and support to founders who are addressing significant market needs through technology. It serves the technology startup ecosystem and partners with entrepreneurs from their initial stages. It was founded in 2005 and is based in Sao Paulo, Brazil.

500 Global operates as a venture capital firm focused on investing in technology companies with a global outlook. The company provides venture capital investment and mentorship to entrepreneurs and investors, with the goal of supporting startups and fostering innovation across various markets. It was founded in 2010 and is based in Palo Alto, California.

Kaszek Ventures is a venture capital firm that focuses on technology-based companies in Latin America. The firm provides capital and strategic guidance, operational support, and access to networks to entrepreneurs at various stages, primarily seed, series A, and series B rounds. Kaszek Ventures invests in industries where technology and innovation can create disruption and value. It was founded in 2011 and is based in Sao Paulo, Brazil.

Loading...