Securitize

Founded Year

2017Stage

Acq - Pending | AliveTotal Raised

$203.02MValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+87 points in the past 30 days

About Securitize

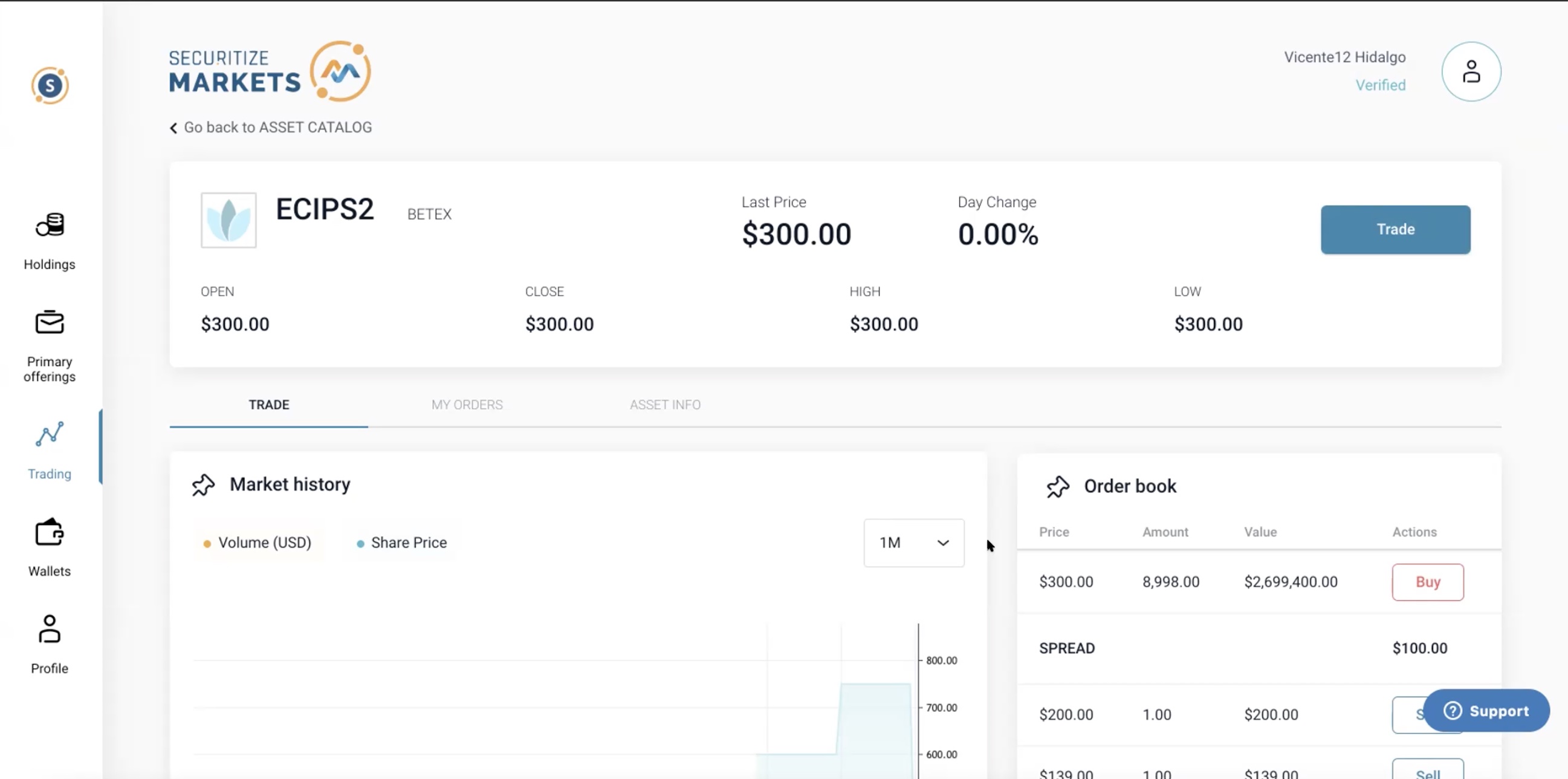

Securitize operates in real-world asset tokenization within the finance and investment industry. The company provides services as a SEC-registered broker-dealer, a digital transfer agent, and an operator of a SEC-regulated Alternative Trading System (ATS), focusing on the tokenization of assets for institutional and individual investors. Securitize serves asset managers, web3 institutional investors, and wealth managers, as well as individual investors. It was founded in 2017 and is based in Miami, Florida.

Loading...

Securitize's Product Videos

ESPs containing Securitize

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The asset tokenization market enables the conversion of ownership rights in various assets such as real estate, artwork, or securities into digital tokens tradable on blockchain networks. This technology allows for more efficient asset management, enhanced security, and increased liquidity through secondary trading markets. Asset tokenization solutions provide investors with fractional ownership o…

Securitize named as Leader among 15 other companies, including Fireblocks, Digital Asset, and Sygnum.

Securitize's Products & Differentiators

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

Tokenized treasury fund with a current AUM of $2.4B+

Loading...

Research containing Securitize

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Securitize in 4 CB Insights research briefs, most recently on Oct 23, 2025.

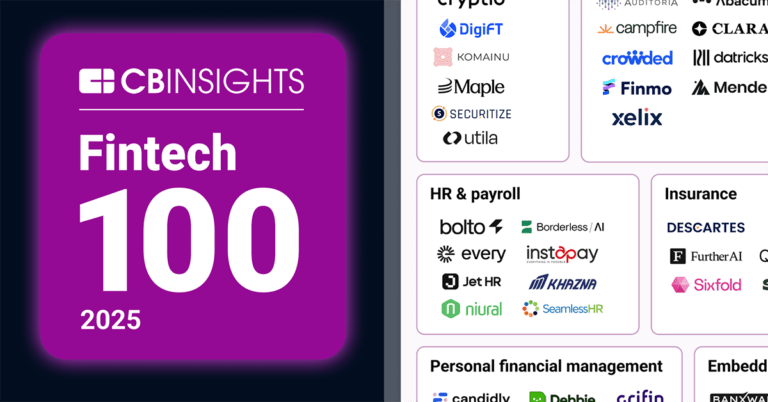

Oct 23, 2025 report

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

May 29, 2025

The stablecoin market mapExpert Collections containing Securitize

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Securitize is included in 8 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

9,558 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,063 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Latest Securitize News

Nov 6, 2025

On Wednesday, Securitize said Hamilton Lane’s tokenized feeder fund (HLSCOPE) now offers instant RLUSD liquidity by integrating with Vaneck’s VBILL onchain facility. Hamilton Lane Feeder Fund Gains 24/7 RLUSD Access via VBILL Integration In a recent X thread and blog post, Securitize explained that the new integration lets HLSCOPE instantly convert VBILL holdings into Ripple’s […]

Securitize Frequently Asked Questions (FAQ)

When was Securitize founded?

Securitize was founded in 2017.

Where is Securitize's headquarters?

Securitize's headquarters is located at 78 South West 7th Street, Miami.

What is Securitize's latest funding round?

Securitize's latest funding round is Acq - Pending.

How much did Securitize raise?

Securitize raised a total of $203.02M.

Who are the investors of Securitize?

Investors of Securitize include Cantor Equity Partners II, ARK Invest, Jump Crypto, 4Founders Capital, Paxos and 44 more.

Who are Securitize's competitors?

Competitors of Securitize include Brickken, Centrifuge, Tokeny, Alt DRX, Pontoro and 7 more.

What products does Securitize offer?

Securitize's products include BlackRock USD Institutional Digital Liquidity Fund (BUIDL) and 4 more.

Loading...

Compare Securitize to Competitors

Brickken specializes in the tokenization of assets and operates within the blockchain and financial technology sectors. The company offers a platform for creating, selling, and managing digital assets, enabling businesses to tokenize various asset types such as real estate, startups, and entertainment ventures. Its services facilitate global investor reach, compliance with regulations, and on-chain management of tokenized assets. It was founded in 2020 and is based in Barcelona, Spain.

Polymath Network is a company involved in security tokenization within the financial services technology sector. Its offerings include a platform for creating, issuing, and managing security tokens, as well as tools for raising capital and managing investor relations in compliance with regulatory frameworks. Polymath serves the financial services industry, including broker-dealers, banks, and asset managers, by providing solutions for digital asset management. It was founded in 2017 and is based in Toronto, Canada.

Societe Generale - FORGE focuses on integrating capital markets with digital assets through financial services. The company offers blockchain-based products, including stablecoins, digital bonds, and structured products, for institutional issuers and investors. Its products are built to ensure compliance with capital market practices and integration with existing financial systems. It was founded in 2018 and is based in Puteaux, France.

tZERO is a financial technology company that provides market-based solutions within the capital markets sector. The company offers a platform for raising capital through various compliant fundraising methods, as well as trading and investment opportunities in private and digital securities. tZERO serves private and public companies, entrepreneurs, and retail and institutional investors. It was founded in 2014 and is based in Salt Lake City, Utah.

Taurus is a company specializing in digital asset infrastructure within the financial technology sector. The company offers a platform for the custody, issuance, and management of cryptocurrencies, tokenized assets, and digital currencies. Taurus provides services including storage solutions, tokenization of various assets, and a trading platform for institutional investors. It was founded in 2018 and is based in Geneva, Switzerland.

Micobo is a company that provides blockchain solutions and asset tokenization services within the financial technology sector. The company's main offerings include a platform for creating, issuing, managing, and trading digital assets, which aids in asset liquidity and management throughout their lifecycle. Micobo's services cater to the capital markets, real estate, energy markets, and sports sectors, supporting the digitalization of financial products and assets. It was founded in 2014 and is based in Essen, Germany.

Loading...