ServiceNow

Founded Year

2003Stage

PIPE | IPOTotal Raised

$94.02MMarket Cap

179.85BStock Price

849.69Revenue

$0000About ServiceNow

ServiceNow provides a cloud-based platform and solutions within the technology sector aimed at digital transformation. The company offers services help organizations digitize and unify their processes. ServiceNow was formerly known as GlideSoft. It was founded in 2003 and is based in Santa Clara, California.

Loading...

ESPs containing ServiceNow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent marketplaces market provides platforms where users can discover, deploy, and customize pre-built AI agents that automate tasks or workflows. These marketplaces typically offer standalone agents or packaged groups that can be integrated into enterprise systems to handle complex processes in areas like customer service, marketing automation, or data analysis. Some marketplaces also offe…

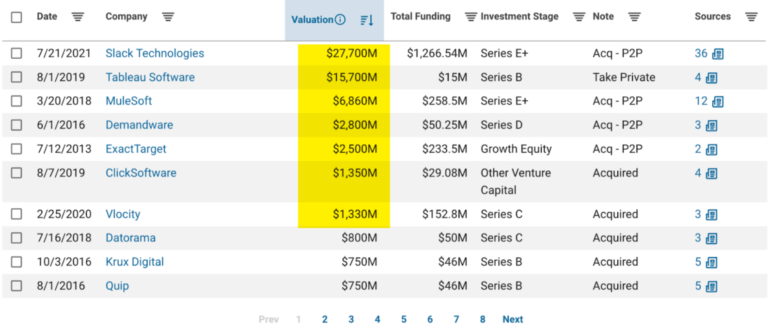

ServiceNow named as Leader among 12 other companies, including Salesforce, Microsoft, and OpenAI.

Loading...

Research containing ServiceNow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ServiceNow in 8 CB Insights research briefs, most recently on Nov 12, 2025.

Nov 12, 2025 report

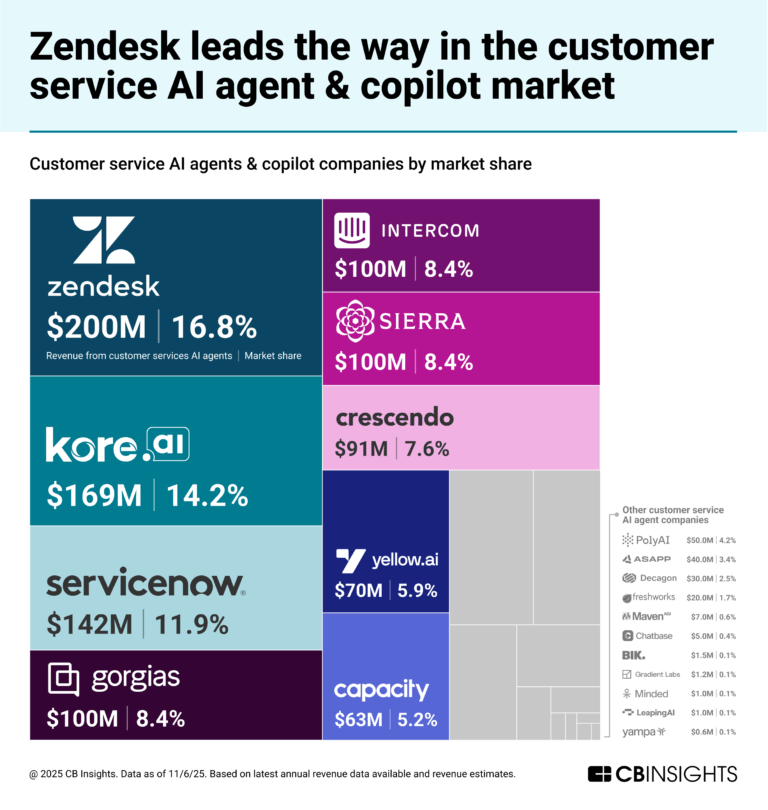

The customer service AI agents leading the market in 2025

Aug 22, 2025

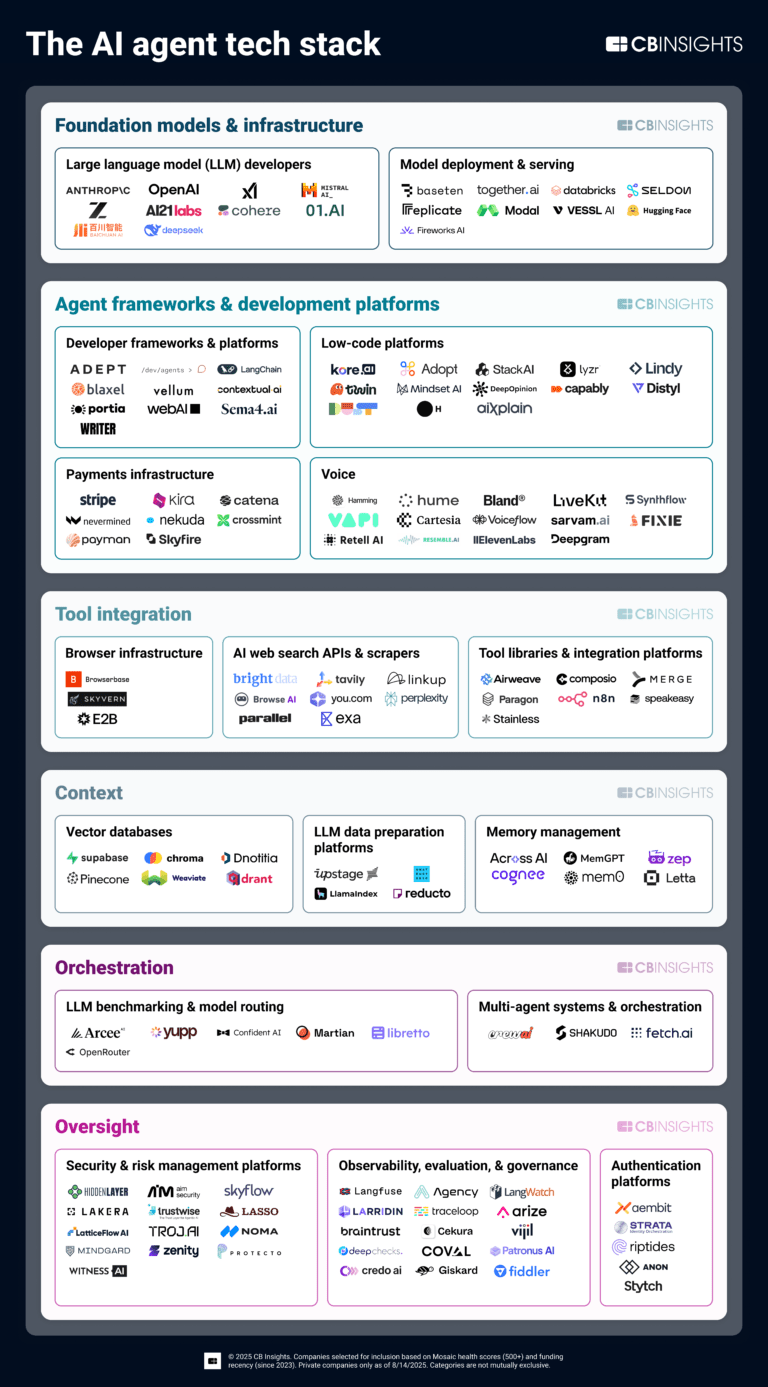

The AI agent tech stack

Aug 14, 2025

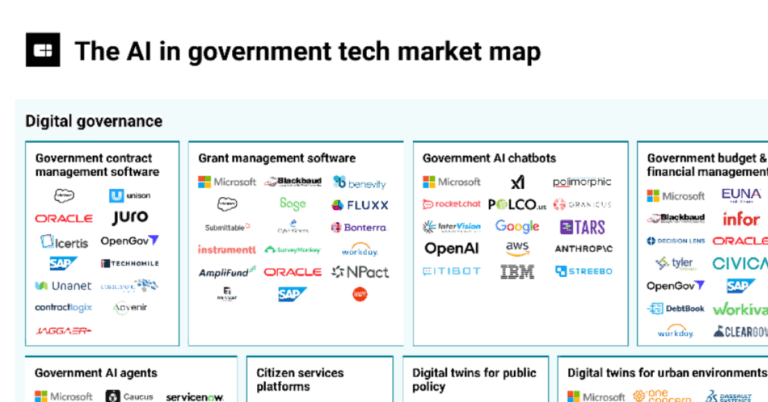

310+ AI companies transforming government

Mar 26, 2025

Nvidia’s next big bet? Physical AI

Mar 21, 2025 report

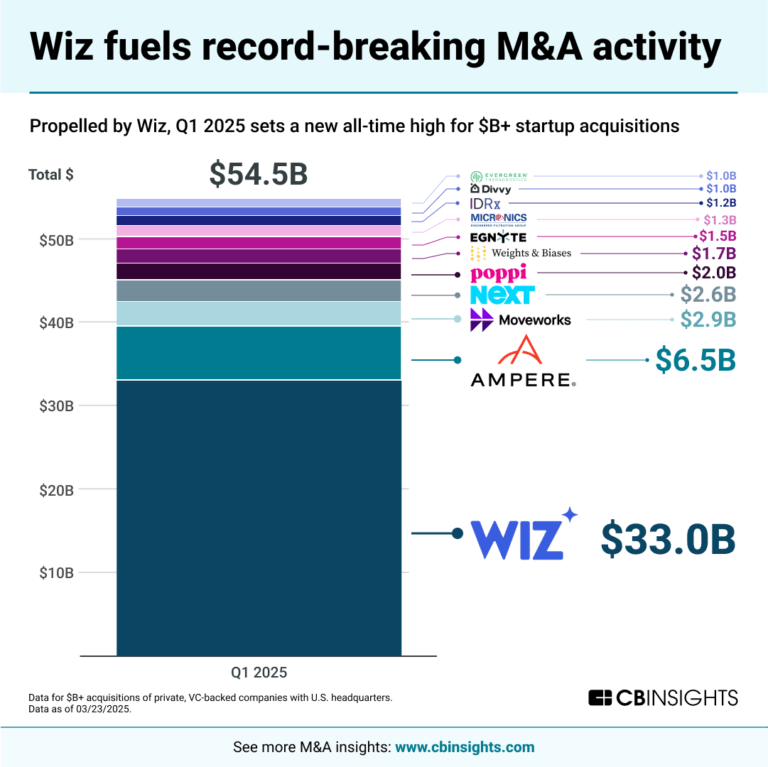

7 tech M&A predictions for 2025Expert Collections containing ServiceNow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

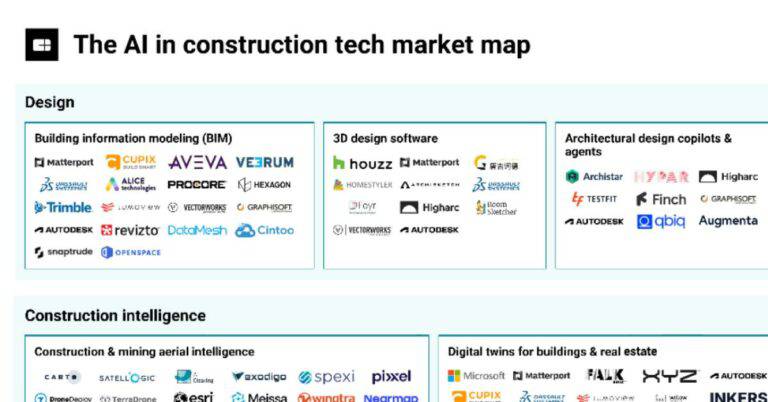

ServiceNow is included in 8 Expert Collections, including Construction Tech.

Construction Tech

1,530 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Regtech

1,811 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Conference Exhibitors

5,302 items

Advanced Manufacturing

7,017 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Job Site Tech

968 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Renewable Energy

4,865 items

ServiceNow Patents

ServiceNow has filed 1320 patents.

The 3 most popular patent topics include:

- data management

- information technology management

- database management systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/25/2022 | 4/8/2025 | Information technology management, Production and manufacturing, Systems engineering, Process management, Quality | Grant |

Application Date | 2/25/2022 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Information technology management, Production and manufacturing, Systems engineering, Process management, Quality |

Status | Grant |

Latest ServiceNow News

Nov 14, 2025

operations, integrating technology, processes, and cultural practices to enhance visibility and control over cloud spending. Valued at USD 12,181.82 million in 2024, the market is projected to expand to USD 27,671.34 million by 2032, achieving a CAGR of 10.8% over the forecast period. This growth trajectory is driven by the proliferation of cloud services, where enterprises increasingly adopt multi-cloud and hybrid architectures to boost agility and resilience. However, unchecked cloud usage often leads to overspending, with reports indicating that up to 82% of organizations waste resources due to inefficient management. FinOps addresses this by fostering cross-functional collaboration, enabling data-driven decisions that correlate costs with business value. Key enablers include automation tools for resource optimization and standardized frameworks like the FinOps Foundation, which promote best practices for cost allocation and forecasting. As industries such as BFSI, healthcare, and IT telecommunications deepen cloud reliance, the demand for sophisticated FinOps solutions intensifies, promising enhanced ROI and operational efficiency. This evolution not only curbs financial leakage but also supports compliance with regulatory mandates on cost transparency. Browse the report and understand how it can benefit your business strategy - https://www.credenceresearch.com/report/cloud-finops-market Key Growth Determinants Increasing Adoption of Multi-Cloud and Hybrid Strategies The rapid embrace of multi-cloud and hybrid cloud models is a primary driver propelling the Cloud FinOps market forward. Enterprises are diversifying across providers like AWS, Azure, and Google Cloud to avoid vendor lock-in, enhance scalability, and ensure business continuity, but this complexity amplifies cost management challenges. FinOps practices provide unified visibility into spending across platforms, enabling automated tagging, allocation, and optimization to prevent redundancy and overprovisioning. According to industry analyses, 87% of organizations now pursue multi-cloud strategies, yet only 22% achieve effective governance without FinOps tools. This determinant is particularly vital in sectors like manufacturing and finance, where hybrid setups balance on-premises security with public cloud flexibility. By streamlining financial operations in diverse environments, FinOps reduces waste by up to 30%, fostering agility and cost predictability. As digital transformation accelerates, this trend will continue to fuel market expansion, with projections indicating hybrid adoption growing at a 14.86% CAGR through 2032. Ultimately, multi-cloud proliferation underscores FinOps' role in turning complexity into competitive advantage. Escalating Cloud Costs and Need for Optimization Rising cloud expenditures are compelling organizations to adopt FinOps for rigorous cost optimization, marking a significant growth determinant. Global cloud spending is forecasted to exceed $723 billion in 2025, yet 67% of enterprises report higher-than-expected costs due to inefficient resource utilization. FinOps introduces granular tracking and anomaly detection, allowing teams to identify idle instances, right-size workloads, and leverage discounts like reserved instances effectively. This is especially critical for SMBs and large enterprises facing budget pressures amid economic volatility. Tools integrating AI for predictive forecasting help correlate usage patterns with financial outcomes, potentially improving ROI by 30% within a year. In regulated industries such as BFSI, where compliance demands precise cost attribution, FinOps ensures accountability and reduces audit risks. As cloud migration intensifies, particularly in emerging markets, the imperative for optimization will drive sustained demand, with the segment expected to grow at over 15% CAGR in Asia-Pacific. By transforming cost centers into value drivers, this factor solidifies FinOps' market dominance. Demand for Real-Time Visibility and Financial Accountability The push for real-time cost visibility and financial accountability is accelerating Cloud FinOps adoption as a core growth driver. Traditional budgeting fails in dynamic cloud ecosystems, where usage fluctuates unpredictably, leading to 46% of organizations struggling with unit economics comprehension. FinOps frameworks enable dashboards and alerts that provide instant insights, empowering cross-team collaboration between DevOps, finance, and executives. This transparency is essential for aligning cloud investments with business KPIs, particularly in AI-heavy workloads where costs can surge unexpectedly. Industry surveys reveal that 65% of FinOps practitioners prioritize visibility enhancements, correlating directly with reduced waste and better forecasting accuracy. In healthcare and retail, where data-driven decisions are paramount, FinOps tools facilitate tagging and showback mechanisms to enforce accountability. As regulatory pressures mount for auditable spending, this determinant will propel market growth, with North America leading due to mature cloud infrastructures. Overall, real-time governance positions FinOps as indispensable for sustainable cloud economics. Key Growth Barriers Shortage of Skilled FinOps Professionals A critical barrier to Cloud FinOps growth is the acute shortage of skilled professionals proficient in cloud financial practices. With only 42% of organizations reporting adequate expertise, many struggle to implement effective strategies amid evolving technologies like Kubernetes and AI optimization. This skills gap hinders adoption, as teams lack the knowledge to navigate complex billing models and integrate FinOps into DevOps workflows. Training programs from bodies like the FinOps Foundation are emerging, but demand outpaces supply, particularly in SMEs without dedicated resources. In regions like APAC, where cloud uptake is rapid, this barrier exacerbates inefficiencies, leading to prolonged implementation timelines. Consequently, enterprises face higher consulting costs and delayed ROI, with 51% citing talent retention as a challenge. Addressing this through certifications and vendor partnerships is essential, yet current shortages cap market penetration at mature levels. Complexity of Multi-Cloud Cost Structures The intricate nature of multi-cloud cost structures poses a substantial barrier to seamless FinOps deployment. Diverse pricing models across providers—such as pay-as-you-go, reserved capacity, and egress fees—create silos that obscure total spend visibility for 51% of global organizations. This complexity is compounded by hybrid environments, where integrating on-premises data with cloud metrics requires specialized tools, often leading to inaccurate forecasting and overprovisioning. Without standardized specifications like FOCUS 1.0, reconciliation across AWS, Azure, and GCP becomes labor-intensive, deterring smaller firms from full adoption. Regulatory variances further complicate compliance, especially in Europe where data sovereignty adds layers of cost tracking. As a result, 43% of teams report ineffective collaboration due to these silos, stalling optimization efforts. Overcoming this demands interoperable platforms, but current fragmentation limits scalability. Organizational Resistance and Siloed Teams Internal resistance and siloed departmental structures represent a key barrier impeding Cloud FinOps maturation. Cultural shifts toward collaborative FinOps are challenging, with 43% of organizations prioritizing cross-team alignment but facing communication breakdowns between engineering and finance. Legacy mindsets view cloud as an IT cost rather than a shared investment, leading to unaccountable resource usage and resistance to new processes. In large enterprises, hierarchical barriers slow decision-making, while 29% doubt achieving goals due to misaligned incentives. This is acute in conservative sectors like government, where change management lags behind tech adoption. Without executive buy-in and metrics tying costs to outcomes, initiatives falter, perpetuating waste. Fostering a FinOps culture through training and KPIs is vital, yet persistent silos constrain broader market growth. Key Market Trends Integration of AI and Automation in Cost Management AI and automation are transforming Cloud FinOps, emerging as a dominant trend for proactive cost governance. Advanced analytics detect anomalies in real-time, automating recommendations for rightsizing and discount applications, which can cut waste by 30%. Platforms like those from CloudBolt leverage machine learning for predictive forecasting, integrating with CI/CD pipelines to embed financial controls in development. This trend is gaining traction in AI-intensive sectors, where workload variability demands dynamic optimization. By 2025, over 50% of FinOps tools are expected to incorporate generative AI for ROI analysis across hybrid setups. Such innovations enhance accuracy, reducing manual interventions and enabling focus on value creation. As cloud volumes swell, AI-driven FinOps will standardize, driving efficiency in multi-cloud landscapes. Rise of Hybrid and Edge Computing Optimization The surge in hybrid and edge computing is a pivotal trend reshaping Cloud FinOps practices. Enterprises are blending on-premises, public, and edge resources for low-latency applications, necessitating tools that unify cost tracking across these domains. FinOps solutions now support edge-specific metrics, optimizing data gravity and reducing latency-related expenses in IoT and 5G deployments. This trend aligns with sustainability goals, as carbon-aware scheduling minimizes environmental impact while controlling costs. In APAC, where edge adoption is booming, platforms with locality-aware billing are essential for compliance. Projections indicate hybrid segments growing at 14.86% CAGR, fueled by regulatory pushes for resilient infrastructures. By bridging silos, this evolution enhances agility and positions FinOps as key to edge-era economics. Emphasis on Sustainability-Linked Financial Analytics Sustainability integration in FinOps is an accelerating trend, linking cloud costs to environmental metrics for greener operations. Tools now track carbon footprints alongside spending, enabling "green tagging" to prioritize low-emission resources. This responds to ESG pressures, particularly in Europe and APAC, where regulations mandate sustainable cloud usage. FinOps platforms incorporate lifecycle analysis to decommission high-impact assets, potentially reducing emissions by 20-30% without performance trade-offs. In manufacturing and telecom, this trend supports carbon credits and reporting, aligning finances with corporate responsibility. As 65% of organizations eye SaaS expansions, sustainability analytics will embed deeper, fostering eco-efficient cloud strategies. This holistic approach not only cuts costs but elevates FinOps' strategic value. Key Opportunities Expansion into AI and SaaS Cost Management The burgeoning integration of AI and SaaS presents vast opportunities for Cloud FinOps providers to extend beyond traditional IaaS/PaaS optimization. With AI workloads driving 25% of new cloud spend, tools offering granular attribution for model training costs can capture this niche. SaaS, comprising 65% of managed expenses, demands unified dashboards for licensing and usage tracking across vendors like Salesforce and Zoom. Opportunities lie in AI-powered platforms that automate compliance and forecasting, targeting BFSI where regulatory scrutiny intensifies. Emerging FinOps-as-a-Service models could democratize access for SMBs, projecting 16% annual growth through 2028. By addressing these gaps, vendors can unlock $10-15 billion in untapped revenue by 2030. This expansion redefines FinOps as comprehensive digital finance. Growth in Emerging Markets and Regulated Sectors Emerging markets and regulated industries offer prime opportunities for Cloud FinOps penetration amid digital acceleration. In APAC, rapid cloud adoption in India and Southeast Asia creates demand for localized tools handling currency fluctuations and sovereignty rules. Sectors like healthcare and public services, facing stringent data privacy, benefit from FinOps' audit-ready features, with BFSI alone poised for 11.7% CAGR. Partnerships with regional hyperscalers can accelerate deployment, tapping into $32.83 billion market potential by 2033. Sustainability-focused analytics align with ESG mandates, appealing to export-oriented firms in South Korea. As 87% of multi-cloud users seek better governance, customized solutions could boost adoption by 40%. This regional dynamism promises scalable, high-margin growth for innovative providers. Development of Interoperable and Standardized Platforms Interoperability and standardization emerge as key opportunities, addressing multi-cloud fragmentation through open frameworks like FOCUS 1.0. Platforms compatible across AWS, Azure, and GCP can streamline billing reconciliation, reducing integration costs by 25%. This is crucial for hybrid environments, where 50% of organizations anticipate expanded support. Opportunities abound in embedding FinOps with DevSecOps for automated governance, targeting IT services with 22.1% market share. Vendor-agnostic tools foster ecosystem partnerships, enhancing trust and scalability. With Kubernetes costs rising, specialized modules for container optimization could capture 15% CAGR segments. By prioritizing open standards, providers can dominate a $38.33 billion market by 2034. This focus on unity drives inclusive FinOps evolution. Preview the report with a detailed sample and understand how it can benefit your business strategy. Request a free sample today - https://www.credenceresearch.com/report/cloud-finops-market Segmentation By Component Solutions Services By Deployment Public Private Hybrid By Application Cost management & optimization Resource allocation & planning Billing & chargeback Others By End Use IT & telecom BFSI Retail Healthcare Government Based on Region: North America United States Canada Europe United Kingdom Germany France Asia-Pacific China India Japan Latin America Brazil Mexico Middle East & Africa South Africa United Arab Emirates Regional Analysis North America commands the largest share of the Cloud FinOps market, driven by the presence of major cloud providers and early adoption of advanced technologies. The U.S. leads with robust digital transformation initiatives, where enterprises in BFSI and healthcare leverage FinOps for compliance and cost control, contributing over 40% to global revenue. High cloud maturity and investments in AI optimization further bolster growth, with the region expected to maintain dominance through 2032. Europe is witnessing steady expansion at an 11.0% CAGR, fueled by regulatory frameworks like GDPR emphasizing cost transparency and sustainability. Countries such as Germany and the UK prioritize hybrid models for data sovereignty, with FinOps tools aiding FOCUS 1.0 standardization to unify billing. The focus on green cloud practices aligns with EU ESG goals, enhancing adoption in manufacturing and telecom sectors. Asia-Pacific emerges as the fastest-growing region at 15.03% CAGR, propelled by digital economies in China, India, and Japan. Rapid cloud migration among SMEs and government pushes for e-governance create demand for affordable FinOps solutions. Challenges like diverse infrastructures are offset by hyperscaler partnerships, positioning APAC for substantial market share gains by 2032. Overall, regional disparities highlight tailored strategies for global equilibrium. Credence Research's Competitive Landscape Analysis Credence Research's analysis of the Cloud FinOps competitive landscape reveals a dynamic ecosystem dominated by tech giants and specialized vendors vying for market leadership through innovation and partnerships. Key players such as AWS, Microsoft, Google Cloud, IBM, and Oracle hold significant shares by integrating native FinOps capabilities into their platforms, offering seamless cost management for users within their ecosystems. Emerging challengers like Flexera, VMware, and ServiceNow differentiate via multi-cloud agnostic tools, focusing on AI-driven analytics and automation to address interoperability gaps. The report highlights intense rivalry, with strategies emphasizing acquisitions such as IBM's Kubecost integration and R&D investments in sustainability features to capture regulated sectors. Market concentration is moderate, with top five firms accounting for 60% of revenue, yet opportunities persist for niche providers like HCL Technologies in APAC customization. Overall, consolidation trends and open-source collaborations are shaping a collaborative yet competitive arena, propelling FinOps toward broader enterprise adoption. Key Player Analysis IBM ServiceNow Oracle Microsoft VMware SAP AWS HCL Technologies Flexera Google Recent Industry Developments In January 2024, CloudBolt announced the launch of its Augmented FinOps capabilities to enhance cloud financial management. These advancements leverage AI and machine learning to provide real-time cost insights, automate decision-making, and unify control across public and private clouds. The goal is to shift organizations from a "Cloud First" to a "Cloud Right" approach, optimizing ROI across the resource lifecycle. In May 2024, Google Cloud Billing introduced a feature that allows users to generate SQL queries in BigQuery directly from billing reports. This integration streamlines data analysis by connecting billing data with BigQuery, improving insight generation and cost management efficiency. In June 2024, Microsoft Azure rolled out FOCUS 1.0 support for cost exports, enhanced AKS cost analysis, and VM hibernation features. These updates improved cost estimation tools and provided better budgeting and planning capabilities for FinOps teams. In August 2024, ServiceNow enhanced its Cloud Cost Management offering with the Infra Stack application, built on a Kubernetes-based framework for parallel processing. This innovation improves billing file processing speed, supports high transaction volumes, and enables seamless credential mapping for AWS, Azure, and GCP. In August 2024, Vantage launched a cloud cost management platform for Managed Service Providers (MSPs). The solution enables MSPs to monitor and analyze clients' cloud expenditures through a unified portal with customizable billing tools and multi-cloud visibility. In September 2024, Microsoft Cost Management introduced advanced tools for tracking and optimizing cloud expenditures. New features included customizable cost analysis views, automated budget alerts, and improved optimization through Azure OpenAI reservations, along with flexible server scaling and updated documentation. In October 2024, Turbonomic released enhancements focused on scalability, cloud cost optimization, and AI-driven automation. Updates included support for Azure SQL Managed Instances, GenAI LLM workload automation, parking actions, savings charts, Kubernetes differentiation, and a refined user interface to improve performance and simplify management. In October 2024, CloudBolt expanded its Augmented FinOps vision, emphasizing AI and ML-driven automation across the cloud lifecycle. The initiative aims to improve resource optimization, automate financial operations, and strengthen partnerships to boost cloud ROI and efficiency. In December 2024, AWS Billing and Cost Management introduced Custom Billing Views, allowing organizations to create tailored cost and usage views for business units, application owners, and FinOps teams. These views can be filtered by tags or accounts and shared securely via AWS Resource Access Manager, enhancing decentralized financial transparency across multiple accounts. In 2024, at FinOps X 2024, Google Cloud launched BigQuery and Looker views aligned with the FOCUS v1.0 specification, unveiled Gemini Cloud Assist for automated cost analysis, introduced carbon-aware FinOps, and added scenario modeling tools to optimize cloud efficiency. In 2025, Oracle Cloud ERP introduced AI-driven finance agents to automate data capture, anomaly detection, and forecasting. Generative AI features now support intelligent reporting and project planning, while sustainability tools align with eco-friendly business goals. In March 2025, Flexera completed the acquisition of Spot from NetApp, expanding its Cloud Financial Management portfolio. The integration of AI-powered FinOps tools—including Spot Eco, Ocean, Elastigroup, and CloudCheckr—strengthens Flexera's ability to automate billing, reduce workload costs, and optimize containers across AI-driven environments. Reasons to Purchase this Report: Gain a comprehensive understanding of the market through qualitative and quantitative analyses, considering both economic and non-economic factors, with segmentation and sub-segmentation details provided in terms of market value (USD Billion). Identify regions and segments expected to experience the fastest growth or dominate the market, with a detailed analysis of geographic consumption patterns and the factors driving or hindering market performance in each region. Stay informed about the competitive environment, with rankings of major players, recent product and service launches, partnerships, business expansions, and acquisitions from the past five years. Access detailed profiles of major market players, including company overviews, insights, product benchmarking, and SWOT analysis, to understand competitive advantages and market positioning. Explore the present and forecasted market landscape, with insights into growth opportunities, market drivers, challenges, and constraints for both developed and emerging regions. Benefit from Porter's Five Forces analysis and Value Chain insights to evaluate various market perspectives and competitive dynamics. Understand the evolving market scenario, including potential growth opportunities and trends expected in the coming years. Tailor the report to align with your specific business needs and gain targeted insights. Request Here - https://www.credenceresearch.com/report/cloud-finops-market Discover additional reports tailored to your industry needs Cloud Network Security Market - https://www.credenceresearch.com/report/cloud-network-security-market Cloud Natural Language Processing Market - https://www.credenceresearch.com/report/cloud-natural-language-processing-market Cloud Native Storage Market - https://www.credenceresearch.com/report/cloud-native-storage-market Cloud Music Service Market - https://www.credenceresearch.com/report/cloud-music-service-market Cloud Mobile Backend as a Service Market - https://www.credenceresearch.com/report/cloud-mobile-backend-as-a-service-market Cloud Data Security Market - https://www.credenceresearch.com/report/cloud-data-security-market Cloud Migration Services Market - https://www.credenceresearch.com/report/cloud-migration-service-market Cloud Native Application Protection Platform Market - https://www.credenceresearch.com/report/cloud-native-application-protection-platform-cnapp-market Cloud Enterprise Resource Planning Market - https://www.credenceresearch.com/report/cloud-enterprise-resource-planning-market Cloud Cost Management Tools Market - https://www.credenceresearch.com/report/cloud-cost-management-tools-market Cloud Backup Market - https://www.credenceresearch.com/report/cloud-backup-market Cloud Encryption Software Market - https://www.credenceresearch.com/report/cloud-encryption-software-market Cloud Database and DBaaS Market - https://www.credenceresearch.com/report/cloud-database-and-dbaas-market Cloud Data Warehouse Market - https://www.credenceresearch.com/report/cloud-data-warehouse-market Cloud Data Center Market - https://www.credenceresearch.com/report/cloud-data-center-market Follow Us: https://www.linkedin.com/company/credenceresearch/ https://x.com/CredenceResearc https://www.facebook.com/CredenceResearch About Us: Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives. Contact Us Credence Research Europe LTD 128 City Road, London, EC1V 2NX, UNITED KINGDOM Europe - +44 7809 866 263 North America - +1 304 308 1216 Australia - +61 4192 46279 Asia Pacific - +81 5050 50 9250 India - +91 6232 49 3207 sales@credenceresearch.com www.credenceresearch.com This News is brought to you by Qube Mark , your trusted source for the latest updates and insights in marketing technology. Stay tuned for more groundbreaking innovations in the world of technology. PR Newswire PR Newswire empowers communicators to identify and engage with key influencers, craft and distribute meaningful stories, and measure the financial impact of their efforts. Cision is a leading global provider of earned media software and services to public relations and marketing communications professionals. Your experience on this site will be improved by allowing cookies Cookie Policy

ServiceNow Frequently Asked Questions (FAQ)

When was ServiceNow founded?

ServiceNow was founded in 2003.

Where is ServiceNow's headquarters?

ServiceNow's headquarters is located at 2225 Lawson Lane, Santa Clara.

What is ServiceNow's latest funding round?

ServiceNow's latest funding round is PIPE.

How much did ServiceNow raise?

ServiceNow raised a total of $94.02M.

Who are the investors of ServiceNow?

Investors of ServiceNow include Alliance Venture, Target Partners, Intel Capital, Investinor, Greylock Partners and 16 more.

Who are ServiceNow's competitors?

Competitors of ServiceNow include Kustomer, Ivanti, Techtouch, Sprinto, TOPdesk and 7 more.

Loading...

Compare ServiceNow to Competitors

Lansweeper focuses on providing visibility into technology assets across information technology (IT), operational technology (OT), and Internet of Things (IoT) environments. The company offers a platform for asset discovery, inventory, and analytics. Lansweeper's solutions are designed for risks and IT management and support cybersecurity efforts by ensuring complete visibility and control over technology assets. It was founded in 2004 and is based in Merelbeke, Belgium.

Gladly is an AI-powered customer service platform. It provides support and addresses customer service efficiency in various sectors. Its platform offers a unified conversation view that integrates customer interactions, enabling understanding and service, and also provides AI-led self-service options. It primarily serves the B2C sector and offers solutions related to cost savings and revenue growth. It was founded in 2014 and is based in Millbrae, California.

Front is a modern customer service platform that specializes in enhancing customer experiences and operational efficiency within the customer support sector. The company offers a suite of tools, including an omnichannel inbox, AI chatbots, live chat, and workflow automation to streamline communication and support processes. Front's platform is designed to facilitate real-time team collaboration and provide actionable service analytics to businesses of various sizes. It was founded in 2014 and is based in San Francisco, California.

Sabio Group is a digital customer experience (CX) transformation company operating in the technology and customer service sectors. The company offers various services such as artificial intelligence (AI) and automation solutions, data insights, cloud transformation, networking services and infrastructure, and customer experience management. It primarily caters to industries such as banking, insurance, housing, retail, and telecommunications. The company was founded in 1998 and is based in London, United Kingdom.

Pipedrive is a sales CRM and pipeline management software company that provides a platform for tracking sales pipelines, managing leads, and automating sales processes. The company's services include CRM dashboards, sales insights, analytics, and a marketplace for integrations, catering to sales teams in different industries. It was founded in 2010 and is based in New York, New York.

SugarCRM is a company that provides customer relationship management (CRM) solutions for various industries. Its offerings include sales automation, marketing automation, customer service, and revenue intelligence, which utilize artificial intelligence and machine learning. SugarCRM serves sectors such as manufacturing, wholesale distribution, financial services, and software & IT services. It was founded in 2004 and is based in Cupertino, California.

Loading...