Shift Technology

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$319.72MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-52 points in the past 30 days

About Shift Technology

Shift Technology focuses on artificial intelligence for the insurance sector, particularly in fraud detection, risk assessment, and claims processing. The company provides solutions that assist in decision-making across underwriting and claims. Shift Technology serves the insurance industry, including property & casualty, healthcare, and life & disability sectors. It was founded in 2014 and is based in Paris, France.

Loading...

Shift Technology's Product Videos

ESPs containing Shift Technology

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The claims outcome & litigation prediction software market provides analytics platforms that help insurance carriers assess litigation risk, predict claims severity, detect fraud, and optimize settlement decisions. These solutions use machine learning, natural language processing, and advanced data analytics to analyze claims data, medical records, adjuster notes, and external data sources. Key ca…

Shift Technology named as Leader among 13 other companies, including Verisk, CCC Intelligent Solutions, and Gradient AI.

Shift Technology's Products & Differentiators

Shift Claims Fraud

Uses AI to identify suspicious claims with high accuracy. It analyzes a wide range of data, including structured and unstructured information like documents, images, and videos, as well as external sources like location and weather data. The solution provides prioritized alerts and detailed reasoning to assist claims handlers and Special Investigation Unit (SIU) investigators. It has been shown to identify double the potential fraud compared to competing solutions and offers significant return on investment within months.

Loading...

Research containing Shift Technology

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shift Technology in 3 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

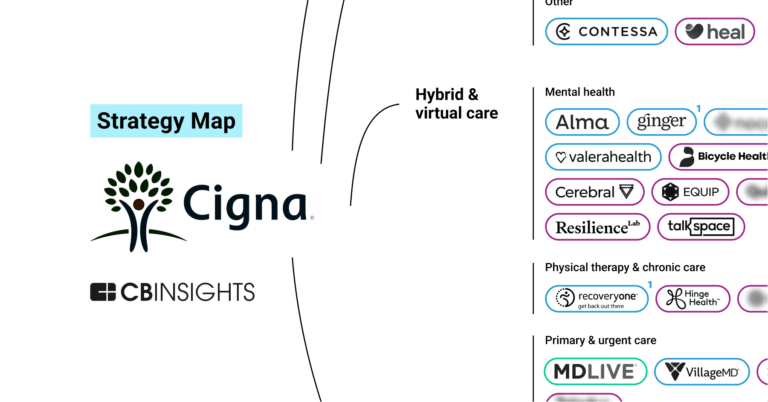

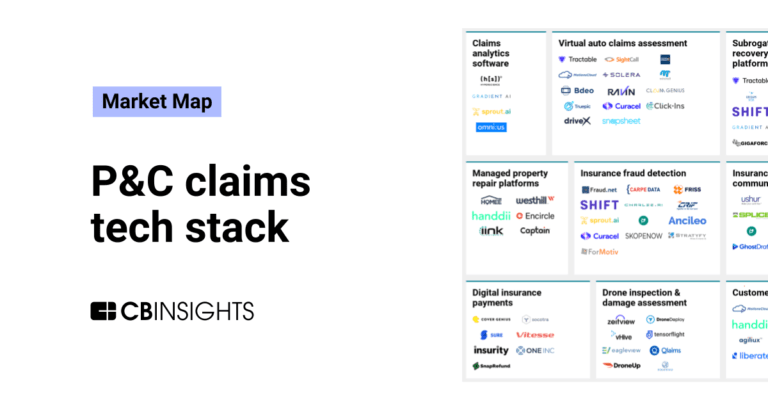

The P&C claims tech stack market mapExpert Collections containing Shift Technology

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shift Technology is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

AI 100 (All Winners 2018-2025)

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence (AI)

14,208 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Shift Technology News

Nov 3, 2025

News provided by Share this article Share toX Leading Market Intelligence Firm Recognizes Company as one of the Top 50 Established Companies Delivering Impact and Transforming the Insurance Industry BOSTON and PARIS, Nov. 3, 2025 /PRNewswire/ -- Shift Technology , the leading AI platform for insurance, has been named to Sønr's 2025 Beyond Boundaries Scale50. The leading market intelligence firm's report recognizes established insurtechs that are delivering impact and driving transformation across the insurance industry. Sønr describes the companies included in the Scale50 as a group that collectively demonstrates that the age of experimentation is over. As such, the emphasis has moved to execution, and scale - delivering efficiencies, growth and measurable outcomes. The report further explains that the trends impacting the industry help to illustrate how organizations such as Shift are operationalizing innovation and, in doing so, reshaping the foundations of modern insurance. As Matt Connolly, CEO, Sønr explains: "Based on dozens of exec interviews, proprietary data analysis and an expert judging panel of insurance leaders, Beyond Boundaries provides a clear view of the key trends impacting insurance and the leading tech providers addressing them. Two of the most significant trends highlighted by the report focus on how additional value is being sought from underwriting and claims processes. These include how active and continuous underwriting can be used to improve portfolio performance, and how claims automation, including straight-through-processing (STP) can drive improvements in speed, cost efficiency, and customer experience. Shift is addressing these trends directly through its Shift Claims , Shift Claims Fraud , Shift Subrogation and Shift Underwriting Risk offerings. These solutions apply predictive, generative, and agentic AI to the underwriting and claims processes to deliver greater accuracy, efficiency, and customer satisfaction. "The insurance industry is evolving, and Shift is proud to be recognized among the insurtechs helping to drive that change," said Jeremy Jawish, CEO and co-founder, Shift Technology. "Our AI solutions help improve decisioning, reduce fraud and streamline claims, delivering measurable benefits for both insurers and policyholders." About Shift Technology Shift Technology is the leading AI platform for insurance. Shift combines generative, agentic, and predictive AI to transform underwriting, claims, and fraud and risk—driving operational efficiency, exceptional customer experiences, and measurable business impact. Trusted by the world's leading insurers, Shift delivers AI when and where it matters most, at scale and with proven results. Learn more at www.shift-technology.com . Contact:

Shift Technology Frequently Asked Questions (FAQ)

When was Shift Technology founded?

Shift Technology was founded in 2014.

Where is Shift Technology's headquarters?

Shift Technology's headquarters is located at 2-14 rue Gerty Archimede, Paris.

What is Shift Technology's latest funding round?

Shift Technology's latest funding round is Series D - II.

How much did Shift Technology raise?

Shift Technology raised a total of $319.72M.

Who are the investors of Shift Technology?

Investors of Shift Technology include Guidewire, IRIS, Accel, General Catalyst, Bessemer Venture Partners and 16 more.

Who are Shift Technology's competitors?

Competitors of Shift Technology include Eyst Technology, Curacel, ClearSpeed, Quantexa, Qantev and 7 more.

What products does Shift Technology offer?

Shift Technology's products include Shift Claims Fraud and 4 more.

Loading...

Compare Shift Technology to Competitors

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Qantev specializes in AI-driven claims management for the health and life insurance sectors. Its main offerings include an automated claims platform that streamlines processing, detects fraud, waste, and abuse, and optimizes healthcare provider networks. It was founded in 2018 and is based in Paris, France.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Charlee.ai focuses on artificial intelligence and predictive analytics in the insurance sector. The company provides solutions for insurance providers to manage claims litigation and reserve management processes. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

CLARA Analytics operates in the insurance sector, focusing on claims management. The company provides machine learning products that assist in claims processing by analyzing medical notes, bills, and other claim-related documents. It was founded in 2017 and is based in Sunnyvale, California.

omni:us focuses on claims automation within the insurance sector. The company's offerings include the Digital Claims Adjuster, which assists in claims processing and decision-making, and services that work with existing insurance core systems. omni:us serves the property and casualty insurance industry with its solutions. omni:us was formerly known as SearchInk. It was founded in 2015 and is based in Berlin, Germany.

Loading...