Sift

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$156.52MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-29 points in the past 30 days

About Sift

Sift operates in the digital trust and security sector, providing identity verification, transaction risk assessment, and fraud prevention services. The company serves sectors including digital commerce, finance, fintech, and online gambling. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Sift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The account takeover (ATO) protection market provides solutions that prevent malicious actors from gaining unauthorized access to user accounts through methods like phishing, credential stuffing, and social engineering. Solutions utilize behavioral biometrics, device fingerprinting, machine learning-based anomaly detection, and real-time risk scoring to identify and block malicious login attempts.…

Sift named as Challenger among 15 other companies, including Akamai, TransUnion, and Experian.

Loading...

Research containing Sift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sift in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Aug 14, 2023

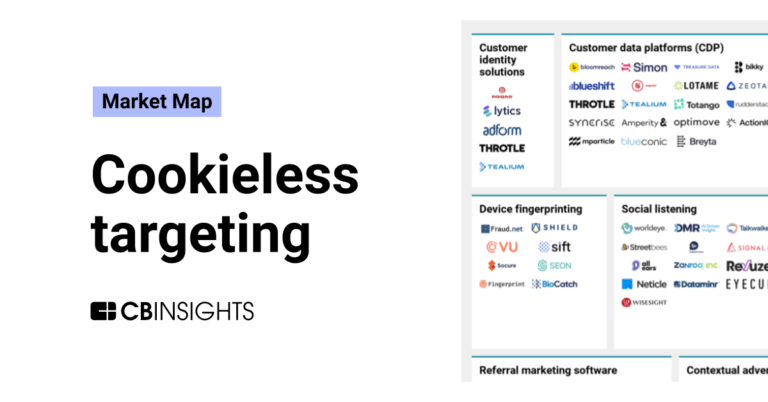

The cookieless targeting market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing Sift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sift is included in 12 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,641 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Sift Patents

Sift has filed 46 patents.

The 3 most popular patent topics include:

- computer security

- machine learning

- social networking services

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/29/2024 | 4/8/2025 | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) | Grant |

Application Date | 5/29/2024 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) |

Status | Grant |

Latest Sift News

Nov 6, 2025

Pune, India, Nov. 06, 2025 (GLOBE NEWSWIRE) -- The QKS Group SPARK Matrix™ provides competitive analysis & ranking of the leading eCommerce Fraud Prevention Solution vendors. Sift, with its comprehensive eCommerce Fraud Prevention platform, has received strong ratings across technology excellence and customer impact. Divya Baranawal, VP Research at QKS Group, states, "Sift has established a differentiated position in the market by architecting a platform that balances sophisticated machine learning with operational practicality. What stands out is their ability to serve diverse high-velocity sectors - from retail to fintech to gaming - with a unified intelligence framework that learns across verticals. This cross-industry data advantage, combined with their focus on reducing analyst workload through generative AI and intuitive workflows, positions them well to address the evolving complexity of eCommerce fraud.” The QKS Group SPARK Matrix™ includes a detailed analysis of the global market dynamics, major trends, vendor landscape, and competitive positioning. The study also provides a competitive analysis and ranking of the eCommerce Fraud Prevention Solution providers in the form of the SPARK Matrix™. The study also provides strategic information for users to evaluate different vendor capabilities, competitive differentiation, and market positions. "The fraud attack surface has fundamentally shifted - fraudsters now operate with AI-powered automation to execute advanced and novel attacks," said Kevin Lee, SVP of Customer Success, Trust & Safety, at Sift. “This recognition from QKS validates our continued investments in deep identity intelligence and real-time fraud decisioning at scale." Additional Resources:

Sift Frequently Asked Questions (FAQ)

When was Sift founded?

Sift was founded in 2011.

Where is Sift's headquarters?

Sift's headquarters is located at 77 Geary Street, San Francisco.

What is Sift's latest funding round?

Sift's latest funding round is Secondary Market.

How much did Sift raise?

Sift raised a total of $156.52M.

Who are the investors of Sift?

Investors of Sift include Fabrica Ventures, Union Square Ventures, Insight Partners, Stripes Group, Spark Capital and 24 more.

Who are Sift's competitors?

Competitors of Sift include Sardine, Vesta, ClearSale, UrbanFox, Ravelin and 7 more.

Loading...

Compare Sift to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

BioCatch provides behavioral biometrics for the financial services industry, concentrating on fraud prevention. The company offers solutions that analyze online users' physical and cognitive digital behavior to protect against various forms of fraud and financial crime. BioCatch serves the banking and financial services sectors with its fraud detection and prevention services. It was founded in 2011 and is based in Tel Aviv, Israel.

Shield operates as a fraud intelligence platform that focuses on device identification and fraud prevention across various digital sectors. The company offers services designed to prevent and detect activities such as fake accounts, account takeovers, payment fraud, and identity fraud, utilizing device intelligence and artificial intelligence (AI) technology. It serves sectors that require fraud prevention measures, including ride-hailing, e-commerce, fintech, gaming, and social media. Shield was formerly known as CashShield. It was founded in 2008 and is based in San Mateo, California.

nSure.ai specializes in payment fraud prevention across the crypto, gaming, prepaid, and gift card sectors. The company offers a managed service that utilizes adaptive Artificial Intelligence (AI) to create a fraud detection model for each customer, focusing on behavior patterns to provide decisions. It was founded in 2019 and is based in New York, New York.

ComplyAdvantage provides solutions for financial crime and compliance management, focusing on the security of the financial system. The company offers a platform that supplies insights for managing risks and meeting compliance obligations. ComplyAdvantage serves sectors that require compliance and risk management, such as financial institutions and businesses dealing with sensitive financial data. ComplyAdvantage was formerly known as Mimiro. It was founded in 2014 and is based in London, United Kingdom.

Fraud.net focuses on AI-driven fraud detection and enterprise risk management in the financial and commerce sectors. The company has a platform that includes transaction monitoring, entity risk assessment, and compliance management to address fraud and regulatory requirements. Fraud.net serves the payments and financial services industries. It was founded in 2015 and is based in New York, New York.

Loading...