Sila

Founded Year

2011Stage

Series G | AliveTotal Raised

$1.406BLast Raised

$375M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+42 points in the past 30 days

About Sila

Sila focuses on battery materials within the energy sector. Its main offerings include nano-composite silicon anodes, which aim to improve the performance and energy density of lithium-ion batteries, used in industries such as automotive, consumer electronics, and cell manufacturing. Sila's products are designed as replacements for traditional graphite anodes. It was founded in 2011 and is based in Alameda, California.

Loading...

ESPs containing Sila

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The battery anode material developers market provides anode active materials and engineered anode structures used in rechargeable batteries. Providers design, produce, or license materials such as natural and synthetic graphite, silicon and silicon‑carbon composites, lithium‑metal anodes, niobium‑based oxides, and hard carbon for sodium‑ion, along with drop‑in anode formulations and coatings that …

Sila named as Leader among 15 other companies, including Amprius Technologies, Enovix, and Novonix.

Loading...

Research containing Sila

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sila in 2 CB Insights research briefs, most recently on Aug 13, 2024.

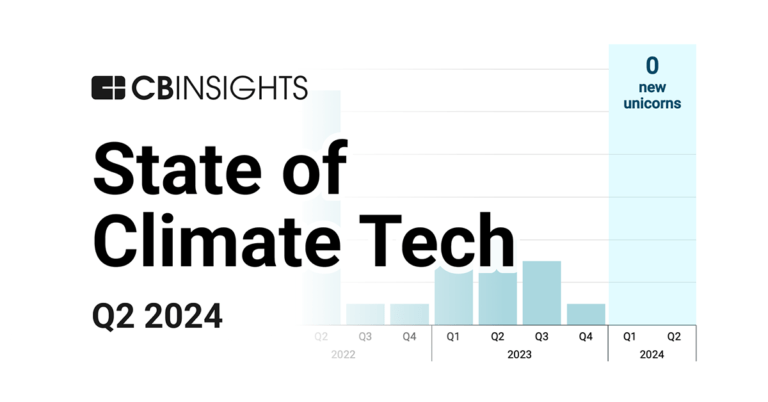

Aug 13, 2024 report

State of Climate Tech Q2’24 Report

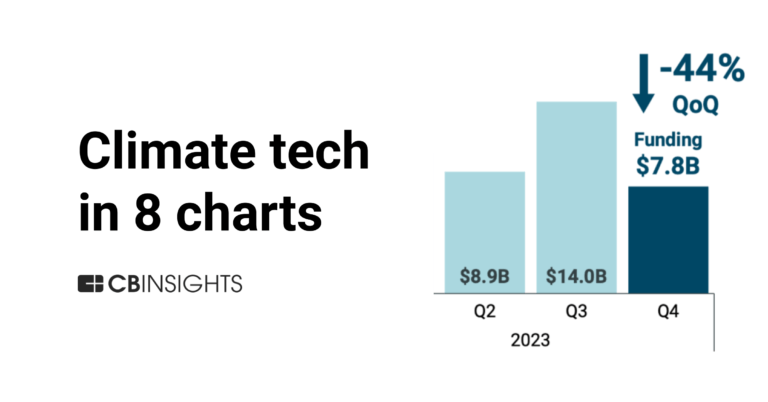

Mar 12, 2024

Climate tech in 8 charts: 2023Expert Collections containing Sila

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sila is included in 4 Expert Collections, including Auto Tech.

Auto Tech

4,189 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,309 items

Energy Storage

5,442 items

Companies in the Energy Storage space, including those developing and manufacturing energy storage solutions such as lithium-ion batteries, solid-state batteries, and related software for battery management.

Advanced Materials

1,459 items

Companies in the advanced materials space, including polymers, biomaterials, semiconductor materials, and more.

Sila Patents

Sila has filed 137 patents.

The 3 most popular patent topics include:

- lithium-ion batteries

- rechargeable batteries

- energy storage

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/16/2023 | 4/1/2025 | Fluorides, Metal halides, Fluorinating agents, Nonmetal halides, Nanomaterials | Grant |

Application Date | 8/16/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Fluorides, Metal halides, Fluorinating agents, Nonmetal halides, Nanomaterials |

Status | Grant |

Latest Sila News

Oct 31, 2025

Expected to grow to $27.51 billion in 2029 at a compound annual growth rate (CAGR) of 21.3%” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, October 31, 2025 / EINPresswire.com / -- "Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors Superfast Charging Battery Cell Market Growth Forecast: What To Expect By 2025? There has been a significant expansion in the market size of high-speed charging battery cells in recent years. It is projected to rise from $10.47 billion in 2024 to $12.73 billion in 2025, registering a compound annual growth rate (CAGR) of 21.6%. The upward trajectory during the historical period is credited to an escalated demand for electric cars, increased customer preference for quick charging options, rising investments toward charging infrastructure development, a growing emphasis on alleviating range anxiety, and enhancements in battery material science. The market size of hyperfast battery cell charging is predicted to surge substantially in the upcoming years. It is slated to escalate to $27.51 billion in 2029, posting a compound annual growth rate (CAGR) of 21.3%. The projected growth within the forecast time frame is due to increased adoption of ultra-fast charging protocols, higher state incentives for electric car production, intensifying competition among battery cell producers, growing need for high-energy storage systems, and expanded integration with green energy networks. Key tendencies within the forecast period are progress in solid-state battery technology, the growth of silicon-dominated anodes, advancements in heat control systems, evolution in ultra-fast charging algorithms, and the creation of ecologically-friendly recycling methods. Download a free sample of the superfast charging battery cell market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=28845&type=smp What Are Key Factors Driving The Demand In The Global Superfast Charging Battery Cell Market? The upsurge in the adoption of electric vehicles (EVs) is set to push forward the expansion of the superfast charging battery cell market. The acceleration in the adoption rate of EVs stems from supportive government regulations and financial schemes like tax credits and subsidies, making EVs more cost-effective and boosting widespread use. By significantly diminishing charge durations and easing range apprehensions, superfast charging battery cells bolster the utility, appeal, and everyday practicality of EVs for users. For instance, according to the International Energy Agency (IEA), a France-based global organization, worldwide sales of electric cars exceeded 17 million in 2024, securing more than 20% of the entire automotive sales and marking a rise of 3.5 million units from 2023. As a result, the escalating adoption of EVs is fuelling the development of the superfast charging battery cell market. Who Are The Leading Players In The Superfast Charging Battery Cell Market? Major players in the Superfast Charging Battery Cell Global Market Report 2025 include: • SK On Co. Ltd • BYD Europe B.V. • Contemporary Amperex Technology Co. Limited (CATL) • SAMSUNG SDI • QuantumScape Battery Inc. • Farasis Energy Europe GmbH • Sila Nanotechnologies Inc • Panasonic Life Solutions India Pvt. Ltd. • Group14 Technologies Inc • Gotion What Are The Top Trends In The Superfast Charging Battery Cell Industry? Leading firms in the superfast charging battery cell marketplace are prioritizing the creation of novel items such as ultra-fast EV batteries, which can drastically cut down the charging times of electric cars. Ultra-fast EV batteries provide high-efficiency energy storage that enables cars to attain significant drive distances within minimal charging time, without compromising on safety, durability, and cost-effectiveness. For example, in September 2024, the China-based lithium-ion battery and energy storage firm, Contemporary Amperex Technology Co., Limited (CATL), along with a partnership between SAIC Motor Corporation and General Motors known as SAIC General Motors Corporation Limited (SAIC-GM), released the 6C Lithium-Iron-Phosphate Battery Cell. This particular battery accommodates a 6C charging rate, meaning electric cars can achieve roughly 200 kilometers of range with just five minutes of direct current swift charging. This introduction marks a benchmark in the lithum-iron-phosphate battery sector, amplifying the impact of superfast charging solutions on the speed of EV adoption and bolstering competitiveness in the worldwide battery market. Analysis Of Major Segments Driving The Superfast Charging Battery Cell Market Growth The superfast charging battery cell market covered in this report is segmented as 1) By Type: 4C, 6C, Other Types 2) By Battery: Graphite, Silicon, Lithium Titanate Oxide 3) By Application: Electric Vehicle, Energy Storage, Other Applications View the full superfast charging battery cell market report: https://www.thebusinessresearchcompany.com/report/superfast-charging-battery-cell-global-market-report Which Region Is Expected To Lead The Superfast Charging Battery Cell Market By 2025? In the Superfast Charging Battery Cell Global Market Report 2025, the Asia-Pacific region led the market in 2024. The report projects the growth status of this region. Other regions documented in the report are Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Superfast Charging Battery Cell Market 2025, By The Business Research Company Glass Flexible Display Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/glass-flexible-display-global-market-report Hydrophobic Coatings Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/hydrophobic-coatings-global-market-report Glass Substrate Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/glass-substrate-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Sila Frequently Asked Questions (FAQ)

When was Sila founded?

Sila was founded in 2011.

Where is Sila's headquarters?

Sila's headquarters is located at 2470 Mariner Square Loop, Alameda.

What is Sila's latest funding round?

Sila's latest funding round is Series G.

How much did Sila raise?

Sila raised a total of $1.406B.

Who are the investors of Sila?

Investors of Sila include Sutter Hill Ventures, Bessemer Venture Partners, Coatue, Perry Creek Capital, U.S. Department of Energy and 19 more.

Who are Sila's competitors?

Competitors of Sila include 3DC, Ionic Mineral Technologies, CTNS, Polarium, NanoGraf and 7 more.

Loading...

Compare Sila to Competitors

Addionics focuses on developing rechargeable batteries using architectural design and 3D metal fabrication. The company produces 3D current collectors aimed at improving battery performance, including mileage, safety, cost, and charging time, for various lithium-ion battery technologies. Addionics' technology is compatible with different battery chemistries, facilitating the development of batteries with increased energy density and faster charging. It was founded in 2017 and is based in London, England.

EnPower operates as a battery company that focuses on advancing lithium-ion technology in the energy sector. The company specializes in developing multilayer electrode batteries that offer charging capabilities and enhanced cycle life without significant degradation. EnPower primarily serves markets that demand battery technology for applications such as electric mobility. EnPower was formerly known as Big Delta Systems. It was founded in 2014 and is based in Indianapolis, Indiana.

Ecellix focuses on the development of high-capacity anode materials for the lithium-ion battery industry. Their product, eCell™, is a silicon-based anode material that enhances the capacity and cycle life of lithium-ion batteries, providing OEMs and battery manufacturers with performance improvements. Ecellix's technology is intended for integration into existing production pipelines. It was founded in 2018 and is based in Seattle, Washington.

Group14 specializes in advanced silicon battery technology within the energy storage sector. The company's main offering includes a patented silicon-carbon composite material, known as SCC55, for rechargeable batteries by enabling them to charge more quickly and last longer than traditional lithium-ion batteries. It primarily serves sectors that require rechargeable batteries, such as the automotive, consumer electronics, and aviation industries. The company was founded in 2015 and is based in Woodinville, Washington.

CTNS operates as a company involved in secondary battery technology within the energy sector. It offers services for the development, manufacturing, and management of secondary battery packs, focusing on energy storage and management solutions. It was founded in 2017 and is based in Changwon-si, South Korea.

Clarios specializes in the production of batteries for a variety of vehicles. The company manufactures batteries annually, including advanced low-voltage systems, lithium-ion, and smart batteries, catering to the automotive and commercial sectors. Its products are integral to powering vehicles with features such as heated seats and cutting-edge safety systems, as well as supporting heavy-duty and leisure vehicles. Clarios was formerly known as Johnson Controls Power Solutions. The company was founded in 2019 and is based in Glendale, Wisconsin.

Loading...