Sixfold

Founded Year

2023Stage

Series A | AliveTotal Raised

$21.5MLast Raised

$15M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+42 points in the past 30 days

About Sixfold

Sixfold provides generative AI tools for the insurance underwriting sector. Its platform ingests underwriting guidelines, extracts relevant risk data, and offers risk insights and suggestions. The company serves insurers, managing general agents (MGAs), and reinsurers across various lines of insurance including life, disability, and property & casualty. It was founded in 2023 and is based in New York, New York.

Loading...

Sixfold's Products & Differentiators

Sixfold

We’ve built the first generative AI purpose-built for insurance underwriting. Unlike generalist AI solutions designed for broad use cases, Sixfold’s AI is specifically engineered to streamline underwriting workflows in insurance, helping underwriters make faster, smarter decisions that drive increased GWP and reduced costs. We offer two solutions: one for commercial underwriting and one for life and health. Both are already being used by some of the world’s leading insurers across North America and Europe.

Loading...

Research containing Sixfold

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sixfold in 11 CB Insights research briefs, most recently on Oct 23, 2025.

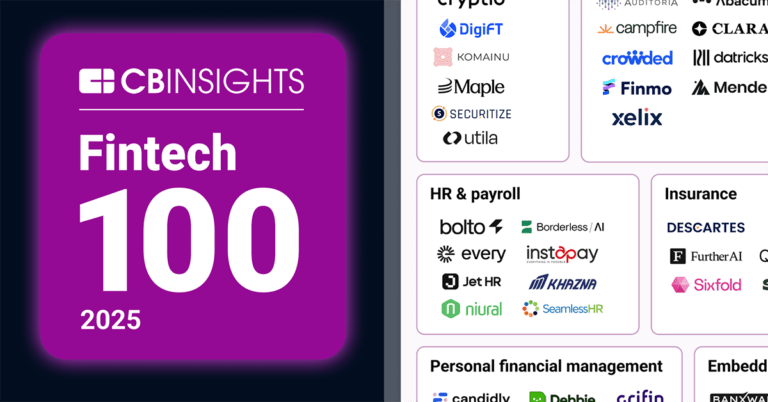

Oct 23, 2025 report

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

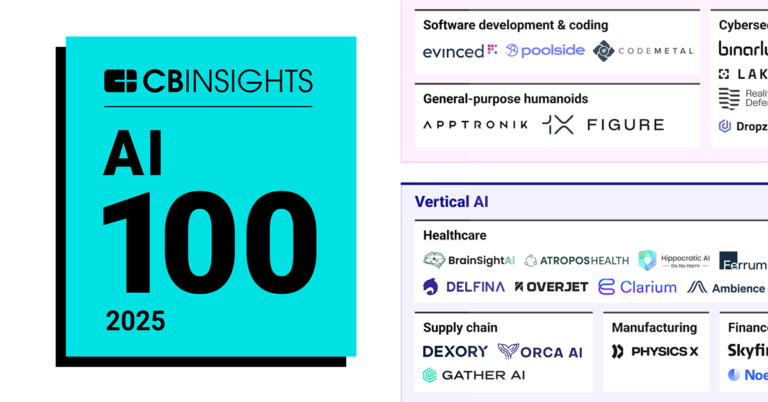

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

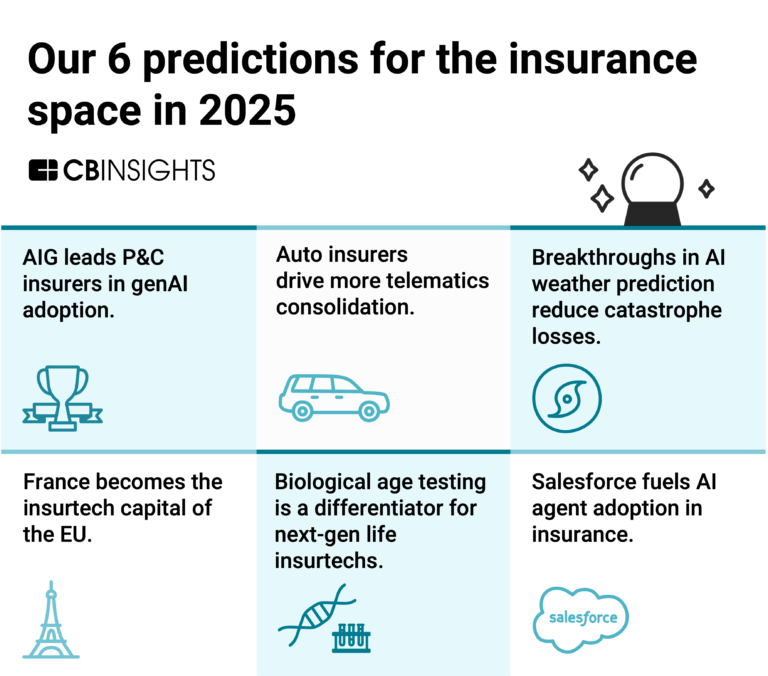

Mar 12, 2025

Our 6 predictions for the insurance space in 2025

Oct 11, 2024

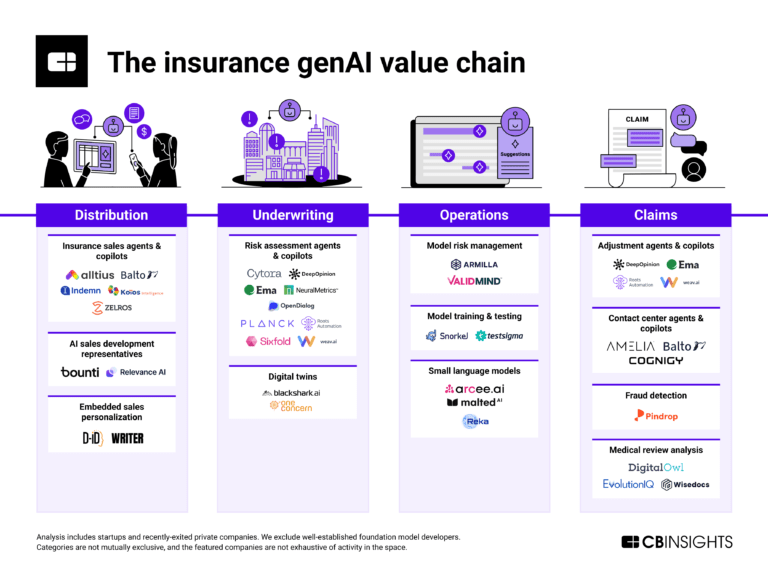

How genAI is reshaping the insurance value chainExpert Collections containing Sixfold

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sixfold is included in 12 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Future Tech Hotshots

52 items

The 52 startups our data says are most likely to get a successful exit in the next decade

Insurtech 50

100 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Artificial Intelligence (AI)

20,894 items

Latest Sixfold News

Nov 13, 2025

Sixfold , the AI underwriting platform used by leading life, health, and P&C insurers, today announced the release of its ‘ Responsible AI Report 2025 , detailing how insurers can adopt, govern, and scale AI in line with evolving global regulations. With the EU AI Act and Colorado AI Act entering full enforcement in 2026, insurers will soon be required to demonstrate fairness, oversight, and control across their AI systems. “Compliance has shifted from principle to proof,” said Jane Tran , COO of Sixfold. “Regulators are no longer asking whether insurers have AI policies. They're asking companies to show how models are governed, how bias is managed, and how oversight works in practice. Our report shows insurers how to operationalise that for ease of compliance.” The report defines five core pillars of Responsible AI that insurers can adopt or benchmark against: Bias prevention & fairness – fairness testing and controls that prevent reliance on protected attributes Model testing & validation – structured accuracy, robustness, and drift monitoring with human oversight AI governance & risk management – a governance programme aligned with global requirements Data security & integrity – SOC 2 Type II and HIPAA-aligned security, strict isolation, and data stewardship Explainability & transparency – clear traceability from model output to source evidence “Insurers need systems they can defend to auditors and regulators,” said Alex Schmelkin , CEO of Sixfold “We built accountability into our daily operations so carriers can demonstrate continuous assurance – not one-time compliance.” Alex Schmelkin has spoken alongside regulators from the NAIC, Colorado Division of Insurance, and Nebraska Department of Insurance, and serves on NAIC Committee H, focused on AI and emerging technology governance.

Sixfold Frequently Asked Questions (FAQ)

When was Sixfold founded?

Sixfold was founded in 2023.

Where is Sixfold's headquarters?

Sixfold's headquarters is located at 134 East 93rd Street 5A, New York.

What is Sixfold's latest funding round?

Sixfold's latest funding round is Series A.

How much did Sixfold raise?

Sixfold raised a total of $21.5M.

Who are the investors of Sixfold?

Investors of Sixfold include Crystal Ventures Fund, Bessemer Venture Partners, Scale Venture Partners, Salesforce Ventures, Munich Re Ventures and 6 more.

Who are Sixfold's competitors?

Competitors of Sixfold include Cytora, segurosIA, Vouch, Openly, Federato and 7 more.

What products does Sixfold offer?

Sixfold's products include Sixfold.

Loading...

Compare Sixfold to Competitors

Convr is a company focused on AI-driven underwriting solutions for the commercial property and casualty insurance industry. Their offerings include a modularized underwriting workbench that improves the underwriting process through data enrichment, risk scoring, and document processing. Convr serves commercial P&C carriers, reinsurers, managing general agents, and underwriters. It was founded in 2015 and is based in Schaumburg, Illinois.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence (AI)-powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Unqork is an enterprise application development platform that creates applications across various sectors. The company provides solutions for building, testing, and running applications. Unqork serves industries such as financial services, insurance, healthcare, and government. It was founded in 2017 and is based in New York, New York.

Advocate provides a software platform to replace manual insurance review processes with automated solutions for lenders in the financial services industry. The platform aims to improve pre-closing and servicing functions. Advocate serves commercial real estate lenders and other financial institutions involved in loan programs. It was founded in 2020 and is based in New York, New York.

mea is a technology company that focuses on the insurance sector. It provides AI-driven data processing and underwriting solutions. The company offers a platform that automates the submission and claims processes for insurers, managing data ingestion, compliance checks, and document processing with generative AI. It serves insurers, brokers, and managing general agents (MGAs). It was founded in 2021 and is based in London, United Kingdom.

Loading...