Skyfire

Founded Year

2024Stage

Seed VC - II | AliveTotal Raised

$10MLast Raised

$1M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+62 points in the past 30 days

About Skyfire

Skyfire focuses on providing financial services for the machine economy. The company offers a financial stack that enables artificial intelligence agents to perform transactions without the need for credit cards or bank accounts and allows businesses to monetize their products, services, and data to AI agents. It primarily sells to sectors that involve AI technology and digital transactions. The company was founded in 2024 and is based in San Francisco, California.

Loading...

ESPs containing Skyfire

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent payments infrastructure market enables secure financial transactions between AI agents, humans, and businesses, eliminating the need for traditional banking infrastructure. Vendors in this space provide APIs, software development kits, and specialized protocols that allow developers to build AI systems that can autonomously initiate, authenticate, and complete financial transactions o…

Skyfire named as Leader among 12 other companies, including Coinbase, Stripe, and Basis Theory.

Skyfire's Products & Differentiators

The Financial Stack for AI Agents

Powering autonomous transactions for developers, services, websites and LLMs across the AI Economy. Skyfire is the payment network built specifically for AI.

Loading...

Research containing Skyfire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Skyfire in 8 CB Insights research briefs, most recently on Oct 20, 2025.

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

Sep 5, 2025 report

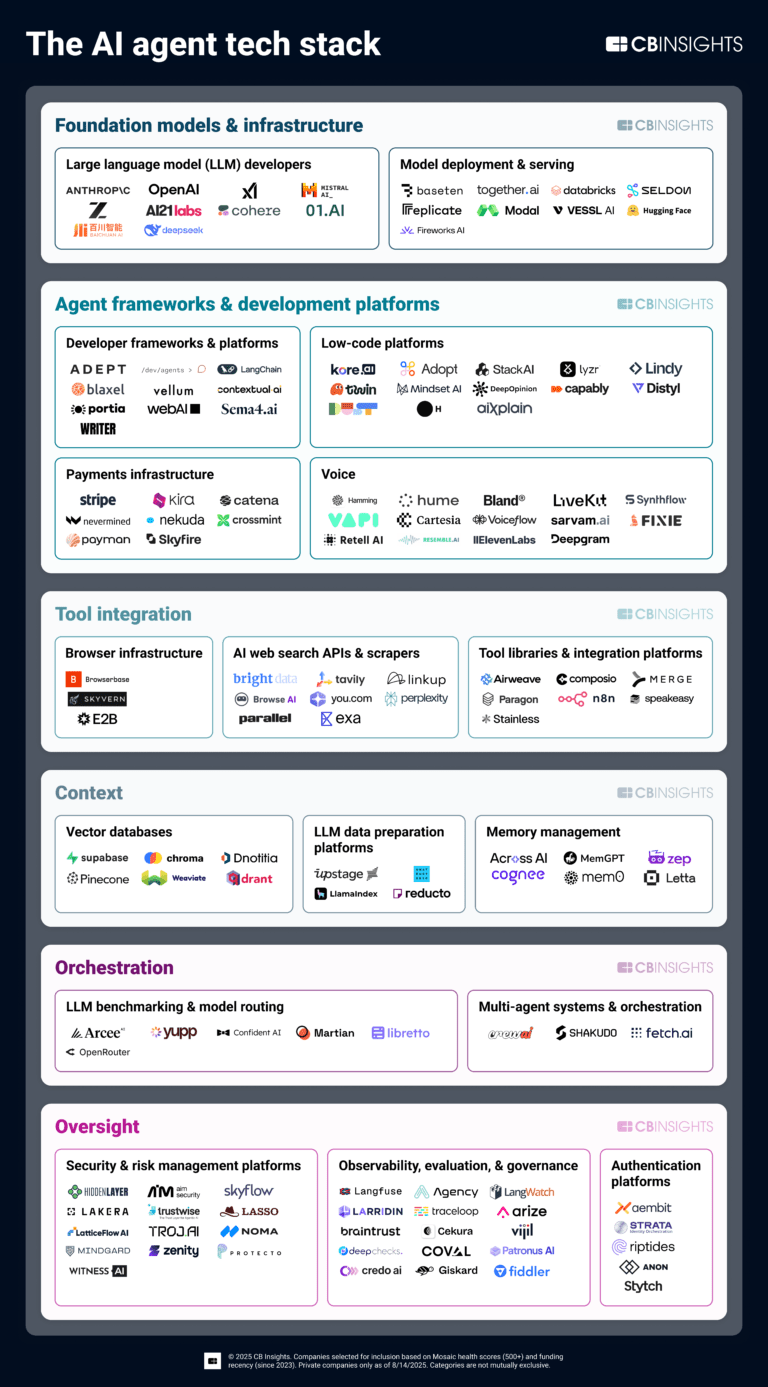

Book of Scouting Reports: The AI Agent Tech Stack

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Aug 22, 2025

The AI agent tech stack

Aug 4, 2025

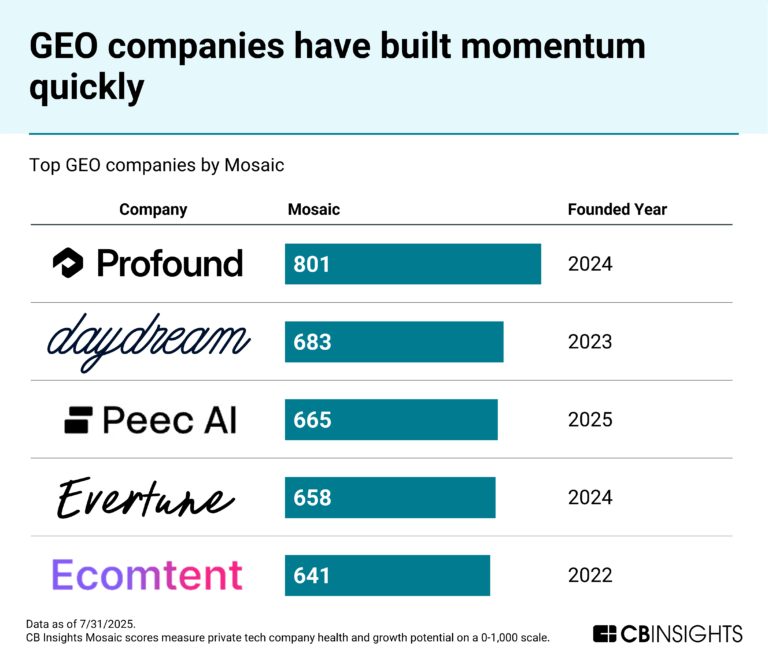

3 markets fueling the shift to agentic commerce

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

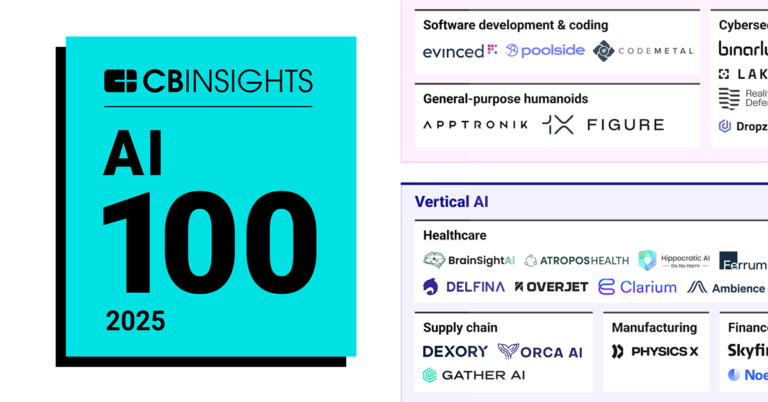

AI 100: The most promising artificial intelligence startups of 2025

Mar 6, 2025

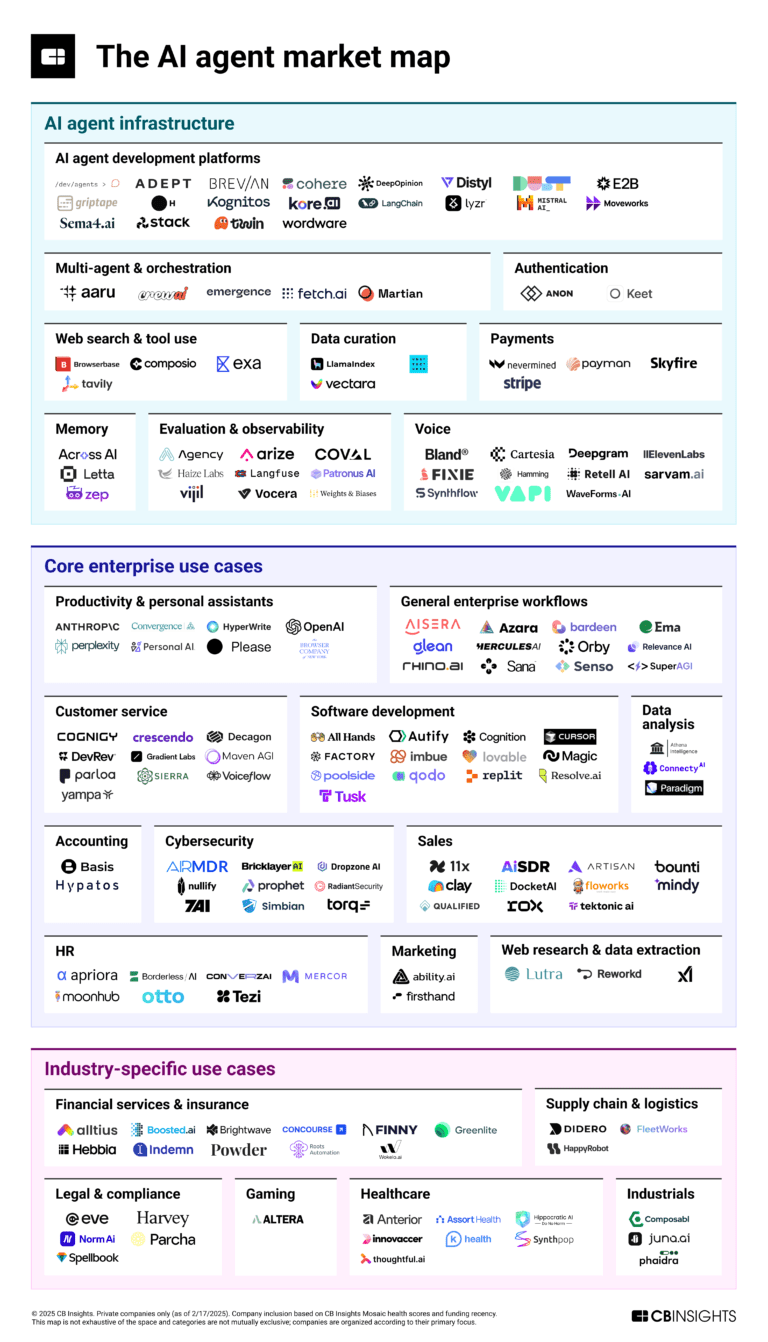

The AI agent market mapExpert Collections containing Skyfire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Skyfire is included in 5 Expert Collections, including Artificial Intelligence (AI).

Artificial Intelligence (AI)

37,256 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

AI agents

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

AI 100 (2025)

100 items

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI 100 (All Winners 2018-2025)

100 items

Latest Skyfire News

Nov 6, 2025

By Cheryl Winokur Munk November 06, 2025, 12:29 p.m. EST 4 Min Read Key insights: As agentic commerce takes off, chargeoffs will initially spike, then start to ease. What's at stake: Managing payment disputes is still mostly done internally, creating an opportunity for outside providers as technology becomes more complicated. Expert quote: "It's going to be messy for the next five years," said Armen Najarian, chief marketing officer at Sift, With gaining steam, some payments professionals anticipate a jump, then an eventual drop in chargebacks, a pervasive and expensive problem for banks. Globally, Datos Insights predicts that chargeback volume will climb 24% from 2025 to 2028 — reaching 324 million globally. Merchants and issuers state their chargeback volume has increased more than 10% in the past year. That's according to a March is costly and labor-intensive. U.S. financial institutions require one full-time employee for every $13,000 to $14,000 in incoming annual cardholder disputes, and each dispute costs them between $9.08 and $10.32 to process, according to the report. Agentic commerce, however, has the potential to decrease chargebacks, which payments professionals predict could happen eventually after some of the initial wrinkles are ironed out. "It's going to be messy for the next five years," Armen Najarian, chief marketing officer at Sift, an AI-powered fraud decisioning company based in San Francisco, told American Banker. Here's what banks need to know about chargebacks as the shift to agentic commerce gains prominence: The potential to reduce friendly fraud Many chargebacks are considered friendly fraud. This means a customer, intentionally or mistakenly, disputes a legitimate transaction instead of seeking a refund directly from a merchant. With agentic commerce, there's strong potential for this type of misuse to be significantly reduced, Najarian said. That's because, as agentic commerce matures, there will be clear definitions regarding how agents are authorized and approved, which limits the ability of consumers to say they didn't make a purchase. With agentic commerce, "you're really got to work hard to prove it wasn't you," Craig DeWitt, co-founder and head of product at Skyfire, a San Francisco-based payments fintech, told American Banker. Even so, Alisdair Faulkner, the chief executive and co-founder of Darwinium, a cyberfraud AI platform with offices in San Francisco, London and Sydney, said friendly fraud claims are likely to increase initially due to genuine consumer mistakes using a new purchasing method. This should decrease in time, he said. Reducing fraud by bad actors One of the challenges being addressed is how merchants can recognize a good bot from a bad bot. A lot of technology today is aimed at blocking bots from making fraudulent purchases during the checkout process, but in the age of agentic commerce, changes have to be made so that legitimate bots can complete the checkout experience, said DeWitt of Skyfire, whose technology allows agents to legitimize themselves for this purpose. Especially in the early days of agentic commerce, bad actors will try to flood the system to see where they are caught and where they are not, said Elias Ghanem, global head of Capgemini Research Institute for Financial Services. This could mean more attacks get through at the onset, but eventually, he said, things should become more manageable as more barriers are erected to keep the bad guys at bay and reduce chargebacks due to fraud. But it can never be 100% secure, Capgemini's Ghanem told American Banker. "It's a never-ending race between the honest and the dishonest people. There's so much money to be stolen, unfortunately, that they will continue to have an incentive to do it." Establishing protocols To be sure, obtaining a meaningful dropoff in chargeoffs due to agentic commerce could be years away. That's because there's a lot that has to happen behind the scenes so that agentic commerce can take off. For starters, the card networks are establishing standards to define the technical framework for agents and proving that a user gave an agent specific authority to make a particular purchase. These protocols are also meant to help merchants ensure that an agent's request accurately reflects the user's true intent and determine accountability if fraud or an incorrect transaction occurs. Challenges remain Beyond standard-setting, consumers have to be willing to use agentic commerce more readily than they are now, Sift's Najarian told American Banker. Only 14% of respondents said they would let an AI shopping agent make purchases on their behalf, according to a recent Sift survey of 1,000 consumers. Najarian predicts this will proliferate over time. As education becomes stronger, more consumers will be willing to try using agents, he said. Signs of growth The growth of agentic commerce also turns on merchants embracing the new model. This is likely to start with larger merchants and trickle down to smaller ones, payments professionals said. Just recently, Walmart

Skyfire Frequently Asked Questions (FAQ)

When was Skyfire founded?

Skyfire was founded in 2024.

Where is Skyfire's headquarters?

Skyfire's headquarters is located at San Francisco.

What is Skyfire's latest funding round?

Skyfire's latest funding round is Seed VC - II.

How much did Skyfire raise?

Skyfire raised a total of $10M.

Who are the investors of Skyfire?

Investors of Skyfire include Crypto Startup Accelerator, Coinbase Ventures, Draper Associates, Crossbeam Venture Partners, Arrington Capital and 16 more.

Who are Skyfire's competitors?

Competitors of Skyfire include Visa.

What products does Skyfire offer?

Skyfire's products include The Financial Stack for AI Agents and 3 more.

Loading...

Compare Skyfire to Competitors

DRUO provides direct-to-account payment processing. The company has a payment network that allows businesses to debit or credit bank accounts or wallets. DRUO serves the financial services industry with its payment solutions. It was founded in 2021 and is based in Miami, Florida.

Interac operates as a financial technology company offering digital payment solutions and identity verification services. The company provides services such as Interac Debit for in-store payments, Interac e-Transfer for sending and receiving money online, and Interac Direct for online shopping payments. Interac also offers solutions for individuals and businesses to authenticate identities and transactions. Interac was formerly known as Acxsys. It was founded in 1984 and is based in Toronto, Canada.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

UnionPay is an international company that operates in the financial services sector and provides digital wallet and account services. Users can store, convert, invest, and donate their digital assets. UnionPay provides access and adoption of digital assets through its services for individual and corporate clients. It is based in Campinas, Brazil.

Alternative Payments provides alternative payment solutions within the financial services industry. The company offers local payment methods and open banking solutions to facilitate transactions and cater to diverse consumer preferences. Alternative Payments serves the e-commerce sector and facilitates international transactions. It was founded in 1999 and is based in Pasadena, California.

Blackhawk Network is a financial technology company that creates commercial and engagement solutions within the payment solutions and technology industry. The company offers products aimed at improving sales, productivity, and customer loyalty, utilizing a network that connects clients with employees, sales channels, and customers across various platforms. Blackhawk Network serves sectors that require payment and engagement solutions, including retail and ecommerce. Blackhawk Network was formerly known as Blackhawk Marketing Services. It was founded in 2001 and is based in Pleasanton, California.

Loading...