Stash

Founded Year

2015Stage

Series H | AliveTotal Raised

$677.85MLast Raised

$146M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Stash

Stash serves as a personal finance app that provides tools for budgeting, stock rewards, and saving for immediate needs and retirement. StashWorks is a workplace benefit that offers education, savings contributions, and rewards for reaching financial goals. Stash was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Loading...

Stash's Products & Differentiators

Invest, Retire + Custodial

With just 1¢1, customers can buy fractional shares of stocks and funds, build their own diversified portfolios, and learn how to invest confidently; access to a curated selection of +3,000 ETFs and stocks; option to open personal brokerage, Roth or traditional IRAs and/or custodial (UGMA and UTMA) accounts.

Loading...

Research containing Stash

Get data-driven expert analysis from the CB Insights Intelligence Unit.

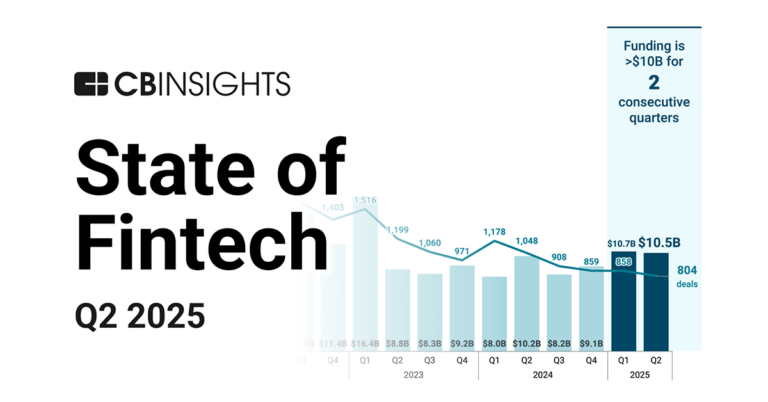

CB Insights Intelligence Analysts have mentioned Stash in 3 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

State of Fintech Q2’25 Report

Mar 5, 2024 report

The top 20 venture investors in North AmericaExpert Collections containing Stash

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stash is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Stash Patents

Stash has filed 7 patents.

The 3 most popular patent topics include:

- automotive suspension technologies

- credit cards

- debit cards

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/13/2020 | 5/28/2024 | Energy conversion, Thermodynamic cycles, Energy conservation, Cooling technology, Thermodynamics | Grant |

Application Date | 3/13/2020 |

|---|---|

Grant Date | 5/28/2024 |

Title | |

Related Topics | Energy conversion, Thermodynamic cycles, Energy conservation, Cooling technology, Thermodynamics |

Status | Grant |

Latest Stash News

Sep 24, 2025

News provided by Share this article Share toX The growth of the Robo Advisor Market is driven by the increasing adoption of digital wealth management platforms, rising demand for cost-effective investment solutions, and growing preference for AI-enabled portfolio customization. Expanding financial literacy among millennials and Gen Z, coupled with the shift toward mobile-first advisory services, further supports market momentum. Additionally, regulatory encouragement for transparent investment practices and the integration of advanced analytics strengthen market expansion, positioning robo advisors as a mainstream financial solution. LEWES, Del., Sept. 24, 2025 /PRNewswire/ -- The global Robo Advisor Market was valued at USD 1.4 trillion in 2024 and is anticipated to reach USD 3.2 trillion by 2033, reflecting a robust growth trajectory. The market is expected to expand at a CAGR of 10.5% during 2026–2033, driven by accelerated digital adoption and growing investor confidence in automated advisory platforms. With increasing demand for personalized, low-cost, and scalable wealth management solutions, robo advisors are emerging as a transformative force in the global financial services sector. 202 - Pages CUSTOMIZATION SCOPE Free report customization (equivalent to up to 4 analyst working days) with purchase. Addition or alteration to country, regional & segment scope Feed Antioxidants Market Overview Digital Transformation in Wealth Management The Robo Advisor Market is a prime example of how digital transformation is reshaping financial services. Traditional wealth management, once heavily reliant on human advisors, is now witnessing an accelerated shift toward automated platforms that leverage artificial intelligence, big data, and machine learning. These technologies allow robo advisors to provide cost-efficient, scalable, and highly personalized investment recommendations, making wealth management accessible to a much wider demographic. Digital-first investors, particularly younger generations, are driving this trend as they prefer seamless mobile experiences, 24/7 accessibility, and transparency in investment strategies. Furthermore, financial institutions are increasingly partnering with fintech providers to enhance their service offerings and capture a digitally savvy customer base. With the growing adoption of cloud computing and secure APIs, robo advisors are becoming more integrated with mainstream financial ecosystems. This digital-first approach not only reduces operational costs for firms but also significantly improves user experience and retention rates. Rising Popularity Among Millennials and Gen Z Millennials and Gen Z represent the fastest-growing investor classes for the robo advisor market. These generations are inherently tech-savvy, value digital convenience, and are less inclined toward traditional advisory models that involve high fees and manual processes. They demand platforms that offer flexibility, automation, and customization of investment portfolios in line with personal values such as sustainability or ESG considerations. Robo advisors meet these expectations by providing low-cost entry points and algorithm-driven strategies that align with individual risk appetites. As global financial literacy improves through digital education platforms, these younger demographics are showing greater willingness to invest early and consistently, using robo advisors as their primary tool. Furthermore, gamification features, intuitive dashboards, and AI-driven financial planning tools make robo advisors particularly appealing to younger investors. This demographic shift is expected to play a pivotal role in driving the long-term adoption and expansion of the robo advisory market worldwide. Cost Efficiency and Accessibility as Key Drivers One of the most compelling growth drivers of the robo advisor market is its ability to drastically reduce the cost of financial advisory services. Traditional wealth managers typically charge high fees and maintain significant account minimums, limiting access for middle- and lower-income groups. Robo advisors, in contrast, operate at a fraction of the cost, often offering services with low or no minimum investment thresholds. This democratization of financial planning has significantly expanded the market base, enabling millions of first-time investors to participate in wealth management. Furthermore, robo advisors leverage automation to manage portfolios with minimal human intervention, further lowering operational costs while maintaining efficiency. Accessibility through mobile applications ensures that users can track, manage, and adjust their investments anytime, anywhere. This combination of affordability and convenience positions robo advisors as a disruptive force that levels the playing field for investors across varying income and wealth brackets worldwide. Integration of Artificial Intelligence and Machine Learning The integration of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing robo advisor platforms. These advanced systems analyze vast volumes of market data, historical investment patterns, and user behavior to create highly personalized financial strategies. AI-enabled robo advisors can predict market fluctuations, optimize asset allocations, and continuously rebalance portfolios in real time, ensuring that investment decisions remain aligned with client goals and risk tolerance. Moreover, ML algorithms improve over time, enhancing accuracy and the ability to adapt to changing market conditions. Natural language processing (NLP) is also being utilized to improve customer service, enabling investors to interact with robo advisors through chatbots and virtual assistants. These innovations reduce the need for manual oversight, allowing providers to scale rapidly while maintaining high service standards. Ultimately, AI and ML integration enhances both the efficiency and effectiveness of robo advisors, making them increasingly attractive to individual and institutional investors alike. Regulatory Support and Market Transparency The global regulatory landscape is evolving in favor of robo advisors, creating a conducive environment for market growth. Many governments and financial authorities are promoting digital advisory platforms as part of broader initiatives to improve financial inclusion and transparency. Regulations often mandate clear disclosures of fees, investment risks, and portfolio strategies, ensuring that investors are well informed. This transparency builds trust and confidence among users who may have previously hesitated to rely on algorithm-driven financial tools. Additionally, regulators are increasingly recognizing the role of robo advisors in complementing traditional financial services, thereby formalizing their place in the wealth management ecosystem. Compliance frameworks also encourage cybersecurity best practices, further enhancing investor protection. In markets such as the U.S., Europe, and parts of Asia, supportive regulations are accelerating adoption by legitimizing robo advisors as credible, mainstream alternatives to human advisory models, reinforcing the sector's growth trajectory. Expanding Institutional Adoption While robo advisors initially targeted retail investors, institutional adoption is rapidly gaining momentum. Asset management firms, banks, and insurance companies are integrating robo advisory services into their product portfolios to attract cost-conscious and digitally inclined clients. Institutions benefit from the scalability of robo platforms, which allow them to serve a larger client base with minimal additional overhead. Additionally, robo advisors provide institutions with powerful analytics and risk assessment tools that enhance decision-making. Hybrid models, which combine algorithmic recommendations with human oversight, are also gaining traction in institutional markets, appealing to high-net-worth individuals who seek both automation and personalized guidance. By adopting robo advisors, institutions are not only diversifying their offerings but also strengthening customer loyalty in a highly competitive financial services sector. This institutional expansion signals a new growth phase for the market, moving beyond individual retail investors toward broader financial ecosystem integration. Global Expansion and Emerging Market Potential The robo advisor market is no longer limited to developed economies like the U.S. and Europe. Emerging markets across Asia-Pacific, Latin America, and the Middle East are witnessing strong adoption driven by rapid digitalization, expanding internet penetration, and increasing financial literacy. Countries such as China, India, and Brazil are particularly promising due to their large, young populations and rising middle classes seeking affordable investment solutions. Local fintech firms, often in collaboration with global players, are tailoring robo advisor platforms to meet region-specific needs such as language localization, regulatory compliance, and cultural investment preferences. Mobile-first strategies are especially effective in emerging markets, where smartphones often serve as the primary access point for financial services. This global expansion is expected to significantly boost the overall size of the robo advisor market, as providers tap into vast underpenetrated regions with growing demand for digital financial management solutions. Future Outlook and Market Opportunities The future outlook for the robo advisor market is highly positive, with sustained growth projected over the next decade. By 2033, the market is expected to reach USD 3.2 trillion, reflecting its mainstream acceptance in global financial services. Opportunities lie in the continued integration of advanced technologies such as blockchain for enhanced security, robo-tax advisors for simplified compliance, and ESG-focused investment portfolios to meet rising demand for ethical finance. Hybrid advisory models, combining AI efficiency with human expertise, are also anticipated to gain popularity among investors seeking personalized engagement. Moreover, partnerships between fintechs and traditional financial institutions will create new synergies, expanding service offerings and customer reach. As customer trust grows and regulations continue to support transparency, robo advisors will become a central pillar in wealth management. The market's evolution promises not only significant economic potential but also greater inclusivity and accessibility in global financial systems. Geographic Dominance: The Robo Advisor Market demonstrates strong geographic dominance across North America, Europe, and Asia-Pacific, with each region contributing significantly to global growth. North America, led by the United States, holds the largest share due to high digital adoption, advanced fintech infrastructure, and a mature investor base that favors cost-efficient advisory services. Europe follows closely, driven by supportive regulations, growing preference for transparent financial tools, and increasing ESG-focused investment strategies. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, fueled by rapid digitalization, rising middle-class wealth, and large-scale adoption of mobile-first financial platforms in countries like China and India. Latin America and the Middle East are also showing promising adoption trends, supported by expanding financial literacy and growing fintech ecosystems. As global players expand their reach while local firms customize solutions for regional needs, geographic diversity is expected to play a central role in shaping the market's future trajectory. Feed Antioxidants Market Key Players Shaping the Future Key players shaping the future of the Robo Advisor Market include Betterment, Wealthfront, Vanguard Personal Advisor Services, Charles Schwab Intelligent Portfolios, Fidelity Go, Personal Capital, SigFig, SoFi Automated Investing, Acorns, Ellevest, Nutmeg, Moneyfarm, Scalable Capital, Stash, M1 Finance, Qplum, Blooom, Bambu, FutureAdvisor, and Wealthsimple. Feed Antioxidants Market Segment Analysis The Feed Antioxidants Market is segmented based on By Type, By Application, and Geography, providing a comprehensive framework for industry analysis: 1. By Type Pure Robo Advisors – Fully automated platforms providing algorithm-driven portfolio management without human intervention, ideal for cost-conscious investors seeking efficiency. Hybrid Robo Advisors – Combine algorithmic intelligence with human financial advisors, catering to clients who value automation but also prefer personalized human insights. 2. By Application Retail Investors – Individual investors, including millennials and Gen Z, who seek affordable, accessible, and user-friendly wealth management solutions. High-Net-Worth Individuals (HNIs) – Wealthier clients using hybrid models to balance AI efficiency with strategic human guidance for complex financial planning. Institutions – Banks, asset managers, and financial service providers integrating robo advisory services into their offerings for scalability and efficiency. 3. By Geography Europe – Strong regulatory support and increasing demand for ESG investment portfolios. Asia-Pacific – Fastest-growing region, fueled by mobile-first adoption in China and India. Latin America & Middle East – Emerging opportunities with growing fintech ecosystems and rising financial literacy. Banking Financial Services And Insurance The Banking, Financial Services, and Insurance (BFSI) sector plays a pivotal role in driving the adoption of robo advisors, as institutions increasingly integrate automated platforms into their service portfolios. Banks and asset managers leverage robo advisory solutions to expand accessibility, reduce operational costs, and cater to digitally savvy clients seeking low-cost investment options. Insurance companies are also adopting robo advisors to offer personalized financial planning and retirement solutions, enhancing customer engagement and long-term value creation. Hybrid robo advisory models, combining algorithm-driven insights with human expertise, are gaining traction within the BFSI space, particularly among high-net-worth individuals and institutional clients. Furthermore, regulatory support for transparency and fiduciary responsibility within financial services is accelerating the integration of robo advisors. As the BFSI sector continues to digitalize, robo advisors are emerging as indispensable tools that strengthen customer trust, improve efficiency, and reshape the global wealth management landscape. Our related Reports Orthodontics Market is categorized based on Type (Traditional Metal Braces, Ceramic Braces, Clear Aligners, Lingual Braces) and Application (Teeth Alignment and Straightening, Bite Correction, Jaw and Facial Structural Correction, Post-Orthodontic Retention and Maintenance) and geographical regions Ozone Washing Machine Market is categorized based on Products (Residential Ozone Washing Machines, Commercial Ozone Washing Machines, Integrated Ozone Washers, Retrofit/External Ozone Injection Systems, Industrial Ozone Washing Plants) and Application (Residential Laundry, Commercial Laundries, Healthcare Facilities, Food and Beverage Industry Uniforms, Fitness Centers and Spas) and geographical regions Thermostatic Baths Market is categorized based on Application (Pharmaceutical Laboratories, Chemical Research, Biotechnology, Food & Beverage Testing, Environmental Testing, Academic & Educational Labs, Clinical Diagnostics) and Type (Heated Circulating Baths, Refrigerated Circulating Baths, Water Baths, Oil Baths, Digital Thermostatic Baths, Open Baths with External Circulators, Shaking Water Baths) and geographical regions Mobile Phone Voice Coil Motor Market is categorized based on Type (Linear VCM, Rotary VCM) and Application (Camera auto-focus, Image stabilization, Smartphone manufacturing, Consumer electronics) and geographical regions Thermostatic Mixing Valves Market is categorized based on Application (Residential Buildings, Commercial Establishments, Healthcare Facilities, Industrial Settings, Educational Institutions) and Product (Point-of-Use TMVs, Central Mixing Valves, High-Flow TMVs, Digital TMVs, Thermostatic Mixing Valve Assemblies) and geographical regions About Us: Market Research Intellect Welcome to Market Research Intellect, where we lead the way in global research and consulting, proudly serving over 5,000 esteemed clients worldwide. Our mission is to empower your business with cutting-edge analytical research solutions, delivering comprehensive, information-rich studies that are pivotal for strategic growth and critical revenue decisions. Unmatched Expertise: Our formidable team of 250 highly skilled analysts and subject matter experts (SMEs) is the backbone of our operations. With extensive training in advanced data collection and governance, we delve into over 25,000 high-impact and niche markets. Our experts seamlessly integrate modern data collection techniques, robust research methodologies, and collective industry experience o produce precise, insightful, and actionable research. Diverse Industry Coverage: We cater to a wide array of industries, ensuring that our insights are both relevant and specialized. Our expertise spans: Energy, Technology, Manufacturing and Construction, Chemicals and Materials, Food and Beverages Having collaborated with numerous Fortune 2000 companies, we bring unparalleled experience and reliability to meet all your research needs. Our proven track record reflects our commitment to excellence and client satisfaction. Contact Us:

Stash Frequently Asked Questions (FAQ)

When was Stash founded?

Stash was founded in 2015.

Where is Stash's headquarters?

Stash's headquarters is located at 257 Park Avenue South, New York.

What is Stash's latest funding round?

Stash's latest funding round is Series H.

How much did Stash raise?

Stash raised a total of $677.85M.

Who are the investors of Stash?

Investors of Stash include Goodwater Capital, Union Square Ventures, T. Rowe Price, Serengeti Asset Management, University of Illinois Foundation and 15 more.

Who are Stash's competitors?

Competitors of Stash include Vestwell, ONE, Public, Moneybox, Changed and 7 more.

What products does Stash offer?

Stash's products include Invest, Retire + Custodial and 4 more.

Loading...

Compare Stash to Competitors

Acorns is a financial technology company that provides savings and investment services within the fintech sector. The company offers products that enable individuals to save and invest their spare change, plan for retirement through individual retirement accounts, and invest for children with custodial accounts. Acorns serves the personal finance and investment sectors, aiming to assist Americans with financial management. It was founded in 2012 and is based in Irvine, California.

Wealthfront specializes in wealth management and robo-advisory services. The company offers automated investing portfolios, cash accounts, and direct stock investing. Wealthfront serves individual investors looking for financial management and investment options. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Changed is a financial technology company that focuses on helping individuals accelerate their debt repayment and achieve financial freedom. The company offers an application-based platform that rounds up users' spare change from everyday transactions and applies it toward their debt, in addition to providing tools for automated payments, tracking loan balances, and setting financial goals. Changed primarily serves individuals looking to pay off personal loans, student loans, auto loans, credit cards, and mortgages more efficiently. It was founded in 2017 and is based in Chicago, Illinois.

Bundil operates as a crypto investment mobile platform. It allows users to automatically invest spare change from everyday credit or debit card purchases into Bitcoin and other cryptocurrencies. It was founded in 2017 and is based in Dallas, Texas.

M1 focuses on personal finance and investment management. The company provides various financial products, including cash accounts, investing tools, brokerage services, loans, and a credit card. M1 serves individual investors interested in managing their wealth through financial solutions. It was founded in 2015 and is based in Chicago, Illinois.

Betterment is a digital investment advisor that provides services in the financial services sector. The company offers services such as investing with diversified portfolios, cash accounts, and retirement savings options. Betterment caters to individual investors looking to grow their wealth through various portfolio options and tax-related features. It was founded in 2010 and is based in New York, New York.

Loading...