Investments

29Portfolio Exits

3Partners & Customers

3About State Farm Ventures

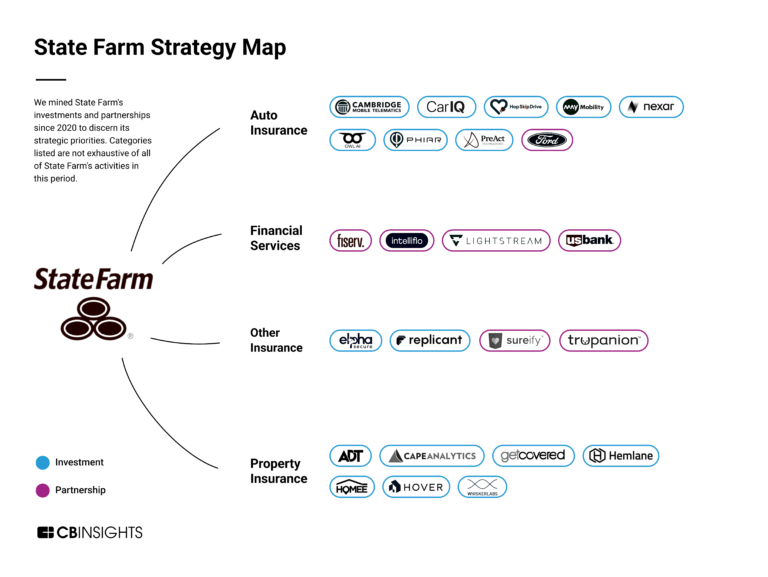

State Farm Ventures operates as a venture capital arm of State Farm. It mainly invests in early-stage startups, including financial technology, insurance technology, telematics, blockchain, and real estate technology sectors. It was founded in 2018 and is based in Bloomington, Illinois.

Research containing State Farm Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned State Farm Ventures in 4 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Latest State Farm Ventures News

Aug 10, 2025

By Astrid Malval-Beharry August 10, 2025, 4:00 p.m. EDT 4 Min Read Adobe Stock. It's 3 AM and Jamie is glued to her computer screen, watching the path of hurricane Minerva, a category 5 storm that just shifted course toward Miami. As a senior underwriter at Flamingo Insurance, Jamie faces a nightmare scenario: reassessing risk for 50,000 coastal properties in their portfolio, including her own home. In today's world, this would take days of frantic cat modeling and number-crunching. But it's 2032, and Flamingo invested in quantum computing two years ago. Jamie's assessment will be completed in minutes instead of days, meaning Flamingo and 50,000 customers can wake up knowing exactly where they stand. Why quantum computing changes everything The quantum advantage stems from qubits, which unlike traditional computer bits that must be either 1 or 0, can exist in both states simultaneously, thanks to a property called superposition. Add entanglement – the ability to interconnect qubits – and quantum computing achieves exponential problem-solving power. It's like the difference between auditioning musicians individually for your band over months versus hearing every possible combination playing together at once and instantly identifying the perfect ensemble. When quantum meets AI: Your new superpower If artificial intelligence (AI) is your most experienced claims adjuster evaluating a case, quantum computing gives that adjuster the ability to simultaneously investigate every possible scenario, witness account and outcome to instantly determine the most accurate settlement. This powerful combination, , transforms how insurers operate. Dynamic risk assessment becomes truly real-time. Picture automatically adjusting homeowner premiums the moment property sensors pick up a recently upgraded security system or newly completed roof repairs or repricing auto policies when major construction begins on a customer's daily route. Real-time fraud detection reaches new levels of sophistication. Traditional systems miss complex schemes because they can't process enough variables simultaneously. Quantum AI evaluates countless combinations instantly. This means catching staged accidents involving multiple claimants across different states or spotting subtle billing patterns where providers gradually inflate charges across hundreds of seemingly unrelated claims. Climate risk modeling finally matches the reality of our changing world. Rather than relying on outdated flood maps, quantum AI systems simultaneously process decades of weather data, topography, soil composition and infrastructure details. They can predict exactly how a Category 3 hurricane hitting Tampa would affect a specific beachfront condo built in 1987 with particular materials and elevation. Personalized pricing becomes microscopically precise. Quantum AI integrates imagery, behavioral patterns, IoT data and countless other data points to deliver real-time risk assessments tailored to individual properties and drivers. From science fiction to strategic reality faces real challenges – extreme cooling requirements and high costs keep it from mainstream adoption. But smart insurers aren't waiting. They're experimenting with quantum-inspired algorithms on traditional systems, achieving promising results in fraud detection and risk modeling right now. Major carriers are already moving. State Farm Ventures has invested in quantum firms like Entropica Labs and Quantum Rings. Your quantum roadmap: Five practical steps You don't need a Ph.D. in quantum physics to prepare. Here's a practical roadmap: 1. Build quantum literacy: Educate your teams using resources like Michio Kaku's Quantum Supremacy and IBM's Qiskit Textbook. Tune into quantum podcasts for ongoing insights. 2. Stay informed: Subscribe to quantum computing newsletters and join industry groups. 3. Conduct small experiments: Test quantum-inspired algorithms using cloud-based simulators for small fraud detection or risk assessment projects. 4. Form strategic partnerships: Engage with quantum startups, universities, or industry exchanges to access cutting-edge expertise without massive upfront investments. 5. Assess your data infrastructure: Ensure your data systems are quantum-ready with clean, high-quality datasets. The bottom line Back to Hurricane Minerva: in our quantum-powered future, that 3 AM scramble disappears. Quantum AI systems would process every possible storm path and recommend optimal responses before you even realize the storm changed course. With the U.S. P&C insurance market surpassing $1 trillion in annual premiums, even small improvements create massive competitive advantages. Insurers embracing quantum strategies today will lead tomorrow's innovation wave. Those who wait risk being caught unprepared when the storm hits.

State Farm Ventures Investments

29 Investments

State Farm Ventures has made 29 investments. Their latest investment was in Lumai as part of their Series A on April 02, 2025.

State Farm Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

4/2/2025 | Series A | Lumai | $10M | Yes | 2 | |

3/7/2025 | Seed VC - II | InsureVision | $2.7M | Yes | 2 | |

2/27/2025 | Series D - III | Proof | Yes | 2 | ||

10/29/2024 | Series C | |||||

9/26/2024 | Series A |

Date | 4/2/2025 | 3/7/2025 | 2/27/2025 | 10/29/2024 | 9/26/2024 |

|---|---|---|---|---|---|

Round | Series A | Seed VC - II | Series D - III | Series C | Series A |

Company | Lumai | InsureVision | Proof | ||

Amount | $10M | $2.7M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 2 | 2 | 2 |

State Farm Ventures Portfolio Exits

3 Portfolio Exits

State Farm Ventures has 3 portfolio exits. Their latest portfolio exit was Cape Analytics on January 13, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

1/13/2025 | Acquired | 5 | |||

Date | 1/13/2025 | ||

|---|---|---|---|

Exit | Acquired | ||

Companies | |||

Valuation | |||

Acquirer | |||

Sources | 5 |

State Farm Ventures Partners & Customers

3 Partners and customers

State Farm Ventures has 3 strategic partners and customers. State Farm Ventures recently partnered with ByteDance on February 2, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/8/2022 | Partner | China | State Farm Punting On Super Bowl Advertising In Favor Of TikTok - InsuranceNewsNet In a statement , State Farm said its agency partners at The Marketing Arm focused on TikTok `` to meet the next generation of consumers by showing up where they 're spending their time and in spaces that they 're interested in . '' | 1 | |

12/7/2021 | Partner | ||||

9/17/2018 | Partner |

Date | 2/8/2022 | 12/7/2021 | 9/17/2018 |

|---|---|---|---|

Type | Partner | Partner | Partner |

Business Partner | |||

Country | China | ||

News Snippet | State Farm Punting On Super Bowl Advertising In Favor Of TikTok - InsuranceNewsNet In a statement , State Farm said its agency partners at The Marketing Arm focused on TikTok `` to meet the next generation of consumers by showing up where they 're spending their time and in spaces that they 're interested in . '' | ||

Sources | 1 |

State Farm Ventures Team

1 Team Member

State Farm Ventures has 1 team member, including current Chief Executive Officer, John Hall.

Name | Work History | Title | Status |

|---|---|---|---|

John Hall | Chief Executive Officer | Current |

Name | John Hall |

|---|---|

Work History | |

Title | Chief Executive Officer |

Status | Current |

Compare State Farm Ventures to Competitors

Qiming Venture Partners operates as a venture capital firm focused on early and growth-stage investments in the technology, consumer, and healthcare sectors. The company offers venture capital funding to startups and growth companies and manages a portfolio that includes various companies. Qiming Venture Partners serves the technology and healthcare industries. It was founded in 2006 and is based in Pudong New Area, Shanghai.

Khosla Ventures operates as a venture capital firm focused on early-stage investments across various sectors. The company provides funding and venture assistance to entrepreneurs in areas such as artificial intelligence, climate and sustainability, enterprise technologies, consumer technologies, financial services, digital health, medtech, and frontier technologies. It was founded in 2004 and is based in Menlo Park, California.

Lightspeed Venture Partners invests in the enterprise, consumer, health, and financial technology sectors. The firm provides funding and support to entrepreneurs at various stages of their development. Lightspeed Venture Partners serves the startup ecosystem by offering financial resources and industry knowledge to companies within its targeted sectors. It was founded in 2000 and is based in Menlo Park, California.

500 Global operates as a venture capital firm focused on investing in technology companies with a global outlook. The company provides venture capital investment and mentorship to entrepreneurs and investors, with the goal of supporting startups and fostering innovation across various markets. It was founded in 2010 and is based in Palo Alto, California.

ATX Venture Partners is an early-stage venture capital firm specializing in investment in B2B software, APIs, marketplaces, and frontier tech across various industries. The firm provides portfolio companies with access to resources from industry experts to support their growth. ATX Venture Partners primarily engages with sectors such as Supply Chain, FinTech, InsurTech, and the Future of Work. ATX Venture Partners was formerly known as ATX Seed Ventures. It was founded in 2014 and is based in Austin, Texas.

FinTLV is a venture capital firm that focuses on insurtech and fintech sectors. The company invests in startups and provides support by utilizing its knowledge of the insurance industry and connections with insurance and reinsurance partners. FinTLV serves the insurtech and fintech industries by offering guidance, facilitating introductions to clients, and aiding in proof of concept projects. It was founded in 2016 and is based in Tel Aviv, Israel.

Loading...