Sygnum

Founded Year

2017Stage

Series D | AliveTotal Raised

$130MValuation

$0000Revenue

$0000About Sygnum

Sygnum is a digital asset group operating in the financial services sector. It offers services including regulated digital asset banking, asset management, tokenisation, and business-to-business (B2B) services. It serves professional and institutional investors, banks, corporates, and DLT foundations. It was founded in 2017 and is based in Zurich, Switzerland.

Loading...

Sygnum's Product Videos

ESPs containing Sygnum

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The asset tokenization market enables the conversion of ownership rights in various assets such as real estate, artwork, or securities into digital tokens tradable on blockchain networks. This technology allows for more efficient asset management, enhanced security, and increased liquidity through secondary trading markets. Asset tokenization solutions provide investors with fractional ownership o…

Sygnum named as Leader among 15 other companies, including Fireblocks, Digital Asset, and Securitize.

Sygnum's Products & Differentiators

Banking services

Custody, trading, lending and staking services for digital assets

Loading...

Research containing Sygnum

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sygnum in 1 CB Insights research brief, most recently on Apr 10, 2025.

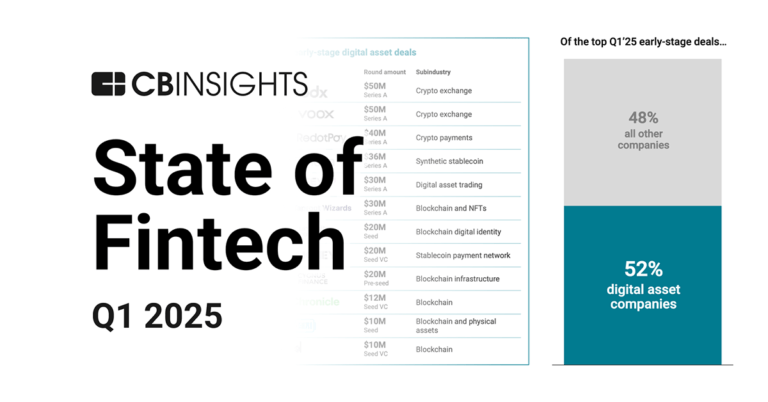

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Sygnum

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sygnum is included in 4 Expert Collections, including Blockchain.

Blockchain

9,488 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,063 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

14,203 items

Excludes US-based companies

Latest Sygnum News

Nov 12, 2025

Institutional investors are increasing their exposure to digital assets at a record pace this year, but expectations for 2026 are far less optimistic, according to new research by Swiss crypto bank Sygnum. In its Future Finance 2025 report released this week, Sygnum found that 61% of institutional respondents plan to expand their cryptocurrency investments by year-end, with 38% adding exposure in Q4 alone. The findings reflect growing confidence in digital assets as a long-term portfolio component, even after a sharp market correction in October that erased nearly $20 billion in market value Has Institutional Confidence Peaked in Crypto, or Is This Just the Beginning? Sygnum said the shift marks a transition from speculative trading to strategic diversification. “Institutions are thinking less about crypto as defense and more about participation in the structural evolution of global finance,” said report author Lucas Schweiger. The survey covered over 1,000 professional and high-net-worth investors across 43 countries. While the short-term outlook remains strong, Sygnum's data suggests the rally may cool in 2026 as liquidity slows and macroeconomic tailwinds fade. “The story of 2025 is one of measured risk, pending regulatory decisions, and powerful demand catalysts,” Schweiger wrote. “Discipline has tempered exuberance, but not conviction, in the market's long-term growth trajectory.” About 55% of institutions remain short-term bullish, expecting further upside driven by ETF approvals and policy clarity. However, investor sentiment turns neutral to bearish beyond year-end, with slower growth expected by mid-2026 as rate cuts plateau and regulatory progress stalls. A major factor behind this shift is the growing concentration of Bitcoin holdings among large entities and regulated funds. CryptoNews analysis of CryptoQuant and Dune Data shows institutional and entity-scale holders have steadily absorbed more supply since spot ETF approvals in January 2024. Retail investors, who once owned 17% of Bitcoin's circulating supply in 2020, have reduced their holdings by roughly 20% over the past year, while ETF-related and institutional wallets now control over 7 million BTC. This reflects a broader structural change as large holders move funds into regulated ETFs for tax and compliance benefits, signaling deeper integration into traditional finance. Sygnum's report also found that institutional interest in tokenized real-world assets like bonds and funds rose from 6% to 26% year-over-year. The bank said tokenization is becoming the gateway for conservative investors seeking regulated on-chain exposure. Coinbase, Sygnum Reports Show Institutions Holding Steady Despite Policy Delays Interest in crypto ETFs beyond Bitcoin and Ether is expanding rapidly. Over 80% of respondents said they want broader ETF access, and 70% indicated they would increase allocations if staking rewards were offered. Sygnum suggested that staking-enabled ETFs could be the next major driver of institutional inflows once regulatory conditions allow. Still, delays in key U.S. policy developments, including the Market Structure bill and approval of altcoin ETFs, have introduced uncertainty. The ongoing U.S. government shutdown now entering its 41st day , has postponed at least 16 pending crypto ETF applications , dampening short-term momentum. Despite these headwinds, institutional conviction remains firm. Coinbase's latest Navigating Uncertainty survey found that 67% of large investors remain bullish on Bitcoin heading into 2026, even as some acknowledge the market is entering the late stage of its bull cycle. 🚀 @Coinbase found that 67% of institutional investors are bullish on Bitcoin, even as some believe market is nearing the end of its bull run. #Crypto #Bitcoin https://t.co/FdLD8DMMco Coinbase researchers noted that supportive macro factors, including expected Federal Reserve rate cuts and fiscal stimulus in China, could extend market strength into 2025. However, analysts warn that as liquidity tightens and long-term holders take profits, market growth could slow by mid-2026. Sygnum's report described 2025 as a year of “powerful demand catalysts” tempered by regulatory caution. The bank expects institutional participation to deepen through ETF adoption, tokenized assets, and diversification but said the next phase of the cycle will likely test investor discipline rather than exuberance.

Sygnum Frequently Asked Questions (FAQ)

When was Sygnum founded?

Sygnum was founded in 2017.

Where is Sygnum's headquarters?

Sygnum's headquarters is located at Uetlibergstrasse 134A, Zurich.

What is Sygnum's latest funding round?

Sygnum's latest funding round is Series D.

How much did Sygnum raise?

Sygnum raised a total of $130M.

Who are the investors of Sygnum?

Investors of Sygnum include Fulgur Ventures, Azimut, SCB 10X, SBI Holdings, WeMade Entertainment and 13 more.

Who are Sygnum's competitors?

Competitors of Sygnum include Fordefi and 4 more.

What products does Sygnum offer?

Sygnum's products include Banking services and 3 more.

Loading...

Compare Sygnum to Competitors

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Komainu is a regulated digital asset custodian that provides custody solutions for institutional clients. The company offers services including custody, collateral management, and staking for the financial services sector. Komainu serves institutional investors, governments, ETP issuers, venture funds, exchanges, foundations, and hedge funds. It was founded in 2018 and is based in Milano, Italy.

BitGo is a digital asset infrastructure company that provides wallet services, custody, and financial services including wealth management and trading for digital assets. BitGo serves institutional investors, trading firms, investment advisors, exchanges, and developers. It was founded in 2013 and is based in Palo Alto, California.

Copper operates in digital asset infrastructure, focusing on custody, prime services, and collateral management within the financial technology sector. The company provides digital asset custody, off-exchange settlement solutions, and agency lending services, utilizing Multi-Party Computation technology to facilitate crypto transactions. Copper serves institutional investors, including hedge funds, trading firms, foundations, exchanges, exchange-traded product (ETP) providers, venture capital funds, and miners. It was founded in 2018 and is based in Zug, Switzerland.

Finoa is a regulated custodian and crypto-asset platform that provides services for institutional investors. The company offers storage and management of digital assets, as well as staking and trading solutions that cater to professional capital allocators. Finoa serves institutional crypto investors and web3 project founders with custody services. It was founded in 2018 and is based in Potsdam, Germany.

Loading...