Tabby

Founded Year

2019Stage

Secondary Market | AliveTotal Raised

$1.804BValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+42 points in the past 30 days

About Tabby

Tabby specializes in financial technology within the ecommerce industry, offering buy now pay later services. The company allows consumers to split their purchases into payments or monthly installments, and provides a shopping assistant app with features like price tracking and a payment card. Tabby serves the ecommerce sector by enabling payment options for online and in-store shopping. It was founded in 2019 and is based in Dubai, United Arab Emirates.

Loading...

Tabby's Product Videos

ESPs containing Tabby

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

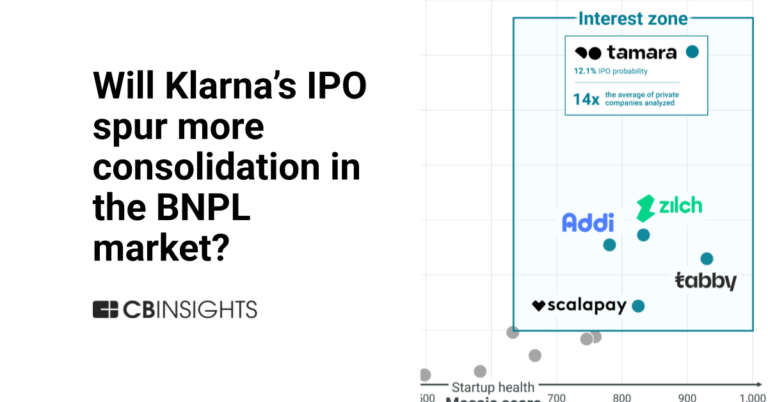

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Tabby named as Leader among 15 other companies, including Klarna, Affirm, and Synchrony.

Tabby's Products & Differentiators

Split in 4

Provide customers the freedom to split their purchase into 4 equal payments billed every month at no interest.

Loading...

Research containing Tabby

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tabby in 7 CB Insights research briefs, most recently on Sep 12, 2025.

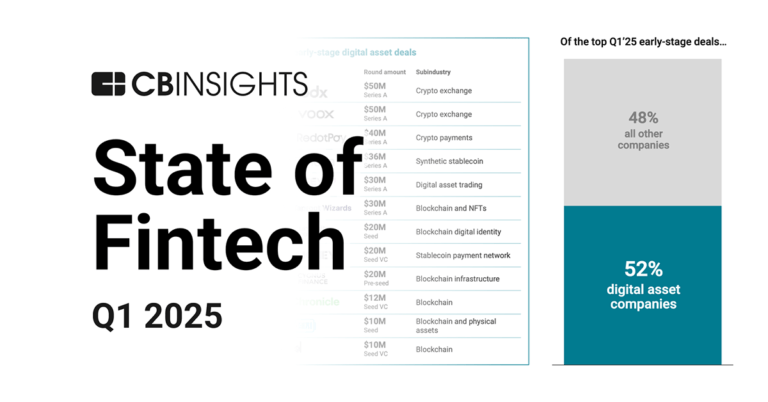

Apr 10, 2025 report

State of Fintech Q1’25 Report

May 8, 2024

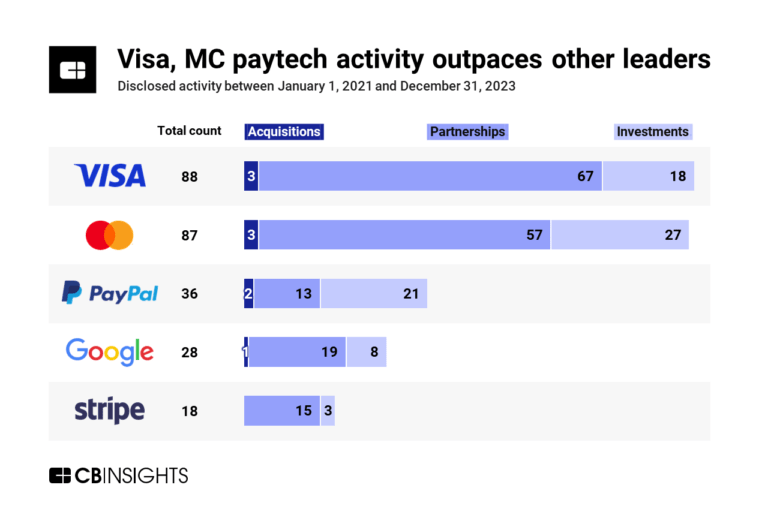

The embedded banking & payments market map

Jan 31, 2024

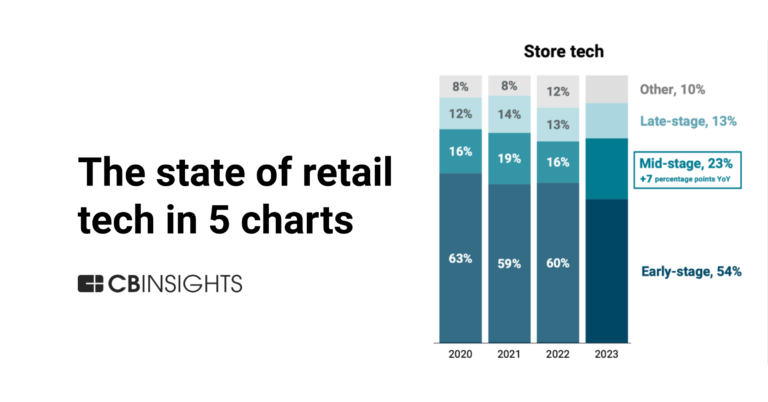

Retail tech in 5 charts: 2023

Jan 18, 2024 report

State of Fintech 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportExpert Collections containing Tabby

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tabby is included in 8 Expert Collections, including E-Commerce.

E-Commerce

11,641 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,840 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,297 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Latest Tabby News

Nov 5, 2025

Tabby, the Saudi Arabia–based financial services app, has recently confirmed the completion of a secondary sale of shares that was reportedly held by certain existing shareholders. As part of the latest transaction, HSG, Boyu Capital and others acquired shares from existing investors, “resulting in an implied company valuation of $4.5 billion.” As clarified in the update, “no new Tabby shares were issued and the company did not receive any proceeds from the sale.” Hosam Arab, Chief Executive Officer and Co-Founder at Tabby, has said that they are pleased to welcome their new shareholders who share Tabby’s goals and “the impact they’re making on financial services across the region.” The team also noted that they are looking forward to working with management as they continue to build “a comprehensive financial services flywheel in a region with tremendous growth potential.” Joey Chen, Partner at Boyu Capital has said that Tabby has demonstrated compelling product innovation as well as “disciplined growth in a developing market, placing the company as the forefront in this region’s nascent financial technology sector.” Chen also mentioned that they are pleased to work cooperatively with Hosam and the Tabby team as they “build the next generation of financial services in the Middle East.” As covered, Tabby is a financial technology company that claims to help millions of consumers who are presently residing in the Middle East to stay in “control of their spending and make the most out of their money.” More than 40,000 international brands as well as small businesses, such as SHEIN, Amazon , Adidas, IKEA, H&M, Samsung and Noon reportedly use Tabby’s digital technology in order to accelerate their growth and also gain customers by offering flexible payments online and in store locations. At present, Tabby is headquartered in Riyadh and serves Saudi Arabia, the UAE as well as Kuwait.

Tabby Frequently Asked Questions (FAQ)

When was Tabby founded?

Tabby was founded in 2019.

Where is Tabby's headquarters?

Tabby's headquarters is located at Meydan Road, Nad Al Sheba, Dubai.

What is Tabby's latest funding round?

Tabby's latest funding round is Secondary Market.

How much did Tabby raise?

Tabby raised a total of $1.804B.

Who are the investors of Tabby?

Investors of Tabby include Boyu Capital, HongShan, STV, Blue Pool Capital, Wellington Management and 24 more.

Who are Tabby's competitors?

Competitors of Tabby include Zilch, Tamara, Klarna, Sav, Atome and 7 more.

What products does Tabby offer?

Tabby's products include Split in 4 and 4 more.

Loading...

Compare Tabby to Competitors

Tamara operates in the financial technology sector. The company provides a mobile application offering flexible payment solutions and allows customers to divide their bills into multiple installments without delay fees. Tamara primarily serves the e-commerce industry, with global and regional brands to local small and medium businesses. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Postpay is a financial services company that provides buy now pay later solutions. The company offers a service that allows customers to make purchases and pay for them in three installments without interest. Postpay primarily serves the retail sector and partners with various brands to provide payment options to consumers. It was founded in 2019 and is based in Dubai, United Arab Emirates.

MNT Halan operates as a financial technology company focusing on digitizing traditional banking and cash-based markets. The company offers services, including digital payment solutions, lending services to the unbanked and underbanked, and an e-commerce platform. It primarily serves the financial sector and the e-commerce industry. MNT Halan was founded in 2017 and is based in Cairo, Egypt.

Khazna is a financial technology company specializing in digital financial services. The company offers a financial super app that provides underbanked Egyptians with access to smartphone-based financial services. Khazna primarily serves the corporate sector by offering financial solutions to employees through a mobile application that allows them to access a portion of their earned salary as needed. It was founded in 2019 and is based in Cairo, Egypt.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products, including buy now, pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Shahry is a digital financial services company that specializes in buy-now-pay-later (BNPL) solutions within the consumer finance sector. The company provides a mobile credit card and wallet that enables consumers to purchase goods and services in installments over a period of up to 36 months. Shahry primarily serves individual consumers looking for payment options and merchants aiming to increase sales through BNPL services. It was founded in 2019 and is based in cairo, Egypt.

Loading...