Tamara

Founded Year

2020Stage

Line of Credit - II | AliveTotal Raised

$2.107BValuation

$0000Last Raised

$1.4B | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-3 points in the past 30 days

About Tamara

Tamara operates in the financial technology sector. The company provides a mobile application offering flexible payment solutions and allows customers to divide their bills into multiple installments without delay fees. Tamara primarily serves the e-commerce industry, with global and regional brands to local small and medium businesses. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Loading...

ESPs containing Tamara

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

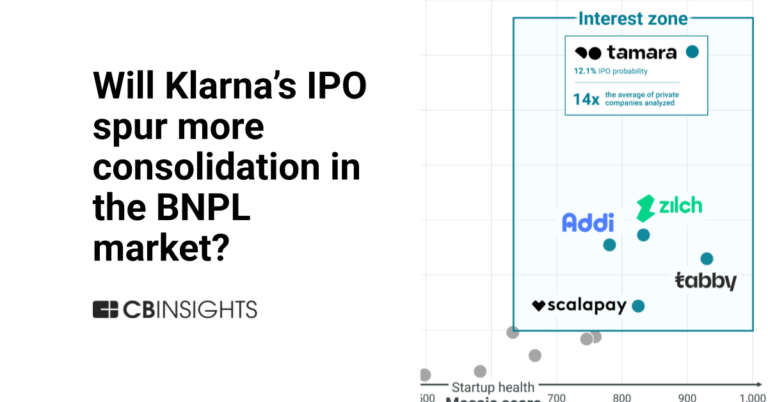

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Tamara named as Challenger among 15 other companies, including Klarna, Affirm, and Synchrony.

Tamara's Products & Differentiators

Split in Installments

Ability to split into multiple installments depending on category of retail and ticket size

Loading...

Research containing Tamara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tamara in 5 CB Insights research briefs, most recently on Sep 12, 2025.

May 8, 2024

The embedded banking & payments market map

Jan 31, 2024

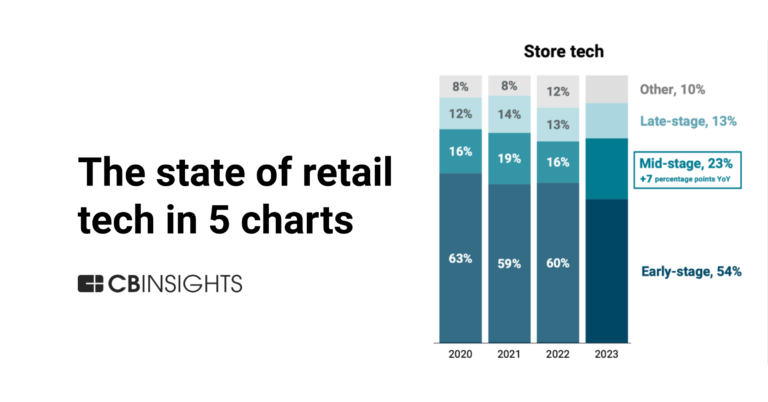

Retail tech in 5 charts: 2023

Jan 18, 2024 report

State of Fintech 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportExpert Collections containing Tamara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tamara is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,641 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,840 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,309 items

Digital Lending

2,735 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Tamara Patents

Tamara has filed 5 patents.

The 3 most popular patent topics include:

- dresses

- lingerie

- sports clothing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/18/2020 | 3/5/2024 | Partner dance technique, Ballroom dance, Graphical projections, Flying boats, Pocket knives | Grant |

Application Date | 3/18/2020 |

|---|---|

Grant Date | 3/5/2024 |

Title | |

Related Topics | Partner dance technique, Ballroom dance, Graphical projections, Flying boats, Pocket knives |

Status | Grant |

Latest Tamara News

Nov 4, 2025

Endeavor Saudi Arabia concluded Riyadh Forward 2025, the latest chapter of its Forward Series, on October 26. With Endeavor's Forward Series annually bringing together world-class founders and investors to explore the future of entrepreneurship from Saudi Arabia, the inaugural Riyadh Forward 2025 aimed to amplify the Kingdom's momentum as a global center for innovation, capital, and scale. The event brought together more than 400 carefully selected attendees, ranging from Endeavor Entrepreneurs, investors, limited partners, and mentors to prominent policymakers, industry leaders, and key ecosystem contributors. "Fast forward five years from now, we expect 5,000–7,000 new startups to launch, potentially more. We hope over 30% of these scaleups will enter global markets, turning Saudi brands into international names," declared Saud Alsabhan, Deputy Governor for Entrepreneurship at Monsha'at (the event's Ecosystem Partner), during the summit. Image courtesy Endeavor Saudi Arabia Alsabhan's words set the tone for what was a full day of expert-led sessions, keynotes, and panels that explored the rise of Riyadh emerging as a global innovation, and the Kingdom's pivotal role in driving growth and investment across MENA and beyond. During one such session, Abdulmajeed Alsukhan, the founder and CEO behind the Saudi-based fintech unicorn Tamara, noted that, "We need mega smart global funding; as entrepreneurs, we can't always rely on ourselves—without it, Tamara wouldn't exist." Meanwhile, Federico Pienovi, CEO (MENA and APAC) at global digital consulting and technology company Globant, added his insights on the Kingdom's growth too. "I come from Latin America, where governments make it hard to grow a big company, so unicorns are rare. In Saudi Arabia, they ask how they can help you expand," he said. Image courtesy Endeavor Saudi Arabia The day opened with "Riyadh to the World: A Journey to Global Innovation" , a conversation between Saud Al Sabhan, Deputy Governor of Monsha'at, and Ahmed Hamdan, Co-Founder & CEO of Unifonic, exploring the evolution of Saudi Arabia's innovation landscape and its global ambitions. Image courtesy Endeavor Saudi Arabia Other key sessions of the day included: "Scaling from Elsewhere: Founders Shaping the Future" — Fireside chat with Linda Rottenberg (Endeavor Global Co-Founder & CEO), Abdulmajeed Alsukhan (Tamara), and Pieter de Villiers (Clickatell). "Asia Meets Saudi: LivSpace's Next Chapter" — Conversation with Anuj Srivastava (LivSpace) and Yana El Dirani (Endeavor Catalyst). "LatAm Meets Saudi: Inside Globant's Global Playbook" — Federico Pienovi (Globant) and Mohammed Alariefy (MCIT), moderated by Marcelo Lima (Monashees). "IPO Signals: Saudi's Tech Listings Unpacked" — Mazen Al Jubeir and Sebastian von Renouard (Isometry Capital), followed by a panel with Abdullah Al-Beesh (CMA), Bandar Al Blehed (Saudi Exchange), and Fahad Almalki (Suhail Partner). Image courtesy Endeavor Saudi Arabia Meanwhile, investor-focused discussions covered themes like "M&A as a Growth Catalyst," "VCs Go Global: Why MENA Is the Next Big Bet," and "AI from the Source: Saudi's Vision," featuring leaders from Prosus, SPICE, Foodics, Endeavor Catalyst, HUMAIN, STV, and Merit Incentives, alongside practical insights on scale and IPO pathways from Mohammed Galal (eXtra ) and Ayman Essawy (Connect Money). "To succeed, you must have a strategic calendar outlining plans for the next 5, 10, and 20 years, along with a mindset tailored to each stage of the business," said Mohamed Galal, Managing Director & CEO, eXtra (United Electronics Co.). "With our current 10 million customers and 100 million daily customer interactions at eXtra, the key is to prioritize the business itself over focusing on an exit strategy." The summit wrapped with an exclusive networking dinner, deepening connections among global and regional changemakers.

Tamara Frequently Asked Questions (FAQ)

When was Tamara founded?

Tamara was founded in 2020.

Where is Tamara's headquarters?

Tamara's headquarters is located at King Abdullah Branch Road, King Salman District, Riyadh.

What is Tamara's latest funding round?

Tamara's latest funding round is Line of Credit - II.

How much did Tamara raise?

Tamara raised a total of $2.107B.

Who are the investors of Tamara?

Investors of Tamara include Goldman Sachs, Apollo Global Management, Citi Alternative Investments, Shorooq Partners, Checkout.com and 19 more.

Who are Tamara's competitors?

Competitors of Tamara include Klarna, Valu, Tabby, Khazna, MNT Halan and 7 more.

What products does Tamara offer?

Tamara's products include Split in Installments.

Loading...

Compare Tamara to Competitors

Tabby specializes in financial technology within the ecommerce industry, offering buy now pay later services. The company allows consumers to split their purchases into payments or monthly installments, and provides a shopping assistant app with features like price tracking and a payment card. Tabby serves the ecommerce sector by enabling payment options for online and in-store shopping. It was founded in 2019 and is based in Dubai, United Arab Emirates.

MNT Halan operates as a financial technology company focusing on digitizing traditional banking and cash-based markets. The company offers services, including digital payment solutions, lending services to the unbanked and underbanked, and an e-commerce platform. It primarily serves the financial sector and the e-commerce industry. MNT Halan was founded in 2017 and is based in Cairo, Egypt.

Khazna is a financial technology company specializing in digital financial services. The company offers a financial super app that provides underbanked Egyptians with access to smartphone-based financial services. Khazna primarily serves the corporate sector by offering financial solutions to employees through a mobile application that allows them to access a portion of their earned salary as needed. It was founded in 2019 and is based in Cairo, Egypt.

Postpay is a financial services company that provides buy now pay later solutions. The company offers a service that allows customers to make purchases and pay for them in three installments without interest. Postpay primarily serves the retail sector and partners with various brands to provide payment options to consumers. It was founded in 2019 and is based in Dubai, United Arab Emirates.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products, including buy now, pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Shahry is a digital financial services company that specializes in buy-now-pay-later (BNPL) solutions within the consumer finance sector. The company provides a mobile credit card and wallet that enables consumers to purchase goods and services in installments over a period of up to 36 months. Shahry primarily serves individual consumers looking for payment options and merchants aiming to increase sales through BNPL services. It was founded in 2019 and is based in cairo, Egypt.

Loading...