Moniepoint

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$257.5MValuation

$0000Last Raised

$90M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+58 points in the past 30 days

About Moniepoint

Moniepoint operates as a financial technology company that provides services in the payments, banking, and business management sectors. The company offers payment processing, banking solutions for businesses and individuals, credit facilities, and tools for managing business operations. It serves businesses and individuals in need of financial services and solutions for managing operations and transactions. Moniepoint was formerly known as TeamApt. It was founded in 2015 and is based in London, United Kingdom.

Loading...

Moniepoint's Products & Differentiators

Monnify

sent Today at 9:27 AM Monnify is a payment gateway for businesses to accept payments from customers, either on a recurring or one-time basis. Monnify offers an easier, faster and cheaper way for businesses to get paid on their web and mobile applications using convenient payment methods for customers with the highest success rates obtainable in Nigeria.

Loading...

Research containing Moniepoint

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Moniepoint in 1 CB Insights research brief, most recently on Apr 10, 2025.

Apr 10, 2025 report

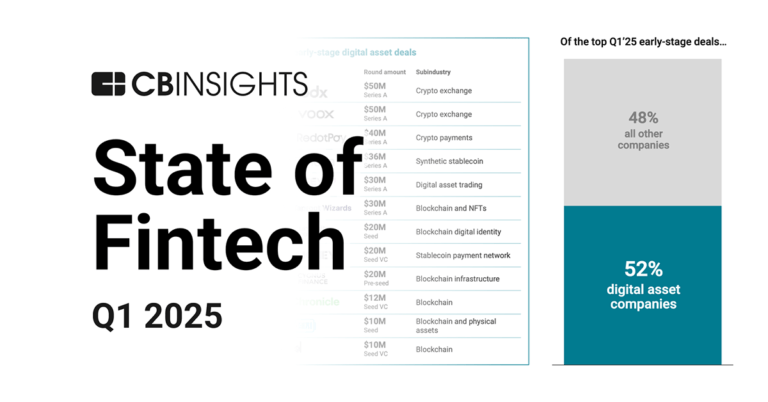

State of Fintech Q1’25 ReportExpert Collections containing Moniepoint

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Moniepoint is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech

14,203 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

937 items

Fintech 100 (2024)

100 items

Latest Moniepoint News

Nov 8, 2025

Africa’s startup funding scene maintained its measured rebound in October 2025, continuing the steady rhythm that has defined much of the year. Across the continent, disclosed funding totaled roughly USD 364.9 M across 31 deals, a year-on-year increase from USD 217 M in October 2024 and a sharp rise from USD 76.6 M in 2023, according to the WT dataset. That’s more than double September’s USD 163.4 M, with deal volume holding steady. The data signals a market that’s no longer chasing quantity but still finding occasions for very large checks. While October’s total was buoyed by a few headline rounds, the spread of deals across regions and sectors reflected a market finding its equilibrium after the volatility of the pandemic years. Rather than exuberance, the month told a story of recalibration, investors placing targeted bets on proven operators, infrastructure, and the next wave of early innovation. Big Rounds Dominated the Month Mid-sized rounds added depth: Chari’s USD 12 M Series A in Morocco’s embedded finance space, Kuunda’s USD 7.5M Pre-Series A in South Africa, and Malengo’s USD 12.9 M non-dilutive grant in education. Smaller plays, from AI startups like Nanovate and Velents.ai to seed rounds in climate tech and mobility, added texture to the overall picture. Regional Snapshot The top five markets, Kenya, Egypt, Nigeria, Morocco, and South Africa, accounted for about 95% of total funding, though the balance within that concentration is improving. Egypt followed with USD 101.4 M, led by MNT-Halan’s USD 71.4 M securitization and Tagaddod’s USD 26.3 M Series A in climate tech. Smaller rounds from SehaTech (USD 1.1 M), Velents.ai (USD 1.5 M), and Sabika (USD 100 K) highlighted diversification in healthtech and AI. Nigeria ranked third with USD 93 M, almost entirely from Moniepoint’s USD 90 M Series C , which brought its total Series C to USD 200 M. Rana Energy’s USD 3 M pre-seed was the only other fund added to the mix. Morocco in fourth place, secured USD 12.23 M, led by Chari’s USD 12 M Series A , backed by Verod-Kepple Africa Ventures and Plug and Play. Early-stage rounds from Hypeo AI (USD 200 K) and Sand to Green (USD 29 K grant) added diversity. Other active markets included Côte d’Ivoire and Tunisia, contributing a combined USD 30 M through rounds by ANKA (USD 5 M), Julaya (USD 1.4 M), and PAYDAY (USD 3 M). Even smaller ecosystems, Gabon, Mali, and Botswana, recorded activity through grants and micro-rounds, showing how innovation is spreading beyond traditional hubs. Fintech, Energy, and Mobility Fintech continued to dominate, pulling in over USD 180 M, nearly half of October’s total. But the mix is changing, from consumer wallets to enterprise payments, embedded finance, and digital banking for small businesses. Moniepoint’s USD 90 M raise underscored this shift, alongside MNT-Halan’s USD 71.4 M securitization, Chari’s USD 12 M, and Kuunda’s USD 7.5 M. Smaller fintech rounds from Julaya (USD 1.4 M) and Sabika (USD 100 K) reflected early-stage activity across regions. Mobility and logistics followed, led by Spiro’s USD 100 M Series D and Enzi Mobility’s USD 3.5 M , highlighting growing investor confidence in electric transport and fleet management. Energy and climate tech also held strong, led by Tagaddod’s USD 26.3 M Series A and Rana Energy’s USD 3 M pre-seed , with smaller sustainability-focused awards to SeaH4, Proverdy, Synnefa, and Sand to Green. AI and data infrastructure quietly expanded through smaller rounds: Velents.ai (USD 1.5 M), Nanovate (USD 1 M), and Hypeo AI (USD 200 K). Healthtech and edtech saw steady interest via SehaTech (USD 1.1 M) and Malengo (USD 12.9 M grant). Equity Dominates, But Alternative Capital Rises Equity remained the backbone, powering about 70% of total deals, including Spiro, Moniepoint, and Chari. Debt and blended instruments represented roughly 20%, led by MNT-Halan’s USD 71.4 M securitization and Julaya’s hybrid round. The remaining 10% came from non-dilutive funding, such as Malengo’s USD 12.9 M grant and Synnefa’s USD 300 K IoT grant. The growing mix of equity, debt, and grant capital reflects a maturing ecosystem, one aligning funding structures with stage and cash flow realities. Who Wrote the Checks October saw strong participation from development finance institutions, regional growth funds, and strategic investors. Major backers included IFC , Proparco, Bpifrance, LeapFrog Investments, FMO, and Microsoft’s PRIF II fund. Active African funds such as E3 Capital, A15, Plus VC, and Verod-Kepple Africa Ventures also featured prominently. Local angel syndicates and corporate accelerators, including MINT Incubator and Microsoft Africa Transformation Office, played a key role at the early stage. Programs like Madica and Techstars continued to back startups in emerging corridors like Tunisia and Nigeria. A Market Finding Its Rhythm By the end of October, Africa’s USD 365.9 M in total funding reaffirmed the continent’s ability to sustain steady inflows despite global caution. The presence of a few very large deals, Spiro’s USD 100.0 M, Moniepoint’s USD 90.0 M, and MNT-Halan’s USD 71.4 M, pushed the month’s total well above prior months. But while the market remains top-heavy, the broader base of early-stage activity and grant funding continues to underpin long-term resilience. October told a twofold story: investors are consolidating around proven operators while selectively seeding the next generation. For founders and ecosystem builders, that’s a healthier, more sustainable landscape to grow in.

Moniepoint Frequently Asked Questions (FAQ)

When was Moniepoint founded?

Moniepoint was founded in 2015.

Where is Moniepoint's headquarters?

Moniepoint's headquarters is located at 241, Southwark Bridge Road, London.

What is Moniepoint's latest funding round?

Moniepoint's latest funding round is Series C - II.

How much did Moniepoint raise?

Moniepoint raised a total of $257.5M.

Who are the investors of Moniepoint?

Investors of Moniepoint include Lightrock, Verod Capital Management, Google for Startups Accelerator, Development Partners International, LeapFrog Investments and 24 more.

Who are Moniepoint's competitors?

Competitors of Moniepoint include Nearpays, Klasha, Kappa, Apenia, FairMoney and 7 more.

What products does Moniepoint offer?

Moniepoint's products include Monnify.

Who are Moniepoint's customers?

Customers of Moniepoint include Fair Money and Konga.

Loading...

Compare Moniepoint to Competitors

Kuda operates in the financial services sector. The company offers a range of services, including money transfers, savings and investment options, and credit facilities such as overdrafts and term loans. Kuda primarily serves individuals and businesses, providing solutions for personal finance management and business operations. Kuda was formerly known as Kudimoney Bank. It was founded in 2018 and is based in Lagos, Nigeria.

OPay is a financial services platform that operates in the digital banking sector. The company offers several services such as transactions, fund transfers, cashback on airtime and data top-ups, and a savings product that accrues daily interest. OPay also provides a debit card and customer support available at all times. It was founded in 2018 and is based in Lagos, Nigeria.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Kuva is a digital wallet company that provides payment solutions across multiple currencies. The company offers a platform for sending and receiving money, facilitating cross-border payments, and enabling multi-currency transactions. Kuva's services are available for individuals and businesses. It was founded in 2018 and is based in Harare, Zimbabwe.

Nearpays operates as a financial payment platform providing mobile and virtual financial services. The company offers products including mobile payment solutions, virtual accounts, and point-of-sale systems to facilitate transactions for businesses and individuals. Nearpays serves sectors such as retail, professional services, beauty and wellness, food and beverage, and healthcare. It was founded in 2023 and is based in Abuja, Nigeria.

MoMo provides financial services within the financial sector. It offers a digital platform for conducting financial transactions, including bill payments, fund transfers, and receiving payments. It was founded in 2007 and is based in Lagos, Nigeria.

Loading...