Temasek

Founded Year

1974Stage

Other Investors | AliveAbout Temasek

Temasek operates as a global investment company focused on managing a diverse portfolio with a net value that includes both listed and unlisted assets. The company operates on commercial principles and is guided by its purpose 'So Every Generation Prospers'. It was founded in 1974 and is based in Singapore.

Loading...

Loading...

Research containing Temasek

Get data-driven expert analysis from the CB Insights Intelligence Unit.

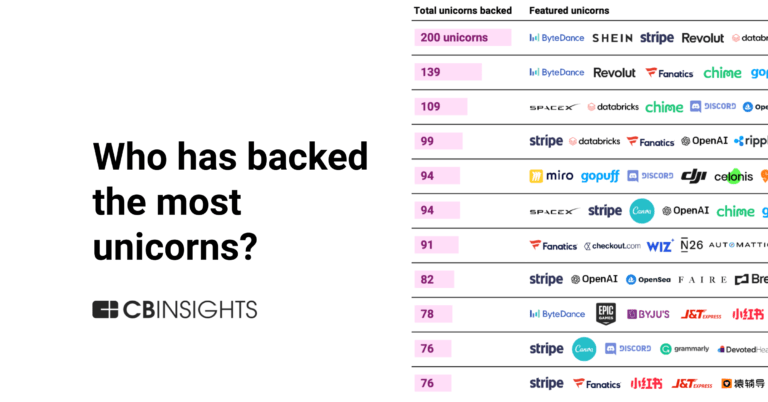

CB Insights Intelligence Analysts have mentioned Temasek in 2 CB Insights research briefs, most recently on Jun 8, 2023.

Temasek Patents

Temasek has filed 31 patents.

The 3 most popular patent topics include:

- membrane technology

- renal dialysis

- nephrology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/20/2021 | 2/18/2025 | Spectroscopy, Nitrates, Remote sensing, Plant physiology, Aquatic ecology | Grant |

Application Date | 5/20/2021 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Spectroscopy, Nitrates, Remote sensing, Plant physiology, Aquatic ecology |

Status | Grant |

Latest Temasek News

Nov 12, 2025

Our exclusive on shareholders of Indonesia's top public-listed dairy firm Ultrajaya Milk Industry & Trading initiating stake sale talks with Dutch dairy cooperative FrieslandCampina for a potential minority transaction and broader strategic collaboration was the most-read story of the month. In other top stories, we featured the sale processes at Indonesian homegrown ice-cream brand Campina and the country's top traditional oil balm brand that is seeking a valuation of up to $3 billion in its upcoming funding round. We also had exclusive updates from Kopi Kenangan and Thai unicorn LINE MAN in the list of top stories from the month. From the fundraising side, we carried exclusives on Indonesia's new private equity firm Sriwijaya Capital and Singapore-headquartered KV Asia Capital The LP View column, featuring an interview with a top executive at The Dietrich Foundation , highlighted that China's VC market is among the least crowded globally, presenting a rare opportunity for institutional investors. From India, healthcare investments continued to make headline news. Our exclusive on Temasek 's possible investment in an Indian healthcare-focused fund manager was the most-read story. The talks come at a time when the sector has become increasingly competitive and sophisticated, prompting the need for consolidation moves. The private equity sector is undergoing a period of significant change as smaller funds exit the market and larger firms scale up to capture more capital. Campina's shareholders have since re-engaged with prospective buyers, including Indonesia-focused private equity funds, to explore a full exit. The group's signature Eagle Brand Medicated Oil has retained its status as one of Southeast Asia's most enduring consumer health products. Barito Pacific, Indika Energy, and Sinarmas Group are among the anchor limited partners (LPs) backing the inaugural fund. The process is being driven largely by investor liquidity needs rather than the company's own capital requirements. The fundraising momentum was partly driven by distributions from its first fund, which has fully exited its portfolio companies. Despite initial momentum and interest from multiple parties in the first half of this year, discussions have gone dormant since late July. Indonesia's consumer retail sector is proving to be a rare bright spot amid venture capital tightening across Southeast Asia. GIC has sold 94% of its shares in LINE MAN held through Gamnat Pte Ltd and Apfarm Investment Pte Ltd, filings show. “China and India VC are positioned at an interesting juxtaposition of tailwinds and headwinds at the moment,” said Edward J. Grefenstette, CEO/CIO, The Dietrich Foundation. Touted as the biggest investment in a Chinese AI application startup this year, the round was backed by Shunwei Capital, Source Code Capital, Future Capital, and INCE Capital. For Temasek, the potential partnership reinforces its long-standing conviction that India's healthcare industry remains one of its most resilient growth stories. Talks between Asia Healthcare, which is backed by TPG Growth and GIC, and Dr. Dangs Lab have fallen through due to a mismatch in expectations on valuation.

Temasek Frequently Asked Questions (FAQ)

When was Temasek founded?

Temasek was founded in 1974.

What is Temasek's latest funding round?

Temasek's latest funding round is Other Investors.

Who are the investors of Temasek?

Investors of Temasek include Thoma Bravo.

Who are Temasek's competitors?

Competitors of Temasek include Lighthouse Canton, Qapita, Matter, Turkiye Wealth Fund, PIF and 7 more.

Loading...

Compare Temasek to Competitors

China Investment Corporation is a sovereign wealth fund focused on diversifying China's foreign exchange holdings and maximizing returns within acceptable risk levels. The company engages in various investment activities including stock equity, private equity, real estate, and mutual funds. It primarily serves the financial sector through its subsidiaries that manage external and domestic investments. It was founded in 2007 and is based in Beijing, China.

Kuwait Investment Authority is a sovereign wealth fund focused on managing the financial reserves of the State of Kuwait. Its primary mission is to achieve long-term investment returns that provide an alternative to the country's oil reserves. The authority engages in various investment activities across global markets to secure economic stability for future generations. It is based in Safat, Kuwait.

Mubadala operates as a sovereign investor managing a diverse portfolio of assets in various sectors and industries. Its main services include executing global direct investments and managing portfolios targeting growth-oriented companies across sectors such as technology, life sciences, consumer, financial services, energy, and industrial and business services. It primarily sells to sectors including technology, life sciences, consumer, financial services, energy, and industrial and business services. It was founded in 2017 and is based in Abu Dhabi, United Arab Emirates.

ADQ operates as a sovereign investor focused on critical infrastructure and supply chain investments across various sectors. The company invests in sectors including energy and utilities, food and agriculture, healthcare and life sciences, transport and logistics, financial services, real estate investments, sustainable manufacturing, and infrastructure and critical minerals. It was founded in 2018 and is based in Abu Dhabi, United Arab Emirates.

Alberta Investment Management (AIMCo) provides financial services. It specializes in investment management for various types of institutional clients. The company manages a diverse portfolio of assets across different classes and focuses on delivering long-term returns and sustainable investing. Its primary clientele includes pension, endowment, insurance, and government fund clients in Alberta. It was founded in 2008 and is based in Edmonton, Canada.

GIC is an investment firm that manages a diversified portfolio of investments in private equity and venture capital funds, as well as direct investments and co-investments in private companies. Its investment team is based out of San Francisco, London, New York, Singapore, and Beijing. The company was established as the private equity investment arm of the Government of Singapore Investment Corporation. The company was founded in 1982 and is based in Singapore.

Loading...