Thought Machine

Founded Year

2014Stage

Series E | AliveTotal Raised

$569.84MLast Raised

$61.79M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+69 points in the past 30 days

About Thought Machine

Thought Machine provides cloud-native core banking and payments processing platforms for the banking industry. The main products, Vault Core and Vault Payments, enable banks to build and run various financial products and payment schemes. The company serves the banking sector with solutions that are adaptable to the needs of financial institutions. Thought Machine was formerly known as TW Shelfco 4988. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Thought Machine's Product Videos

ESPs containing Thought Machine

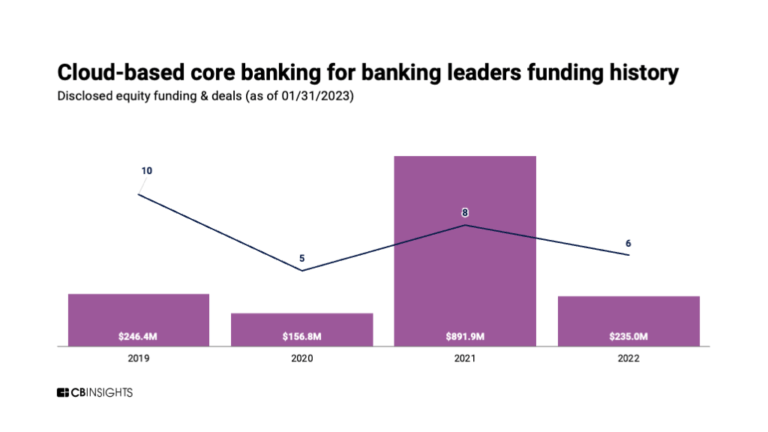

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The transaction banking solutions market provides software platforms and technology solutions that enable banks and financial institutions to offer corporate banking services including cash management, payment processing, liquidity management, and treasury operations to business clients. These platforms facilitate real-time transaction processing, multi-currency operations, automated reconciliatio…

Thought Machine named as Outperformer among 15 other companies, including Oracle, Temenos, and Fiserv.

Thought Machine's Products & Differentiators

Vault Core

https://www.thoughtmachine.net/vault-core

Loading...

Research containing Thought Machine

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Thought Machine in 3 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Thought Machine

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Thought Machine is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Future Unicorns 2019

50 items

Fintech

14,203 items

Excludes US-based companies

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,153 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Thought Machine News

Nov 3, 2025

The move is part of GBC's long-term plan to adopt a cloud-native infrastructure as it aims to expand its role in Canada's evolving financial landscape. The collaboration will see GBC migrate its new core banking product development to Thought Machine's Vault Core platform. The system, built entirely without legacy code, offers real-time processing and customisable product capabilities designed to help banks build and manage financial services more efficiently. GBC expects the migration to enhance its operational flexibility and support faster product delivery. Focus on cloud-native banking in Canada Through this initiative, the bank aims to become a financial product manufacturer operating within a Bank-to-Business-to-Consumer (B2B2C) framework. This would enable GBC to design products under its charter and distribute them through partners and external channels, widening its market reach while maintaining compliance with Canadian banking regulations. Representatives from Thought Machine said the company's Vault Core platform was developed to support institutions looking for reliability and scalability in their technology infrastructure. They noted that GBC's transformation aligns with a wider trend among financial institutions moving away from traditional systems in favour of flexible, cloud-based solutions that enable real-time services and product innovation. Officials from General Bank of Canada added that adopting a cloud-native core system represents an important step in the bank's modernisation plan. They said the initiative is intended to improve the bank's ability to compete in a rapidly changing financial sector, where speed, automation, and system interoperability are increasingly important.

Thought Machine Frequently Asked Questions (FAQ)

When was Thought Machine founded?

Thought Machine was founded in 2014.

Where is Thought Machine's headquarters?

Thought Machine's headquarters is located at 7 Herbrand Street, London.

What is Thought Machine's latest funding round?

Thought Machine's latest funding round is Series E.

How much did Thought Machine raise?

Thought Machine raised a total of $569.84M.

Who are the investors of Thought Machine?

Investors of Thought Machine include Lloyds Banking Group, Eurazeo, JPMorganChase, Intesa Sanpaolo, Morgan Stanley and 18 more.

Who are Thought Machine's competitors?

Competitors of Thought Machine include Apex Fintech Solutions, Fimple, Pismo, FintechOS, Tuum and 7 more.

What products does Thought Machine offer?

Thought Machine's products include Vault Core and 1 more.

Who are Thought Machine's customers?

Customers of Thought Machine include Standard Chartered, JP Morgan, Intesa Sanpaolo and Atom Bank.

Loading...

Compare Thought Machine to Competitors

10x Banking provides cloud-native core banking solutions within the financial services sector. The company offers a platform that enables banks to create products using configuration and coding to support any programming language. 10x Banking primarily serves retail, SME, and corporate/commercial banking sectors, providing technology for digital transformation and operational efficiency. It was founded in 2016 and is based in London, England.

Tuum specializes in cloud-native core banking solutions within the financial technology sector. Its main offerings include a banking as a service platform, modular Islamic banking, payments and wallets engine, progressive core transformation, unified lending solutions, and a venture launchpad. The services are intended to assist financial institutions in modernizing their operations, introducing new financial services, and scaling. Tuum was formerly known as Modularbank. It was founded in 2019 and is based in Tallinn, Estonia.

Finastra provides financial software solutions across various sectors, including lending, payments, universal banking, and treasury & capital markets. The company offers lending solutions, payment processing, and banking software, serving financial institutions such as retail banks, commercial banks, investment managers, and corporate treasuries. Finastra was formerly known as Misys. It was founded in 1970 and is based in London, United Kingdom.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Mambu operates as a cloud banking platform that provides core banking solutions. The company offers a framework for banking, allowing financial institutions to construct their digital financial products using various engines, systems, and connectors. Mambu serves banks, lenders, fintechs, retailers, and other financial service providers. It was founded in 2011 and is based in Amsterdam, Netherlands.

BackBase operates in the financial services sector and provides digital banking solutions. The company offers an Engagement Banking Platform that allows banks to update customer journeys and replace legacy information technology (IT) systems with a composable, omnichannel banking architecture. BackBase's platform includes tools for digital onboarding, banking apps development, lending, investing, and front-office assistance, which are intended for use in the banking industry. It was founded in 2003 and is based in Amsterdam, Netherlands.

Loading...