Tide

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$391.94MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+55 points in the past 30 days

About Tide

Tide serves as a financial technology company that provides business banking services and financial management tools for small and medium-sized enterprises (SMEs). The company offers services including digital business accounts, invoicing, accounting, savings solutions, loans, and company registration services. Tide primarily serves the SME sector with various products. It was founded in 2015 and is based in London, United Kingdom.

Loading...

Tide's Product Videos

Tide's Products & Differentiators

Tide Platform

Tide offers one product - the Tide platform, which. has many different features to help small businesses manage a huge array of admin needs. This includes: making, receiving and categorising payments, integrations with accountancy software, invoicing services, expense management, team expense cards, payroll and credit products.

Loading...

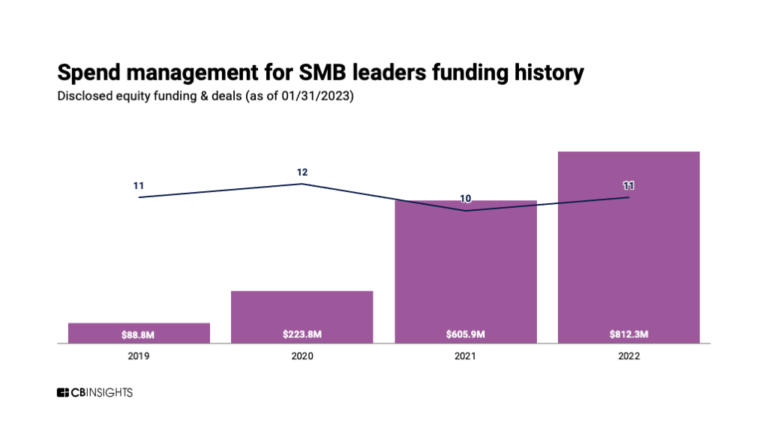

Research containing Tide

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tide in 2 CB Insights research briefs, most recently on Oct 26, 2023.

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing Tide

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tide is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

SMB Fintech

1,648 items

Fintech

14,203 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tide Patents

Tide has filed 6 patents.

The 3 most popular patent topics include:

- banking technology

- cognitive biases

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/18/2018 | 3/12/2019 | Fluid dynamics, Valves, Plumbing valves, Plumbing, Hydraulics | Grant |

Application Date | 1/18/2018 |

|---|---|

Grant Date | 3/12/2019 |

Title | |

Related Topics | Fluid dynamics, Valves, Plumbing valves, Plumbing, Hydraulics |

Status | Grant |

Latest Tide News

Nov 7, 2025

New research has found that four in ten social media users have received money or free gifts in return for their posts - but many may not be aware of the tax implications 11:02, 07 Nov 2025 Tax Account(Image: Getty) Millions of social media users are being alerted to a potential tax fine from HM Revenue and Customs ( HMRC ). Fresh research from business management platform Tide has disclosed that the burgeoning content creator economy is enabling millions of Brits to monetise their hobbies, with the average social media income now standing at £1,223 per annum. However, as more creators evolve their side hustles into flourishing online small businesses, aided by social media, many might be oblivious to HMRC's £1,000 trading allowance. This could inadvertently lead them to fall short of full compliance as their enterprises expand. Platforms such as TikTok, X, and YouTube offer anyone the chance to earn extra income. This can be accomplished through promoting products on the TikTok Shop, partnering with brands, or monetising high-performing content. The new study has discovered that four in ten (42%) social media users aged 18 and above have received money or free gifts in exchange for their posts. The average annual financial gain from this activity is £1,223, with one fifth (21%) of those who receive income for their content earning over the £1,000 HMRC tax-free allowance on trading income. Despite the legal obligation to submit a self-assessment tax return if any additional earnings, including the value of gifted items, exceed £1,000 in a single year, only 52% of social media users claim to be aware of this requirement. Merely 44% of those who earn income from their content have reported filing a self-assessment with HMRC, reports the Mirror . Penalties for missing the self-assessment filing deadline start at £100 and increase as more time elapses, potentially amounting to significant sums within a single year. These statistics are particularly alarming for social media users aged between 18 and 24 years old, as only 36% of them have filed a self-assessment with HMRC, despite over half (55%) profiting financially from their social media activity - the highest percentage of any age group surveyed. Late submission of your tax returns could lead to the following: after 3 months, additional daily penalties of £10 per day, up to a maximum of £900 an initial £100 penalty after 12 months, another 5% or £300 charge, whichever is greater after 6 months, a further penalty of 5% of the tax due or £300, whichever is greater You may need to declare any gifts you received on your tax return if you: earn more than £1,000 from influencing activities during the tax year, receive gifts worth over £50, or receive gifts in exchange for promoting services or products on social media. While receiving free items might seem like an advantage of being an influencer, HMRC sees it differently. If a brand gives you something and expects you to promote it in return, that gift is considered a form of payment, which means you have to pay tax on it. For example, over the course of a year, if you receive: £200 worth of skincare for a sponsored video A £150 jacket in return for an Instagram tag A complimentary restaurant meal worth £80 in exchange for a TikTok post These add up to £430 in gifted value. If you also received £800 in cash for another collaboration, your total income from influencing would be £430 (gifts) plus £800 (cash), totalling £1,230. As this surpasses the £1,000 trading allowance, you would need to register as self-employed and declare it on your tax return. It's crucial to understand that not every complimentary item counts as income. For instance, if a brand sends you a small gift, such as a £50 candle, and you're not obliged to post about it, it's generally just a kind gesture, and you don't need to pay tax on it. Similarly, if you receive other low-value items (under £50) without being required to promote them, you typically don't need to report those either. Heather Cobb, UK Managing Director at Tide, cautions social media users that they could face penalties if they're unaware of the regulations. She said: "It's great that TikTok, Instagram and other social platforms have opened up new ways for people to add to their income, and what might start as a bit of extra pocket money can quickly spiral into a serious side hustle. "Most people won't treat this as a legitimate business venture at first, so it can be easy to lose track of exactly how much has been made over the course of a year. Especially for those who receive gifted items in return for social media promotion, as the value of these items also counts towards the yearly £1,000 allowance. Unknowingly going over this can result in a costly penalty. "This can range from a 'failure to notify' penalty to late return and payment penalties. As these penalties are often based on a percentage of the tax owed, they can amount to substantial sums for millions of creators to cover. "Our advice is to keep track of what you earn from the very first payment, and Tide makes it easy to open a separate business account for each business you run. Tools such as Tide Accounting also make it easy to track earnings and expenses. That way, you'll be able to understand whether you're over the allowance and need to tell HMRC, as well as monitor the growth of your new side hustle." Megan Paul, a content creator and founder of Gel by Megan from Warwickshire, explained: "What started out as me posting photos of my nails on Instagram as a creative outlet alongside my 'day job' in the civil service, quickly grew to thousands of followers, brand partnerships, sponsored posts and now my own training academy. "I took the leap to being self-employed four years ago, and my social media earnings have definitely helped me on my way. Taxes and self-assessments may feel scary, but most areas have thriving small business communities that you can lean on for advice, while modern business management platforms take a lot of stress out of the admin and organisation of your finances. Article continues below "I would urge anyone making additional income from a passion project or content creation to not just view it as that little thing you do on the side, but to figure out whether it's something you could take more seriously, and turn it into doing something you love full time." Follow Chronicle Live:

Tide Frequently Asked Questions (FAQ)

When was Tide founded?

Tide was founded in 2015.

Where is Tide's headquarters?

Tide's headquarters is located at 66 City Road, London.

What is Tide's latest funding round?

Tide's latest funding round is Series C - II.

How much did Tide raise?

Tide raised a total of $391.94M.

Who are the investors of Tide?

Investors of Tide include Apax Digital, TPG, Fasanara Capital, Tencent, Phoenix Court and 25 more.

Who are Tide's competitors?

Competitors of Tide include Finom, SumUp, Revolut, Allica Bank, ANNA and 7 more.

What products does Tide offer?

Tide's products include Tide Platform.

Who are Tide's customers?

Customers of Tide include N/a - we have over 350,000 customers.

Loading...

Compare Tide to Competitors

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

Revolut operates as a financial technology company that provides a digital banking platform. It offers financial services including money management tools, foreign exchange trading, cryptocurrency transactions, and investment services. The company serves individual consumers who want to manage finances. It was founded in 2015 and is based in London, United Kingdom.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

Tandem Bank provides digital banking services in the financial sector. The company offers financial products including savings accounts, green home improvement loans, energy-efficient mortgages, and motor finance for eco-friendly vehicles. Tandem Bank serves individuals making environmentally conscious financial decisions. It was founded in 2013 and is based in Blackpool, England.

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Loading...