Tractable

Founded Year

2014Stage

Series E | AliveTotal Raised

$184.83MLast Raised

$65M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

About Tractable

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Tractable's Product Videos

ESPs containing Tractable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual auto claims assessment market uses AI, computer vision, and augmented reality to automate vehicle damage inspection and repair cost estimation for auto insurance claims. These platforms enable policyholders or adjusters to submit photos or videos of vehicle damage, which are analyzed to identify damage, assess severity, and generate repair estimates. Solutions may include fraud detecti…

Tractable named as Leader among 14 other companies, including Verisk, CCC Intelligent Solutions, and Snapsheet.

Loading...

Research containing Tractable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tractable in 5 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Dec 18, 2023

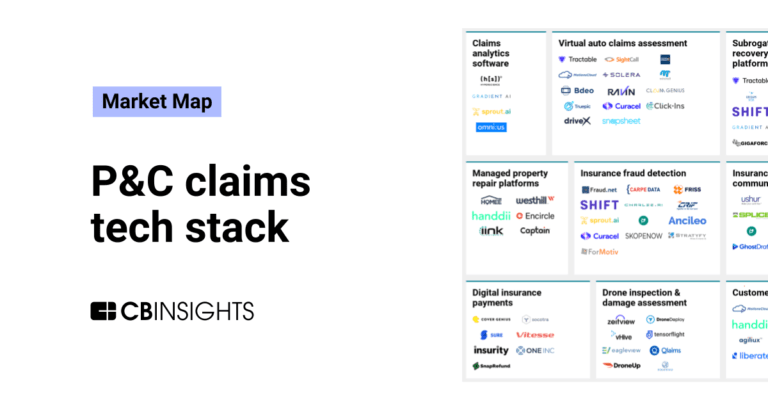

The P&C claims tech stack market map

Aug 1, 2023

Customer perspectives on the Insurtech 50

Expert Collections containing Tractable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tractable is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

AI 100 (All Winners 2018-2025)

399 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence (AI)

14,208 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tractable Patents

Tractable has filed 22 patents.

The 3 most popular patent topics include:

- insurance

- machine learning

- classification algorithms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/11/2022 | 12/10/2024 | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance | Grant |

Application Date | 2/11/2022 |

|---|---|

Grant Date | 12/10/2024 |

Title | |

Related Topics | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance |

Status | Grant |

Latest Tractable News

Sep 29, 2025

The Business Research Company's Latest Report Explores Market Driver, Trends, Regional Insights - Market Sizing & Forecasts Through 2034” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, September 29, 2025 / EINPresswire.com / -- "Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors How Large Will The Damage Evaluation Service Market Be By 2025? The market for damage evaluation services has vastly expanded in the last few years. It is projected to increase from a value of $3.30 billion in 2024 to more than $3.67 billion in 2025, reflecting a compound annual growth rate (CAGR) of 11.1%. Factors contributing to this significant growth within the historical timeline include an escalation in the frequency and intensity of natural disasters, a rise in the intricacy of insurance claims, growing implementation of technology within the property and casualty insurance (P&C) sector, an evolution in regulatory requirements and compliance norms, along with an increased requirement for drones and aerial imagery for inspection purposes. The market size of damage evaluation services is anticipated to experience swift expansion in the forthcoming years. By 2029, it is predicted to reach $5.53 billion with a compound annual growth rate (CAGR) of 10.8%. This market surge during the forecast period can be credited to the escalating importance of data analytics and predictive modeling, enlargement of applications beyond the conventional insurance arena, the increasing necessity for climate resilience and mitigation strategies, the increasing demand from the insurance and legal industries, and the escalating intensity and occurrences of natural calamities. Key trends for the forecast period encompass advancements in artificial intelligence (AI) and machine learning, technology for scalable and automated workflows, enhancements in drone and data capture technology, integration with blockchain for enhanced security and clarity, and progress in augmented reality (AR) for remote aid. Download a free sample of the damage evaluation service market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=27542&type=smp What Are The Major Driving Forces Influencing The Damage Evaluation Service Market Landscape? The escalating frequency of natural calamities is anticipated to drive the expansion of the damage evaluation service market. Natural disasters encompass extreme natural occurrences such as earthquakes, floods, or hurricanes, which inflict significant harm on human life, property, and the environment. The rate of natural disasters is on the rise due to a changing climate, which amplifies extreme weather events. Damage evaluation services bolster disaster management infrastructure by offering quick and accurate assessments, which are perfect for both residential and commercial properties. They minimize recovery delays by facilitating quicker decision-making and effective resource distribution, thus enhancing overall disaster response measures. For example, the Health Security Agency, a government agency based in the UK, noted in December 2023 that the stats of individuals at risk of flooding in the UK is projected to elevate by 61% by 2050, and further to 118% by 2080. Therefore, the escalating number of natural calamities is fueling the expansion of the damage evaluation service market. Who Are The Top Players In The Damage Evaluation Service Market? Major players in the Damage Evaluation Service Global Market Report 2025 include: • AECOM Technology Corporation • WSP Global Inc. • Caliber Holdings LLC • Copart Inc. • Tetra Tech Inc. • Verisk Analytics Inc. • Rambøll Group A/S • Crawford & Company • PuroClean Inc. • Envista Forensics Inc. What Are The Top Trends In The Damage Evaluation Service Industry? Leading businesses in the damage evaluation services market are concentrating on developing technologically advanced solutions, like AI-propelled property damage assessment tools, to enhance precision, decrease claim settlement periods, and offer quick recovery assistance for residential as well as commercial clients. An AI-propelled property damage assessment tool is a technology that utilizes artificial intelligence to swiftly and accurately appraise the magnitude of property damage by scrutinizing images, videos, and data inputs. For example, in January 2022, Tractable Ltd., a technology firm based in the US and specializing in the creation of artificial intelligence, released AI Property, an AI-driven property damage assessment tool intended to evaluate exterior damage to structures caused by natural calamities such as hurricanes, floods, and harsh weather conditions. This tool gives homeowners the ability to assess damage speedily via a mobile-compatible web application simply by taking photographs, which are immediately evaluated by Tractable's AI to deliver prompt damage estimates. This AI-facilitated process paces up the damage appraisal from the traditional span of several months to potentially just one day, enabling insurers to intervene swiftly and aid their customers more resourcefully after disasters. Market Share And Forecast By Segment In The Global Damage Evaluation Service Market The damage evaluation service market covered in this report is segmented 1) By Service Type: Residential Damage Evaluation, Commercial Damage Evaluation, Industrial Damage Evaluation, Environmental Damage Assessment, Automotive Damage Evaluation 2) By Damage Type: Fire Damage, Water Damage, Storm Damage, Accidental Damage, Wear And Tear Assessment 3) By Technology Utilized: Manual Inspection And Reporting, Drones And Aerial Surveys, Advanced Imaging Techniques, 3D Modeling And Simulation Tools, Data Analytics Tools And Software 4) By Application: Insurance, Construction, Real Estate, Manufacturing, Transportation Subsegments: 1) By Residential Damage Evaluation: Structural Damage, Electrical Damage, Plumbing Damage, Roofing Damage, Foundation Damage 2) By Commercial Damage Evaluation: Office Building Damage, Retail Store Damage, Hospitality Property Damage, Educational Facility Damage, Healthcare Facility Damage 3) By Industrial Damage Evaluation: Manufacturing Plant Damage, Warehouse Damage, Power Plant Damage, Chemical Facility Damage, Construction Site Damage 4) By Environmental Damage Assessment: Soil Contamination, Water Pollution, Air Quality Damage, Deforestation Impact, Natural Disaster Impact 5) By Automotive Damage Evaluation: Body Damage, Engine Damage, Electrical System Damage, Transmission Damage, Suspension Damage View the full damage evaluation service market report: https://www.thebusinessresearchcompany.com/report/damage-evaluation-service-global-market-report Damage Evaluation Service Market Regional Insights In the Damage Evaluation Service Global Market Report 2025, North America is identified as the leading region in the market for the year 2024. The forecast period anticipates the Asia-Pacific to outpace other regions in terms of growth. The report includes regional information for Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Damage Evaluation Service Market 2025, By The Business Research Company Failure Analysis Equipment Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/failure-analysis-equipment-global-market-report Electronic Equipment Repair Service Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/electronic-equipment-repair-service-global-market-report Surface Protection Service Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/surface-protection-service-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Tractable Frequently Asked Questions (FAQ)

When was Tractable founded?

Tractable was founded in 2014.

Where is Tractable's headquarters?

Tractable's headquarters is located at 6 Orsman Road, London.

What is Tractable's latest funding round?

Tractable's latest funding round is Series E.

How much did Tractable raise?

Tractable raised a total of $184.83M.

Who are the investors of Tractable?

Investors of Tractable include Insight Partners, Georgian, SoftBank, Ignition Partners, K5 Global Technology and 29 more.

Who are Tractable's competitors?

Competitors of Tractable include Curacel, Fractal, DriveX, UVeye, Trueclaim and 7 more.

Loading...

Compare Tractable to Competitors

Ravin AI focuses on automating vehicle damage assessments and claims management within the insurance and automotive industries. The company provides tools that use artificial intelligence to capture vehicle conditions and assess damages for insurers, fleet managers, and service centers. It was founded in 2018 and is based in Austin, Texas.

Snapsheet focuses on claims processing technology within the insurance sector, providing a cloud-based platform for claims management. The company's offerings include virtual appraisals, claims management, and digital payment solutions, which aim to address cycle times and efficiency in the handling of auto, property, and commercial insurance claims. Snapsheet's technology is designed to support various stakeholders in the insurance industry, enabling a claims experience. It was founded in 2011 and is based in Chicago, Illinois.

Inspektlabs provides AI-powered digital vehicle inspections within the automotive and insurance industries. The company offers services including damage detection, claim assessment, and fraud detection using photos and videos, for vehicle inspection. Inspektlabs serves sectors such as motor insurance, fleet management, car rental/leasing, and repair networks. It was founded in 2019 and is based in Middletown, Delaware.

UVeye serves as a computer vision technology company specializing in the development of automated inspection systems for vehicles within the automotive industry. The company's main offerings include AI inspection systems that utilize proprietary hardware to detect vehicle issues and security threats, particularly in the undercarriage. UVeye primarily serves sectors such as vehicle manufacturers, dealerships, fleet companies, and various security-sensitive facilities. It was founded in 2014 and is based in Teaneck, New Jersey.

Trueclaim focuses on vehicle damage detection within the automotive insurance and collision repair sectors. The company offers a platform utilizing machine learning and computer vision to automate the vehicle appraisal process, providing damage estimates and workflows for insurance companies and repair shops. It primarily serves the automotive industry. The company was founded in 2021 and is based in Laval, Canada.

Viewapp specializes in digital inspection technology through a smartphone application within the anti-fraud and inspection sectors. The application enables users to conduct remote self-inspections using pre-designed scenarios, with the results guaranteed to be protected against fraud. The app is used for various business purposes, including inspections according to detailed scenarios, photo and video documentation of assets such as real estate and vehicles, and monitoring the condition and presence of items for insurance or valuation purposes. It is based in Moscow, Russian Federation.

Loading...