Navan

Founded Year

2015Stage

IPO | IPOTotal Raised

$1.644BDate of IPO

10/30/2025About Navan

Navan engages as a corporate travel management platform operating in the travel and expense management sector. The company offers services including travel program management, expense tracking, and payment solutions. Navan primarily serves a range of industries such as energy and utilities, financial services, and technology. Navan was formerly known as TripActions. It was founded in 2015 and is based in Palo Alto, California.

Loading...

Navan's Product Videos

ESPs containing Navan

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

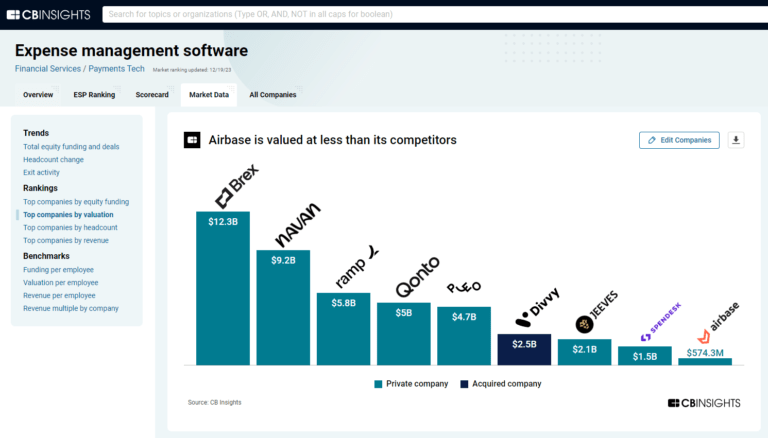

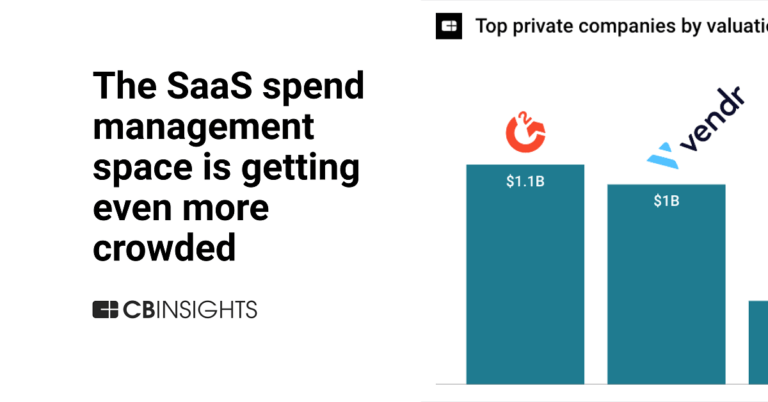

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Navan named as Leader among 15 other companies, including Coupa, Ramp, and Pleo.

Navan's Products & Differentiators

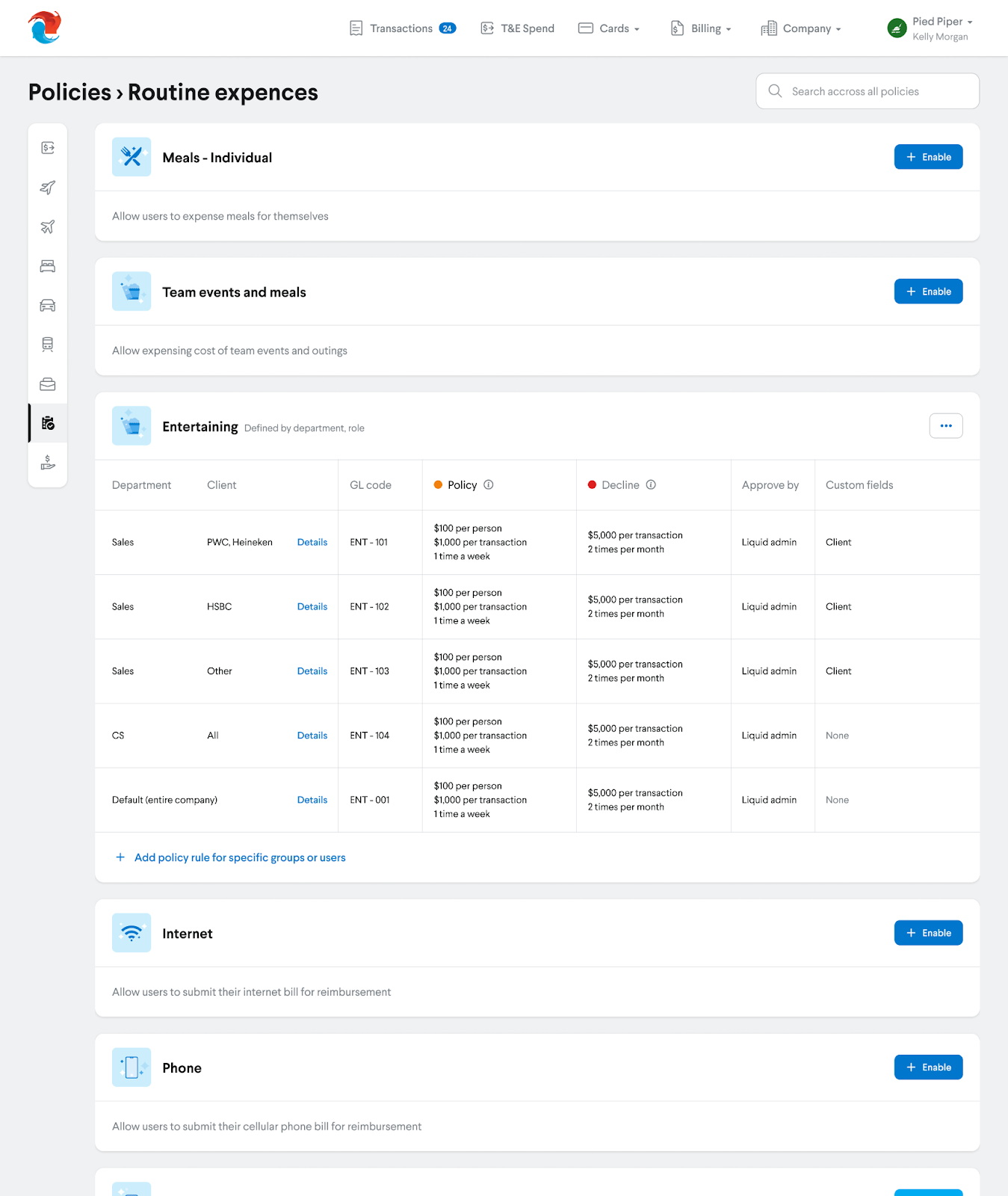

Virtual cards for travel payments

TripActions Liquid is a centralized billing solution that streamlines the payment process from reservation through reconciliation. Instead of using personal funds for travel, employees can pay with a virtual corporate card when booking travel on TripActions. At the end of each billing cycle, finance teams get one consolidated statement that details each traveler’s spend, making reconciliation fast and easy.

Loading...

Research containing Navan

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Navan in 5 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing Navan

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Navan is included in 5 Expert Collections, including HR Tech.

HR Tech

6,137 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,297 items

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Tech IPO Pipeline

825 items

SMB Fintech

355 items

Navan Patents

Navan has filed 16 patents.

The 3 most popular patent topics include:

- identifiers

- biological databases

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/7/2021 | 8/8/2023 | Graphical user interface elements, Identifiers, URI schemes, Domain name system, Diagrams | Grant |

Application Date | 7/7/2021 |

|---|---|

Grant Date | 8/8/2023 |

Title | |

Related Topics | Graphical user interface elements, Identifiers, URI schemes, Domain name system, Diagrams |

Status | Grant |

Latest Navan News

Nov 10, 2025

By PYMNTS | November 10, 2025 | Highlights Flight disruptions are heightening uncertainty for business travel and budgets, but the sector is building resilience through ecosystem integration, automation and platform expansion. The corporate travel industry is morphing into a data-driven, AI-powered ecosystem where every trip is a transaction and every traveler a node in the enterprise network. Booking, payment and expense are fusing into one seamless flow. Per Amex GBT’s Q3 results, 82% of transactions are digital and 40% are AI-assisted, signaling an era of intelligent, frictionless business travel. For business travel, disruption has become a default setting. Get the Full Story Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins required. yesSubscribe to our daily newsletter, PYMNTS Today. By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions . Δ The combination of supply chain stress, hybrid work, demand volatility and shifting traveler expectations has transformed corporate mobility from a routine cost center into a testbed for agility. With the ongoing government shutdown having impacted nearly 10,000 flights at 40 high-traffic airports in the United States in just the past 72 hours, the need for agility and resilience is increasingly in the spotlight. For corporate travel programs in the U.S., the government shutdown, which is showing signs of an agreement being reached as of Monday morning (Nov. 10), means two things: uncertainty in the execution of trips, which impairs business outcomes; and budget uncertainty, which may lead to fewer trips being approved. Despite the disruption, the earnings picture across travel providers points to a nuanced resilience. American Express Global Business Travel (Amex GBT) reported Monday that, for the third quarter 2025, its travel revenue (the core bookings business) grew 10%, supported by a 19% increase in transactions and a 23% rise in total transaction value (TTV). “We raised our full-year guidance for 2025 and expect accelerated growth and cost transformation in 2026,” Amex GBT Chief Financial Officer Karen Williams said in a statement. Advertisement: Scroll to Continue Amex GBT management repeatedly highlighted its strategic alliance with SAP Concur , the forthcoming “Complete” travel and expense solution, and artificial intelligence-assisted transaction flows, saying 82% of transactions are digital and over 40% of call interactions are AI-assisted. The story of resilience in corporate travel today, per the earnings results, could be one of integration, diversification and intelligence. From Travel Management to Spend Management Corporate travel is inherently cyclical and exposed to macro headwinds such as recession, geopolitical unrest, commodity shocks, inflation and evolving corporate travel policies. Across the sector, travel management companies (TMCs), technology vendors and enterprise software partners are converging to make corporate travel infrastructure shock-proof, data-driven and integrated with the enterprise stack. Travel no longer exists in isolation. Every booking is a financial transaction, every itinerary a compliance event, and every traveler a node in the data network of corporate spend. By integrating directly with ERP and expense systems, travel management solutions become part of the financial nervous system of the enterprise. The marketplace is responding. At the end of last month, for example, business travel and expense management software company Navan raised $923 million upon going public . Per its Monday earnings report, Amex GBT is also betting its future on AI enablement alongside platform convergence. Amex GBT and SAP Concur are co-developing “Complete,” a next-generation, AI-powered solution that merges Concur Expense with Egencia , Amex GBT’s digital booking platform. Per Amex GBT’s financials , 98 of the world’s 100 largest companies use SAP systems, and roughly 80% of its customers are small- to medium-sized businesses (SMBs), a segment Amex GBT identified as a “large and profitable” growth opportunity. The company’s investor materials put the global SMB travel market at $834 billion in 2024, with about $625 billion still “unmanaged,” being handled through consumer channels or decentralized tools. Amex GBT sees this as a greenfield worth pursuing. The New Tech Architecture of Corporate Travel If the first wave of corporate travel modernization was about booking automation, the next is about spend orchestration. The industry’s emerging complete travel and expense (T&E) platforms unify booking, payments, expense reporting and analytics in a single continuum. This consolidation reflects that travel management is no longer just about moving people. It’s about managing money. According to the PYMNTS Intelligence report “ Time to Cash™: A New Measure of Business Resilience ,” published Oct. 24, 77.9% of CFOs see improving the cash flow cycle as “very or extremely important” to their strategy in the year ahead. That figure jumps to 93.5% among “strategic movers,” those organizations that outperform their peers on growth and digital transformation. The boundary between booking, payment and reconciliation is dissolving. The traditional handoff between travel booking and expense reporting, once mediated by spreadsheets and manual uploads, is being replaced by continuous data flows. When an employee books a trip, expenses can now auto-generate, policy checks can run instantly, and reconciliation can often happen in near real time. Corporate travelers increasingly expect the same fluidity they enjoy in consumer apps. Post-pandemic digital acceleration has set the new baseline of mobile booking, real-time notifications and frictionless approvals becoming table stakes. Recommended

Navan Frequently Asked Questions (FAQ)

When was Navan founded?

Navan was founded in 2015.

Where is Navan's headquarters?

Navan's headquarters is located at 3045 Park Boulevard, Palo Alto.

What is Navan's latest funding round?

Navan's latest funding round is IPO.

How much did Navan raise?

Navan raised a total of $1.644B.

Who are the investors of Navan?

Investors of Navan include Silicon Valley Bank, Goldman Sachs, Group 11, Andreessen Horowitz, Coatue and 16 more.

Who are Navan's competitors?

Competitors of Navan include Amgine, Supertripper, Locomote, Center, TravelPerk and 7 more.

What products does Navan offer?

Navan's products include Virtual cards for travel payments and 4 more.

Loading...

Compare Navan to Competitors

TravelPerk is a business travel management platform that provides services for corporate travel. The company offers solutions for booking flights, hotels, trains, and car rentals, along with features for managing travel policies, approvals, and expenses. TravelPerk serves the corporate travel management sector with tools for travelers, travel managers, and finance teams. It was founded in 2015 and is based in Barcelona, Spain.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Ramp develops a financial operations platform. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. The company was founded in 2019 and is based in New York, New York.

BizAway operates in business travel management within the corporate travel industry. The company provides a platform for booking and managing business trips, which includes travel policy automation, cost control, and invoicing. It serves the corporate sector and offers services for business travelers, travel managers, and accountants. It was founded in 2015 and is based in Spilimbergo, Italy.

Spotnana focuses on modernizing the infrastructure of the travel industry. The company offers a travel-as-a-service platform that simplifies travel and makes it more affordable for corporations, while also enabling operational efficiency, new revenue sources, and innovation for its partners in the travel industry. It was founded in 2020 and is based in New York, New York.

Torpago specializes in providing a corporate credit card and expense-tracking platform. The company helps businesses manage expenses and has established a white-label program partnership with banks and credit unions. It serves the banking and financial services industries with modern credit experiences. It was founded in 2019 and is based in Burlingame, California.

Loading...