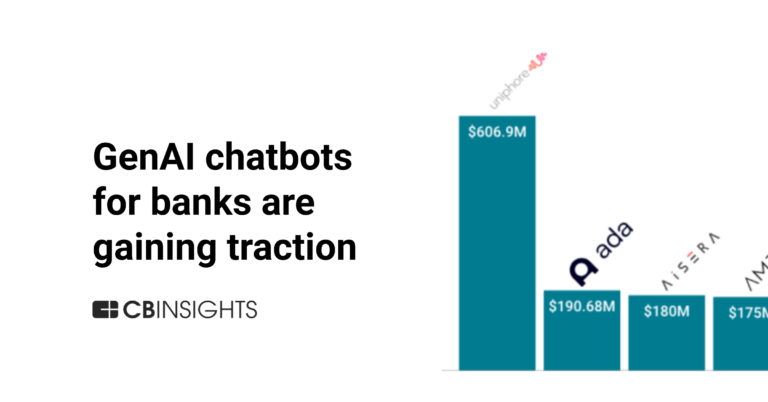

Uniphore

Founded Year

2008Stage

Series F | AliveTotal Raised

$886.63MValuation

$0000Last Raised

$260M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+88 points in the past 30 days

About Uniphore

Uniphore operates as a business-to-business (B2B) artificial intelligence (AI)-native company that focuses on AI transformation in various industries. The company provides a multimodal AI and data platform that allows businesses to deploy AI agents and create domain-specific AI models. Uniphore's technology includes features related to data security and sovereignty. Uniphore was formerly known as Uniphore Software Systems. It was founded in 2008 and is based in Palo Alto, California.

Loading...

Uniphore's Product Videos

ESPs containing Uniphore

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The customer service AI agents & copilots market comprises tools that automate client support inquiries and processes across multiple communication channels. These solutions converse with customers, answer questions, support inquiries, and resolve issues. Many can handle complex inquiries and complete processes end-to-end with minimal human oversight. They may also provide real-time assistance to …

Uniphore named as Leader among 15 other companies, including NiCE, Zendesk, and ServiceNow.

Uniphore's Products & Differentiators

Composable Data Layer

The biggest bottleneck in AI adoption is data fragmentation. Enterprises waste months or years integrating data before AI can deliver value. Uniphore eliminates this problem by providing a zero-copy, composable data fabric that allows AI to query and process data in place—without expensive migrations or complex ETL processes. Instant access to structured and unstructured enterprise data No need for large-scale data movement or duplication Reduces AI deployment time from months to weeks

Loading...

Research containing Uniphore

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uniphore in 5 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Jan 4, 2024

The core banking automation market map

Expert Collections containing Uniphore

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uniphore is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Sales & Customer Service Tech

1,058 items

Companies offering technology-driven solutions for brands and retailers to enable customer service before, during, and after in-store and online shopping.

Digital Banking

104 items

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Uniphore Patents

Uniphore has filed 33 patents.

The 3 most popular patent topics include:

- videotelephony

- computer telephony integration

- audio codecs

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/22/2022 | 9/5/2023 | Computer memory, Microcontrollers, Rotating disc computer storage media, Diagrams, Audio codecs | Grant |

Application Date | 2/22/2022 |

|---|---|

Grant Date | 9/5/2023 |

Title | |

Related Topics | Computer memory, Microcontrollers, Rotating disc computer storage media, Diagrams, Audio codecs |

Status | Grant |

Latest Uniphore News

Nov 11, 2025

Indian Startup Funding Up 60% In October 2025 Dana LeighNovember 11, 2025 India’s startup scene is heating up, and this time, it’s not just about quantity; it’s about quality. In October 2025, startups across India raised an impressive $1.83 billion from private equity and venture capital , up more than 60% from September’s total of $1.14 billion. But whilst the value increased, the actual number of startups raising decreased. October saw 100 deals done, compared with 108 seen in September. And yet, funding jumped over 60%. (DealStreetAsia). What that means in practice is that fewer startups are raising, but those that are, are getting much bigger cheques. In short: investor confidence is there, it’s just reserved for the few, not the many. As described by Serrari Group, India went through a ‘funding winter’ in 2023 and early 2024. However, India has well and truly bounced back. Compared with October last year, funding is up 63%. Interestingly however, whilst the number of deals hasn’t drastically changed, the value of them has. With inflation becoming more stable, as well as India being recognised as one of the fastest-growing economies in the world, it’s no surprise that investors are taking notice and piling in to get a piece of the action. Whilst the actual number of deals dropped in October, the value of them skyrocketed. Early-stage funding took a dip with 38 deals compared to 44 in September. However, growth-stage funding (Series B +) accounted for over 50% of funds raised. These startups raised a total of $957 million across 19 deals in October, compared with $472 million from 10 deals in the previous month. (Serrari Group) This shift is a clear sign that India’s startups are growing and maturing, with investors seeing real opportunity for revenue growth and development. In fact, this evolution towards later stage deals could be a sign that India is becoming a resilient and trustworthy startup economy that not only generates revenue, but builds real, long-term businesses. When it came to October’s big raises, 4 deals led the way, raising a total of $955 million. The biggest was Zepto, India’s grocery delivery app, which raised $450 million led by CalPERS, one of the biggest pension funds in the US. The round, which was also backed by VC General Catalyse, pushed Zepto’s valuation to a whopping $7 billion. India’s AI sector also caught investor attention, with Uniphore, a business AI platform, raising a $260 million Series F round. Big names like Nvidia, AMD, Databricks and Snowflake all took part showing a lot of confidence in India’s future as an AI superpower. The other two megadeals in October came from the fintech sector. The first was a buy-now-pay-later startup called Snapmint, which raised a $125 million round led by General Atlantic and joined by Prudent Investment Managers, Kae Capital, Elev8 Venture Partners, and others. The other was Dahn, a stock trading platform, which bought in a big $120 million Series B raise. When it came to the sectors leading the way, Zepto’s mega raise of $450 pulled the logistics sector into the top of the funding charts. Next came financial services, which bought in $449.6 million across 15 deals in October. In third place came SaaS, which pulled in more than $400 million across 23 deals. Between them, these 3 sectors show exactly where investors feel that India is going to thrive. When it came to the geographical areas in India that investment was flowing, Bengaluru took the top spot, attracting over $1 billion in deals in October. Next came Mumbai, India’s financial capital, with $441 million attracted. Delhi came third with $160 million, followed by Pune ($46.9 million) and Hyderabad ($24.6 million). October’s stats show that India is well and truly out of its ‘funding winter’ and into a new phase of growth. Investors aren’t just giving small cheques, they are investing billions into Indian startups that they believe show real, long-term growth. Combine that with companies like Google and Microsoft investing in data centres in the country, as well as India’s growing youth economy, and it’s no surprise that India is attracting so much interest. What will 2026 bring? We wait and see…. Related Articles

Uniphore Frequently Asked Questions (FAQ)

When was Uniphore founded?

Uniphore was founded in 2008.

Where is Uniphore's headquarters?

Uniphore's headquarters is located at 1001 Page Mill Road, Palo Alto.

What is Uniphore's latest funding round?

Uniphore's latest funding round is Series F.

How much did Uniphore raise?

Uniphore raised a total of $886.63M.

Who are the investors of Uniphore?

Investors of Uniphore include March Capital, National Grid Partners, NEA, BNF Capital, Prosperity7 Ventures and 33 more.

Who are Uniphore's competitors?

Competitors of Uniphore include Interactions, Verint Systems, Cognigy, Adastra, Proceder.ai and 7 more.

What products does Uniphore offer?

Uniphore's products include Composable Data Layer and 3 more.

Loading...

Compare Uniphore to Competitors

Sabio Group is a digital customer experience (CX) transformation company operating in the technology and customer service sectors. The company offers various services such as artificial intelligence (AI) and automation solutions, data insights, cloud transformation, networking services and infrastructure, and customer experience management. It primarily caters to industries such as banking, insurance, housing, retail, and telecommunications. The company was founded in 1998 and is based in London, United Kingdom.

Replicant specializes in Contact Center Automation(CCA), focusing on customer service interactions through conversational AI. It offers a platform that automates customer service calls, facilitating conversations across voice, messaging, and digital channels, and aims to address a significant portion of these interactions without human involvement. Replicant serves enterprise contact centers in sectors including insurance, healthcare, and financial services. The company was founded in 2017 and is based in San Francisco, California.

Genesys provides customer experience and contact center solutions, focusing on experience orchestration across various industries. The company offers a suite of products that facilitate personalized customer interactions, workforce engagement management, and cloud-based contact center operations. Genesys serves sectors such as banking, healthcare, retail, insurance, and government, supplying tools for customer and employee interactions. It was founded in 1990 and is based in Menlo Park, California.

Banza specializes in digital transformation and business process automation within the banking and retail sectors. The company offers customer relationship management (CRM) and business process management (BPM) solutions to streamline sales, marketing, and customer service processes. Banza primarily serves the banking and retail industries with comprehensive solutions for credit management, sales, customer service, and omnichannel customer interactions. It was founded in 2020 and is based in Uzhhorod, Ukraine.

![[24]7.ai Logo](https://s3-us-west-2.amazonaws.com/cbi-image-service-prd/original/b029c933-1e02-401f-bb6b-777a5d7ed5b5.png)

[24]7.ai provides artificial intelligence (AI)-based customer service products and solutions. It offers solutions such as conversation automation solutions, workforce engagement solutions, campaign management solutions, and more. [24]7.ai was formerly known as 24/7 Customer. It was founded in 2000 and is based in Campbell, California.

Medallia provides experience management software to address customer, employee, citizen, and patient experiences across various sectors. The company has a platform that captures and analyzes experience signals from multiple interactions to provide insights that inform business decisions and improve customer and employee engagement. Its solutions serve various industries, including automotive, financial services, healthcare, and retail. Medallia was formerly known as Berrypick. The company was founded in 2001 and is based in Pleasanton, California.

Loading...