Upgrade

Founded Year

2016Stage

Series G | AliveTotal Raised

$715.5MValuation

$0000Last Raised

$165M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+167 points in the past 30 days

About Upgrade

Upgrade specializes in personal loans and credit card products. The company offers financial services including personal loans, credit card options, and savings accounts. Upgrade primarily serves individuals seeking solutions such as debt consolidation, home improvements, or major purchases. It was founded in 2016 and is based in San Francisco, California.

Loading...

ESPs containing Upgrade

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The home improvement financing market provides loans, credit lines, and payment solutions to fund home renovation, remodeling, and repair projects. Companies in this market offer personal loans, specialized renovation financing, contractor point-of-sale solutions, and buy-now-pay-later options to homeowners and contractors. These solutions enable property improvements without requiring large upfro…

Upgrade named as Leader among 12 other companies, including LendingClub, Synchrony, and SoFi.

Loading...

Research containing Upgrade

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Upgrade in 2 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Upgrade

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Upgrade is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

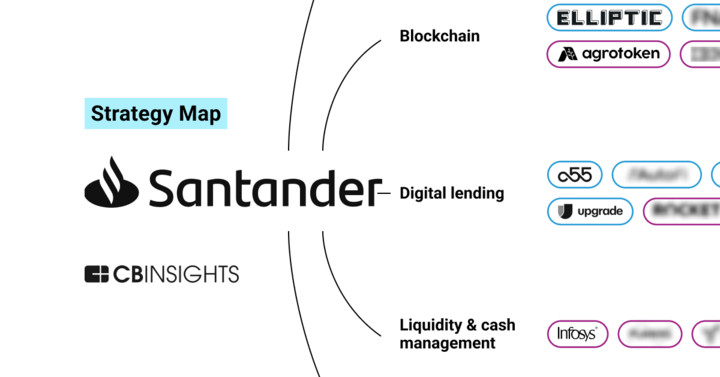

Digital Lending

2,538 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Future Unicorns 2019

50 items

Upgrade Patents

Upgrade has filed 4 patents.

The 3 most popular patent topics include:

- assisted reproductive technology

- battery charging

- battery electric cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | 9/17/2024 | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Semen | Grant |

Application Date | 10/20/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Semen |

Status | Grant |

Latest Upgrade News

Oct 23, 2025

Webcapitalriesgo UPGRADE, PARTICIPADA POR MOURO, CIERRA UNA RONDA DE $165M 23/10/2025 Nota de prensa Upgrade, Inc., una empresa fintech que ofrece productos de crédito y bancarios asequibles y responsables para consumidores convencionales, ha anunciado que ha recaudado 165 millones de dólares en nueva inversión de capital. La ronda Serie G Preferente de Upgrade fue liderada por Neuberger, con la participación de LuminArx Capital Management*. Los accionistas existentes, incluidos DST Global, Ribbit Capital y varios otros, también incrementaron su inversión en la compañía. Peter Sterling, jefe de Specialty Finance en Neuberger, se une al Consejo de Administración de Upgrade. Desde su fundación en 2017, Upgrade ha proporcionado más de 42.000 millones de dólares en crédito asequible a más de 7,5 millones de clientes. Ofrece una amplia gama de productos bancarios y de crédito, incluidos banca móvil, BNPL (compra ahora, paga después), tarjetas de crédito, préstamos personales, financiación para mejoras del hogar y financiación de automóviles. Upgrade ha establecido canales de distribución únicos con cientos de aerolíneas, líneas de cruceros y otras marcas de viaje, así como con miles de contratistas de mejoras del hogar y concesionarios de automóviles en todo el país. “Upgrade representa una oportunidad sin igual en el sector fintech”, dijo Peter Sterling. “Mientras muchas empresas del sector luchan con los costes de adquisición y la estrategia de monetización, Upgrade ha mantenido un crecimiento rentable gracias a una estrategia multicanal y multiproducto que se apoya en canales de distribución propios y de bajo coste para adquirir nuevos clientes, así como en su capacidad de monetizar usuarios a través de múltiples productos. Conocemos a Renaud y al equipo fundador de Upgrade desde hace más de una década y estamos muy entusiasmados por ampliar nuestra colaboración.” Recientemente, Upgrade ha alcanzado hitos de crecimiento significativos, incluyendo 2.000 millones de dólares en financiación acumulada para mejoras del hogar y 1.000 millones en financiación de automóviles, lo que refleja un rápido crecimiento, ya que ambos productos se lanzaron hace tres y dos años, respectivamente. “Estamos encantados de ampliar nuestra relación con Neuberger y dar la bienvenida a Peter como nuevo miembro del consejo”, dijo Renaud Laplanche, cofundador y CEO de Upgrade. “Planeamos utilizar el nuevo capital de inversión para seguir desarrollando nuevos productos y ampliar la distribución, con el objetivo de ayudar a más consumidores convencionales a acceder a los productos bancarios y de crédito que necesitan hoy, al tiempo que mejoramos su situación financiera y crediticia a largo plazo.” Desde su creación, Upgrade, Inc. ha recaudado 750 millones de dólares en capital de inversión. BofA Securities actuó como agente colocador exclusivo de Upgrade. “Neuberger” en este comunicado se refiere a varios fondos gestionados por NB Alternatives Advisers. “LuminArx” en este comunicado se refiere a fondos gestionados por LuminArx Capital Management LP.

Upgrade Frequently Asked Questions (FAQ)

When was Upgrade founded?

Upgrade was founded in 2016.

Where is Upgrade's headquarters?

Upgrade's headquarters is located at 275 Battery Street, San Francisco.

What is Upgrade's latest funding round?

Upgrade's latest funding round is Series G.

How much did Upgrade raise?

Upgrade raised a total of $715.5M.

Who are the investors of Upgrade?

Investors of Upgrade include Ribbit Capital, DST Global, LuminArx Capital Management, NB Alternatives Advisers, VY Capital and 28 more.

Who are Upgrade's competitors?

Competitors of Upgrade include Brighte, Best Egg, Tala, Kissht, Prodigy Finance and 7 more.

Loading...

Compare Upgrade to Competitors

Tala provides digital financial services. The company offers a money app that facilitates access to credit, payments, savings, and transfers, utilizing artificial intelligence (AI) and machine learning to create financial experiences. Tala primarily serves individuals seeking services beyond traditional banking. It was founded in 2011 and is based in Santa Monica, California.

Branch International provides digital banking services. The company offers financial products including loans, money transfers, bill payments, investments, and savings, accessible through a smartphone app. Branch serves individuals in emerging markets. It was founded in 2015 and is based in Mumbai, India.

Prodigy Finance offers collateral-free loans for international master's students at various educational institutions. It provides co-signer and no co-signer loan options, focusing on terms and interest rates that relate to the borrower's future earning potential. It serves the education sector, allowing students from over 120 countries to study at universities globally. It was founded in 2007 and is based in London, United Kingdom.

Brighte operates within the solar finance and energy-efficient products industry. The company offers financing solutions for solar energy systems, battery installations, electric vehicle upgrades, and personal loans for energy-efficient home improvements. Brighte primarily serves the residential sector by providing financial products. It was founded in 2015 and is based in Sydney, Australia.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Avant is a financial technology company that provides personal loans and credit cards. Their offerings include personal loan options for purposes such as debt consolidation, home improvements, and emergencies, as well as credit cards for purchasing. Avant serves individuals seeking financial solutions to meet personal goals. It was founded in 2012 and is based in Chicago, Illinois.

Loading...