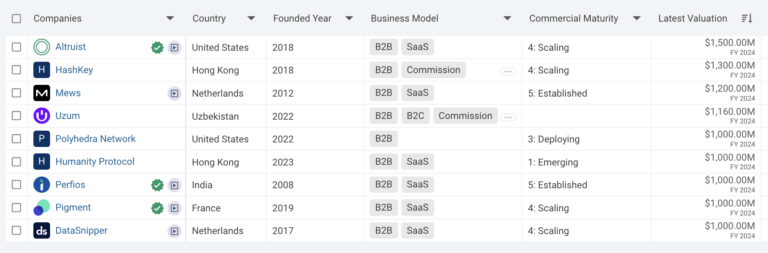

Uzum

Founded Year

2022Stage

Series B | AliveTotal Raised

$179.5MValuation

$0000Last Raised

$65.5M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+39 points in the past 30 days

About Uzum

Uzum is a digital ecosystem company in Uzbekistan, focusing on integrating e-commerce, fintech, and banking services within its ecosystem. The company offers a marketplace, express delivery service, digital banking, BNPL services, a car purchase platform, and an app for entrepreneurs. Uzum primarily serves the e-commerce and financial technology sectors. It was founded in 2022 and is based in Tashkent, Uzbekistan.

Loading...

Loading...

Research containing Uzum

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uzum in 4 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

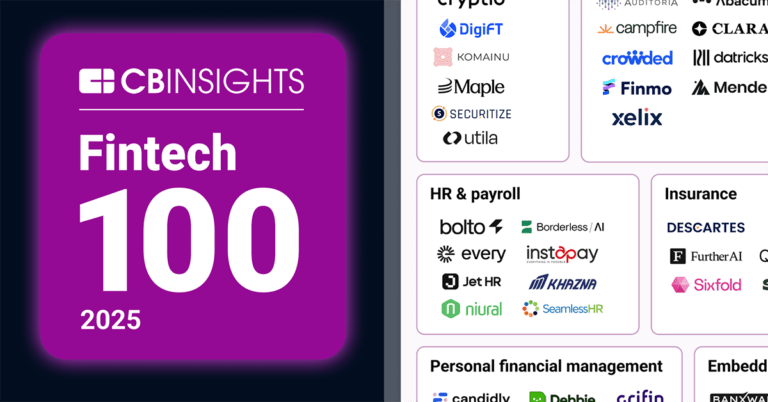

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 7, 2025 report

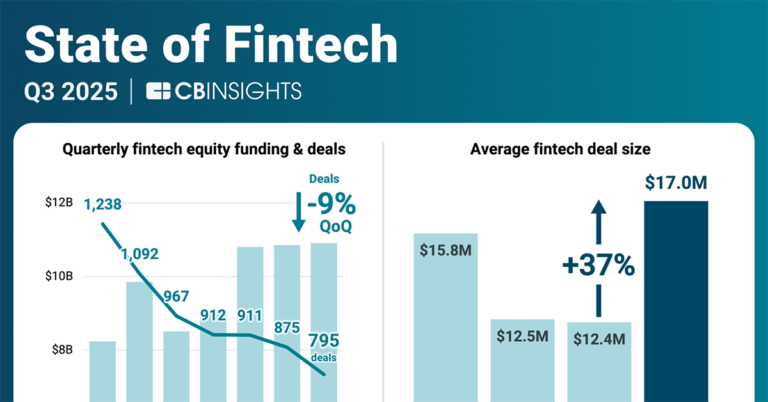

State of Fintech Q3’25 ReportExpert Collections containing Uzum

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uzum is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Digital Banking

937 items

Fintech

14,203 items

Excludes US-based companies

Fintech 100

100 items

Latest Uzum News

Nov 10, 2025

Think Ecosystem, Not App Uzum isn't just one app—it's an ecosystem. We operate Uzum Market for e-commerce, Uzum Bank for digital finance and Uzum Tezkor for express delivery. These services aren't separate businesses; they're mutually reinforcing layers. Payments fuel shopping. Credit unlocks consumption. Logistics drives satisfaction. By integrating verticals, we increase user "stickiness" and build trust across touchpoints. In a market where brand loyalty is fragile and digital habits are still forming, ecosystems offer resilience. They create a flywheel of engagement, where every new service improves the experience—and the economics—of the others. Global Inspiration, Local Execution We took inspiration from giants like Kaspi, Grab, Nubank and MercadoLibre—but we never assumed their playbooks would work out of the box. Uzbekistan has its own DNA. For example, while Buy Now, Pay Later (BNPL) products are now mainstream, trust in digital finance was initially low. So, we focused on building trust by making the user journey intuitive, locally relevant and transparent—from clear repayment terms to support in the Uzbek language. We start by giving people what feels familiar and matches their expectations—simple, reliable experiences that build trust. Then, step by step, we introduce them to new digital services within our ecosystem. This gradual approach helps users feel comfortable and naturally adopt fintech, marketplace and delivery products. We also adapted operations to local behaviour. Many customers still preferred physical receipts, so we made it easy to print confirmations right at pickup points. Some users felt more comfortable speaking than typing, so we added voice support to make service more human and accessible. These may sound like small tweaks—but in emerging markets, they often make the difference between growth and abandonment. Strategic Focus: Say No To Scale Blindness High-growth markets tempt companies to chase every opportunity. We learned early to say no. We didn't expand regionally before we were ready. We didn't launch verticals we couldn't operationalize with excellence. Instead, we focused on building a few services exceptionally well—and scaling them only when the infrastructure, demand and team were aligned. Where Innovation Meets Everyday Life Our story is part of a larger national transformation. Uzbekistan is rapidly modernizing. But the most powerful driver of change is the Uzbek people—young, entrepreneurial and hungry for tools that improve daily life. That's why we see our mission as more than commercial. We're helping digitize small businesses. We're onboarding the unbanked. We're creating new jobs in logistics, fintech and IT. The digital economy here isn't abstract—it's personal. As Uzbekistan's infrastructure and institutions continue to mature, the opportunity for investors and innovators will only grow. But success in markets like ours doesn't come from copying models from Silicon Valley. It comes from listening, adapting and building systems that solve real problems—sustainably and at scale. The Takeaway Scaling a digital platform in an emerging market isn't about speed alone. It's about sequencing—building the right foundations before the shiny features. It's about ecosystems, not apps. It's about respecting local nuance while thinking globally. And most of all, it's about staying focused on the user—not the hype. Our journey is still just beginning. But our experience proves that with the right strategy, emerging markets aren't just places to grow. They're where the future is built. Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?

Uzum Frequently Asked Questions (FAQ)

When was Uzum founded?

Uzum was founded in 2022.

Where is Uzum's headquarters?

Uzum's headquarters is located at Fidokor street, Tashkent.

What is Uzum's latest funding round?

Uzum's latest funding round is Series B.

How much did Uzum raise?

Uzum raised a total of $179.5M.

Who are the investors of Uzum?

Investors of Uzum include FinSight Ventures, Tencent, VR Capital Group, Xanara Investment Management and Prosto VC.

Who are Uzum's competitors?

Competitors of Uzum include Alif and 6 more.

Loading...

Compare Uzum to Competitors

Alif is a FinTech company that provides personal loans, mobile banking, vehicle financing, and online shopping through its platform, along with investment and insurance products. Alif serves the financial technology sector with various services. It was founded in 2014 and is based in Dushanbe, Tajikistan.

Finmedia operates as a payment aggregator for games, social networks, and entertainment projects. The company provides payment processing solutions and works with entertainment projects while using modern technologies. It was founded in 2016 and is based in Tashkent, Uzbekistan.

Juni is a financial technology company that specializes in modern banking solutions for finance teams within the eCommerce sector. The company offers a suite of services, including business banking, spend management, financing, and accounting, all integrated into a single platform designed to streamline financial operations and enhance growth. Juni's platform caters primarily to e-commerce businesses, providing tools for real-time financial control and operational efficiency. It was founded in 2020 and is based in Gothenburg, Sweden.

Credo Bank provides financial services intended for Georgian micro and small businesses. The bank offers opportunities for employees to develop their careers and grow personally, aiming to maintain a positive work environment. It was founded in 1997 and is based in Tbilisi, Georgia.

The Astana International Financial Centre (AIFC) is a financial hub that focuses on connecting the economies of Central Asia, the Caucasus, the EAEU, Western China, Mongolia, the Middle East, and Europe within the financial services industry. It offers a platform for business and finance, including capital markets, Islamic finance, green finance, private banking, financial technology, and asset management. The AIFC primarily serves the financial sector by providing a regional center for various financial services and attracting investments. It was founded in 2017 and is based in Nur-Sultan, Kazakhstan.

Yandex.Market is an online marketplace that operates in the retail sector. The company offers a platform for purchasing a wide range of products, including electronics and children's toys, from various partner stores. Yandex.Market facilitates order processing, delivery, and customer communication. It was founded in 2000 and is based in Moscow, Russian Federation.

Loading...